Please use a PC Browser to access Register-Tadawul

Is Arista Networks Still a Good Value After 55% Surge in the Last Year?

Arista Networks, Inc. ANET | 124.76 | -7.17% |

Thinking about what to do with Arista Networks stock? You are definitely not alone. With a history that reads like a growth investor’s dream, this networking powerhouse has left the broader market in the dust. Just take a look at the numbers: up 55.0% over the past 12 months, a jaw-dropping 381.8% over the last 3 years, and a mind-boggling 1009.7% over the last 5 years. Even after a modest slip of 2.4% in the last week, Arista Networks' story is one of sustained growth that has consistently outpaced most tech peers.

Much of this multi-year surge has been underpinned by the growing appetite for data-center networking, accelerated cloud adoption, and the increasing relevance of Arista’s solutions as companies modernize their technology stacks. Market watchers have certainly taken notice, with some viewing recent volatility as a predictable pause following such a strong run rather than a broad reversal in fortune. Of course, the stock’s climb also means valuations are drawing more scrutiny than ever.

If you are wondering whether Arista’s share price still leaves room for upside, a quick glance at its value score provides a reality check: 0 out of 6 on the undervaluation tests. That suggests, by typical valuation approaches, the stock does not appear to be a “bargain” right now. But numbers never tell the whole story. Next, we will break down the different valuation methods and reveal why looking beyond the usual metrics could give you a truer sense of what Arista is really worth.

Arista Networks scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Arista Networks Discounted Cash Flow (DCF) Analysis

