Please use a PC Browser to access Register-Tadawul

How the 24% 2025 Rally in First Solar Stacks Up After New Tariff Announcements

First Solar, Inc. FSLR | 225.52 | +0.67% |

Thinking about what to do with your First Solar shares right now? You are definitely not alone. With the stock closing at $231.85 lately and notching a healthy 24.3% jump year-to-date, there is no shortage of investors keeping a close eye on this company. Over the past month alone, the stock has climbed 10.0%, and if you zoom out longer term, the results only get more impressive: in the last three years, shares have returned 89.1%, and over five years, 171.6%. That kind of performance has more than a few people wondering if the rally still has legs or if the party is winding down.

One big factor behind the recent upward momentum comes from broader market enthusiasm for clean energy. There has been growing optimism about solar and renewables in general as global policy support firms up and investors hunt for growth in sectors tied to decarbonization. First Solar, as a leading US-based manufacturer, has taken center stage in that discussion. At the same time, new trade policy signals and supply chain shifts have played a role in boosting confidence about First Solar's competitive position as well as future profitability.

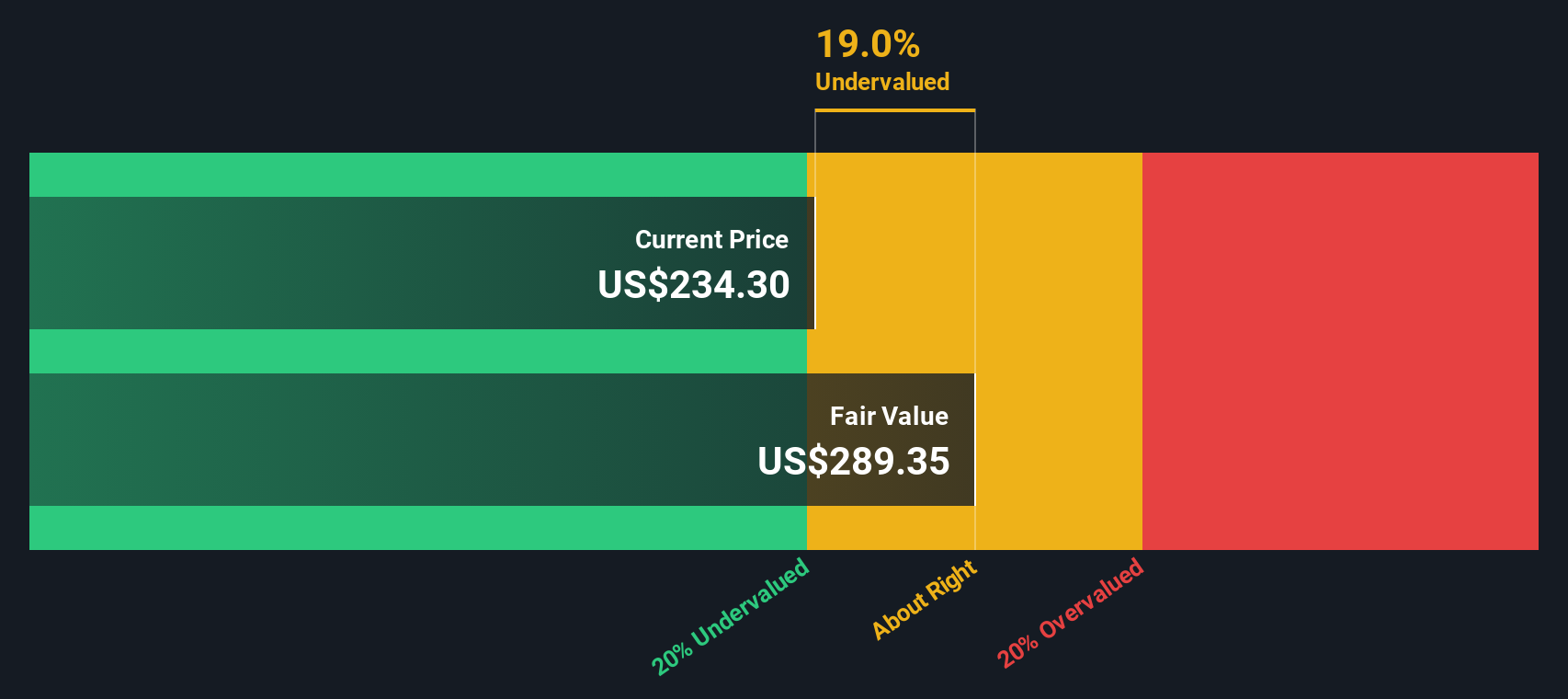

But, as with any strong run, smart investors zoom in on whether the stock's price actually lines up with what the business is worth. Here is where things get interesting: First Solar gets a valuation score of 5 out of 6, meaning it passes nearly every check for being undervalued right now. Still, there is more to evaluation than even traditional methods show. Let's dig into the specific valuation approaches analysts use, and stick around for a look at an even deeper way to understand value at the end of this article.

