Please use a PC Browser to access Register-Tadawul

In One Chart | NVIDIA's Six Major Holdings Attract Strong Investment, Top Holding CoreWeave Soars Over 171% in the Past 20 Days

NVIDIA Corporation NVDA | 177.72 177.18 | +0.81% -0.30% Pre |

CoreWeave CRWV | 69.50 69.00 | -3.94% -0.72% Pre |

Nebius Group NBIS | 80.95 83.35 | -0.23% +2.96% Pre |

Applied Digital APLD | 24.24 24.83 | +5.48% +2.42% Pre |

WeRide Inc. Sponsored ADR WRD | 8.64 8.75 | +2.37% +1.27% Pre |

NVIDIA Holdings Continue to Attract Market Attention

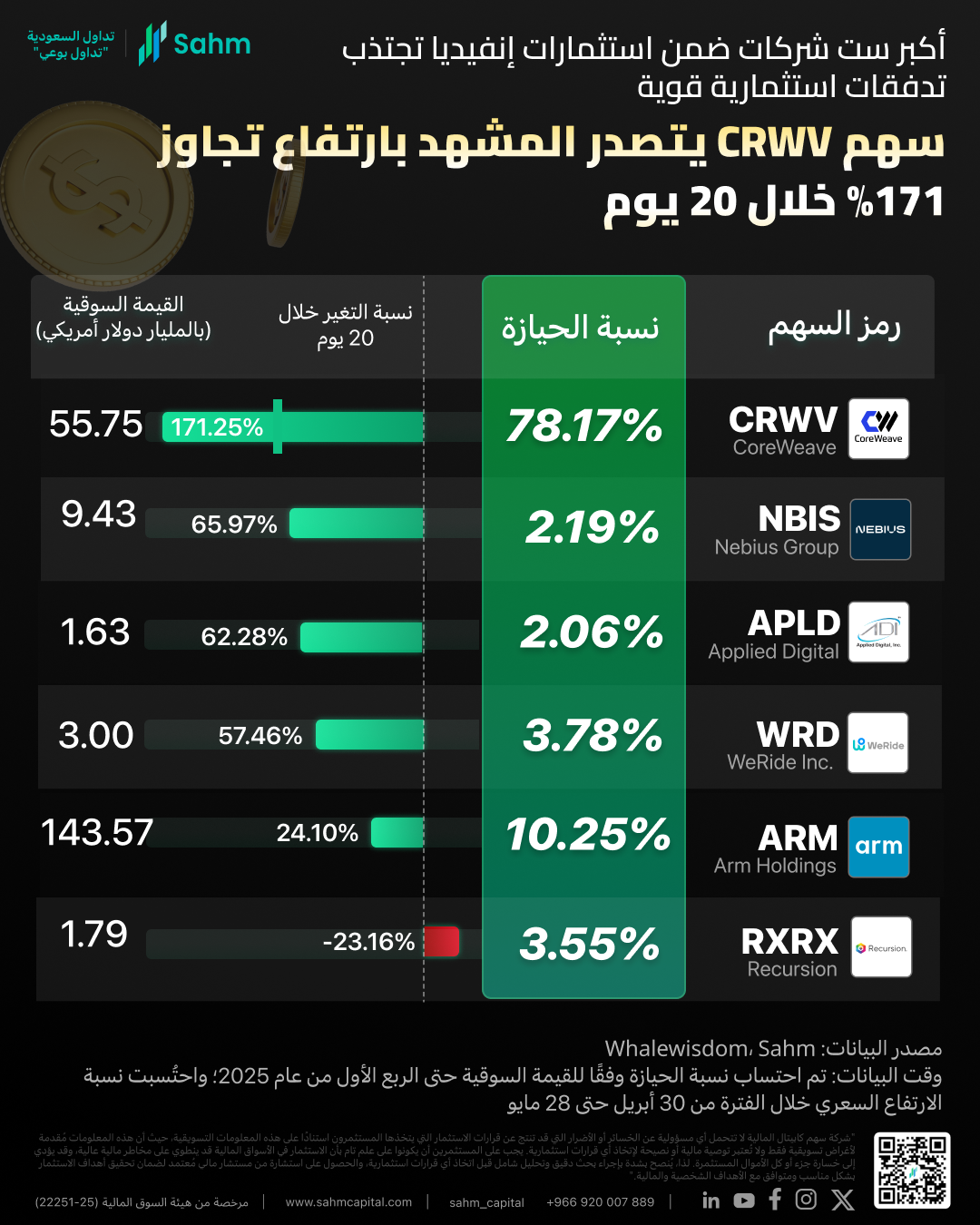

NVIDIA Corporation(NVDA.US)-backed CoreWeave(CRWV.US) has captured significant investor interest, surging 171% over the past 20 trading days.

