Please use a PC Browser to access Register-Tadawul

Investors in Exact Sciences (NASDAQ:EXAS) have unfortunately lost 52% over the last three years

Exact Sciences Corporation EXAS | 101.64 | -0.09% |

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Exact Sciences Corporation (NASDAQ:EXAS) shareholders know that all too well, since the share price is down considerably over three years. Sadly for them, the share price is down 52% in that time. Even worse, it's down 9.6% in about a month, which isn't fun at all.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for Exact Sciences

Given that Exact Sciences didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Exact Sciences grew revenue at 18% per year. That's a pretty good rate of top-line growth. So some shareholders would be frustrated with the compound loss of 15% per year. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. So this is one stock that might be worth investigating further, or even adding to your watchlist.

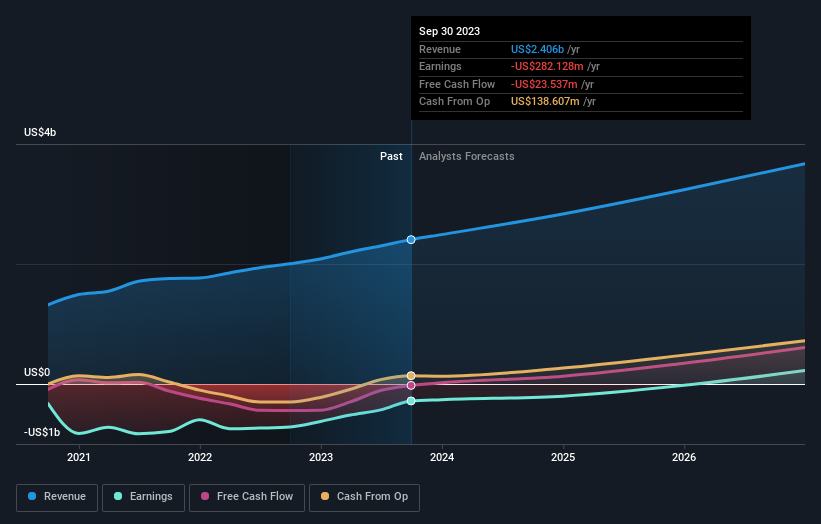

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Exact Sciences is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Exact Sciences provided a TSR of 1.0% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 4% per year, over five years. So this might be a sign the business has turned its fortunes around. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.