Please use a PC Browser to access Register-Tadawul

How Oracle’s Massive Data Center Expansion Affects Its 2025 Stock Valuation

Oracle Corporation ORCL | 189.97 | -4.47% |

Thinking about whether to hold, buy, or sell Oracle? You are in good company. Oracle’s stock has experienced considerable volatility, with short-term dips but significant growth over the past year. In just the last 90 days, shares are up almost 50%, and that one-year return is nearly 70%. Clearly, something notable is happening behind the scenes.

What is driving these swings? For one, Oracle continues to secure major deals and draw investment headlines. Over the past month, news broke that Oracle is building some of the largest data centers ever, and powering high-profile projects like Elon Musk’s xAI, which is fueling interest in artificial intelligence and cloud computing. Oracle is also reportedly close to finalizing a $100 million-per-year partnership if the Skydance-Paramount merger is completed. While these developments generate excitement about Oracle’s future growth potential, they also come with a degree of risk, since large-scale spending and ambitious projects can quickly affect investor sentiment if expectations are not met.

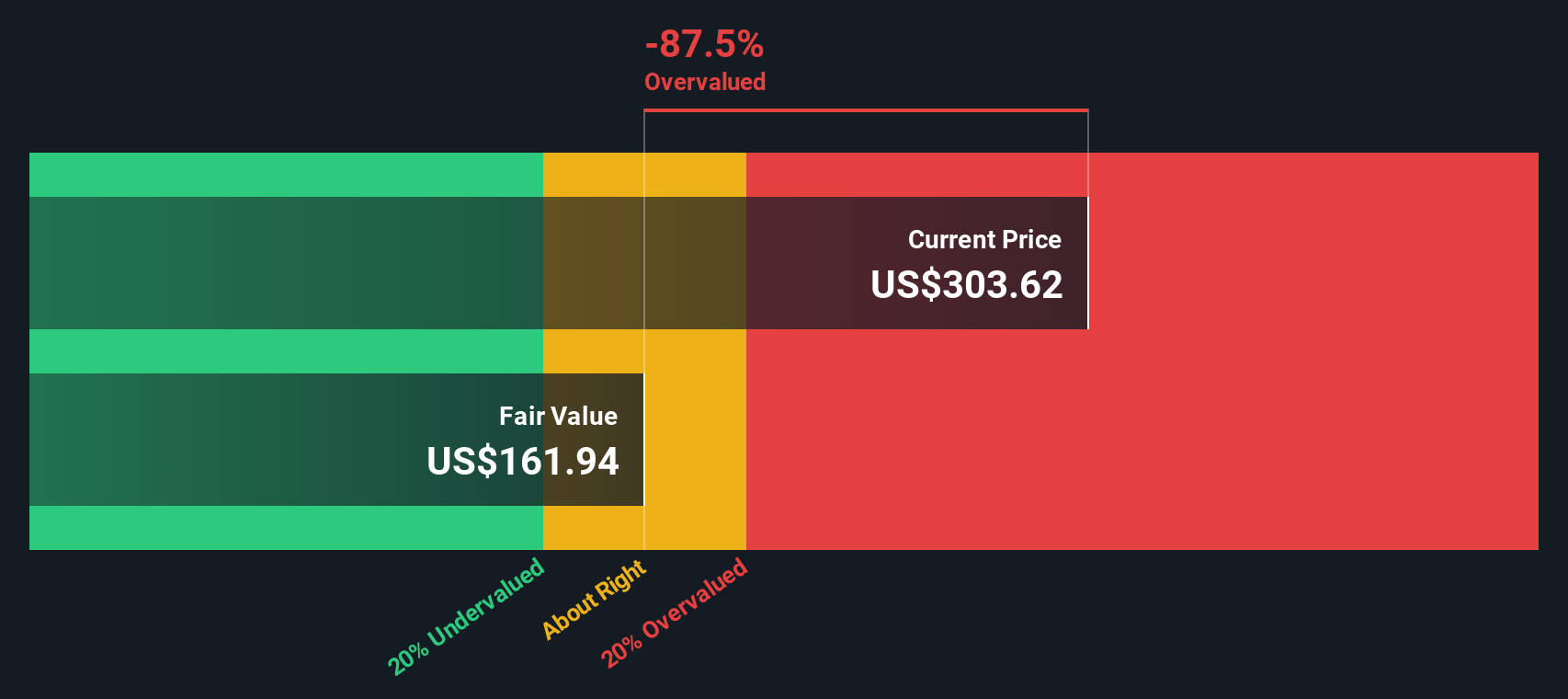

If you are wondering whether Oracle is undervalued right now, here is a quick score: based on key valuation checks, Oracle meets just 2 out of 6 criteria for being considered undervalued. That gives it a valuation score of 2. This is a mixed signal, suggesting there is value present but also areas where the stock may be somewhat expensive.

But what do those six valuation checks actually tell us about Oracle’s prospects? Up next, we will break down each approach and then look for a more refined way to sort through the various valuation metrics at the end of the article.

