Please use a PC Browser to access Register-Tadawul

IPO X-Ray | Chagee, Set to Be The First Freshly-Made Tea IPO in the US Stock Market

Dutch Bros Inc. BROS | 61.16 | +0.07% |

CAVA Group Inc. CAVA | 53.15 | +0.95% |

On March 26th, Chagee Holdings Limited, the parent company of the popular freshly-made tea brand "Chagee", officially submitted its IPO prospectus in the United States.

The company will be listed under the stock ticker "CHA".

The joint underwriters for the offering include Vbrokers, Citi, Morgan Stanley, Deutsche Bank, and CICC.

1. Company Profile:

Impact on the US stock market as the “first freshly-made tea stock”

The company was founded in 2017 and is headquartered in Yunnan, China. It is a freshly-made tea beverage brand with "Oriental Tea" as its core, positioning itself in the mid-to-high-end market, and mainly focusing on the original leaf fresh milk tea series.

The company adopts a dual-drive model of "direct sales + franchising".

By the end of 2024, the number of stores worldwide will reach 6,440, which is the largest store network among all high-quality freshly-made tea brands in China.

The company plans to be listed on the Nasdaq and is expected to become the first "freshly-made tea listed company" in the US stock market.

2. Business Scale:

China's largest, fastest growing and most popular high-end ready-made tea brand

Data from the prospectus shows that nearly eight years after its establishment, Chagee has become China's largest, fastest-growing and most popular high-end freshly-made tea brand.

| Core indicators | Data Details |

Number of stores | 6,440 (97% of which are franchise stores by 2024) |

GMV | 29.5 billion yuan (2024, +173% year-on-year) |

Average monthly GMV of a single store | 511,700 yuan (China stores) |

Hot-selling items | Cumulative sales of "Chagee" exceeded 600 million cups (as of August 2024) |

Note: The default currency in this article is RMB, and the US dollar unit has been specially marked.

3. Business Highlights:

The number of stores exceeded 6,400, and the cumulative sales of the core product "Boya Juexian" exceeded 600 million cups

3.1. Rapid store expansion, to launch in North American market in 2025:

- Data from the prospectus shows that the company's number of stores will increase from 1,087 in 2022 to 6,440 in 2024, a nearly six-fold increase in two years, with an average annual compound growth rate of 143.2%.

- The overseas market has covered Malaysia, Singapore, and Thailand, with a total of 156 stores. It plans to expand into the North American market in 2025 (with the first store in Los Angeles).

- While expanding rapidly, Chagee also maintained an extremely low store closure rate. In 2023 and 2024, its store closure rate was only 0.5% and 1.5%, far below the industry average.

3.2. Single-store profitability leads the industry:

- In 2024, the average monthly GMV of a single store in the Chinese market reached 512,000 yuan, and the average monthly sales of cups exceeded 25,000 cups, far exceeding the industry average.

3.3. Super single product strategy:

The prospectus revealed that in 2024, 91% of the GMV of Chagee in the Chinese market (including Hong Kong, China) came from the sales of Tea Latte. As of August 2024, Chagee's star product "Boya Juexian" has sold more than 600 million cups in total.

The "super single product" strategy means a simpler supply chain, which aims to help Chagee further reduce inventory and logistics pressure.

The prospectus disclosed that in 2024, its logistics costs accounted for less than 1% of the global total GMV.

At the same time, the inventory turnover days are 5.3 days - according to iResearch, this number is the lowest among tea beverage companies with more than 1,000 stores.

4. Focus on the high-end tea market

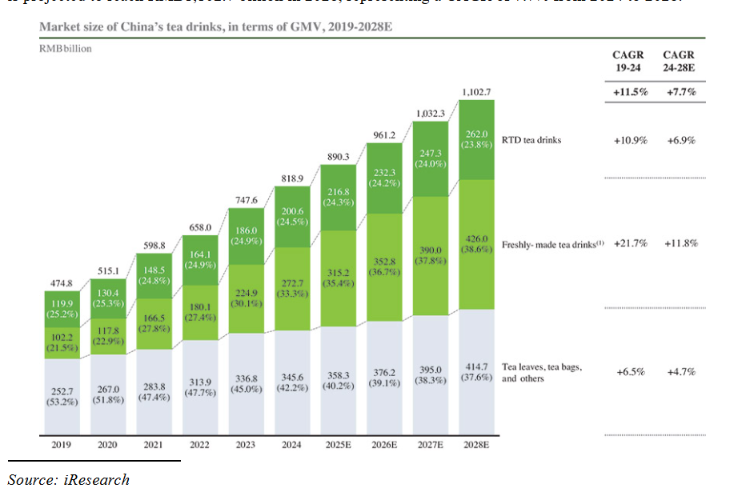

According to iResearch data, measured by GMV, China's ready-made tea beverage market has a compound annual growth rate of 21.7%, and is expected to reach 426 billion yuan by 2028, of which the GMV of the high-end ready-made tea beverage market segment can reach 167.1 billion yuan, accounting for 31.7% of the total ready-made tea beverage market.

