Please use a PC Browser to access Register-Tadawul

Is Block's Crypto Expansion Already Priced In After 4.4% Gain This Year?

Block XYZ | 61.11 | -1.74% |

- Wondering if Block’s stock price is still a bargain or if the market has already caught on? Let’s break down what you need to know before making your next move.

- Block's share price has edged up 0.8% in the past week and 1.5% over the last month, but is still down 11.8% year-to-date, despite gaining 4.4% in the last year.

- Recent headlines have focused on Block's expansion into digital payment solutions and its partnerships in the crypto space. These moves have sparked investor interest and stirred debate on whether the market is fully capturing Block's long-run potential.

- Currently, Block scores just 1 out of 6 on our valuation checks. However, there is more to the valuation story than meets the eye. Next, we will explore traditional valuation methods and, at the end of the article, discuss another way to assess value.

Block scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Block Excess Returns Analysis

The Excess Returns valuation method assesses whether Block is generating returns above its cost of equity, focusing on how effectively it is using shareholder capital to create value. In this model, we examine metrics like the company's book value, expected earnings per share, and the required rate of return for investors.

For Block, the current Book Value stands at $36.31 per share. The projected Stable EPS is $4.11 per share, as derived from weighted future Return on Equity estimates from nine analysts. Block’s Cost of Equity is estimated at $3.21 per share, which results in an annual Excess Return of $0.90 per share. The company’s average Return on Equity is calculated at 9.81%, and the Stable Book Value is projected to rise to $41.93 per share, based on forecasts from eight analysts.

