Please use a PC Browser to access Register-Tadawul

How Does Intuitive Surgical Stack Up After Recent FDA Robot Surgery Guidance in 2025?

Intuitive Surgical, Inc. ISRG | 592.85 592.85 | +4.67% 0.00% Pre |

If you are eyeing Intuitive Surgical stock and wondering whether to jump in, hold on, or cash out, you are not alone. This company has been a favorite among tech-forward healthcare investors, and its track record is enough to get anyone’s attention. Over the past three years, shares have soared an incredible 124.1%, and over the last five years, they are up nearly 84%. Yet, the past year has brought a bit of turbulence, with the stock down 7.6% and still off by 15.5% year-to-date. Even though there was a modest 1.1% uptick this past week, many investors have been recalibrating their expectations as the broader market adjusts to shifting risk appetites and evolving economic headwinds.

It is clear that Intuitive Surgical is a remarkable growth story. That brings us to the bigger question: is the current stock price a bargain, fairly valued, or potentially overpriced? To answer that, we will look at a range of valuation approaches. Right now, Intuitive Surgical holds a value score of 1, meaning it is considered undervalued in just one out of six key checks. But that metric is just the beginning. Let’s break down exactly how analysts are scoring this company, before I share an even smarter perspective for evaluating its true worth.

Intuitive Surgical scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Intuitive Surgical Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future free cash flows and then discounting them back to today’s value. This helps investors gauge whether a stock price reflects the actual cash-generating potential of the business, adjusted for the time value of money.

Intuitive Surgical currently generates about $1.75 billion in free cash flow annually. Analyst projections see this figure rising rapidly over the coming years. For 2029, the company’s free cash flow is expected to reach nearly $4.4 billion. While the forecasts up to 2029 are based on analyst consensus, estimates beyond this period are extrapolated using industry-standard assumptions.

