Please use a PC Browser to access Register-Tadawul

Investors Don't See Light At End Of Appian Corporation's (NASDAQ:APPN) Tunnel And Push Stock Down 29%

Appian Corporation Class A APPN | 25.14 | +2.44% |

To the annoyance of some shareholders, Appian Corporation (NASDAQ:APPN) shares are down a considerable 29% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 31% share price drop.

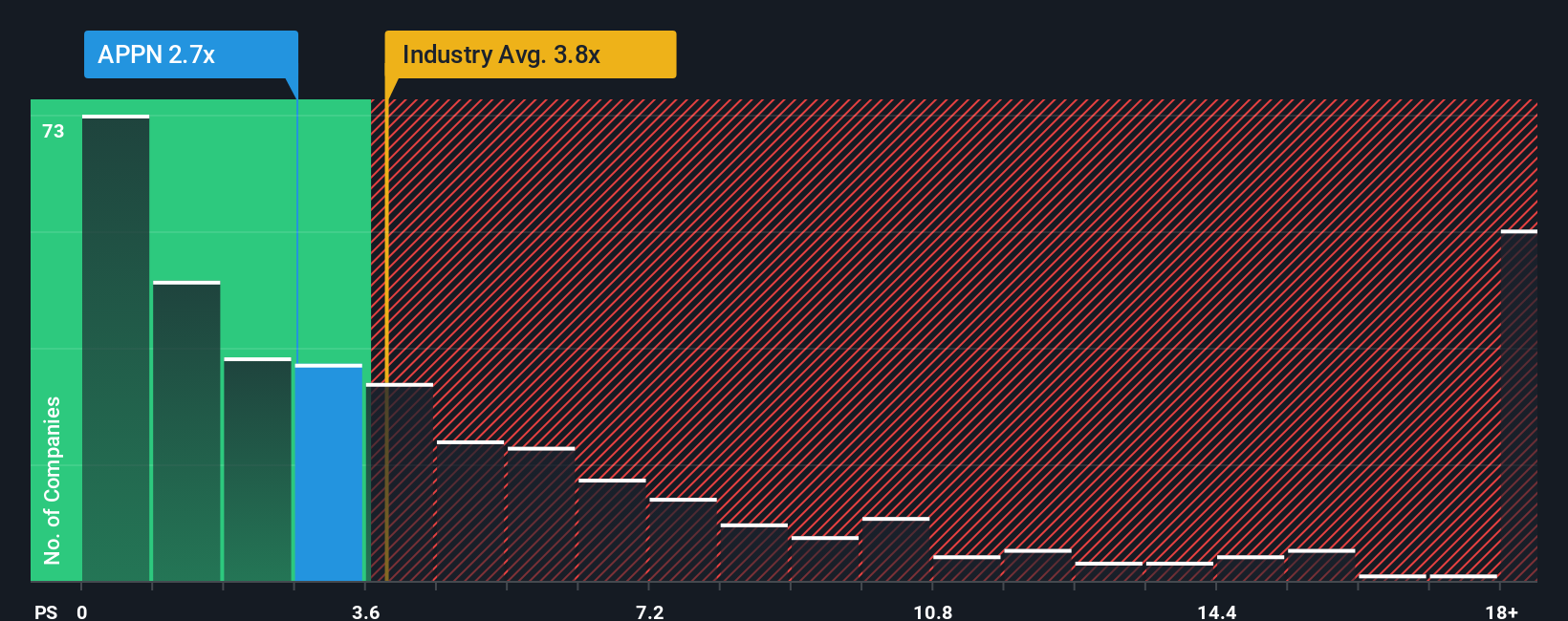

After such a large drop in price, Appian may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.5x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 3.7x and even P/S higher than 8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Appian Has Been Performing

With revenue growth that's inferior to most other companies of late, Appian has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Appian's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Appian?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Appian's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. Pleasingly, revenue has also lifted 54% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 12% over the next year. That's shaping up to be materially lower than the 32% growth forecast for the broader industry.

With this information, we can see why Appian is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Appian's P/S Mean For Investors?

Appian's recently weak share price has pulled its P/S back below other Software companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Appian's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Appian.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.