Please use a PC Browser to access Register-Tadawul

Investors in Nova (NASDAQ:NVMI) have seen incredible returns of 472% over the past five years

Nova Measuring Instruments Ltd NVMI | 318.21 318.94 | -1.85% +0.23% Pre |

Buying shares in the best businesses can build meaningful wealth for you and your family. While the best companies are hard to find, but they can generate massive returns over long periods. Don't believe it? Then look at the Nova Ltd. (NASDAQ:NVMI) share price. It's 472% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. On top of that, the share price is up 58% in about a quarter.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

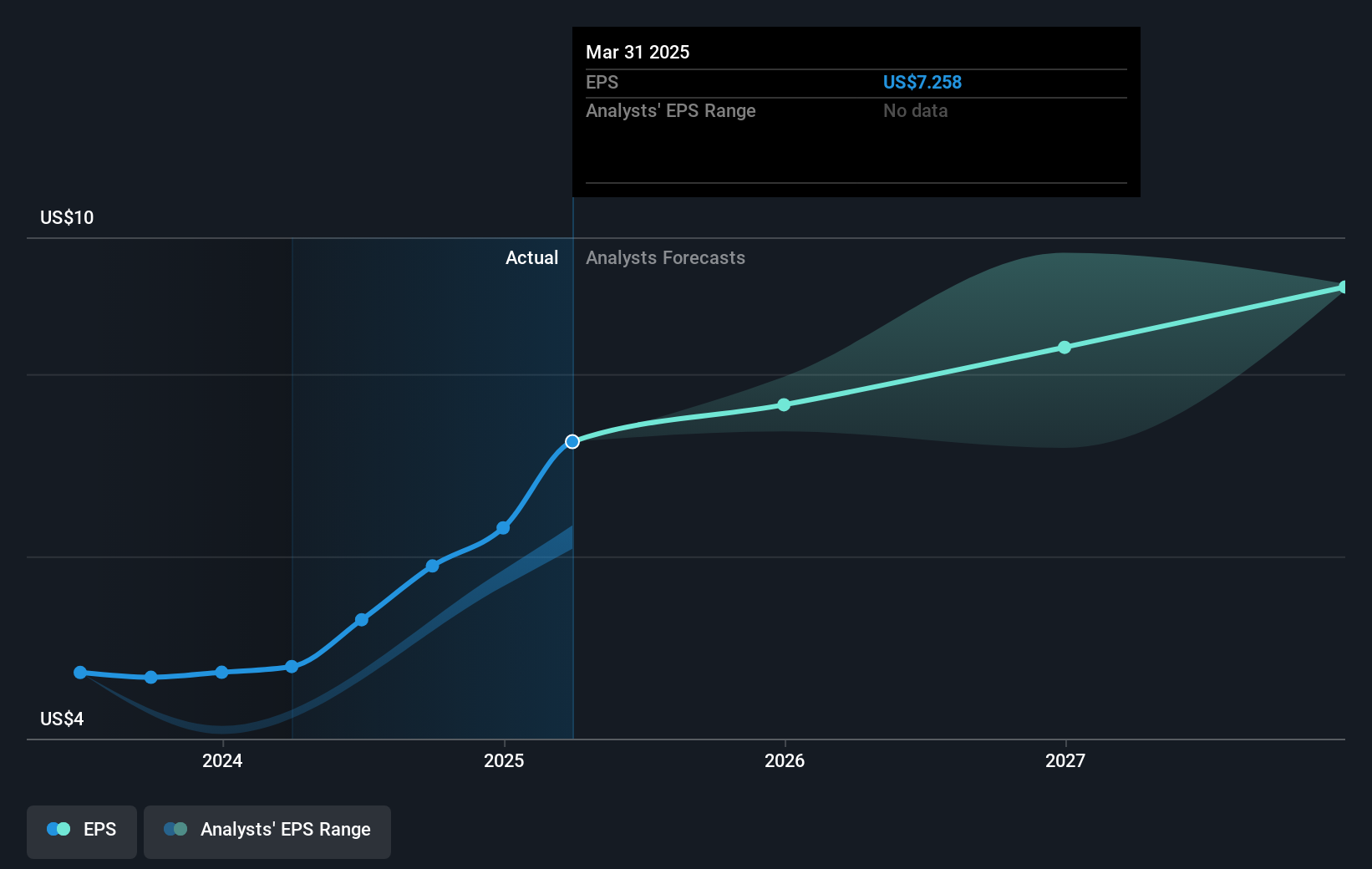

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Nova managed to grow its earnings per share at 39% a year. This EPS growth is reasonably close to the 42% average annual increase in the share price. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Indeed, it would appear the share price is reacting to the EPS.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Nova has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

It's nice to see that Nova shareholders have received a total shareholder return of 37% over the last year. However, that falls short of the 42% TSR per annum it has made for shareholders, each year, over five years. Before forming an opinion on Nova you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.