Please use a PC Browser to access Register-Tadawul

IPO Monitor | Derayah IPO: 162x Institutional Demand—Retail Subscription Opens at SAR 30

Tadawul All Shares Index TASI.SA | 10590.17 | +0.01% |

Derayah Financial IPO Overview

Riyadh, 20 February 2025 – The retail subscription phase for Derayah Financial Company’s initial public offering (IPO) officially begins today. Eligible Individual investors can now participate in the offering on Sahm Platform, which Derayah is set to list on the Saudi Exchange (Tadawul)'s Main market.

Institutional Offering Results:

- Final Offer Price: SAR 30 per share, at the top of the previously announced range.

- Market Capitalization at Listing: Approximately SAR 7.5 billion (USD 2.0 billion).

- Oversubscription: The institutional offering was oversubscribed by approximately 162 times, with a total of SAR 243 billion in orders.

- Subscription Period for Individual Investors: Starts on Thursday, 20 February 2025, and ends on Saturday, 22 February 2025.

Cornerstone Investor Commitment

As disclosed in its recent supplementary prospectus, Derayah has secured Olayan Saudi Investment Company as a cornerstone investor for its IPO. The agreement, finalized on 4 February 2025G, binds Olayan to subscribe to 4.687 million shares at the final offering price, representing approximately 1.88% of Derayah’s post-IPO share capital.

Introducing the IPO feature on Sahm platform: A step-by-step guide to subscribing to the IPO

Company Background

Derayah, founded in 2009, operates as a digital investment platform in Saudi Arabia, providing brokerage and asset management services. The company reports serving a client base that has grown 12-fold since 2016, with SAR 15.1 billion in assets under management as of June 2024. Its platform offers access to 43 local and international markets, covering equities, fixed income, and derivatives.

Key aspects of Derayah’s operations include a technology-driven infrastructure and a diversified business model spanning brokerage and wealth management. The company has positioned itself within a rapidly expanding market, supported by evolving financial sector dynamics and regional digital transformation trends.

Financial Performance Highlights (First Nine Months of 2024)

Derayah Financial Company reported financial results for the first nine months of 2024, with net profit surging 57% year-on-year (YoY) to SAR 336.3 million, up from SAR 214.7 million in the same period of 2023.

| Financial Item | 9m 2023 (M) | 9m 2024 (M) | Change |

|---|---|---|---|

| Revenues | 437.18 | 644.04 | 47.3% |

| Gross Income | 437.18 | 644.04 | 47.3% |

| Operating Income | 250.21 | 384.90 | 53.8% |

| Net Income | 214.72 | 336.32 | 56.6% |

| Average Shares | 249.74 | 249.74 | - |

| Earnings Per Share before unusual items (Riyals) | 0.86 | 1.35 | 56.6% |

| EPS (Riyals) | 0.86 | 1.35 | 56.6% |

Key Metrics:

