Please use a PC Browser to access Register-Tadawul

In One Chart | With Gold Continuously Reaching New Highs, How Are Gold Mining Stocks Performing?

Harmony Gold Mining Co. Ltd. Sponsored ADR HMY | 20.40 | -0.87% |

Kinross Gold Corporation KGC | 27.92 | -2.21% |

Agnico-Eagle Mines Limited AEM | 168.27 | -1.25% |

AngloGold Ashanti Limited Sponsored ADR AU | 82.92 | -3.02% |

Alamos Gold Inc. AGI | 38.49 | +0.10% |

On October 30th, spot gold reached a new all-time high, surpassing $2,780 per ounce. This surge has been driven by geopolitical tensions and uncertainties surrounding the U.S. presidential election, which have heightened market demand for safe-haven assets. Exinity Group's Chief Market Analyst Han Tan noted that if election uncertainties continue to influence market sentiment and the Federal Reserve's rate cut expectations remain unchanged, gold prices might continue to rise and potentially hit $2,800 in the coming days.

It's worth noting that gold mining stocks have underperformed in recent years due to rising mining costs and high interest rates. However, with declining energy costs for extraction and increasing gold prices, the operational leverage effect might enable gold mining stocks to outperform spot gold in a bull market.

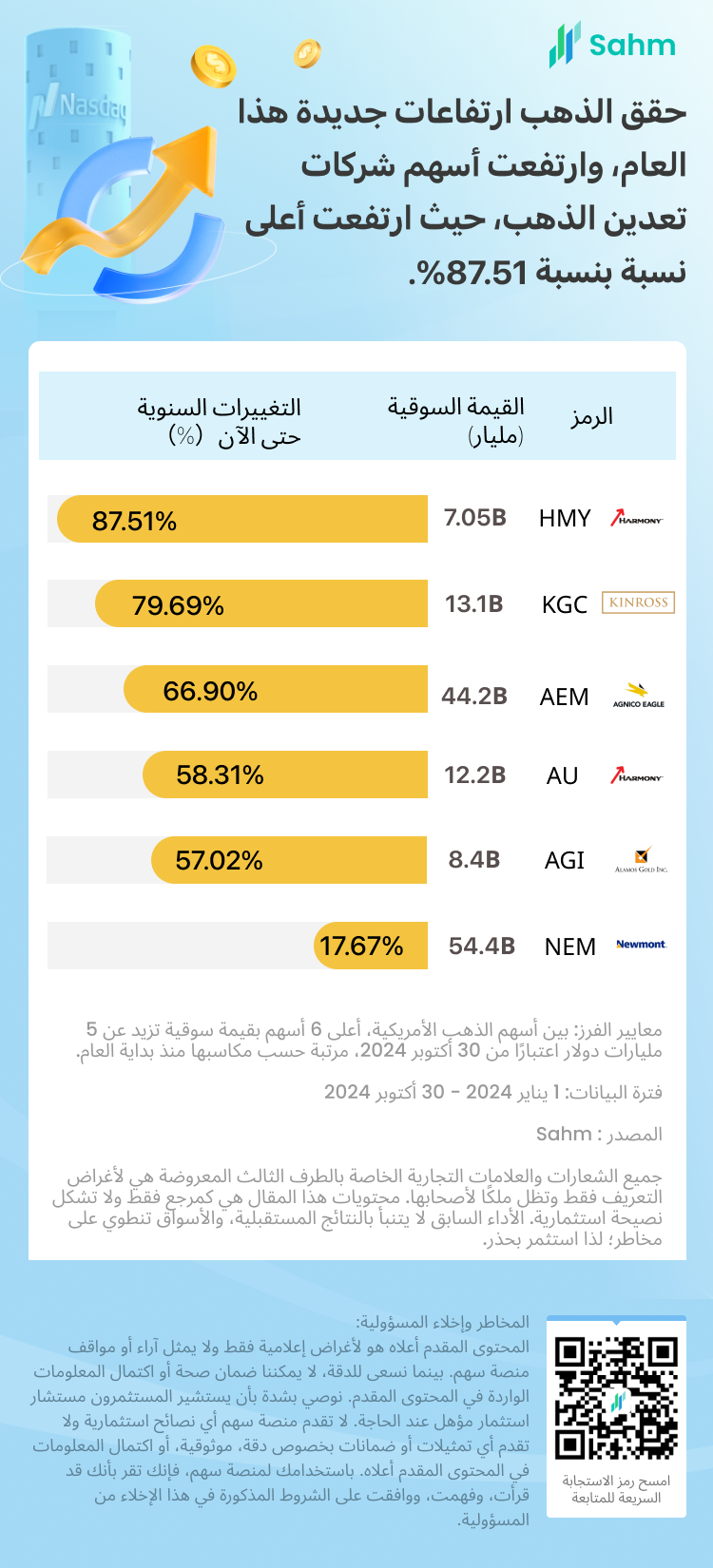

Among U.S. gold mining stocks, companies with a market cap exceeding $5 billion have mostly outperformed spot gold's year-to-date gain of over 34%. Harmony Gold Mining Co. Ltd. Sponsored ADR(HMY.US) leads with an 87.51% increase year-to-date, followed by Kinross Gold Corporation(KGC.US), Agnico-Eagle Mines Limited(AEM.US), AngloGold Ashanti Limited Sponsored ADR(AU.US), Alamos Gold Inc.(AGI.US), and Newmont Mining Corporation(NEM.US).

Gold Mining Stocks Look “Cheap” Compared to Gold Prices

Gold mining stocks have underperformed recently, mainly due to rising mining costs and high interest rates. In 2022 and 2023, the All-In Sustaining Cost (AISC), which measures the cost of producing one ounce of gold, increased sharply, severely impacting gold mining stocks and causing many investors to lose confidence in the sector.

However, this so-called "mispricing" of gold mining stocks presents a buying opportunity. Because a significant portion of gold miners' revenue comes from gold itself, their stock prices tend to move in tandem with spot gold prices.

For instance, Newmont Mining Corporation(NEM.US), a component of the VanEck Vectors Gold Miners ETF(GDX.US), reported $8.4 billion in revenue in the first half of the year, with $7 billion coming from gold and $1.4 billion from other metals. Similarly, AngloGold Ashanti Limited Sponsored ADR(AU.US) reported $4.5 billion in revenue, with only $100 to $200 million coming from by-products.