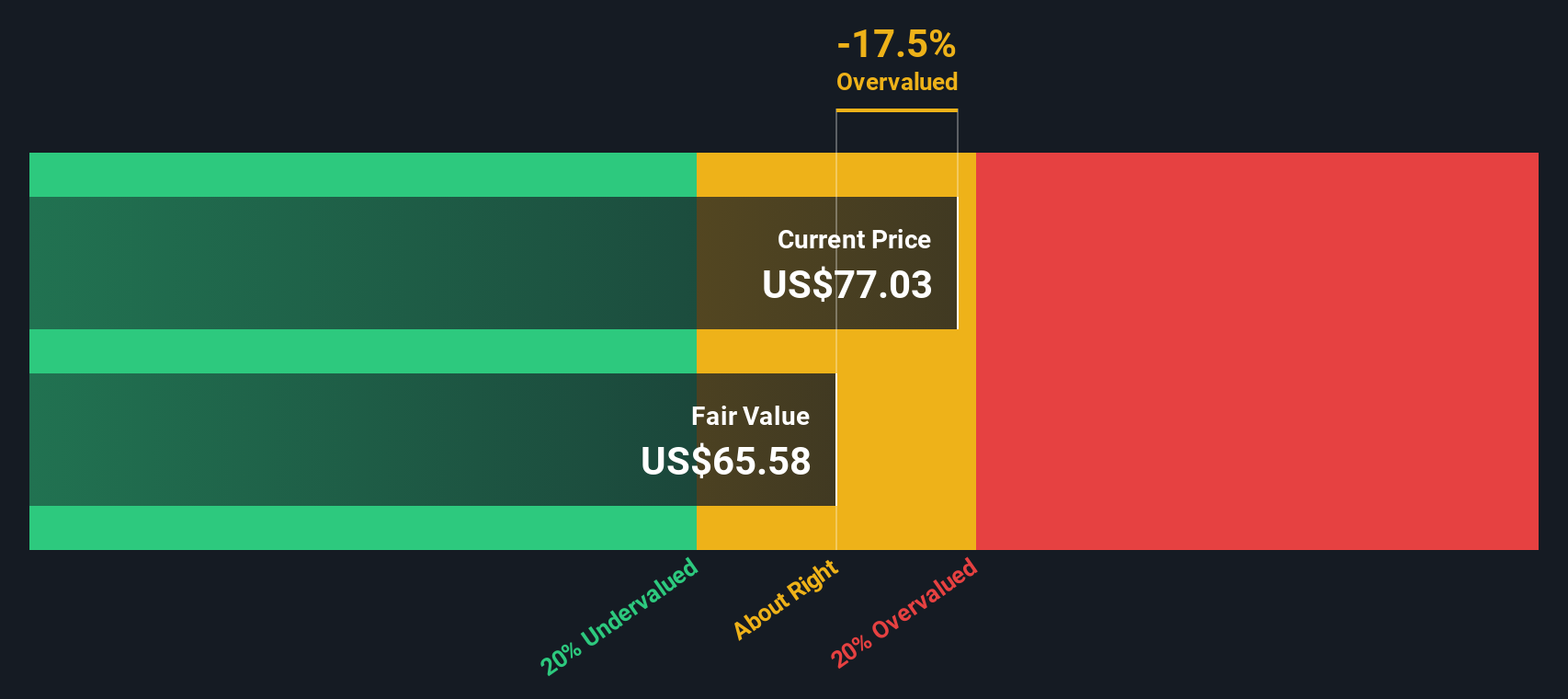

Applying this analysis, the intrinsic value for Block is assessed at $61.71 per share. Given the current market valuation, this model indicates that shares are approximately 24.0% overvalued using excess returns as the benchmark.

Result: OVERVALUED

Our Excess Returns analysis suggests Block may be overvalued by 24.0%. Discover 851 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Block Price vs Earnings

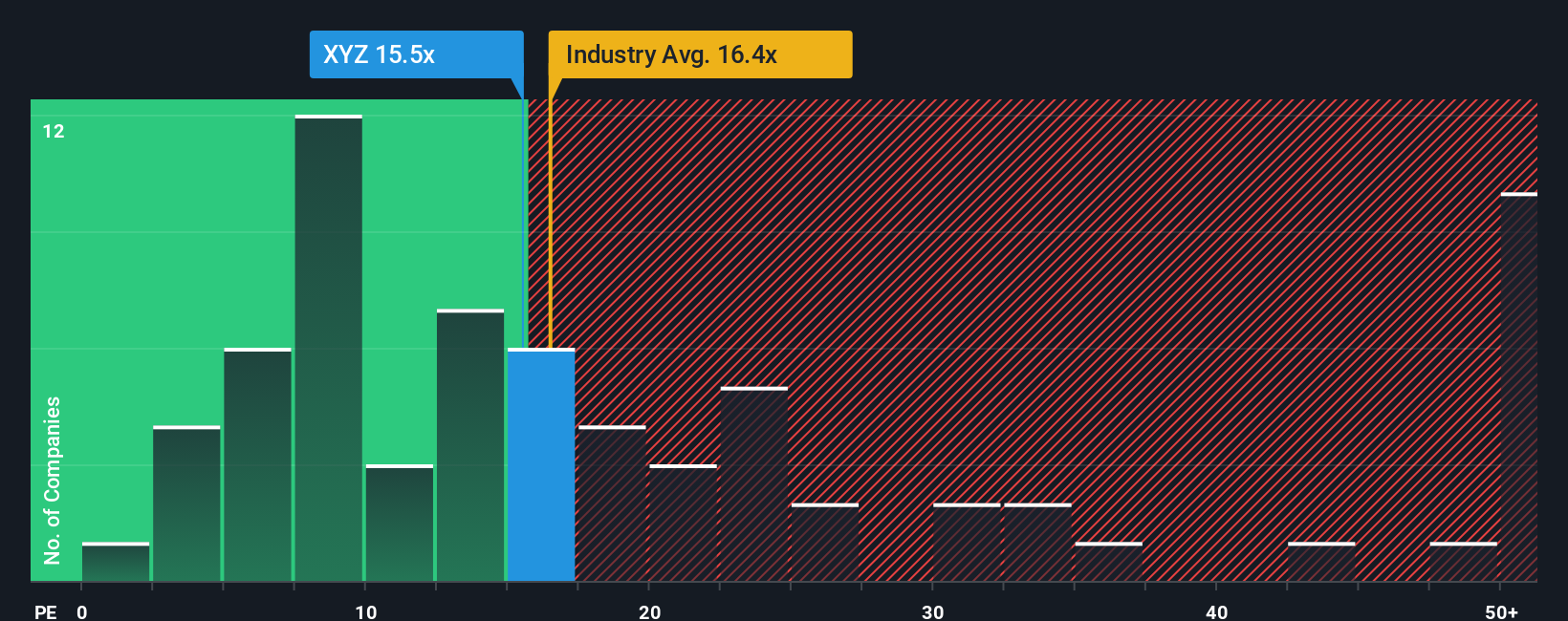

The Price-to-Earnings (PE) ratio is often the go-to measure for valuing profitable companies like Block because it directly relates a company's market price to its earnings, making it a clear indicator of how much investors are willing to pay for each dollar of profit. It also allows for easier comparisons across companies and industries.

