Please use a PC Browser to access Register-Tadawul

Is Arrowhead Pharmaceuticals (ARWR) Pricing Reflect Recent RNAi Progress And Strong Share Price Gains?

Arrowhead Pharmaceuticals, Inc. ARWR | 63.59 | -0.42% |

- If you are looking at Arrowhead Pharmaceuticals and wondering whether the recent excitement matches the stock's underlying value, this article will walk you through the key signals to watch.

- The share price sits at US$72.14 after returns of 7.8% over the past week, 6.4% over the past month, 6.4% year to date, 266.6% over the past year and 114.6% over three years, while the five year return is negative at 19.7%.

- Recent coverage around Arrowhead has focused on its progress in RNA interference based therapies and ongoing development across its pipeline, which has kept attention on the stock. This context helps explain why some investors are reassessing both potential and risk, and why sentiment has been active around the current price.

- On Simply Wall St's 6 point valuation checklist, Arrowhead scores 2 out of 6, which raises fair questions about how different valuation methods treat its prospects. We will look at those approaches next and then close by tackling a broader way to think about what this valuation really means for you.

Arrowhead Pharmaceuticals scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Arrowhead Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth by projecting its future cash flows and then discounting those back into today’s dollars.

For Arrowhead Pharmaceuticals, the latest twelve month free cash flow is a loss of about US$83.8 million. Analysts have provided cash flow estimates out to 2030, and Simply Wall St extends that path further using its own assumptions. Within those projections, free cash flow is expected to reach US$348.5 million in 2030, with intermediate years moving from further losses into positive territory based on the supplied schedule.

When all those future cash flows are discounted back using a 2 Stage Free Cash Flow to Equity model, Simply Wall St arrives at an estimated intrinsic value of US$136.94 per share. Compared with the current share price of US$72.14, this output suggests the stock is about 47.3% undervalued under this specific DCF setup.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arrowhead Pharmaceuticals is undervalued by 47.3%. Track this in your watchlist or portfolio, or discover 872 more undervalued stocks based on cash flows.

Approach 2: Arrowhead Pharmaceuticals Price vs Sales

For companies where earnings are not yet a steady guide, the P/S ratio is often a useful way to think about value, because it relates what you pay per share to the revenue the business is already generating.

Growth expectations and risk still matter here, just as they do with P/E ratios. Higher expected growth or lower perceived risk can justify a higher multiple, while slower growth or higher uncertainty often calls for a lower one.

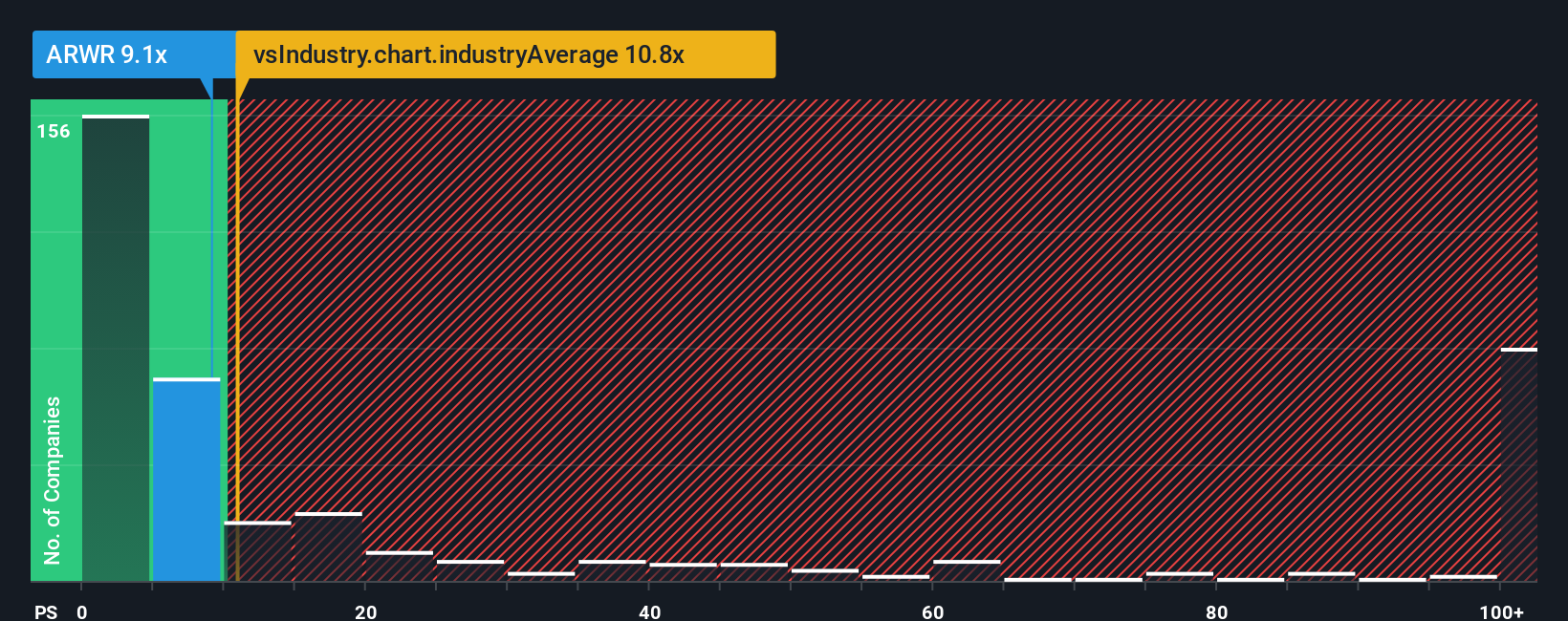

Arrowhead Pharmaceuticals currently trades on a P/S ratio of 12.18x. That is close to the Biotechs industry average of 12.01x, and above the peer group average of 6.07x. Simply Wall St’s Fair Ratio for Arrowhead is 9.90x, which is the level that model suggests could be reasonable after taking into account factors such as earnings growth, margins, industry, market cap and company specific risks.

This Fair Ratio can be more informative than a simple comparison with peers or the broad industry, because it adjusts for Arrowhead’s own profile rather than assuming that all companies in the group deserve the same multiple. Compared with the Fair Ratio of 9.90x, the current P/S of 12.18x indicates that the shares screen as overvalued on this measure.

Result: OVERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arrowhead Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company connected directly to the numbers you think are realistic for its future revenue, earnings, margins and fair value.

On Simply Wall St’s Community page, Narratives let you link what you believe about Arrowhead Pharmaceuticals, such as how its RNA interference based pipeline might develop, to a financial forecast and then to a fair value that sits next to today’s share price.

This makes it easier to decide whether you prefer to wait, add, or reduce your exposure by comparing your Fair Value to the current Price. Your Narrative will automatically refresh when new information like earnings releases or major news is fed into the platform.

For example, one Arrowhead Pharmaceuticals Narrative on the Community page might see relatively conservative revenue growth and margins that support a fair value close to the current US$72.14 price. Another more optimistic Narrative could assume stronger long term cash generation that supports a materially higher fair value.

Do you think there's more to the story for Arrowhead Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.