Please use a PC Browser to access Register-Tadawul

Improved Revenues Required Before Orion S.A. (NYSE:OEC) Stock's 26% Jump Looks Justified

Orion S.A. OEC | 6.08 | -3.03% |

Orion S.A. (NYSE:OEC) shares have had a really impressive month, gaining 26% after a shaky period beforehand. But the last month did very little to improve the 56% share price decline over the last year.

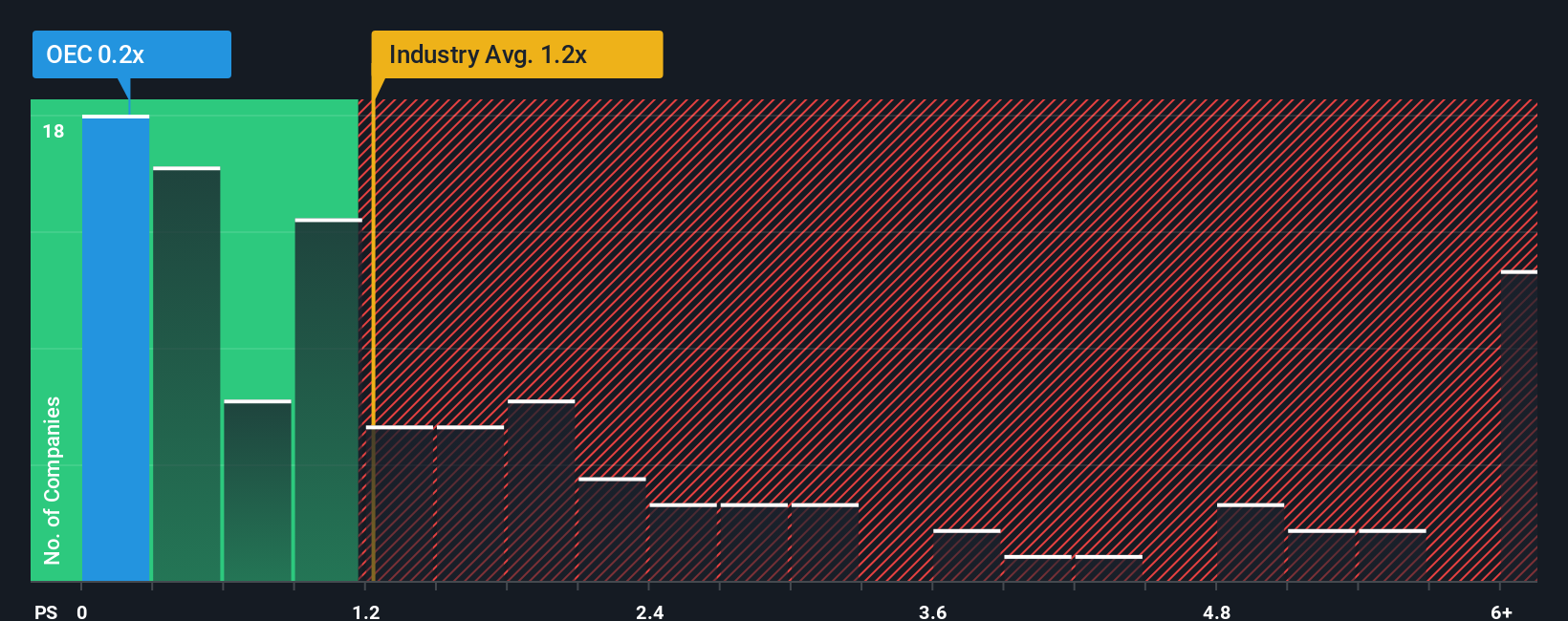

Even after such a large jump in price, it would still be understandable if you think Orion is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in the United States' Chemicals industry have P/S ratios above 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Orion Has Been Performing

Orion could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Orion.How Is Orion's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Orion's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 4.3% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 6.7% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 0.9% each year during the coming three years according to the five analysts following the company. That's not great when the rest of the industry is expected to grow by 9.8% per year.

With this in consideration, we find it intriguing that Orion's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Orion's P/S?

Despite Orion's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Orion's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.