Please use a PC Browser to access Register-Tadawul

Is Adobe a Bargain After AI Innovations and a 26.8% Drop in 2025?

Adobe Systems Incorporated ADBE | 333.95 | -1.50% |

- Wondering whether Adobe’s share price really reflects its true value? You’re not alone, and you don’t need to be a Wall Street pro to get to the bottom of it.

- This year hasn’t been friendly to Adobe shareholders, with the stock dropping 26.8% year-to-date and 37.5% over the past 12 months. However, there have been a few glimmers of optimism in recent weeks.

- Recent headlines have focused on Adobe’s ongoing innovation in AI-powered creative tools and strategic acquisitions, both of which have attracted renewed attention from analysts and investors. These developments may help explain some of the recent volatility as the market recalibrates its expectations for growth and profitability.

- If you’re looking for a quick number to consider, Adobe scores a 5 out of 6 on our valuation checks, suggesting it passes most of the critical undervalued tests. Up next, we’ll break down the main approaches to valuing a stock like Adobe. At the end of this article, we will also introduce another way to determine whether a stock is a bargain.

Approach 1: Adobe Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today's value. This approach is popular because it focuses on the company's ability to generate cash for shareholders over time.

For Adobe, the current Free Cash Flow (FCF) stands at about $9.5 Billion. Analysts expect this figure to grow steadily, with projections showing Adobe generating $13.1 Billion in FCF by 2030. The first five years of cash flow projections are based on analyst estimates, while figures beyond that are extrapolated. These forecasts rely on expected organic growth from Adobe's established creative software platforms and contributions from recent strategic initiatives.