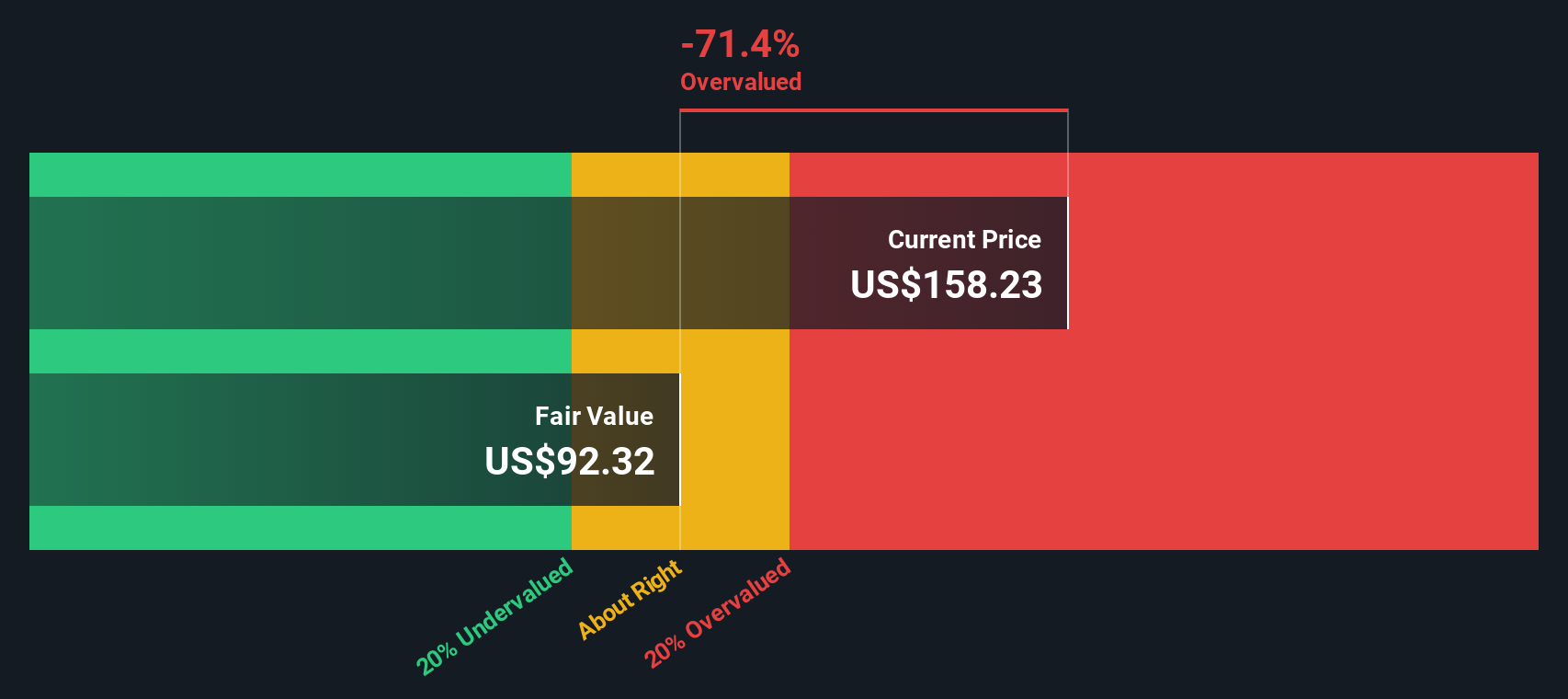

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those values back to today using a required rate of return. This helps investors estimate what the business is really worth if all future cash generation were considered in present terms.

For Arista Networks, the latest trailing twelve-month Free Cash Flow stands at $3.99 billion. Analyst projections indicate steady growth, expecting Free Cash Flow to reach about $5.89 billion by the end of 2028. Further into the next decade, Simply Wall St extrapolates these forecasts and estimates Arista Networks could generate around $7.66 billion in Free Cash Flow by 2035.

Based on these projections, the DCF model assigns an intrinsic fair value of $90.44 per share. However, with the current share price substantially above this estimate, the DCF model implies the stock is roughly 54.1% overvalued when discounted back to today.

For investors, this means that despite remarkable past growth, Arista Networks’ stock price may have moved significantly beyond its underlying cash flow, and expectations for future performance are already heavily priced in.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Arista Networks.