Other data center operators like Nebius Group(NBIS.US), Applied Digital(APLD.US), and autonomous driving company WeRide Inc. Sponsored ADR(WRD.US) have also seen over 50% gains in the same period, while Arm Holdings(ARM.US) rose by more than 24%. However, RECURSION PHARMACEUTICALS, INC.(RXRX.US) experienced a 23.16% decline.

The latest 13F filings reveal that CoreWeave is NVIDIA's largest holding, with a stake of 78%.

What is CoreWeave?

CoreWeave, founded in 2017, is an AI infrastructure provider offering GPU cloud services, with NVIDIA as a key supporter.

The company leases high-end NVIDIA GPU chips (such as H100 and Blackwell architecture products) to provide high-performance computing power to clients like OpenAI, Microsoft, and Meta. By the end of 2024, CoreWeave will have deployed over 250,000 NVIDIA GPUs across 32 data centers globally, nearing Meta's scale.

CoreWeave's major clients are large CSPs, with Microsoft Corporation(MSFT.US) being the largest, accounting for 62% of 2024 revenue. NVIDIA is the second-largest client, contributing 15%, with both giants making up about 80% of the company's income. Other partners include International Business Machines Corporation(IBM.US), Meta Platforms(META.US), and AI startups like Cohere and Mistral.

What are the company's advantages?

CoreWeave began with cryptocurrency mining, establishing its first data center in New Jersey during the 2017 crypto boom. After the crypto crash, the company diversified, focusing on building a specialized cloud infrastructure with extensive GPU resources.

In September 2020, CoreWeave became one of NVIDIA's preferred cloud service providers and, in 2021, its first elite cloud computing provider. In April 2025, CoreWeave became the first to offer large-scale GB200 cloud services, gaining a competitive edge with priority access to NVIDIA's scarce GPU products.

Why the big shift on Wall Street?

In mid-May, CoreWeave inked a deal worth up to $4 billion with AI firm OpenAI, extending to 2029 to provide additional cloud computing capacity.

Recently disclosed financials show that CoreWeave's Q1 2025 revenue hit $980 million, a 420% year-over-year increase, surpassing the market expectation of $850 million. The Q2 revenue guidance is between $1.06 billion and $1.1 billion, again beating forecasts. For 2025, the company projects revenue of $4.9 to $5.1 billion, over 360% growth. To sustain this growth, CoreWeave plans to spend $20 to $23 billion on Capex in 2025, primarily for computing infrastructure.

Citi Research noted that CoreWeave's first quarterly earnings as a public company exceeded expectations, alleviating concerns about demand weakness. Analysts stated that this report reinforces the company's high-growth image and may ease investor worries about slowing AI capital expenditure and infrastructure. They raised their Q2 and full-year revenue forecasts while reducing valuation discounts.

Guosheng Securities highlighted that CoreWeave's market performance and results indicate robust global computing power demand. Despite market disagreements over high Capex guidance, the stock's strong growth this month speaks volumes about the potential for computing power expansion.

NVIDIA's moves have further boosted CoreWeave's stock. At Computex in Taipei, NVIDIA CEO Jensen Huang announced plans to allow customers to use competitor chips in data centers built on NVIDIA technology, seen as a response to internal R&D needs from major clients like Microsoft.

CoreWeave also recently appointed Carl Holshouser as VP of Government Affairs. Holshouser, who has held various public policy roles, most recently served as the Federal Policy and Government Relations Director at TechNet. Investors welcomed the addition of his extensive government affairs experience.

However, some analysts remain cautious. Barclays' Raimo Lenschow downgraded CoreWeave from a buy to a hold.