Please use a PC Browser to access Register-Tadawul

Investors Give Best Buy Co., Inc. (NYSE:BBY) Shares A 29% Hiding

Best Buy Co.,Inc. BBY | 73.46 | -2.01% |

Best Buy Co., Inc. (NYSE:BBY) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 32% share price drop.

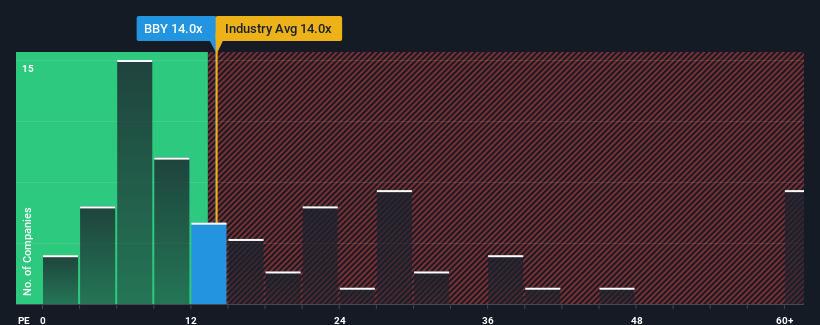

Although its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 16x, you may still consider Best Buy as an attractive investment with its 12.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Best Buy hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Best Buy's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 24%. As a result, earnings from three years ago have also fallen 56% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 20% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 11% per year, which is noticeably less attractive.

With this information, we find it odd that Best Buy is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Best Buy's recently weak share price has pulled its P/E below most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Best Buy's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks.

You might be able to find a better investment than Best Buy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.