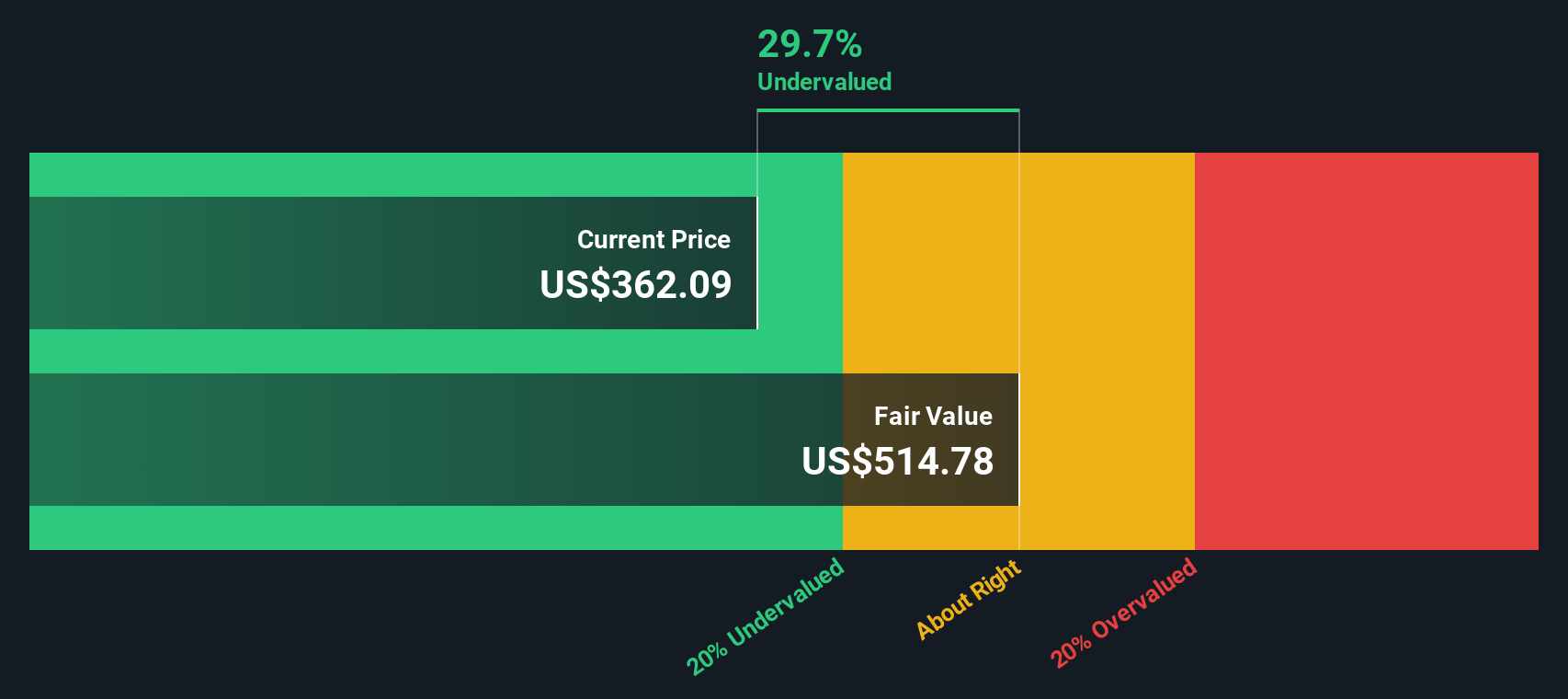

Based on the DCF analysis, the model calculates an estimated intrinsic fair value of $530.57 per share. When compared to Adobe's current share price, the stock appears to be about 39.2% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Adobe is undervalued by 39.2%. Track this in your watchlist or portfolio, or discover 922 more undervalued stocks based on cash flows.

Approach 2: Adobe Price vs Earnings

The Price-to-Earnings (PE) ratio is a common valuation tool for profitable companies like Adobe because it directly relates the company's share price to its earnings. This ratio offers a straightforward gauge of investor expectations. It is particularly useful when a company is generating consistent profits, as it helps compare value across the same sector or against broader market benchmarks.

However, what qualifies as a "normal" or "fair" PE ratio can vary based on how quickly investors expect a company to grow earnings and the risks it faces. Higher growth rates can justify a higher PE, while elevated risks or slowdowns generally mean a lower ratio is appropriate.

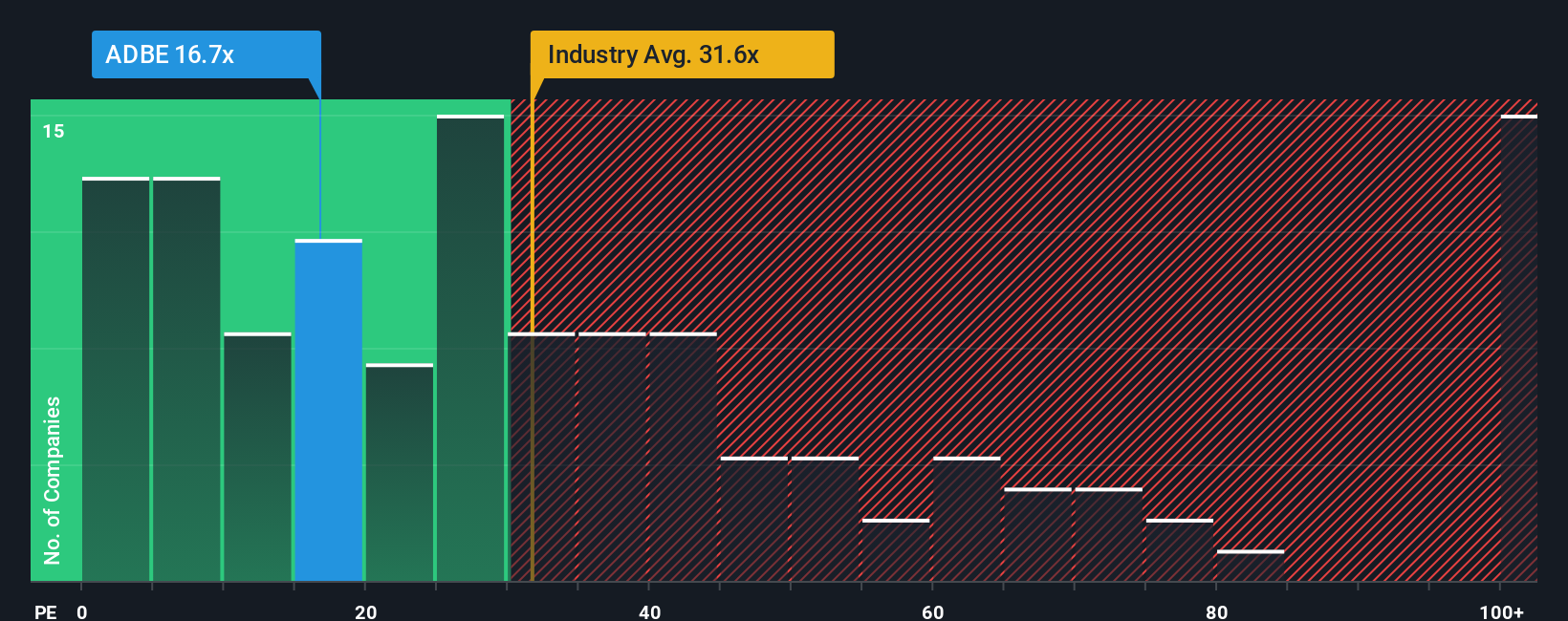

As it stands, Adobe currently trades on a PE ratio of 19.4x. This is well below the Software industry’s average of roughly 31.8x and also significantly below the peer group average of 56.3x. At first glance, that could suggest Adobe is undervalued compared to its sector and direct competitors.

