Please use a PC Browser to access Register-Tadawul

Intapp, Inc.'s (NASDAQ:INTA) 26% Share Price Plunge Could Signal Some Risk

Intapp, Inc. INTA | 21.83 | -1.49% |

Intapp, Inc. (NASDAQ:INTA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

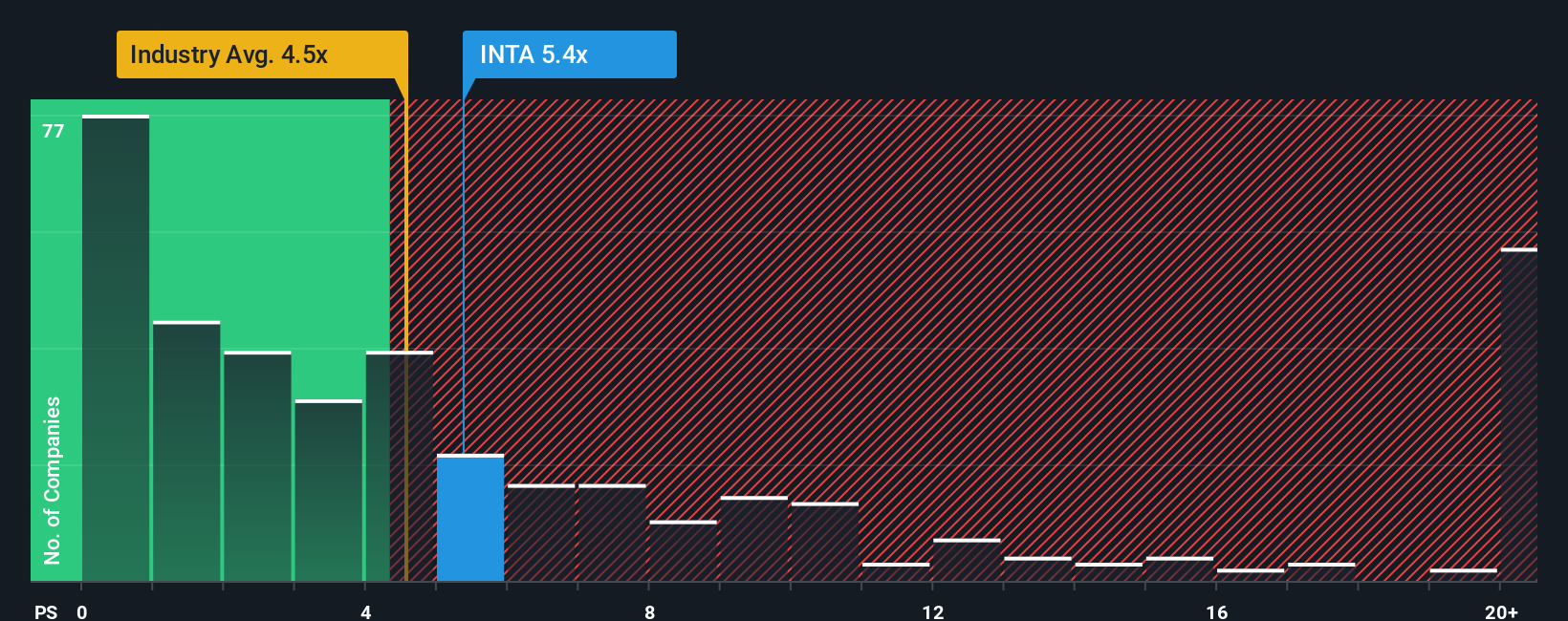

Although its price has dipped substantially, Intapp may still be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 5.4x, since almost half of all companies in the Software in the United States have P/S ratios under 4.4x and even P/S lower than 1.9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

How Has Intapp Performed Recently?

Recent times haven't been great for Intapp as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Intapp.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Intapp would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. Pleasingly, revenue has also lifted 81% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the nine analysts following the company. With the industry predicted to deliver 33% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Intapp's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Intapp's P/S

Intapp's P/S remain high even after its stock plunged. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Intapp currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Intapp with six simple checks on some of these key factors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.