Approach 1: First Solar Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by taking a company's expected future cash flows, projecting them forward, and then discounting them back to today's value to estimate what the business is really worth. For First Solar, this approach uses the 2 Stage Free Cash Flow to Equity method.

Looking at the data, First Solar's trailing twelve-month free cash flow is currently negative, at -$1.25 billion. However, analysts expect a sharp turnaround and project substantial growth over the coming years. By 2029, free cash flow is forecast to reach $3.52 billion. Although analyst estimates are provided for up to five years, longer-term projections are extrapolated out to a full decade, with free cash flows expected to continue rising through 2035.

Given these projections and discounting them accordingly, the DCF analysis estimates First Solar's intrinsic value at $388.84 per share. With the stock recently trading at $231.85, this means the shares are currently trading at a 40.4% discount to their intrinsic value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests First Solar is undervalued by 40.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

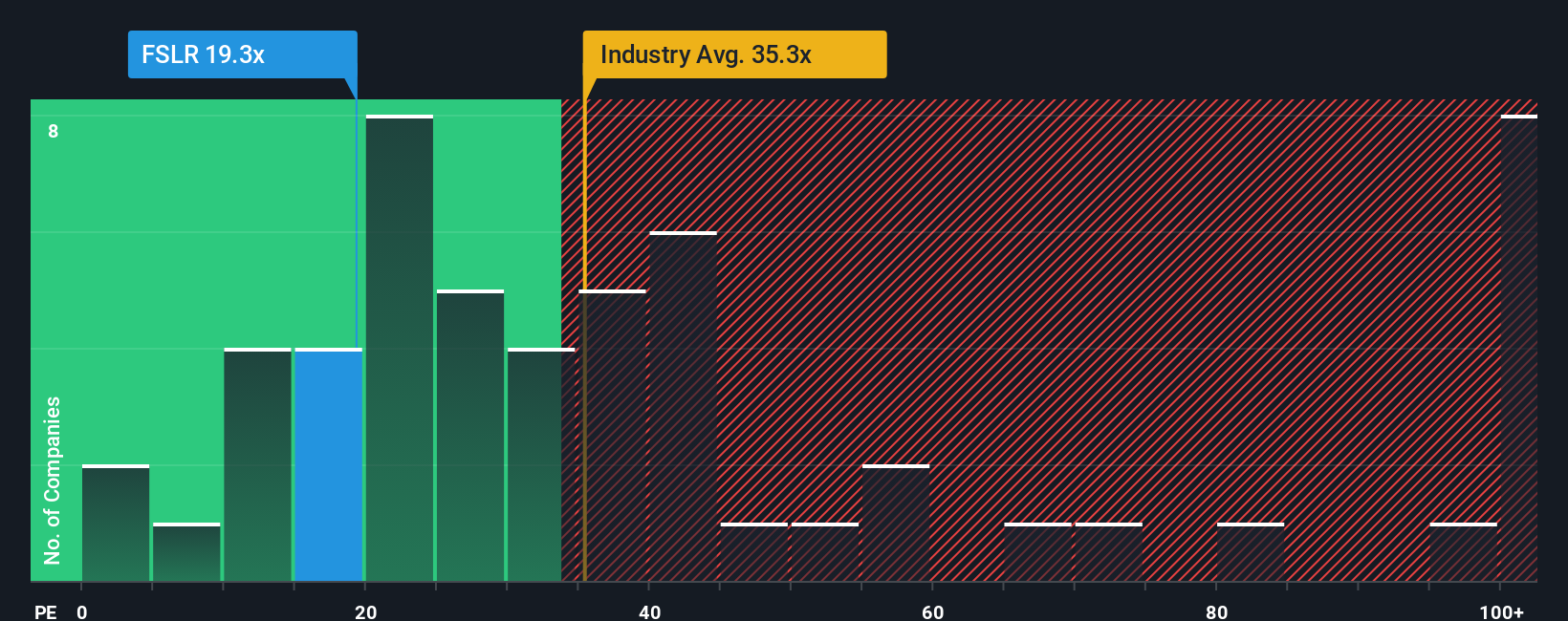

Approach 2: First Solar Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is often the go-to method for valuing profitable companies like First Solar because it directly ties a company's share price to its annual earnings. This makes it a handy way to see what investors are willing to pay for each dollar of current profits, which is a key anchor in determining valuation, especially when earnings are positive and stable.