To add more context, Simply Wall St calculates a proprietary “Fair Ratio” for each stock. This benchmark for Adobe is 35.5x and takes into account factors like the company’s historical and forecast earnings growth, its profit margins, risks, industry conditions and its size. Unlike basic peer or sector averages, the Fair Ratio provides a customized benchmark that adjusts for the company’s unique profile. This gives investors a meaningful sense of how a stock should be valued based on its fundamentals.

Comparing Adobe’s actual PE of 19.4x against its Fair Ratio of 35.5x indicates the shares appear undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Adobe Narrative

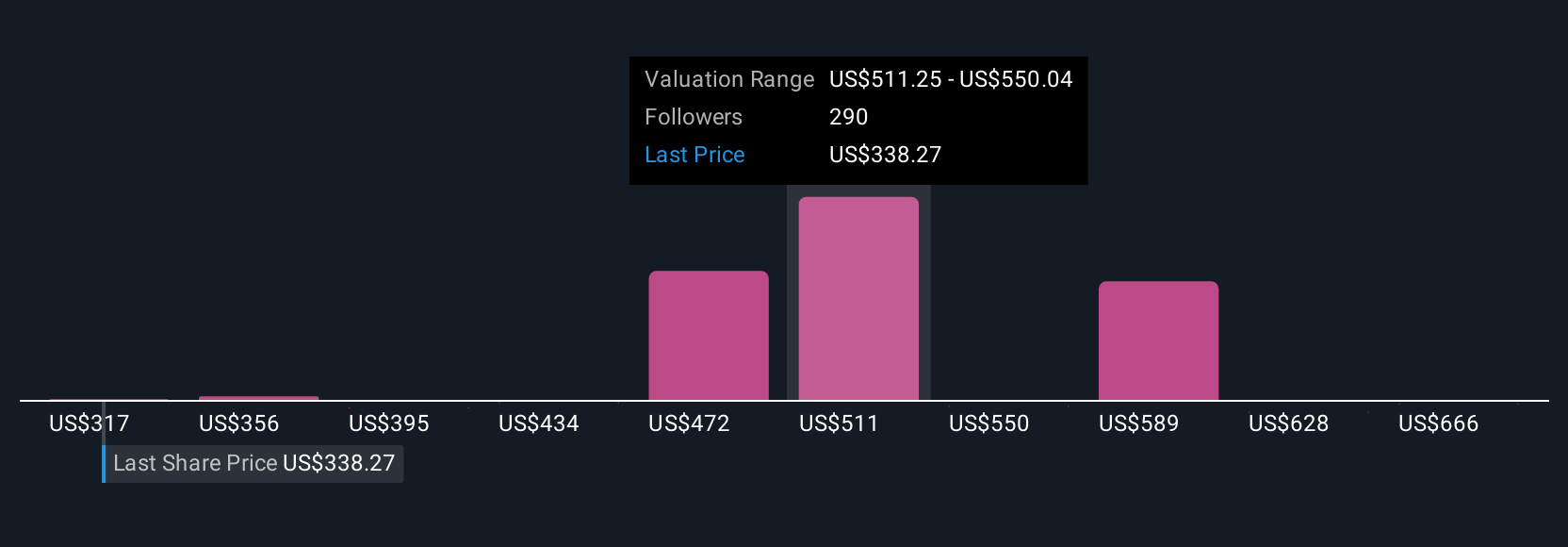

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful concept. It is your story behind the numbers, combining your views on Adobe's future revenue, earnings, and margins with a fair value grounded in your personal forecast. Rather than relying solely on standard ratios or consensus, Narratives enable you to connect the company’s business story to the hard numbers and see how that story plays out financially.

Narratives are available on Simply Wall St’s Community page, used by millions of investors globally, and make it easy for anyone to create, refine, and update their investment thesis as new information comes in. They help you decide when to buy or sell by comparing your Fair Value estimate to the real-time share price. Best of all, because Narratives can be dynamically updated whenever there is news, earnings, or market developments, your investment decisions always reflect the most current picture.

For example, with Adobe, some investors may see a fair value as high as $605 in an optimistic scenario where AI adoption soars and margins expand, while others may feel it is closer to $380 if growth stalls or risks intensify. Narratives let you see, test, and compare all these perspectives so you can invest smarter, with confidence in your own story.

Do you think there's more to the story for Adobe? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.