Please use a PC Browser to access Register-Tadawul

iQIYI, Inc. (NASDAQ:IQ) Stock Rockets 36% But Many Are Still Ignoring The Company

IQIYI, INC. IQ | 1.95 | -4.41% |

iQIYI, Inc. (NASDAQ:IQ) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

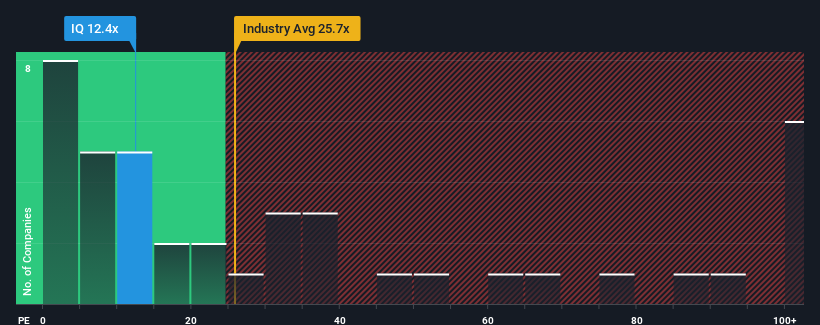

Even after such a large jump in price, iQIYI's price-to-earnings (or "P/E") ratio of 12.4x might still make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

iQIYI could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

How Is iQIYI's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as iQIYI's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 22%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 13% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 11% per annum, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that iQIYI's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On iQIYI's P/E

Despite iQIYI's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of iQIYI's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.