However, the “right” PE ratio for a business can shift based on expectations for growth, profit stability, and risk. Higher growth companies or those in robust industries often command above-average PE ratios, while those with greater risk or slower growth might trade at lower values.

First Solar currently trades at a PE ratio of 19.8x. For context, the average PE for its semiconductor industry peers is 35.9x, while the broader peer group sits even higher at 78.9x. At first glance, this might make First Solar look like a bargain. But it is also worth noting Simply Wall St's proprietary Fair Ratio, which for First Solar is 37.7x. Unlike standard benchmarks, the Fair Ratio takes into account the company's specific growth outlook, profitability, risk profile, market cap, and its competitive landscape, offering a far more tailored and realistic assessment.

When you compare the current PE of 19.8x to the Fair Ratio of 37.7x, it suggests that First Solar is trading well below what would be considered a fair value given its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First Solar Narrative

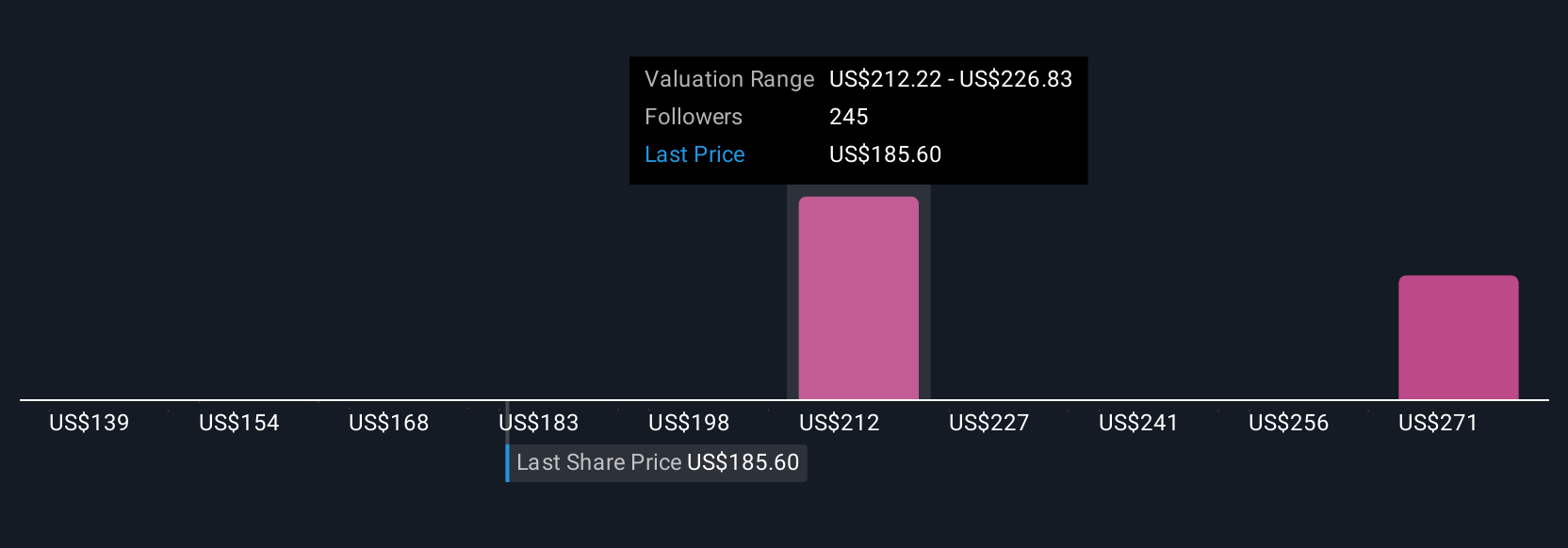

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own take on a company's future. It links your story and beliefs about First Solar to actual financial forecasts, which then map directly to a fair value estimate. Unlike traditional analysis, Narratives capture your assumptions about how the business might grow, what margins it could achieve, and which risks or opportunities matter most, turning your perspective into clear, actionable numbers.

This approach is both accessible and dynamic, and you can use Narratives directly within Simply Wall St's Community (where millions of investors share their views). Narratives empower you to decide when a stock looks like a buy or sell by comparing your fair value against the live share price, and they are automatically updated whenever new financials or news land so your insights stay relevant. For example, some First Solar Narratives project a fair value as high as $287 if you believe in rapid U.S. expansion and technology leadership, while more conservative views set it as low as $100 if policy or competition risks loom larger. This shows how investor stories drive meaningful differences in value and timing.

Do you think there's more to the story for First Solar? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.