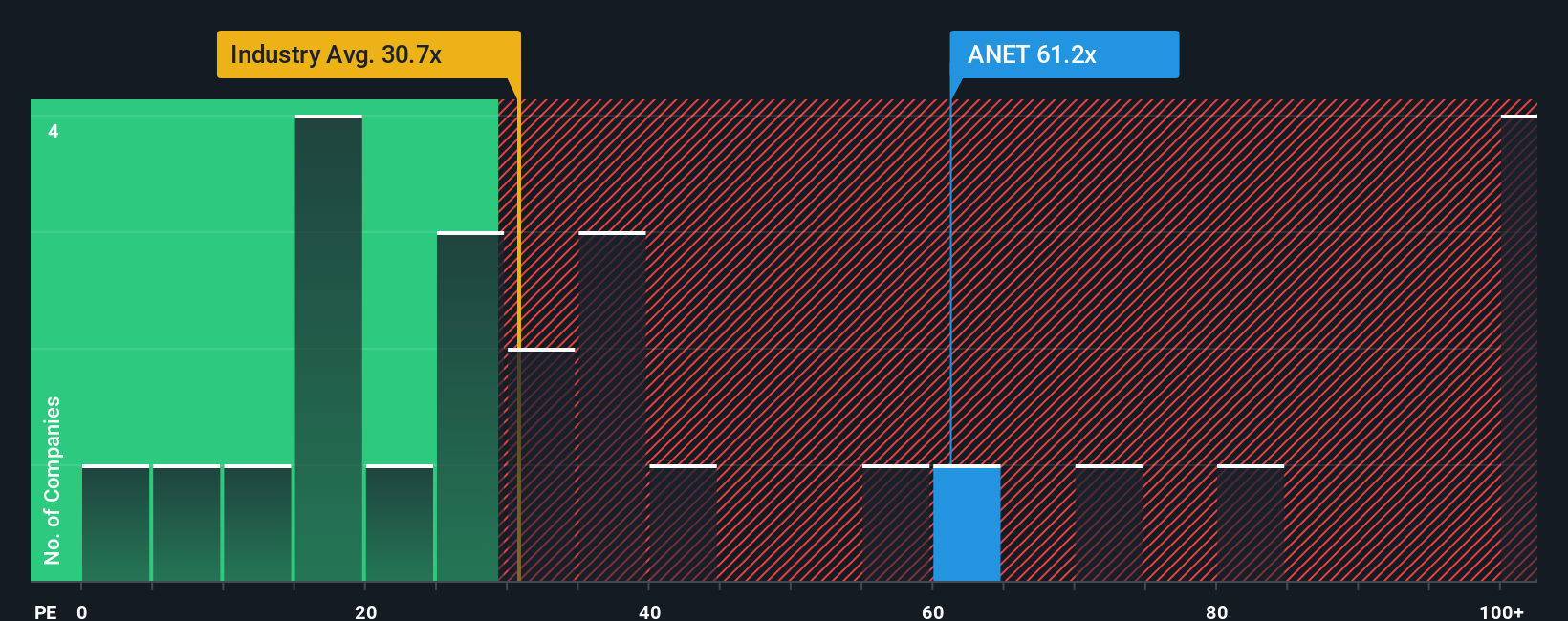

Approach 2: Arista Networks Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely recognized as a reliable yardstick for valuing profitable companies like Arista Networks. Because it measures the price investors are willing to pay for each dollar of current earnings, the PE ratio is especially effective for tech firms with a track record of consistent profit generation.

Of course, what qualifies as a "reasonable" or "fair" PE can vary. Companies with higher expected growth and lower perceived risks typically command higher PE multiples, as investors are willing to pay more for anticipated future profits. In contrast, slower-growing or riskier businesses generally receive lower PE ratios.

Currently, Arista Networks trades at a lofty PE multiple of 53.9x. That is well above both the average PE of its direct peers (35.7x) and the broader communications industry (27.6x). At first glance, this premium may seem extreme, but context matters, especially for high-growth tech companies.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, calculated specifically for Arista Networks at 38.9x, adjusts for its unique mix of earnings growth, profit margins, risk profile, market cap, and industry sector. Unlike plain peer or sector averages, this proprietary metric provides a more tailored fair value benchmark that reflects the company’s real-world advantages and risks.

Comparing the current PE to the Fair Ratio, Arista Networks’ 53.9x is significantly above the “about right” level suggested by its underlying fundamentals and growth prospects. That suggests the stock is trading at a premium well above what its stellar performance alone might justify.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Arista Networks Narrative

