Please use a PC Browser to access Register-Tadawul

Investors push Baldwin Insurance Group (NASDAQ:BWIN) 12% lower this week, company's increasing losses might be to blame

The Baldwin Insurance Group, Inc. - Class A Common Stock BWIN | 22.34 | -5.62% |

The The Baldwin Insurance Group, Inc. (NASDAQ:BWIN) share price has had a bad week, falling 12%. But in stark contrast, the returns over the last half decade have impressed. We think most investors would be happy with the 190% return, over that period. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Only time will tell if there is still too much optimism currently reflected in the share price.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

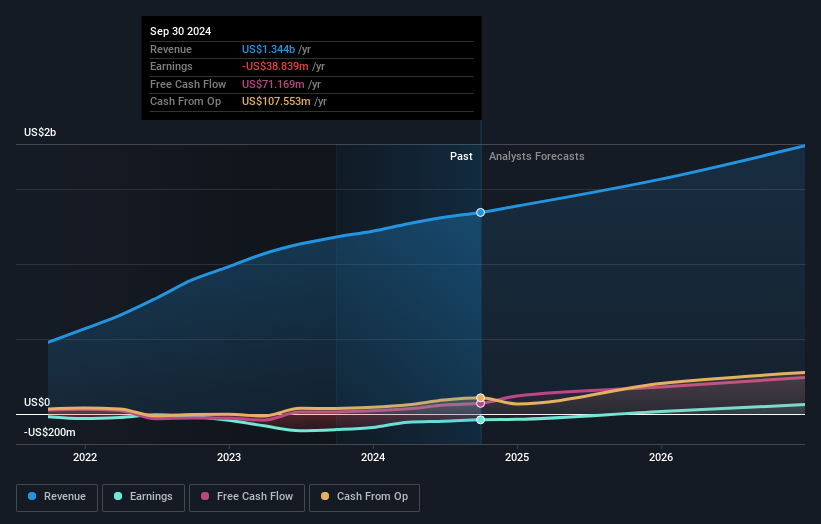

Baldwin Insurance Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Baldwin Insurance Group saw its revenue grow at 41% per year. That's well above most pre-profit companies. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 24% per year, in that time. This suggests the market has well and truly recognized the progress the business has made. Baldwin Insurance Group seems like a high growth stock - so growth investors might want to add it to their watchlist.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Baldwin Insurance Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Baldwin Insurance Group shareholders have received a total shareholder return of 104% over the last year. That's better than the annualised return of 24% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research Baldwin Insurance Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Baldwin Insurance Group better if we see some big insider buys.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.