Please use a PC Browser to access Register-Tadawul

Investors ignore increasing losses at GDS Holdings (NASDAQ:GDS) as stock jumps 34% this past week

GDS Holdings Ltd. Sponsored ADR Class A GDS | 36.26 | +0.30% |

For many, the main point of investing in the stock market is to achieve spectacular returns. When you find (and hold) a big winner, you can markedly improve your finances. For example, the GDS Holdings Limited (NASDAQ:GDS) share price is up a whopping 470% in the last 1 year, a handsome return in a single year. It's also good to see the share price up 99% over the last quarter. Zooming out, the stock is actually down 8.1% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

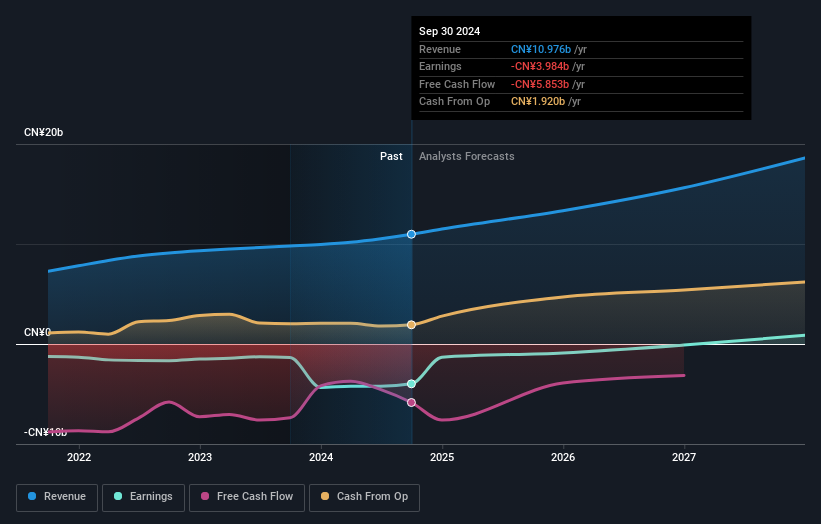

Because GDS Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, GDS Holdings' revenue grew by 12%. That's not a very high growth rate considering it doesn't make profits. So the 470% gain in just twelve months is completely unexpected. We're happy that investors have made money, but we can't help questioning whether the rise is sustainable. It just goes to show that big money can be made if you buy the right stock early.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

GDS Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels.

A Different Perspective

It's nice to see that GDS Holdings shareholders have received a total shareholder return of 470% over the last year. Notably the five-year annualised TSR loss of 6% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.