Growth expectations and risk play a crucial role in determining what a "normal" or "fair" PE ratio should be. Companies with stronger expected earnings growth or lower risk often justify higher PE ratios, while those with lower growth or heightened risk typically trade at lower multiples.

Currently, Block’s PE ratio stands at 15.8x. When we set this against the industry average of 15.1x and a peer average of 13.9x, Block’s valuation appears slightly elevated but not extreme. However, Simply Wall St’s proprietary “Fair Ratio,” which factors in Block’s earnings growth outlook, market cap, profit margins, and risk, is 18.0x. This tailored benchmark recognizes the company’s unique strengths and challenges, making it more insightful than simply comparing with peers or industry averages.

Since Block’s current PE ratio of 15.8x is notably below its Fair Ratio of 18.0x, this suggests that the stock is trading at an attractive price relative to its fundamentals and future prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1392 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Block Narrative

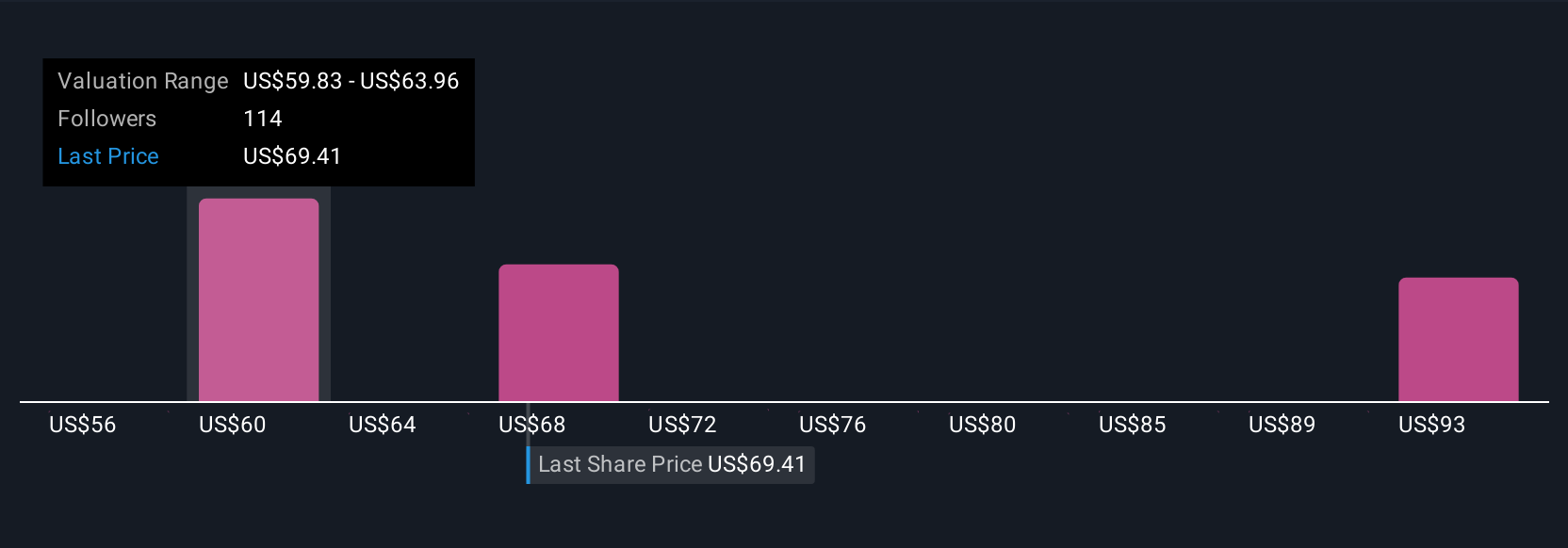

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own story about a company that ties together your view on where the business is headed with a financial forecast and a calculated fair value. It’s about putting your perspective, assumptions about future revenue, earnings, and margins, behind the numbers.

Narratives help make investing easier by connecting the “why” behind the numbers to the “what” of price and value. They allow you to lay out your rationale, back it up with key figures, and update it as the facts change.

On Simply Wall St’s Community page, millions of investors use Narratives to bring their insights to life and see how their story stacks up. For example, if your Narrative’s Fair Value is above the current price, you might consider buying, but if it falls below, you may think about selling. Because Narratives refresh dynamically with news and earnings, you can react quickly to market changes.

For example, some Block Narratives price the company as high as $104 by assuming stronger growth in core segments and successful crypto expansion, while others see it as low as $35 based on concerns over earnings volatility and rising risk. Your decision starts with the story you believe.

Do you think there's more to the story for Block? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.