Oracle delivered 69.4% returns over the last year. See how this stacks up to the rest of the Software industry.Approach 1: Oracle Cash Flows

The Discounted Cash Flow (DCF) model is a common valuation tool that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach provides insight into what a stock might really be worth, beyond current market fluctuations.

For Oracle, the company generated Free Cash Flow of $7.65 billion over the last twelve months. Analysts forecast steady growth, with projections rising sharply to $32.6 billion by 2030. The model uses a Two-Stage Free Cash Flow to Equity approach, factoring in expected growth rates and risk, and then discounts those future billions to their net present value today.

The result is an estimated intrinsic value of $255.17 per share. When compared to Oracle’s current market price, this suggests the stock is trading at approximately a 7.9% discount to its intrinsic value, indicating the market price and the calculated value are very close.

Result: ABOUT RIGHT

Approach 2: Oracle Price vs Earnings

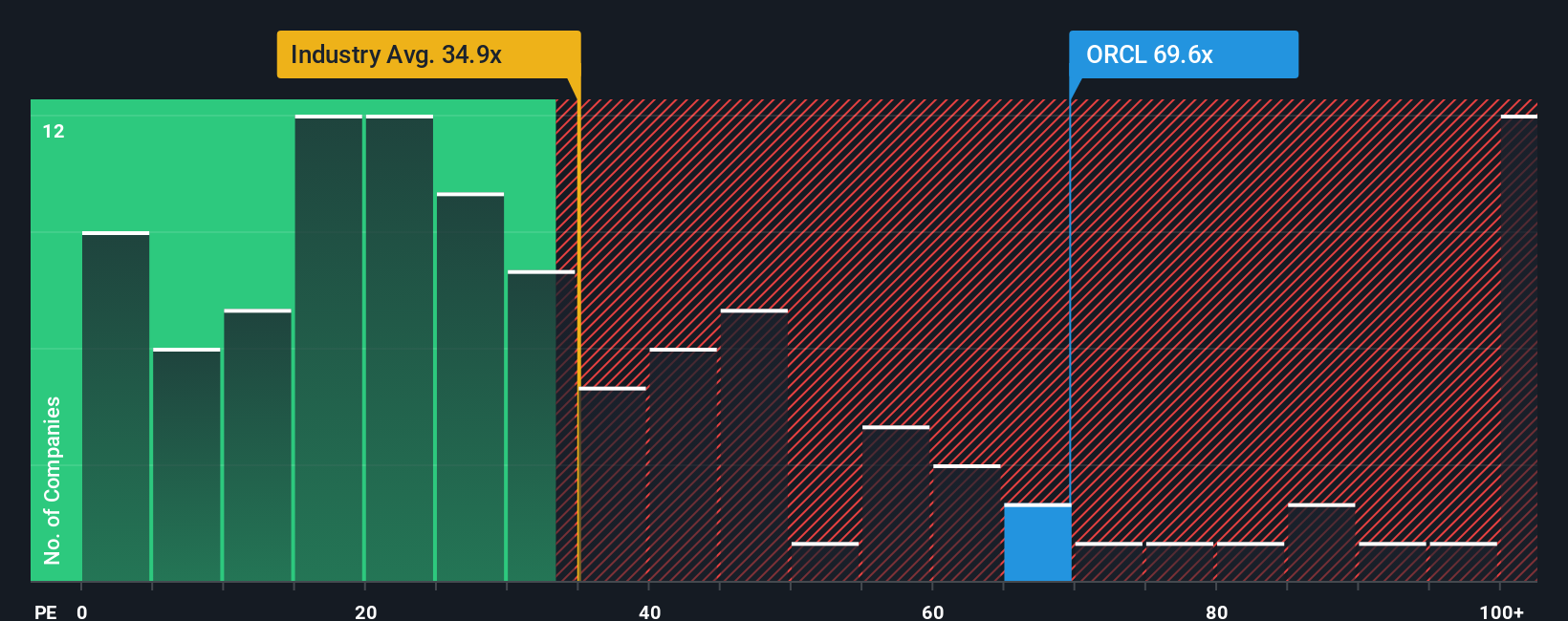

The price-to-earnings (PE) ratio is a well-established method for evaluating profitable companies like Oracle. It tells investors how much they are paying for each dollar of earnings and is a quick way to gauge whether a stock trades at a premium or a discount compared to its peers and growth expectations.

The appropriate PE ratio depends on both the company’s expected growth and the level of risk investors are taking on. Fast-growing companies or those with lower risk profiles typically command higher PE multiples because the market anticipates higher future profits or greater stability. In contrast, slower growth or higher risks usually mean investors are willing to pay less per dollar of earnings.

Oracle currently trades at a PE ratio of 53.1x, which is higher than the average for the Software industry (36.7x), but notably lower than the peer group average (72.1x). The proprietary Fair Ratio for Oracle, which factors in unique attributes such as its earnings trajectory and profitability, comes in at 52.3x. This puts Oracle almost exactly in line with what would be considered a reasonable valuation, suggesting the current price reflects its earnings outlook and risk fairly well.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Oracle Narrative

Instead of relying on a single number or metric, Narratives let you bring your perspective to the investment table by connecting Oracle’s story, your expectations for revenue and profits, and your fair value estimate into a single, clear line of thinking.