Positioning itself as a "boutique" tea beverage, Chagee is expected to become one of the biggest winners in this market segment.

4. Financial Performance:

Revenue increased 25 times in two years! Profitability leads the industry

4.1. Financial performance from 2022 to 2024

| Financial indicators | 2022 | 2023 | 2024 |

Revenue (100 million yuan) | 4.92 | 46.40 | 124.06 |

Net profit (100 million yuan) | -0.91 | 8.03 | 25.15 |

Net Profit Margin | -18.5% | 17.3% | 20.3% |

4.2. Industry comparison (2024)

| Company | Revenue (100 million yuan) | Net profit (100 million yuan) | Net Profit Margin | Number of stores |

Chagee | 124.06 | 25.15 | 20.3% | 6440 |

MIXUE | 248.29 | 44.54 | 17.94% | 46479 |

Note: The data comes from Chagee's prospectus and Mixue Group's latest financial report in 2024

4.3. Financial highlights

- Explosive revenue growth: Data from the prospectus shows that revenue will jump from 492 million to 12.406 billion from 2022 to 2024, a 25-fold increase in two years, with an average annual compound growth rate (CAGR) of 402.10%.

- Profitability level leads the industry: Thanks to the cost advantage of the company's "super single product" strategy for milk tea products, the company's net profit will turn from a loss of 91 million in 2022 to a profit of 2.515 billion in 2024, with a net profit margin of 20.3%, surpassing MIXUE (17.94%) and leading the industry.

- The franchise model drives economies of scale: the proportion of franchise business revenue will increase from 83.4% in 2022 to 93.8% in 2024, and the light asset model will reduce operational risks.

5. Market Prospects:

The growth rate of the freshly-made tea market reached 21%! The valuation of popular catering stocks in the US stock market is hot

5.1. China’s ready-made tea market

China's tea beverage market has maintained a growth trend.

According to iResearch, the gross merchandise volume (GMV) of China's tea beverage market increased from RMB 474.8 billion in 2019 to RMB 818.9 billion in 2024, and is expected to reach RMB 1,102.7 billion by 2028, with a compound annual growth rate of 7.7% from 2024 to 2028.

Measured by gross merchandise volume (GMV), China's ready-made tea beverage market, where the company focuses, is growing at a compound annual growth rate of 21.7% from RMB 102.2 billion in 2019 to RMB 272.7 billion in 2024, and is expected to reach RMB 426 billion by 2028.

5.2. Globalization potential

- The prospectus shows that the company currently has a total of 156 stores overseas, covering Malaysia, Singapore, Thailand and other places, and plans to focus on overseas markets such as Southeast Asia and North America in 2025.

5.3. Valuations of new catering brands in the US stock market are booming

In early 2025, MIXUE's successful listing on the Hong Kong Stock Exchange triggered a wave of oversubscription. The IPO was oversubscribed by more than 5,300 times, and has become a representative of the industry's phenomenal IPO.

As a new popular milk tea brand, Chagee, coupled with the US stock market's favor for new consumer brands, may also trigger a new wave of market enthusiasm.

| US restaurant stocks | Market Cap | Dynamic P/E ratio |

Starbucks | $112.3 billion | 31.93 times |

$7.541 billion | 212.89 times | |

$10.25 billion | 78.68 times |

Data source: Vbrokers; Data deadline: March 27, 2025, Eastern Time

6. Use of IPO Funds:

Plan to add 1,000-1,500 stores by 2025

6.1. Store expansion: The prospectus shows that the company plans to add 1,000-1,500 stores by 2025, of which 207 have been opened in China and worldwide this year, and 442 stores are currently under development.

6.2. Use of IPO funds

- Expanding the teahouse network in China and overseas

- Develop and innovate new products

- Building overseas supply chain network

- Invest in technology to support business development and operations

- For general corporate and working capital purposes.

7. Risk Warning

- Competition in the domestic tea beverage market is intensifying, and same-store growth rates may slow down;

- Overseas expansion faces localization challenges (such as North American consumer taste preferences);

- Fluctuations in the prices of raw materials (tea, fresh milk) affect profit margins.