Please use a PC Browser to access Register-Tadawul

Improved Revenues Required Before Neogen Corporation (NASDAQ:NEOG) Stock's 46% Jump Looks Justified

Neogen Corp NEOG | 11.33 | +3.19% |

Despite an already strong run, Neogen Corporation (NASDAQ:NEOG) shares have been powering on, with a gain of 46% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.6% over the last year.

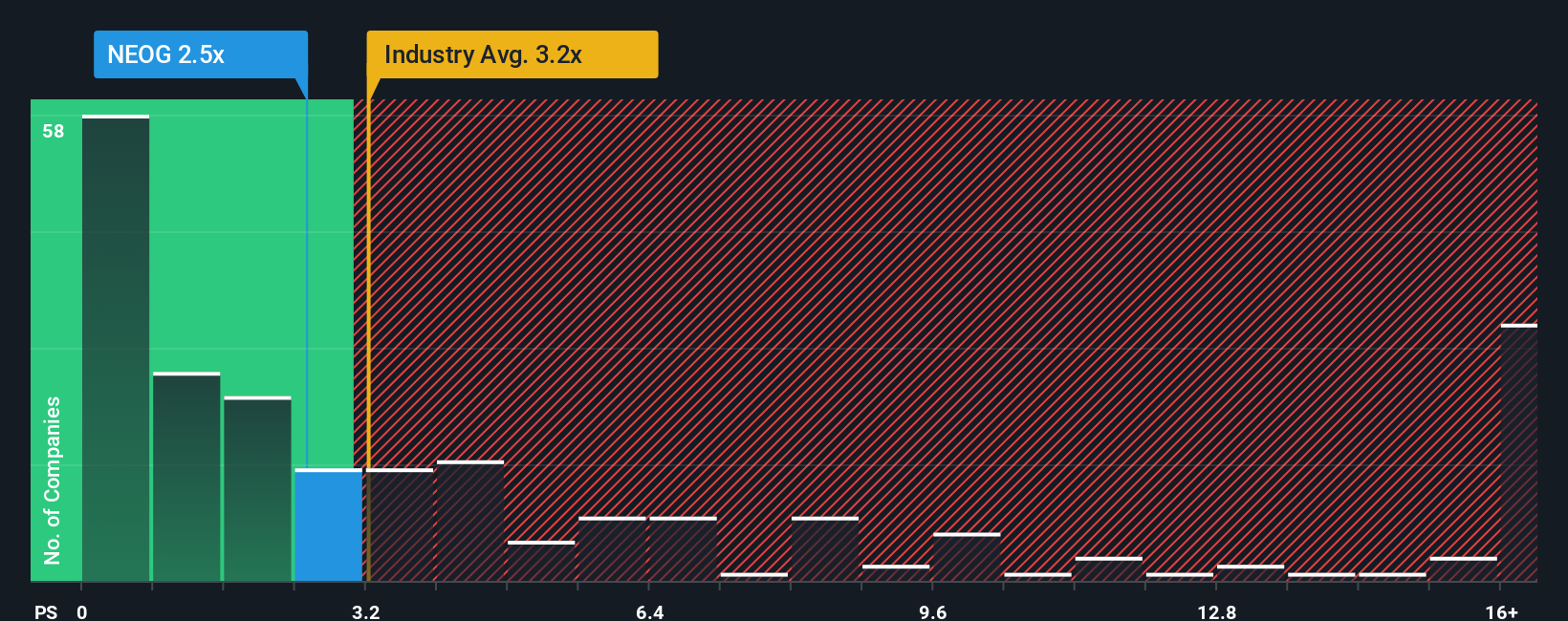

In spite of the firm bounce in price, Neogen's price-to-sales (or "P/S") ratio of 2.5x might still make it look like a buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.2x and even P/S above 9x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Neogen Has Been Performing

While the industry has experienced revenue growth lately, Neogen's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Neogen will help you uncover what's on the horizon.How Is Neogen's Revenue Growth Trending?

In order to justify its P/S ratio, Neogen would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.7%. Still, the latest three year period has seen an excellent 40% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 0.4% per year as estimated by the four analysts watching the company. That's not great when the rest of the industry is expected to grow by 127% each year.

In light of this, it's understandable that Neogen's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Neogen's P/S?

Neogen's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Neogen maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.