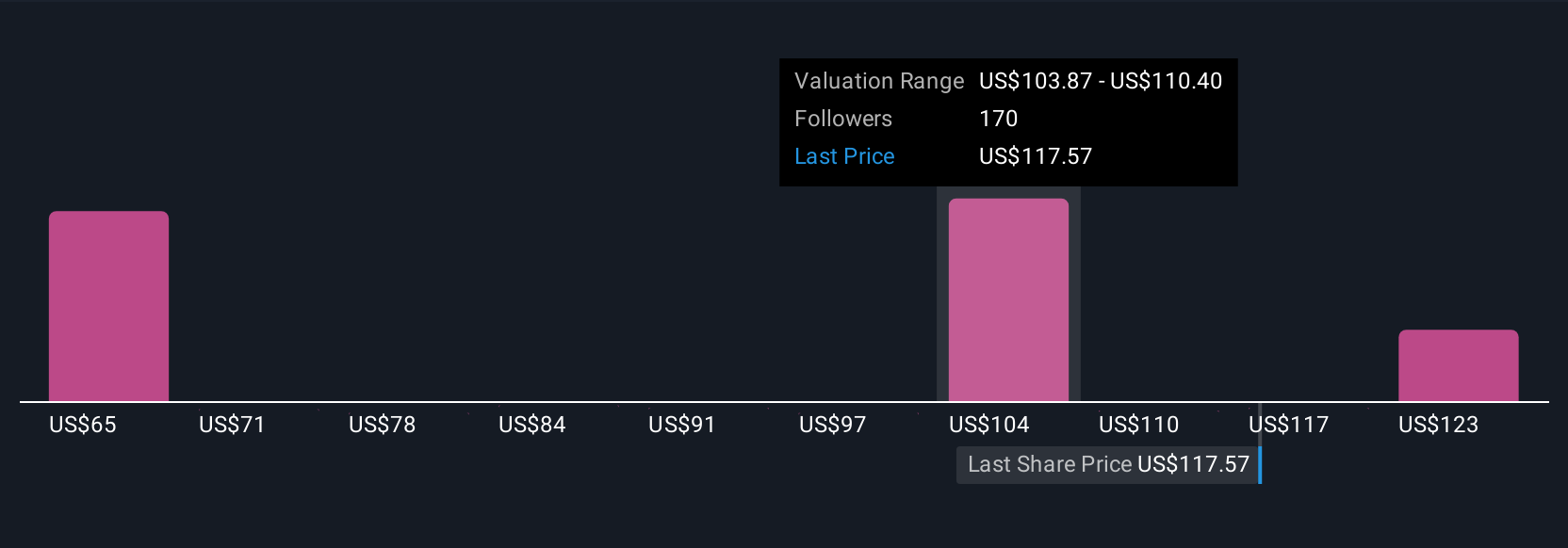

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are simplified, story-based frameworks where investors can spell out not just the numbers, but the “why” behind their assumptions for a company’s future, such as expected revenue, margins, and fair value, all anchored by their unique perspective on the business and industry trends.

Instead of just focusing on rigid formulas, Narratives connect a company’s story directly to forecasted financials. This turns your view of Arista into a personalized valuation that makes sense for you. This approach is both accessible and dynamic. On Simply Wall St’s Community page, millions of investors can easily create and browse Narratives in just a few clicks.

Narratives help you decide when it might be worth buying or selling by comparing what you believe is a fair value to the current market price. Because they automatically update when important news drops or earnings are released, your thesis always reflects the latest reality.

For example, two investors might reach very different conclusions about Arista Networks. One sees future growth in AI and cloud driving a fair value of $130, while another, more cautious, lands at $76. Each position is informed by their unique outlook and assumptions.

For Arista Networks, we will make it really easy for you with previews of two leading Arista Networks Narratives:

- 🐂 Arista Networks Bull Case

Fair value: $142.63

Currently trading at a 2.3% discount to this narrative fair value

Revenue growth rate: 19.6%

- Leadership in open, high-bandwidth networking and AI places Arista at the forefront of industry expansion and sustained growth. The company also maintains a strong pipeline of product innovation and new market opportunities.

- Software-driven platforms and automation are contributing to a shift toward higher-margin, recurring revenues, which enhances earnings stability as Arista expands into enterprise and campus markets.

- Risks include high customer concentration, intensifying competition, potential margin compression from open-source alternatives and technological shifts, and possible regulatory or supply chain challenges that may affect international growth.

- 🐻 Arista Networks Bear Case

Fair value: $127.06

Currently trading at a 9.7% premium to this narrative fair value

Revenue growth rate: 15%

- Arista disrupts established players such as Cisco with innovative hardware and software, achieving high customer loyalty and satisfaction, especially in fast, high-bandwidth internet switching.

- The company’s financial strength is notable, with a debt-free balance sheet and strong return on equity measured over both past and forecast periods.

- The fair value estimate depends on the company needing to roughly double free cash flow within three years. While this is possible, it presents a demanding growth target amid ongoing market competition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.