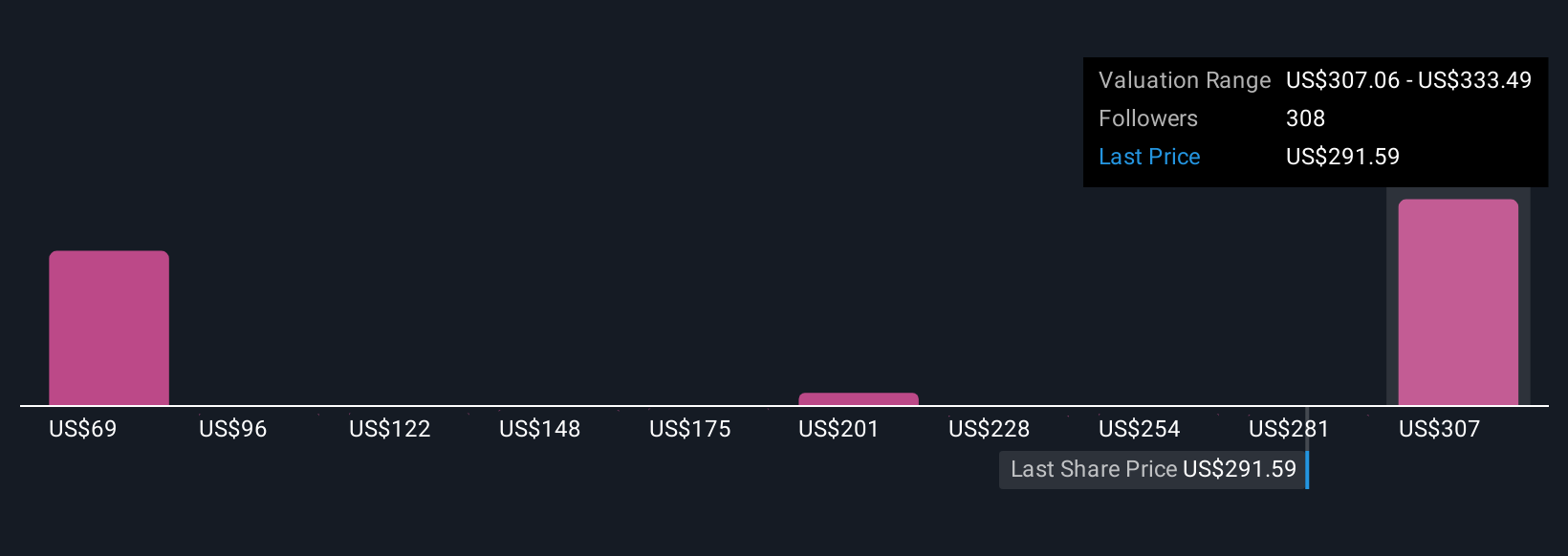

A Narrative is simply the story you believe about Oracle’s future. It links what you know about the company to a financial forecast and then to a fair value in a straightforward and intuitive way. Within the Simply Wall St platform, Narratives make it easy for millions of investors to combine facts, projections, and their own view into a transparent tool for deciding when to buy or sell. When your Fair Value diverges from the current Price, that might be your cue.

What makes Narratives even more powerful is that they update automatically whenever news, earnings, or company events happen, so your analysis always stays in sync with real-world developments. For example, one Oracle Narrative pegs fair value at $325, based on rapid cloud growth and AI innovation, while another sees risks and values the stock at just $175. This demonstrates how different viewpoints can lead to very different investment conclusions.

For Oracle, we'll make it really easy for you with previews of two leading Oracle Narratives: 🐂 Oracle Bull Case- Fair Value: $244.36

- Oracle is 3.8% undervalued (current: $235.06 vs. narrative FV)

- Expected annual revenue growth: 19.3%

- Oracle’s rapid cloud region and power expansion along with strong multi-cloud partnerships with AWS, Google, and Azure are set to accelerate future growth, particularly from AI and database migration demand.

- Analysts forecast significant earnings and margin increases over the next three years, with robust contract performance obligations indicating strong underlying demand.

- Short-term risks include cloud build-out delays, heavy capital expenditure requirements, and currency volatility. Consensus is that the stock is fairly priced with long-term upside if growth targets are met.

- Fair Value: $212.00

- Oracle is 10.9% overvalued (current: $235.06 vs. narrative FV)

- Expected annual revenue growth: 14.4%

- Oracle’s long-term strategy focuses on expanding cloud services and integrating AI, targeting highly regulated industries and global expansion. Execution may be challenging given fierce competition from top cloud providers and the need to scale efficiently.

- Financial discipline supports ongoing R&D and shareholder returns, yet Oracle’s leveraged balance sheet and dependence on large infrastructure investments may limit flexibility if market conditions change.

- Key risks include intense industry competition, potential economic slowdowns affecting IT spending, and operational challenges from scaling both cloud and AI solutions. These factors could restrain future valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.