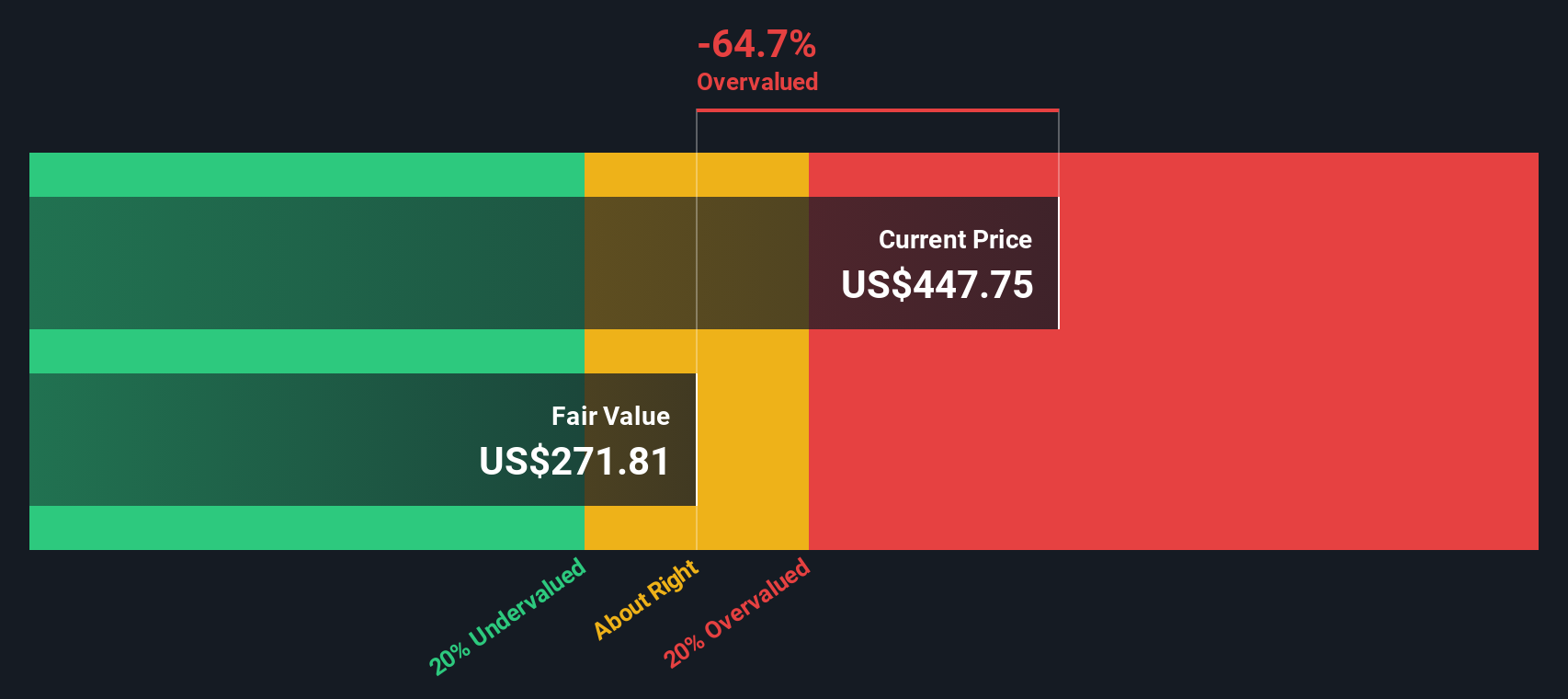

Based on these forward-looking projections and Simply Wall St’s 2 Stage Free Cash Flow to Equity DCF model, Intuitive Surgical’s intrinsic value per share is estimated to be $272.76. However, when compared to the current share price, the model indicates the stock is roughly 62.4% overvalued at present.

While Intuitive Surgical’s growth story is impressive, the DCF analysis suggests the market has more than priced in this potential. Investors may be paying a significant premium for future gains.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intuitive Surgical may be overvalued by 62.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Intuitive Surgical Price vs Earnings

The price-to-earnings (PE) ratio is a widely accepted valuation tool for analyzing established, profitable companies like Intuitive Surgical. This metric tells investors how much they are paying for each dollar of current earnings, making it a quick reference point for comparing companies across sectors or tracking how the market values growth and risk.

Growth potential and risk factors both play a big part in shaping what is considered a "normal" or "fair" PE ratio. Companies with robust growth prospects and lower risks typically command a higher PE, while those facing industry headwinds or slowing expansion tend to see their multiples fall back toward the market, industry, or peer averages.