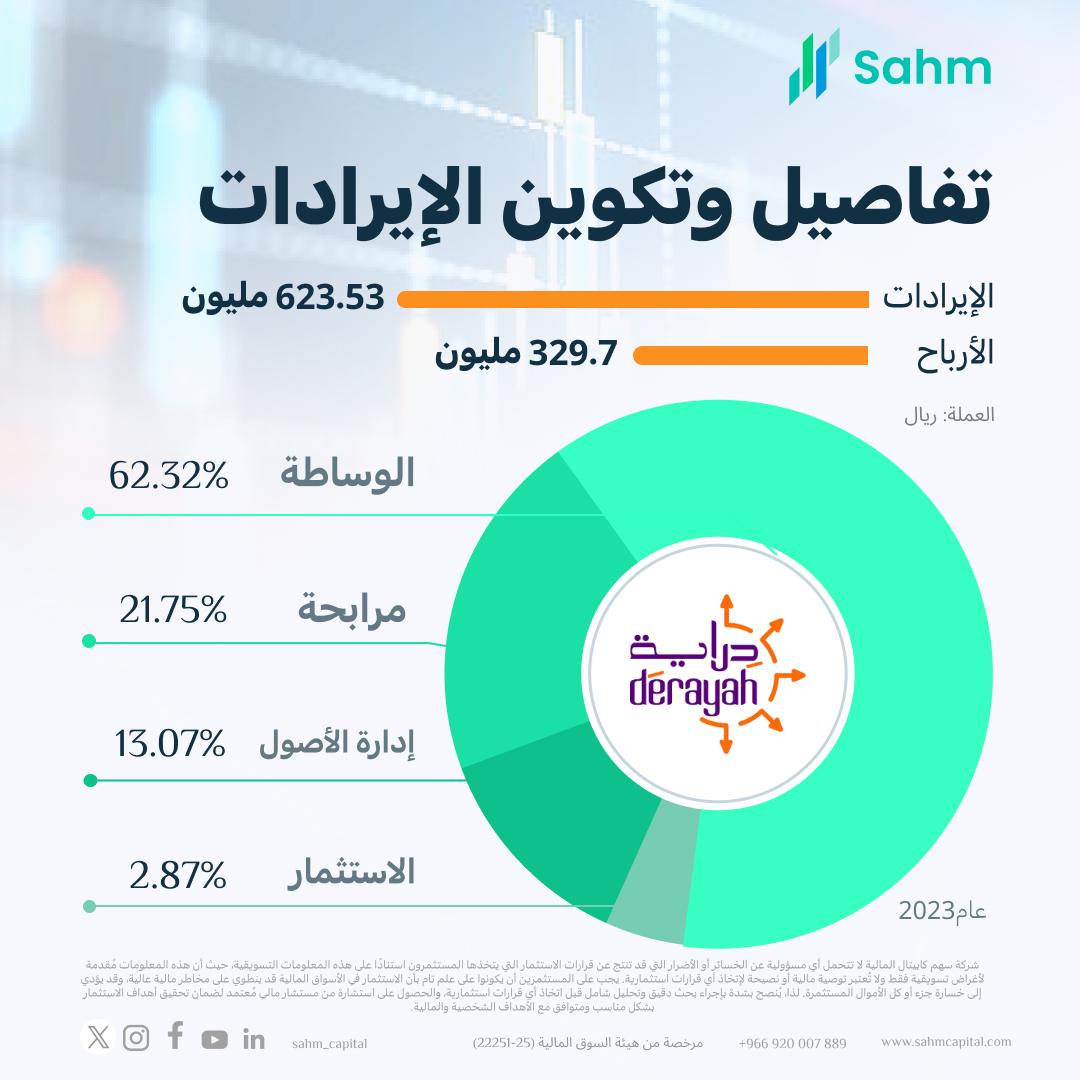

- Total Revenues: SAR 644.0 million (+47% YoY), driven by a 31% increase in brokerage income and growth across Murabaha financing, asset management, and investment services.

- Gross Profit Margin: Expanded to 79% (vs. 74% in 9M 2023).

- Operating Income: SAR 384.9 million (+54% YoY), reflecting improved operational efficiency.

- EBITDA: Rose 54% to SAR 399.3 million (vs. SAR 260.1 million in 9M 2023).

Quarterly Comparison:

| Item | Q3 2023 (M) | Change (YoY) | Q2 2024 (M) | Q3 2024 (M) | Change (QoQ) |

|---|---|---|---|---|---|

| Revenues | 171.45 | 22.4 % | 212.30 | 209.84 | (1.2 %) |

| Gross Income | 171.45 | 22.4 % | 212.30 | 209.84 | (1.2 %) |

| Operating Income | 97.47 | 33.5 % | 103.01 | 130.16 | 26.4 % |

| Net Income | 80.72 | 34.2 % | 91.85 | 108.31 | 17.9 % |

| Average Shares | 249.74 | - | 249.74 | 249.74 | - |

| Earnings Per Share before unusual items (Riyals) | 0.32 | 34.2 % | 0.37 | 0.43 | 17.9 % |

| EPS (Riyals) | 0.32 | 34.2 % | 0.37 | 0.43 | 17.9 % |

IPO Summary

| Category | Details |

|---|---|

| Company Name | Derayah Financial Company |

| Market | Main Market (TASI) |

| Core Activities | Digital brokerage and asset management services |

| Total Capital | SAR 499.47 million |

| Total Shares | 249.74 million |

| Share Par Value | SAR 2 per share |

| Issue Percentage | 20% |

| Number of Offered Shares | 49.95 million |

| Offer price | SAR 30 per share |

| Qualified Subscribers | Participating institutions & Retail investors |

| Minimum subscription limit for retail investors | 10 shares |

| Maximum subscription limit for retail investors | 250,000 shares |

Substantial Shareholders

The following table shows the names of the Substantial Shareholders and their ownership percentages in the Company before and after the Offering:

