Please use a PC Browser to access Register-Tadawul

Investors Give Biodesix, Inc. (NASDAQ:BDSX) Shares A 33% Hiding

BIODESIX, INC. BDSX | 7.85 | -2.12% |

To the annoyance of some shareholders, Biodesix, Inc. (NASDAQ:BDSX) shares are down a considerable 33% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

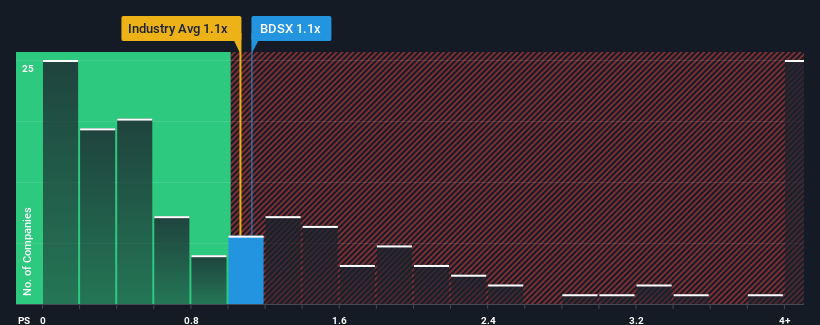

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Biodesix's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in the United States is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Our free stock report includes 5 warning signs investors should be aware of before investing in Biodesix. Read for free now.

How Biodesix Has Been Performing

Biodesix certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Biodesix will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Biodesix would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 45% gain to the company's top line. Pleasingly, revenue has also lifted 31% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 25% per annum as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 8.2% each year growth forecast for the broader industry.

With this information, we find it interesting that Biodesix is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Biodesix's P/S

Following Biodesix's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, Biodesix's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

If you're unsure about the strength of Biodesix's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.