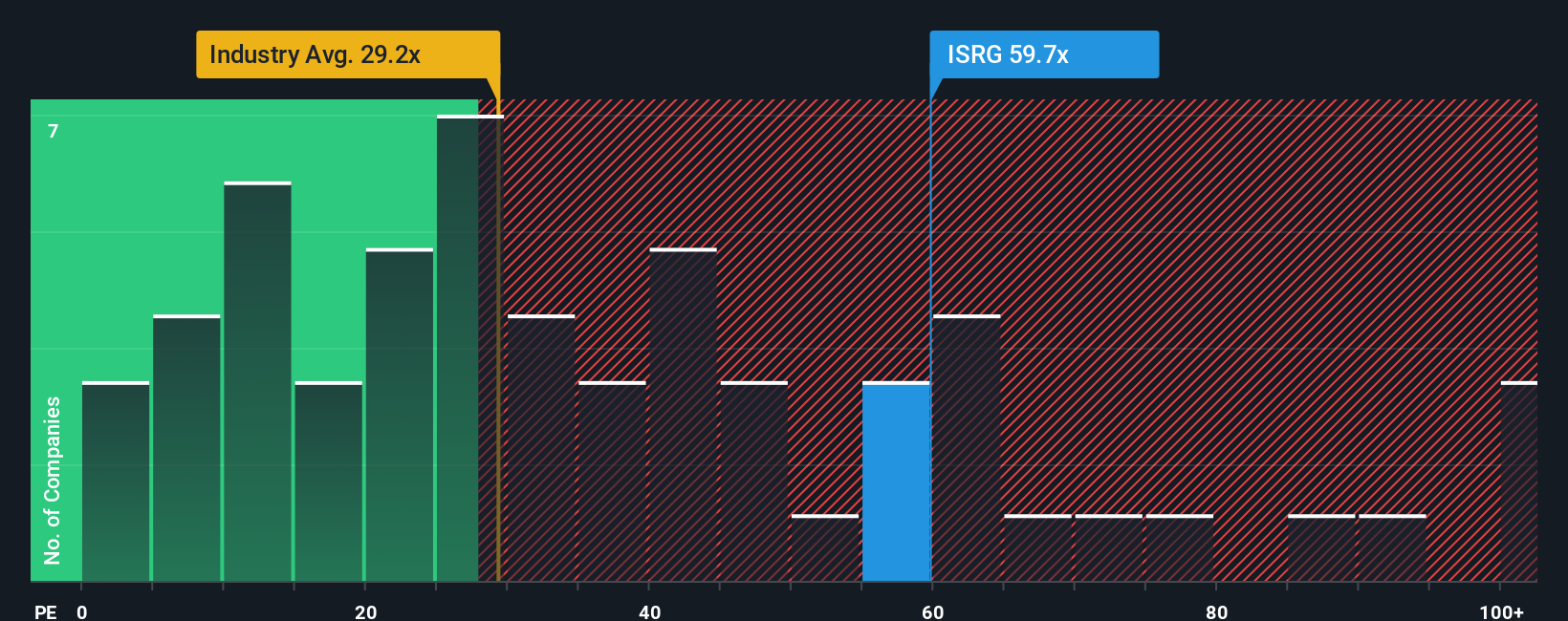

Right now, Intuitive Surgical trades on a PE ratio of 60.9x. That is a premium not just to the medical equipment industry average of 30.4x, but also to the peer group average of 37.0x. However, Simply Wall St’s proprietary Fair Ratio, which adjusts for factors like earnings growth, margins, market capitalization, and business risks, comes in at 35.7x for Intuitive Surgical.

The Fair Ratio offers a more tailored view than generic industry or peer comparisons as it incorporates the specific characteristics and outlook of the company in question, rather than painting with a broad brush. This helps investors avoid common pitfalls, such as overpaying simply because a company is a category leader or overlooking unique risks not captured by sector averages.

Since Intuitive Surgical’s actual PE is significantly higher than its Fair Ratio, the stock looks overvalued using this lens.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intuitive Surgical Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a powerful new approach that puts your perspective into every investment decision. A Narrative is your own story about a company, built on your views about what will drive future revenue, earnings, and margins, connecting these beliefs to a fair value estimate.

Narratives go beyond the surface by linking the company’s qualitative story to a financial forecast and, ultimately, a data-driven fair value. With Simply Wall St’s easy-to-use tools (found right inside the Community page used by millions of investors), anyone can create or explore Narratives, turning complex valuation into something simple and actionable.

By using Narratives, you can better decide when to buy or sell. Just compare your Narrative’s fair value to the current price and see if your thesis stacks up. Plus, since Narratives update automatically whenever there is important news, earnings, or market shifts, your investment rationale always stays current.