Due to operational leverage, gold mining stocks could potentially outperform spot gold during a bull market. Gold mining is an energy-intensive industry, with energy costs being the largest expense for miners (often estimated to be about one-third). Operations are usually off-grid, consuming large amounts of diesel. Since 2014, aided by U.S. shale oil production, gold mining has become a more profitable activity.

Currently, with lower oil prices keeping mining costs down and gold prices rising, the margin for miners becomes more lucrative. If the cost to mine $100 worth of gold is $50, when gold prices double, profits increase from $50 to $150.

Additionally, gold mining stocks often move independently of the broader market, providing a level of diversification that can help hedge against market downturns. Notably, hedge fund maestro Stanley Druckenmiller sold large tech stocks like Alphabet and Amazon at the end of 2023 and began investing in gold mining companies like Newmont and Barrick Gold.

Multiple Analysts Predict Gold Prices Surging to $3,000

The U.S. 10-year Treasury yield (US10Y.BD) climbed from around -1.2% lows in August 2021 to 4.2% in October 2024. For many investors, particularly in Western countries, rising yields have been a signal to sell gold.

This has indeed been the case. From the end of 2020 to May 2024, ETFs holding physical gold reduced their positions by approximately 30 million ounces, more than a quarter of their total holdings, as yield-seeking investors trimmed their gold allocations.

However, a significant drop in real interest rates could benefit gold and gold stocks. If the Federal Reserve sticks to rate cuts, we could see gold prices not only holding their current levels but soaring to new heights. Citi, Goldman Sachs, and Bank of America all anticipate that gold could hit $3,000 per ounce.

Citi analysts maintain that gold prices will reach $3,000 within the next six to nine months. They suggest that if oil prices surge due to recent Middle Eastern tensions, gold prices should rise. Citi notes that despite a drop in retail demand from China over the past three months, gold has still performed "very well," indicating buyers' willingness to pay higher prices.

Michael Widmer, Head of Metals Research at Bank of America, commented on Monday that the real yield on 10-year U.S. Treasuries (inflation-adjusted) has decoupled from gold prices, positing that if there are significant concerns about the U.S. Treasury market, gold is almost the ideal safe-haven asset.

Goldman Sachs analysts also predicted in early September that gold prices would hit $2,700 per ounce by 2025, a target that now seems to be reached ahead of schedule. The analysts reiterated their bullish stance on gold, citing global rate declines, structurally increased demand from central banks, and gold's benefits as a hedge against geopolitical, financial, and recession risks.