Please use a PC Browser to access Register-Tadawul

How Could the New White House Crypto 401k Order Impact Coinbase Stock Valuation?

Coinbase COIN | 252.34 | +0.77% |

If you are asking yourself whether holding onto Coinbase Global is the right call right now, you are certainly not alone. This stock has been anything but boring lately, with a rollercoaster pattern that gets both optimists and skeptics talking. Over just the last week, Coinbase jumped 8.0%, clawing back some of what it gave up in the previous 30 days, when it slipped by 1.2%. Still, if you zoom out a bit, the performance looks far more impressive. The stock is up a remarkable 25.6% year-to-date and has nearly doubled over the past year with a 98.1% gain. For truly patient investors, the three-year return clocks in at a staggering 336.5%.

So, what’s moving the stock? There is definitely a swirl of news for crypto investors to digest lately. The policy landscape is shifting, with the White House considering allowing retirement accounts to tap into crypto and other alternative assets. That kind of regulatory attention can drive risk perceptions in both directions. In addition, analysts are revisiting price targets. In the case of BofA, they have lowered their target for Coinbase, perhaps reflecting concerns about volatility or competitive pressures. Meanwhile, Coinbase’s global ambitions do not seem to be slowing down, as it reportedly moves to acquire India’s CoinDCX, despite bouncing back from a major cyberattack.

Given all this momentum and movement, the big question on everyone’s mind is whether the current price is justified. According to standard valuation methods, Coinbase only scores 1 out of 6 on the undervaluation scale, suggesting its current price might not offer much of a discount. But don't get discouraged just yet. The real story can emerge when examining the different ways stocks like Coinbase get valued, and it may be useful to consider a smarter way to size up the company in the end. Here is a closer look at what these checks actually mean for your decision-making.

Coinbase Global scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Coinbase Global Excess Returns Analysis

