Please use a PC Browser to access Register-Tadawul

Is Burlington Stores (BURL) Pricing In Too Much Optimism After Recent Share Price Resilience

Burlington Stores, Inc. BURL | 298.98 | +1.05% |

- If you are wondering whether Burlington Stores is offering good value at its recent price, you are not alone. This article looks at what the current market price might be implying.

- The stock recently closed at US$292.51, with returns of a 2.5% decline over 7 days, 1.6% over 30 days, a 2.0% decline year to date, a 0.4% decline over 1 year, 26.7% over 3 years and 13.9% over 5 years.

- Recent coverage has focused on how Burlington Stores fits into the broader off price retail space and how investors are weighing its store footprint and merchandising model against peers. This backdrop helps frame the recent share price moves as the market continually reassesses how much it is prepared to pay for those characteristics.

- Simply Wall St currently gives Burlington Stores a valuation score of 0 out of 6. Next, we will look at what that means across different valuation methods before finishing with a way of thinking about valuation that goes beyond any single model.

Burlington Stores scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Burlington Stores Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth today by projecting its future cash flows and then discounting those back into present value terms.

For Burlington Stores, the model used is a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is a loss of $2.25 million. Analysts have provided estimates up to 2027, with Simply Wall St extrapolating further to create a 10 year cash flow path. For example, projected free cash flow is $230.35 million in 2026 and $245.45 million in 2027, rising in the model to $700.95 million by 2035, all in US$ terms.

Bringing these projected cash flows back to today, the DCF model arrives at an estimated intrinsic value of $124.63 per share. Compared with the recent share price of $292.51, this suggests Burlington Stores is 134.7% overvalued on this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Burlington Stores may be overvalued by 134.7%. Discover 866 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Burlington Stores Price vs Earnings

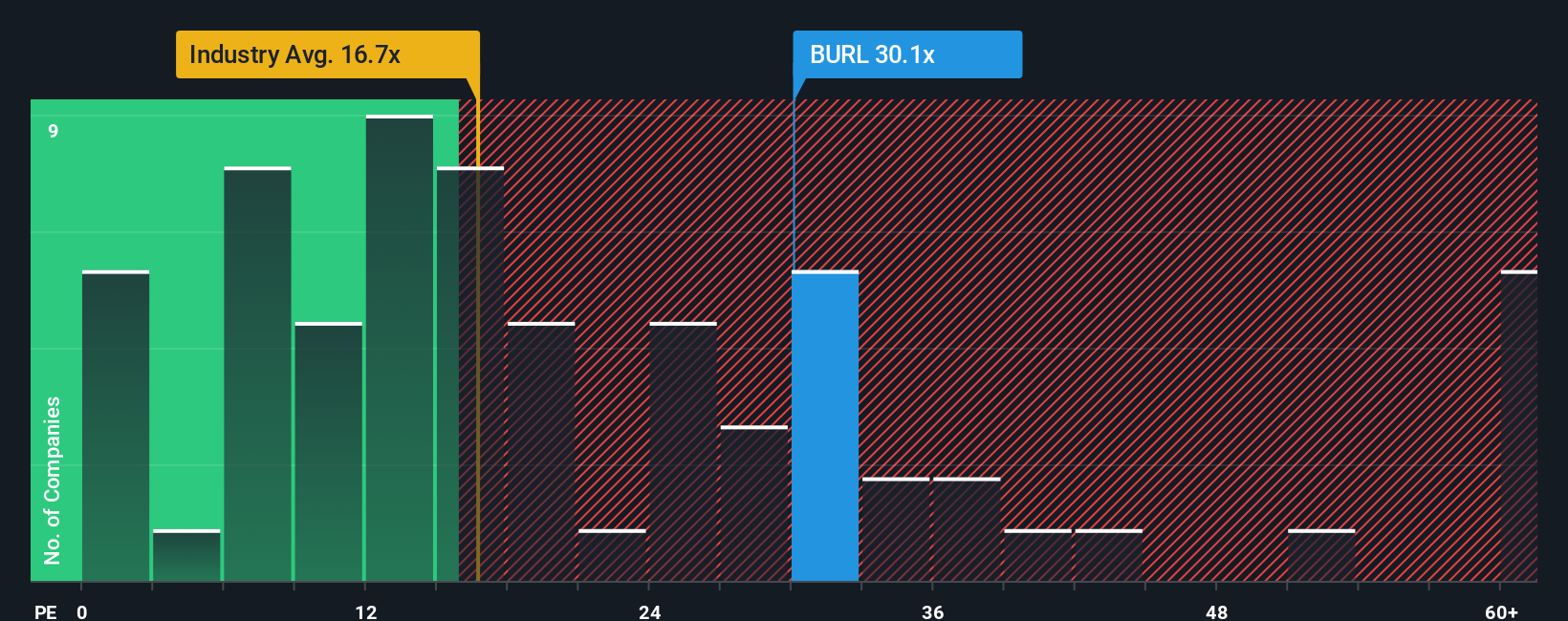

P/E is a common way to look at valuation for profitable companies because it links what you pay directly to the earnings the business is generating. In simple terms, the higher the expected growth and the lower the perceived risk, the more investors are usually willing to pay in the form of a higher P/E ratio.

Right now, Burlington Stores trades on a P/E of 32.45x. That sits above both the Specialty Retail industry average P/E of 19.29x and the peer average of 19.86x. On those simple comparisons, the shares are pricing in more optimistic earnings expectations or lower risk than the typical peer in the group.

Simply Wall St also calculates a proprietary “Fair Ratio” of 23.66x for Burlington Stores. This Fair Ratio is designed to be more tailored than a straight industry or peer comparison because it blends in factors such as the company’s earnings growth profile, profit margins, market capitalization, risk indicators and its industry.

Comparing Burlington Stores actual P/E of 32.45x with the Fair Ratio of 23.66x suggests the shares are trading above what this framework would point to as a fair level.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Burlington Stores Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These let you attach a clear story about Burlington Stores to the numbers you are seeing, such as your own fair value, revenue, earnings and margin assumptions.

A Narrative is simply your view of what the business is doing and could do, linked directly to a structured financial forecast and then to a fair value estimate, rather than just relying on a single model or market multiple.

On Simply Wall St, Narratives sit inside the Community page and are designed to be easy to use. This means you can compare your Burlington Stores view with those shared by other investors who already use the platform.

Each Narrative compares a user’s fair value with the current share price to help them consider whether Burlington Stores appears attractive, fully valued or expensive on their numbers. That view automatically updates as new information such as earnings reports or news headlines is incorporated into the forecasts behind the scenes.

For example, one Burlington Stores Narrative might use relatively conservative revenue and margin assumptions that lead to a lower fair value, while another uses more optimistic inputs and arrives at a much higher fair value. This shows how the same stock can support very different but clearly explained views.

Do you think there's more to the story for Burlington Stores? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.