| Pre-Offering | Post-Offering | |||||||

|---|---|---|---|---|---|---|---|---|

| Shareholder | Number of Shares | Nominal Value (SAR) | Direct Ownership Percentage (%) | Indirect Ownership Percentage (%)* | Number of Shares | Nominal Value (SAR) | Direct Ownership Percentage (%) | Indirect Ownership Percentage (%)* |

| Taha Abdullah Al-Kuwaiz | 60,535,050 | 121,070,100 | 24.2% | N/A | 48,075,562 | 96,151,124 | 19.3% | N/A |

| Abdulaziz Ibrahim AlJammaz & Brothers Company | 23,823,525 | 47,647,050 | 9.5% | N/A | 18,920,102 | 37,840,204 | 7.6% | N/A |

| Sanad Investment Company | 23,121,015 | 46,242,030 | 9.3% | N/A | 18,362,185 | 36,724,370 | 7.4% | N/A |

| AlTouq Company Ltd. | 17,100,000 | 34,200,000 | 6.8% | N/A | 13,580,432 | 27,160,864 | 5.4% | N/A |

| Total | 124,579,590 | 249,159,180 | 49.8% | - | 98,938,281 | 197,876,558 | 39.7% | N/A |

*Indirect Ownership Percentage is not applicable (N/A) in all cases.

Eligible Investors & Allocation Structure

The IPO is open to two investor groups, with distinct allocation mechanisms and eligibility criteria:

Tranche (A): Institutional Investors

- Participants:

- Investment funds, Gulf Cooperation Council (GCC) institutions, foreign entities under Regulation S, and foreign investors via swap agreements.

- Allocation:

- Initial: 49,947,039 shares (100% of total offering), including 4,687,500 shares reserved for the cornerstone investor (Olayan Saudi Investment Company).

- Claw-Back Option:

- If retail demand is high, institutional shares may be reduced to 44,952,335 shares (90% of total), but the cornerstone investor’s allocation remains fixed.

Tranche (B): Individual Investors

- Eligibility:

- Saudi nationals (including divorced/widowed Saudi women with non-Saudi spouses, upon submitting proof of status).

- Non-Saudi residents in KSA or GCC nationals with active investment accounts at approved institutions.

- Key Restrictions:

- Subscriptions through inactive portfolios or duplicate applications will be voided.

- Shares registered under a divorced spouse’s name are invalid and subject to legal action.

- Allocation:

- Up to 4,944,704 shares (10% of total offering).

- If Individual Investors do not subscribe to all the allocated shares, the financial advisor, in cooperation with the Company, may reduce the allocated shares proportionally.

General Requirements:

- All retail investors must hold an active stock portfolio with a Capital Market Institution linked to the IPO’s receiving entities at the time of subscription.

Note: Final allocations for both tranches will be announced after the retail subscription period closes.

Anticipated Timeline for the Subscription

| Event | Dates |

|---|---|

| Application registration period for Participating Parties and the Book Building Process | 8 days starting from Sunday, 02/02/2025G (03/08/1446H) until 2:00 p.m. Kingdom time on Sunday, 09/02/2025G (10/08/1446H) |

| Subscription period for Individual Subscribers | 3 days starting from Thursday, 20/02/2025G (21/08/1446H) until 5:00 p.m. Kingdom time on Saturday, 22/02/2025G (23/08/1446H) |

| Deadline for submission of Subscription Applications for Participating Parties based on the number of shares provisionally allocated to each of them | Monday, 17/02/2025G (18/08/1446H) |

| Deadline for payment of subscription amounts for Participating Parties based on the number of shares provisionally allocated to each of them | Wednesday, 19/02/2025G (20/08/1446H) |

| Deadline for submission of Subscription Applications and payment of subscription amounts (for Individual Subscribers) | 5:00 p.m., Saturday, 22/02/2025G (23/08/1446H) |

| Announcement of final allocation of Offer Shares | No later than Thursday, 27/02/2025G (28/08/1446H) |

| Refund of excess subscription monies (if any) | No later than Tuesday, 04/03/2025G (04/09/1446H) |

| Expected date of commencement of trading on the Exchange | Trading is expected to commence after the fulfillment of all relevant statutory requirements. The start of share trading will be announced on the Saudi Tadawul website. |

Source: The Company

Note: The above timeline and dates are approximate. Actual dates will be communicated through announcements in local daily newspapers published in Arabic, on Tadawul’s website, the Financial Advisor’s website, and the Company’s website.

Read the full Prospectus

Introducing the IPO feature on Sahm platform: A step-by-step guide to subscribing to the IPO

Further updates regarding this IPO will be provided as more information becomes available.

- Reporting by Zaid, Sahm News team