Please use a PC Browser to access Register-Tadawul

Investors Will Want Aljouf Mineral Water Bottling's (TADAWUL:9532) Growth In ROCE To Persist

ALJOUF WATER 9532.SA | 2.24 | 0.00% |

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So on that note, Aljouf Mineral Water Bottling (TADAWUL:9532) looks quite promising in regards to its trends of return on capital.

Our free stock report includes 5 warning signs investors should be aware of before investing in Aljouf Mineral Water Bottling. Read for free now.Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Aljouf Mineral Water Bottling:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.042 = ر.س5.9m ÷ (ر.س210m - ر.س70m) (Based on the trailing twelve months to June 2024).

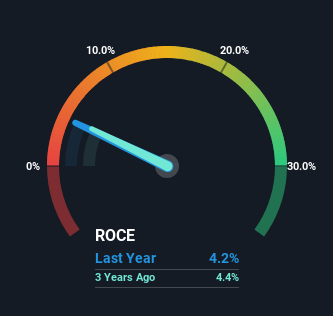

So, Aljouf Mineral Water Bottling has an ROCE of 4.2%. Ultimately, that's a low return and it under-performs the Beverage industry average of 12%.

Historical performance is a great place to start when researching a stock so above you can see the gauge for Aljouf Mineral Water Bottling's ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Aljouf Mineral Water Bottling.

What Does the ROCE Trend For Aljouf Mineral Water Bottling Tell Us?

While there are companies with higher returns on capital out there, we still find the trend at Aljouf Mineral Water Bottling promising. Looking at the data, we can see that even though capital employed in the business has remained relatively flat, the ROCE generated has risen by 32% over the last four years. Basically the business is generating higher returns from the same amount of capital and that is proof that there are improvements in the company's efficiencies. The company is doing well in that sense, and it's worth investigating what the management team has planned for long term growth prospects.

The Bottom Line On Aljouf Mineral Water Bottling's ROCE

As discussed above, Aljouf Mineral Water Bottling appears to be getting more proficient at generating returns since capital employed has remained flat but earnings (before interest and tax) are up. And since the stock has fallen 39% over the last three years, there might be an opportunity here. So researching this company further and determining whether or not these trends will continue seems justified.

Aljouf Mineral Water Bottling does come with some risks though, we found 5 warning signs in our investment analysis, and 2 of those shouldn't be ignored...

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.