Please use a PC Browser to access Register-Tadawul

ICU Medical, Inc.'s (NASDAQ:ICUI) Price Is Right But Growth Is Lacking

ICU Medical, Inc. ICUI | 147.07 | -0.65% |

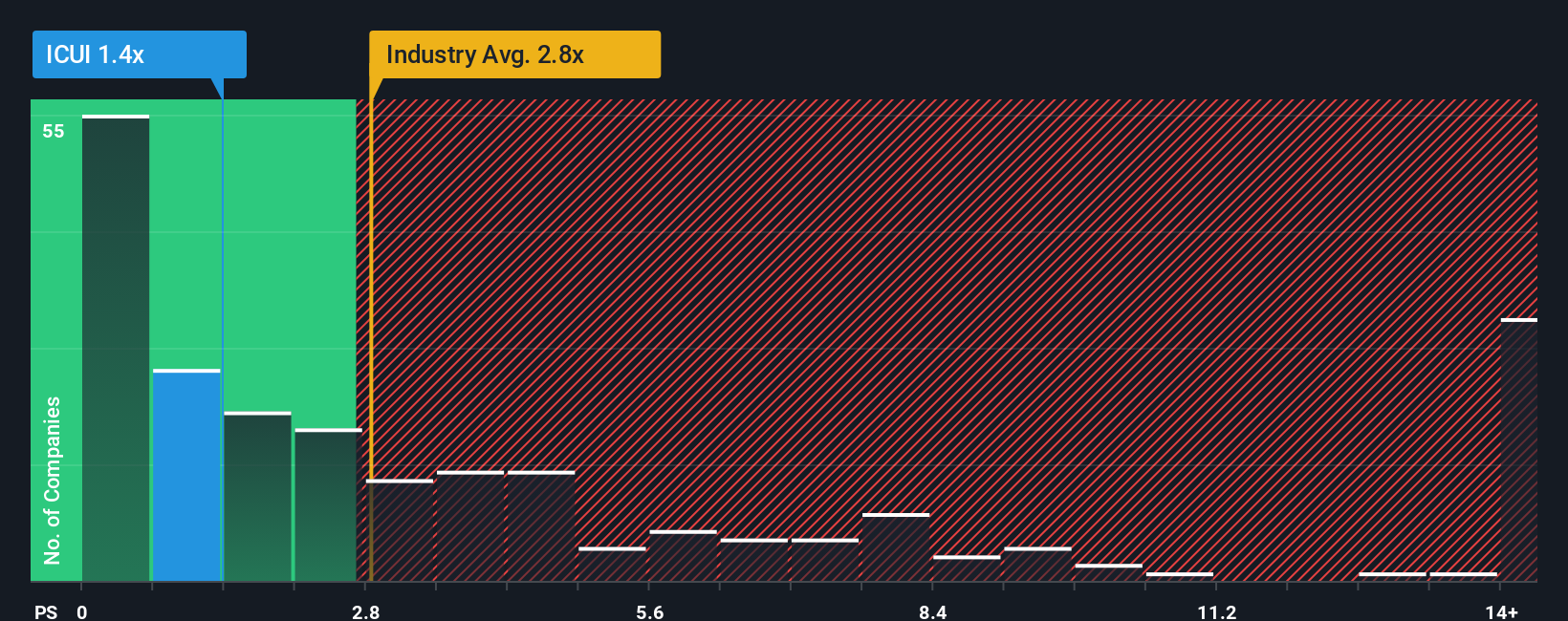

ICU Medical, Inc.'s (NASDAQ:ICUI) price-to-sales (or "P/S") ratio of 1.4x might make it look like a buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 2.8x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has ICU Medical Performed Recently?

Recent times haven't been great for ICU Medical as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ICU Medical.How Is ICU Medical's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as ICU Medical's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.2%. This was backed up an excellent period prior to see revenue up by 57% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 0.6% per year over the next three years. With the industry predicted to deliver 9.9% growth per annum, that's a disappointing outcome.

In light of this, it's understandable that ICU Medical's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of ICU Medical's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, ICU Medical's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks.

If these risks are making you reconsider your opinion on ICU Medical, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.