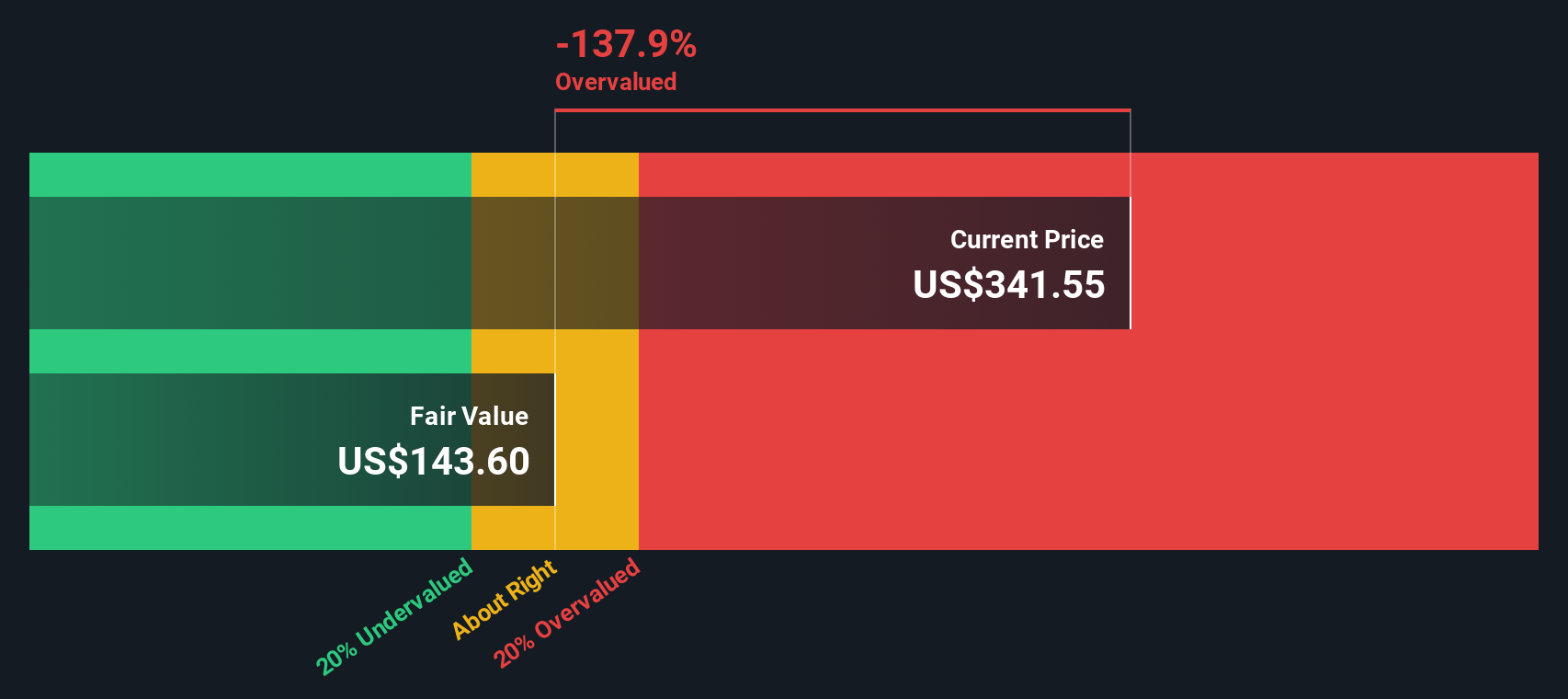

The Excess Returns model estimates a company’s intrinsic value by examining how much it earns over its cost of equity. In other words, it measures the profit Coinbase generates above the minimum return investors require. This approach spotlights both the company’s return on invested capital and its capacity for future growth.

For Coinbase Global, the current Book Value is $47.17 per share, while future projections indicate a Stable Book Value rising to $56.02, based on weighted analyst estimates. The company’s Stable EPS (Earnings Per Share) is $8.77, with the excess return specifically measured as $4.17 per share above the $4.59 cost of equity. This is underpinned by an average Return on Equity of 15.65%, which suggests above-average value creation in the capital markets sector.

However, when plugging these figures into the model, the estimated intrinsic value per share comes out sharply lower than today’s share price. This indicates that Coinbase is 134.8% overvalued using this method. In other words, even with respectable profitability and growth prospects, the current price far outpaces the company’s underlying excess returns. Prudence may be warranted at these levels.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Coinbase Global.

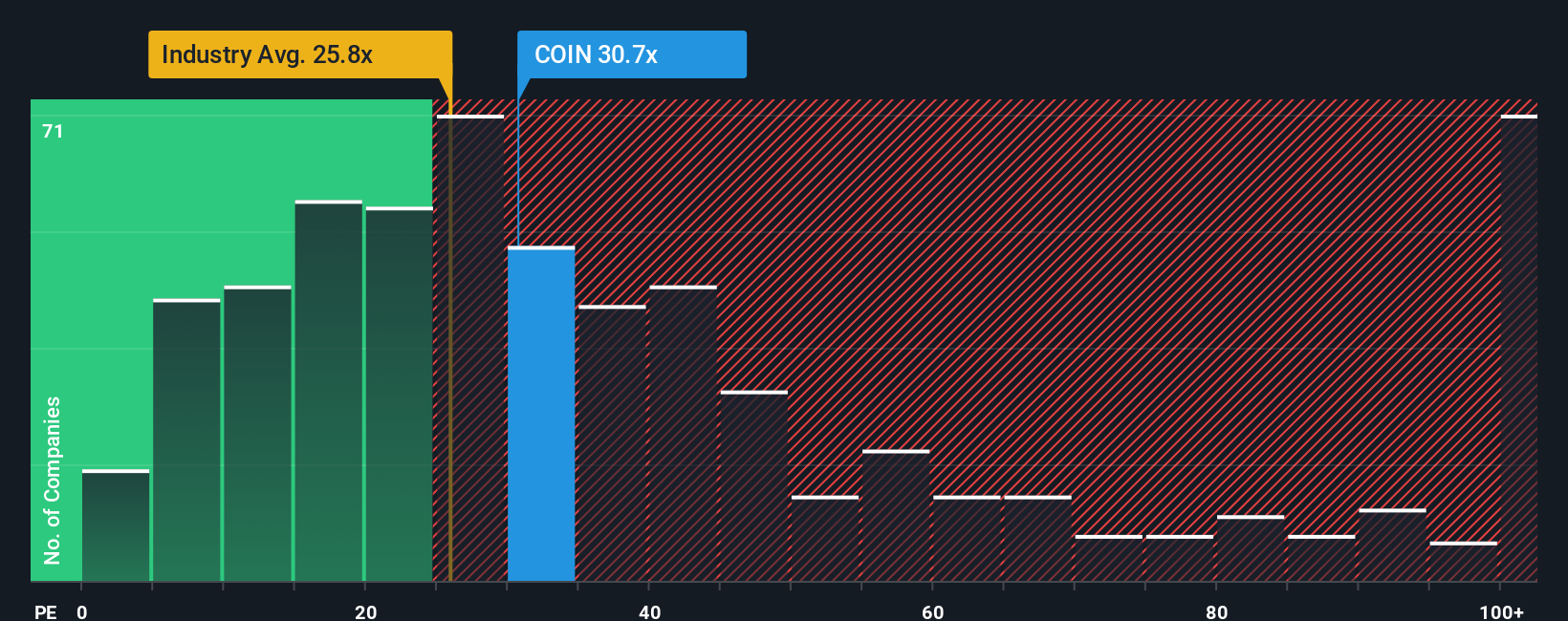

Approach 2: Coinbase Global Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation tool for profitable companies like Coinbase Global. It provides investors with a quick way to assess how much they are paying for each dollar of earnings. This makes it especially useful when a business has established profitability and relatively stable earnings growth.