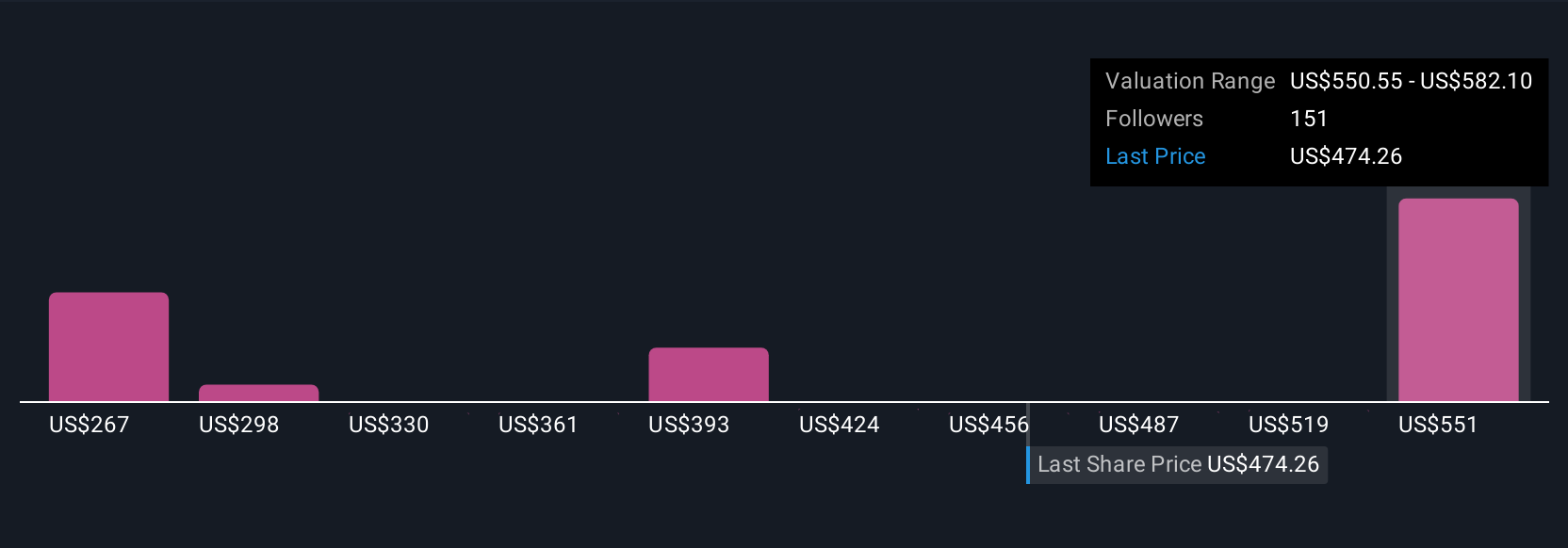

For example, some investors believe Intuitive Surgical is only worth $325 per share, while others see its fair value as high as $685, showing how different informed perspectives can lead to very different investment conclusions.

For Intuitive Surgical, we will make it easy for you with previews of two leading Intuitive Surgical Narratives:

🐂 Intuitive Surgical Bull CaseFair value: $582.10

Current price is 23.9% below the narrative fair value

Forecast annual revenue growth: 13.5%

- Growth is driven by expanding adoption of robotic surgery around the world, especially in emerging markets, and by the company’s innovation in new products and digital tools supporting recurring revenues and margin stability.

- Supportive clinical outcomes and increasing regulatory backing are breaking down barriers, allowing Intuitive Surgical to build long-term competitive advantage. However, international budget pressures and regulatory complexities remain as risks.

- Analysts expect sustained double-digit revenue growth and higher earnings, projecting a 3-year revenue CAGR of 13.5%, with earnings per share reaching $10.28 by 2028 and a fair value well above today’s trading price, which could suggest undervaluation if these growth assumptions hold true.

Fair value: $400.91

Current price is 10.5% above the narrative fair value

Forecast annual revenue growth: 12.0%

- Intuitive Surgical’s strong business model is underpinned by the recurring revenue from its global installed base of da Vinci systems, which accounts for the vast majority of income and delivers resilience even in volatile times.

- Despite robust growth and high-margin subscription-like revenues, the current stock price is considered expensive and is trading 37% above fair value as estimated based on free cash flow. This suggests that annual returns may be limited at current valuation.

- While the company is a recognized leader in its field, the bear view argues that the stock rarely presents a compelling entry point due to high valuations, so investors may want to wait for a more attractive price to buy in.

Do you think there's more to the story for Intuitive Surgical? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.