Please use a PC Browser to access Register-Tadawul

Ionis Pharmaceuticals (IONS) Valuation Check As Dawnzera Approval And Other Milestones Support Growth Prospects

Ionis Pharmaceuticals, Inc. IONS | 83.15 | +0.01% |

Ionis Pharmaceuticals (IONS) is in focus after a series of drug pipeline milestones, including European Commission approval of Dawnzera, FDA Breakthrough Therapy status for zilganersen, and positive Phase 3 data for bepirovirsen from partner GSK.

The series of regulatory wins and positive trial updates appears to be supporting momentum in Ionis Pharmaceuticals, with a 24.39% 90 day share price return and a very large 1 year total shareholder return that far outpaces the shorter term moves. Executive share sales have been relatively routine alongside these developments. The share price, at $86.5, reflects a market that is reacting more strongly to the expanded drug portfolio and potential future cash flows than to insider selling.

If this kind of biotech news is on your radar, it could be a moment to look at other healthcare names that are using AI in drug development through our screener of 26 healthcare AI stocks.

With Ionis shares up 24.39% over 90 days and a very large 1 year total return, yet still showing an intrinsic discount of 67.79%, should investors see untapped value here, or is the market already pricing in future growth?

Most Popular Narrative: 4.6% Undervalued

Ionis Pharmaceuticals' most followed narrative places fair value at about $90.67 per share, slightly above the current $86.50 price. This sets up a tight valuation debate.

The analysts have a consensus price target of $68.346 for Ionis Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $96.0, and the most bearish reporting a price target of just $43.0.

Want to see what justifies a fair value above the current price while the consensus target sits lower? Revenue growth, margin shifts and a steep future earnings multiple are doing the heavy lifting in this narrative. The real question is how those projections stack up once you see them side by side.

Result: Fair Value of $90.67 (UNDERVALUED)

However, this depends on key late stage approvals and pricing outcomes. As a result, any regulatory delays or tougher than expected payer pushback could quickly challenge that fair value story.

Another View: Multiples Point To A Richer Price

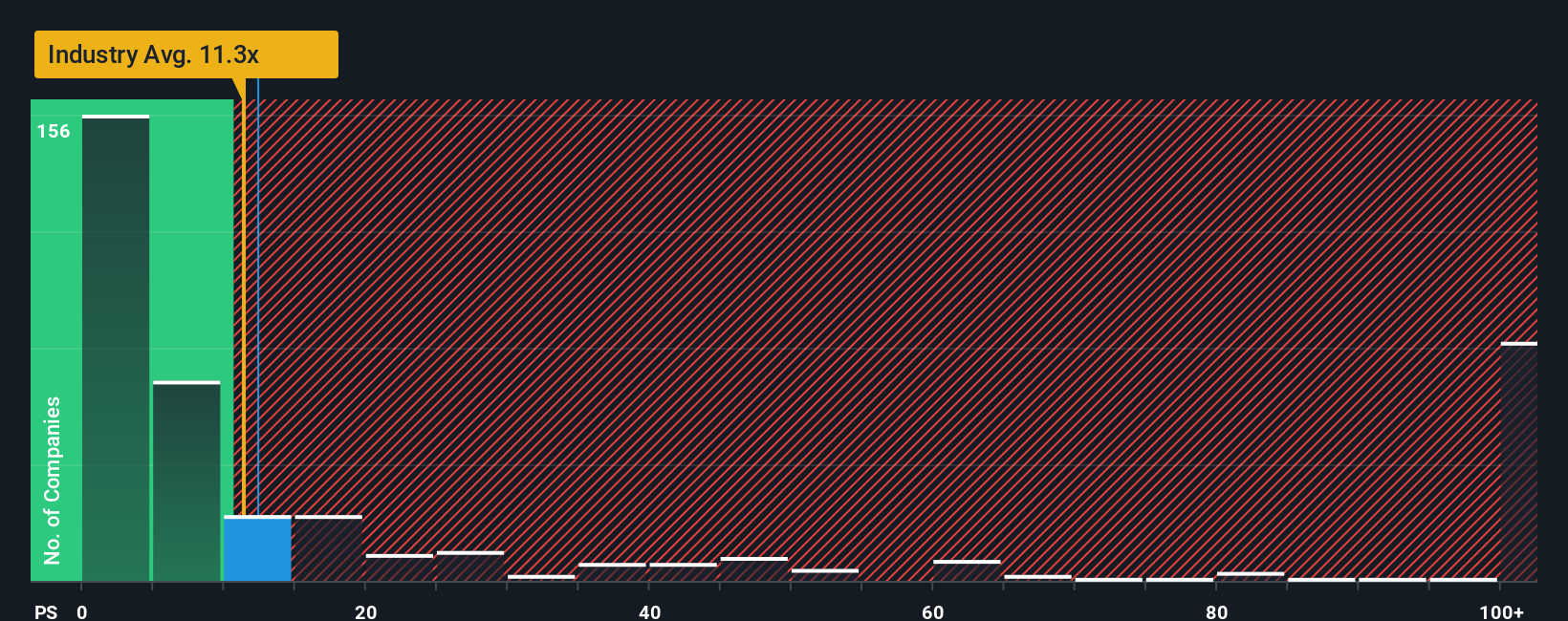

Our DCF model indicates Ionis is trading at a 67.8% discount to estimated future cash flow value. However, the market is paying a P/S of 14.5x, which is higher than the US Biotechs industry at 11.2x, peers at 5.1x, and a fair ratio of 5.2x. This suggests expectations are already demanding. So is this a mispriced bargain or simply a high bar for execution?

Build Your Own Ionis Pharmaceuticals Narrative

If you do not fully agree with these views or prefer to weigh the numbers yourself, you can shape a complete Ionis thesis in just a few minutes, starting with Do it your way.

A great starting point for your Ionis Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are weighing Ionis today, it is worth widening your lens and lining up a few other high quality ideas before you decide what to do.

- Target potential mispricings across the market by scanning our list of 52 high quality undervalued stocks that pair solid fundamentals with a marked gap between price and estimated worth.

- Focus on income by checking out 14 dividend fortresses, where you will find companies offering 5%+ yields with an emphasis on resilience and consistency.

- Prioritise resilience first by reviewing a 82 resilient stocks with low risk scores that highlights businesses with lower risk scores and balance sheets that may handle stress more effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.