Growth expectations and perceived risks heavily influence what investors consider a "normal" or "fair" PE ratio. Companies with high growth prospects or lower risks can often justify higher PE multiples, while businesses facing uncertainty or slower growth tend to command lower ones. For Coinbase, the current PE ratio stands at 29x, which is above the Capital Markets industry average of 27.16x but below the average of direct peers at 34.35x.

Simply Wall St’s proprietary "Fair Ratio" for Coinbase is calculated as 25.03x. Unlike basic peer or industry comparisons, the Fair Ratio takes into account the company’s future earnings growth, profit margins, risk profile, market capitalization, and industry dynamics. This provides a more tailored yardstick for investors deciding what the stock should be worth.

With a current PE of 29x versus a Fair Ratio of 25.03x, Coinbase trades noticeably above its fundamental value based on these comprehensive factors. This signals that investors are paying a premium for its growth story right now.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Coinbase Global Narrative

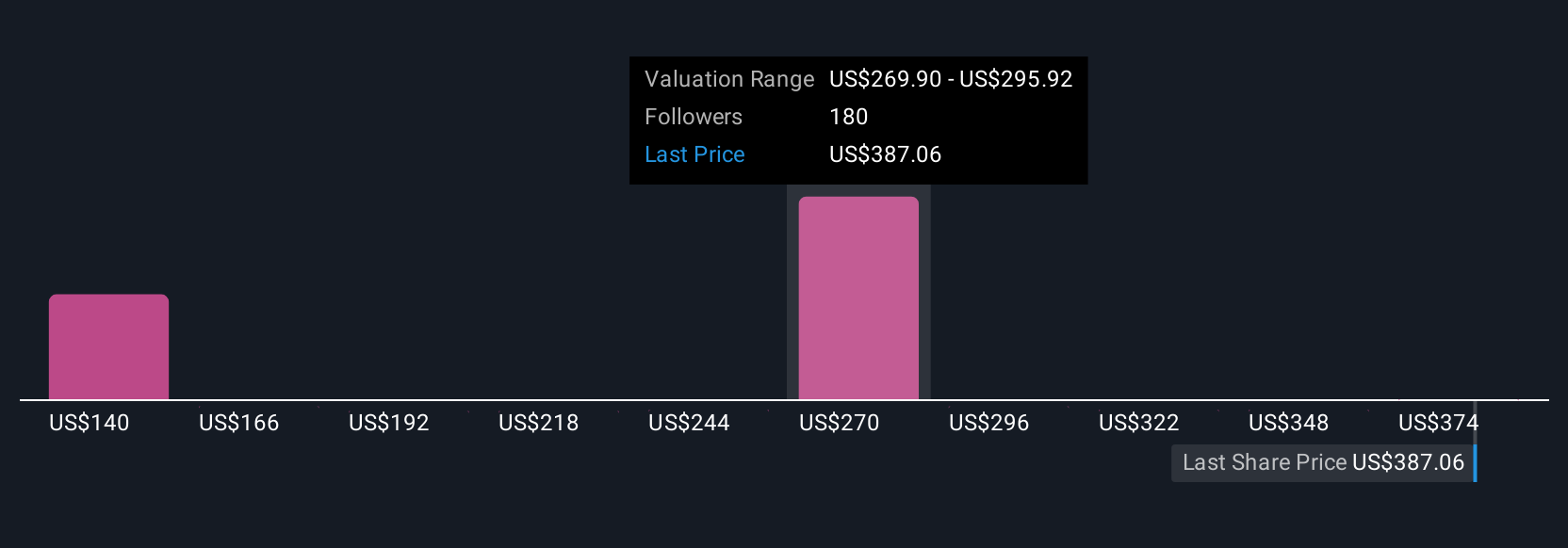

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company—your view of how its future might unfold—translated into concrete financial estimates like future revenue, profit margins, earnings, and ultimately a fair value for the stock.

Narratives connect your outlook on a company directly to a forecast, making the numbers meaningful and personal. This approach is not just for experts. On Simply Wall St's Community page, millions of investors create and share their Narratives for companies like Coinbase Global, making it easy and accessible to anyone.

With Narratives, you can track and compare Fair Value against the current Price, helping you decide when the stock is undervalued or overvalued according to your own research or convictions. The powerful part is that Narratives are dynamic. They update automatically as new information, such as earnings releases or news, becomes available and help ensure your fair value stays relevant.

For example, some investors may have a bullish Narrative for Coinbase, projecting earnings growth and expansion into blockchain payments, with a fair value above $500. Others, more cautious about trading volumes and cybersecurity risks, might see a much lower fair value around $185. By tapping into Narratives, you can quickly see the full spectrum of market perspectives and decide which story and valuation make the most sense for you.

Do you think there's more to the story for Coinbase Global? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.