Please use a PC Browser to access Register-Tadawul

ICF International (ICFI) Valuation After Securing Nearly US$300 Million In New EU Contracts

ICF International, Inc. ICFI | 79.01 | +0.34% |

ICF International (ICFI) has attracted fresh attention after securing two multi year contracts with European institutions to lead public communication campaigns across all 27 EU Member States, with a combined ceiling near US$300 million.

The recent EU contract wins come as ICF International’s share price trades at US$95.96, with a 30 day share price return of 12.16% and a year to date gain of 12.48%. However, the 1 year total shareholder return is a 23.74% decline, which hints that shorter term momentum has picked up while longer term holders have yet to recover past losses.

If this kind of contract driven story has your attention, it could be a good moment to see what else is out there with fast growing stocks with high insider ownership.

So with ICF International trading at US$95.96, showing mixed recent returns, an intrinsic value estimate above the current price and fresh EU contract wins, is there still a buying opportunity here or is the market already pricing in future growth?

Price-to-Earnings of 17.9x: Is it justified?

At a last close of US$95.96, ICF International is trading on a P/E of 17.9x, which screens as inexpensive versus both peers and its own fair ratio.

The P/E multiple compares the current share price to earnings per share. For a services business like ICF International it reflects what investors are paying for each dollar of profit generated. A lower P/E than comparable companies can hint that the market is assigning a more conservative view of future earnings, even when profits are growing over time.

Here, ICF International is assessed as good value on several fronts. Its 17.9x P/E is below the US Professional Services industry average of 24.1x, and also below a peer average of 39x. It also sits under an estimated fair P/E of 20.1x, a level the market could move toward if sentiment or earnings expectations shift closer to that fair ratio.

Result: Price-to-Earnings of 17.9x (UNDERVALUED)

However, the 23.74% 1 year total return decline and revenue growth of 5.04% may lead to disappointment if future contracts or earnings do not meet expectations.

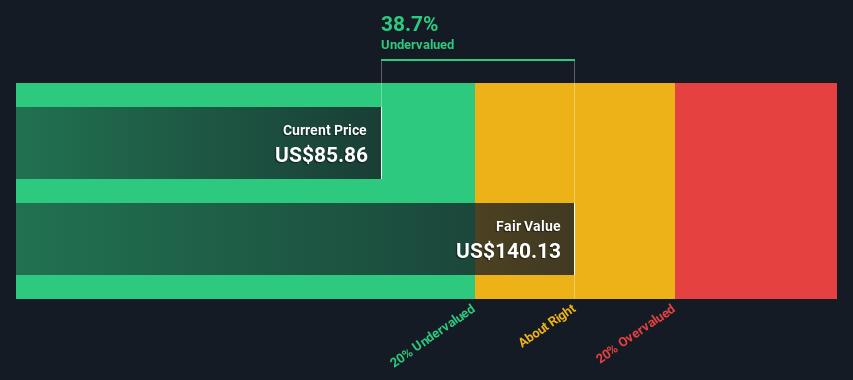

Another View: Our DCF Model Points To Deeper Upside

The P/E comparison already suggests ICF International looks inexpensive, but our DCF model goes a step further. On that approach, the shares at about US$95.96 sit roughly 26% below an estimate of future cash flow value near US$130, which also screens as undervalued.

When both earnings multiples and our DCF model lean in the same direction, it can appear to be a clear opportunity, but it also raises a question: Are current expectations too low, or are investors simply cautious about execution and growth quality from here?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ICF International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ICF International Narrative

If you see the numbers differently or prefer to test your own assumptions against the data, you can build a personalised view in just a few minutes with Do it your way.

A great starting point for your ICF International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If ICF International has sparked your interest, do not stop here, broaden your watchlist now so you do not miss other opportunities that might fit your approach.

- Scan for potential mispriced opportunities by checking out these 882 undervalued stocks based on cash flows that align with your return expectations and risk comfort.

- Target income focused ideas by reviewing these 13 dividend stocks with yields > 3% that could complement a portfolio built around regular cash payouts.

- Tap into digital asset themes with these 19 cryptocurrency and blockchain stocks and see which listed companies are tied to cryptocurrency and blockchain trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.