Please use a PC Browser to access Register-Tadawul

Improved Earnings Required Before SandRidge Energy, Inc. (NYSE:SD) Stock's 26% Jump Looks Justified

SandRidge Energy, Inc. SD | 17.61 | +0.28% |

SandRidge Energy, Inc. (NYSE:SD) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 43% in the last year.

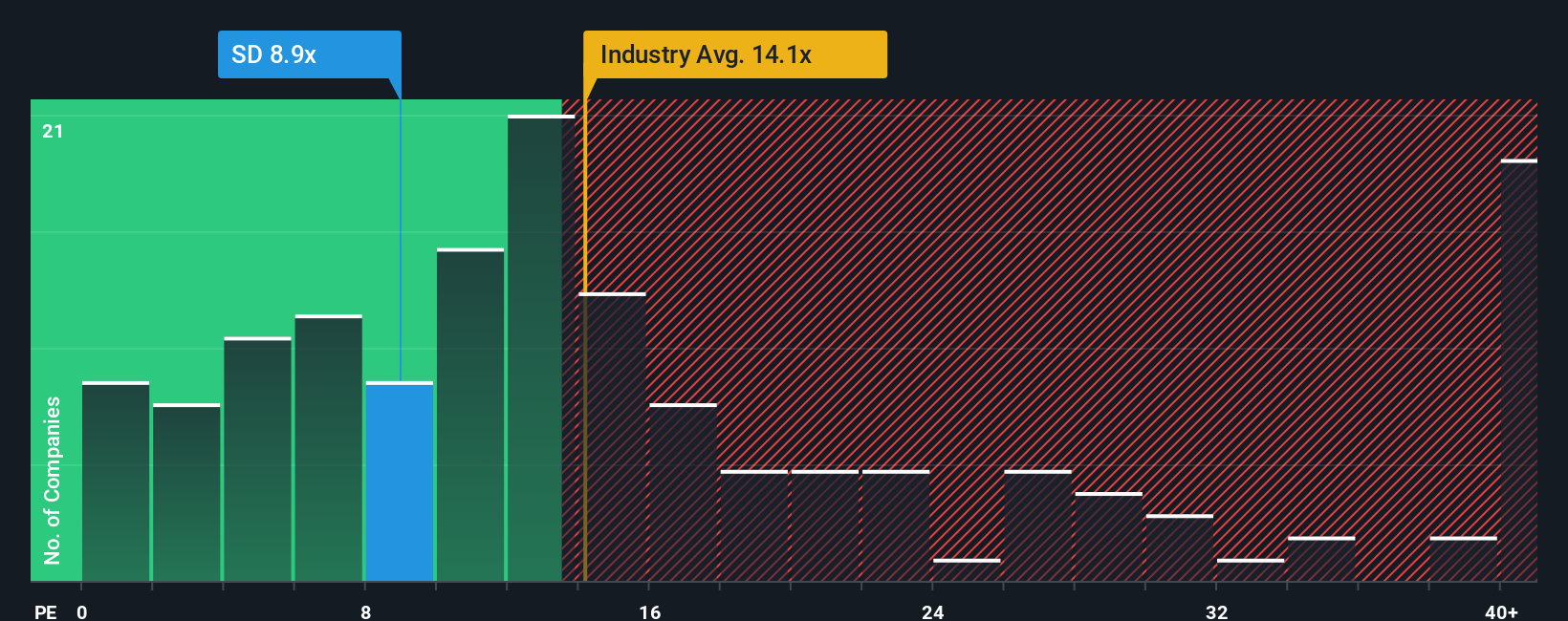

In spite of the firm bounce in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may still consider SandRidge Energy as a highly attractive investment with its 9.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been quite advantageous for SandRidge Energy as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

How Is SandRidge Energy's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like SandRidge Energy's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 41% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 62% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 16% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that SandRidge Energy is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On SandRidge Energy's P/E

SandRidge Energy's recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of SandRidge Energy revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for SandRidge Energy with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than SandRidge Energy. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.