Please use a PC Browser to access Register-Tadawul

Improved Revenues Required Before Aytu BioPharma, Inc. (NASDAQ:AYTU) Stock's 25% Jump Looks Justified

Aytu BioScience Inc AYTU | 2.42 | +3.86% |

Aytu BioPharma, Inc. (NASDAQ:AYTU) shares have continued their recent momentum with a 25% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

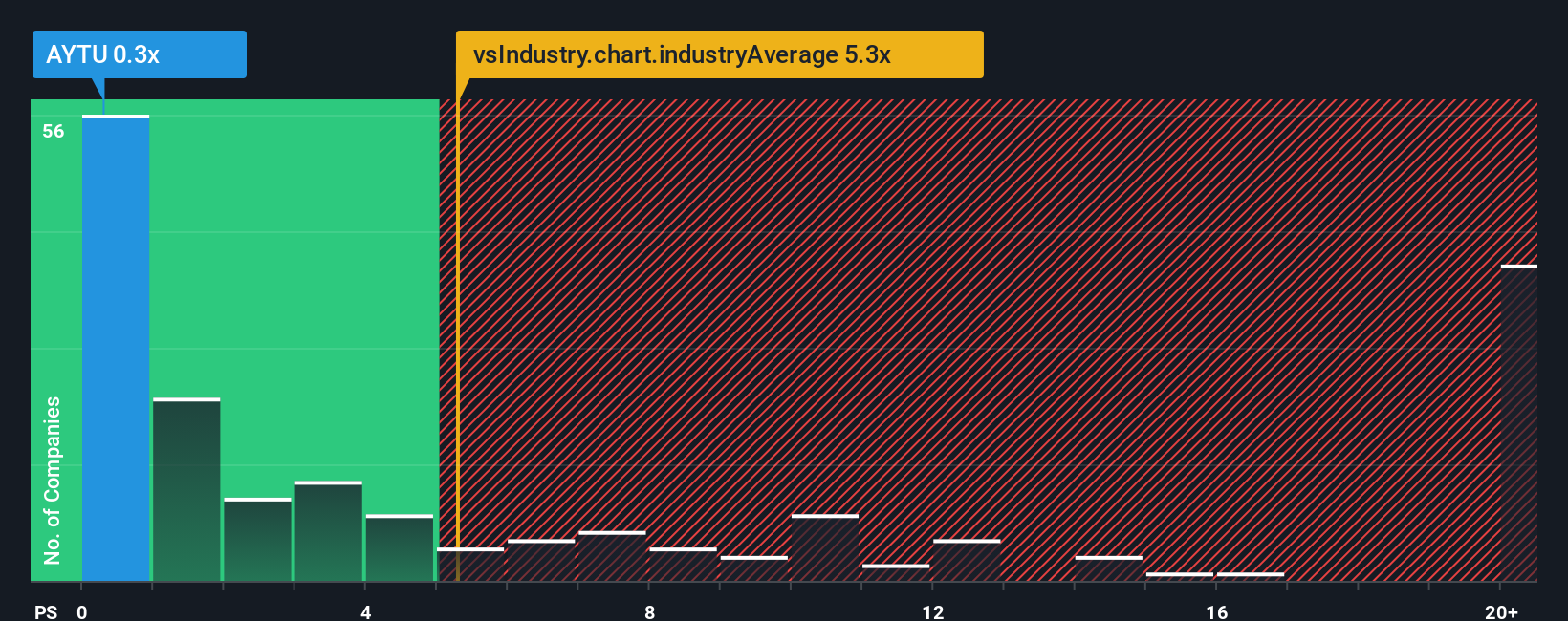

Even after such a large jump in price, Aytu BioPharma may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 5.3x and even P/S higher than 15x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

What Does Aytu BioPharma's P/S Mean For Shareholders?

Recent times haven't been great for Aytu BioPharma as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Aytu BioPharma.Is There Any Revenue Growth Forecasted For Aytu BioPharma?

Aytu BioPharma's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 12% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 13% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 18% per year, which is noticeably more attractive.

With this information, we can see why Aytu BioPharma is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Aytu BioPharma's P/S?

Shares in Aytu BioPharma have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Aytu BioPharma's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.