Please use a PC Browser to access Register-Tadawul

Is Celsius Holdings (CELH) Still Attractive After 107% One Year Share Price Surge?

Celsius Holdings, Inc. CELH | 48.32 | +9.49% |

- If you are wondering whether Celsius Holdings is still priced for strong growth or already ahead of itself, this article will help you make sense of what you are paying for at today's share price.

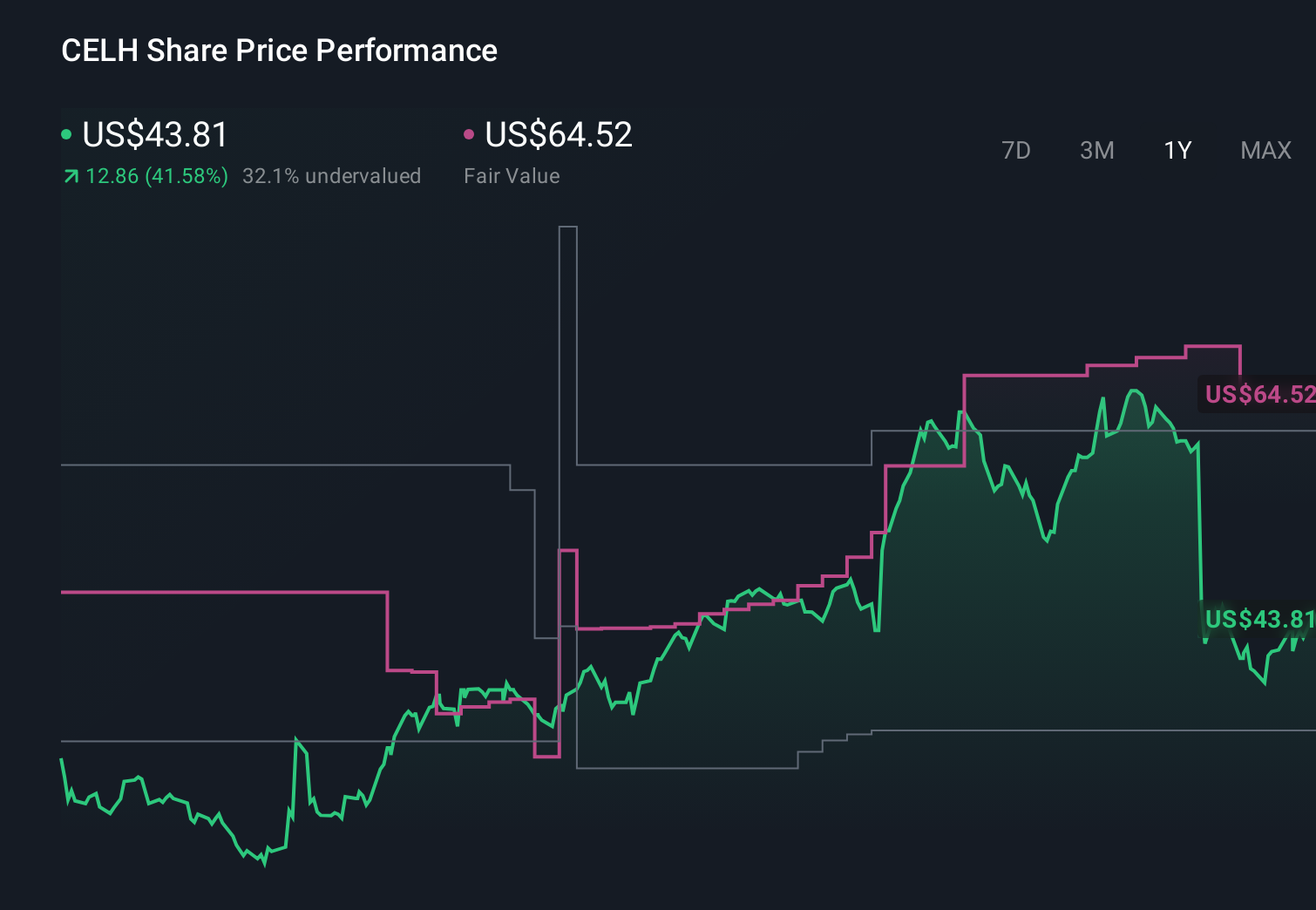

- The stock trades at US$53.37, with returns of 15.7% over 30 days and 107.0% over the past year, which can reshape how investors think about both upside and risk.

- Recent coverage has focused on Celsius Holdings as a fast growing energy drink brand with an expanding presence in the US market, supported by distribution through large retail and convenience channels. Commentary has also highlighted how brand partnerships and broadened shelf space can affect expectations for future demand, which often feeds directly into valuation debates.

- Celsius Holdings currently has a valuation score of 2 out of 6, and in the sections ahead we will look at what different valuation approaches say about that score, then finish with a way of thinking about value that goes a step beyond the usual multiples and models.

Celsius Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Celsius Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of a company’s future cash flows, then discounts them back to today to arrive at an estimate of what the business might be worth on a per share basis.

For Celsius Holdings, the DCF uses a 2 Stage Free Cash Flow to Equity approach, starting from last twelve month free cash flow of about $522 million. Analysts provide explicit free cash flow estimates out to 2030, with projected free cash flow of $722 million for that year. Beyond the first few years, Simply Wall St extrapolates the path of cash flows, such as the 2031 to 2035 projections, and discounts each of these figures back to today using a required return assumption.

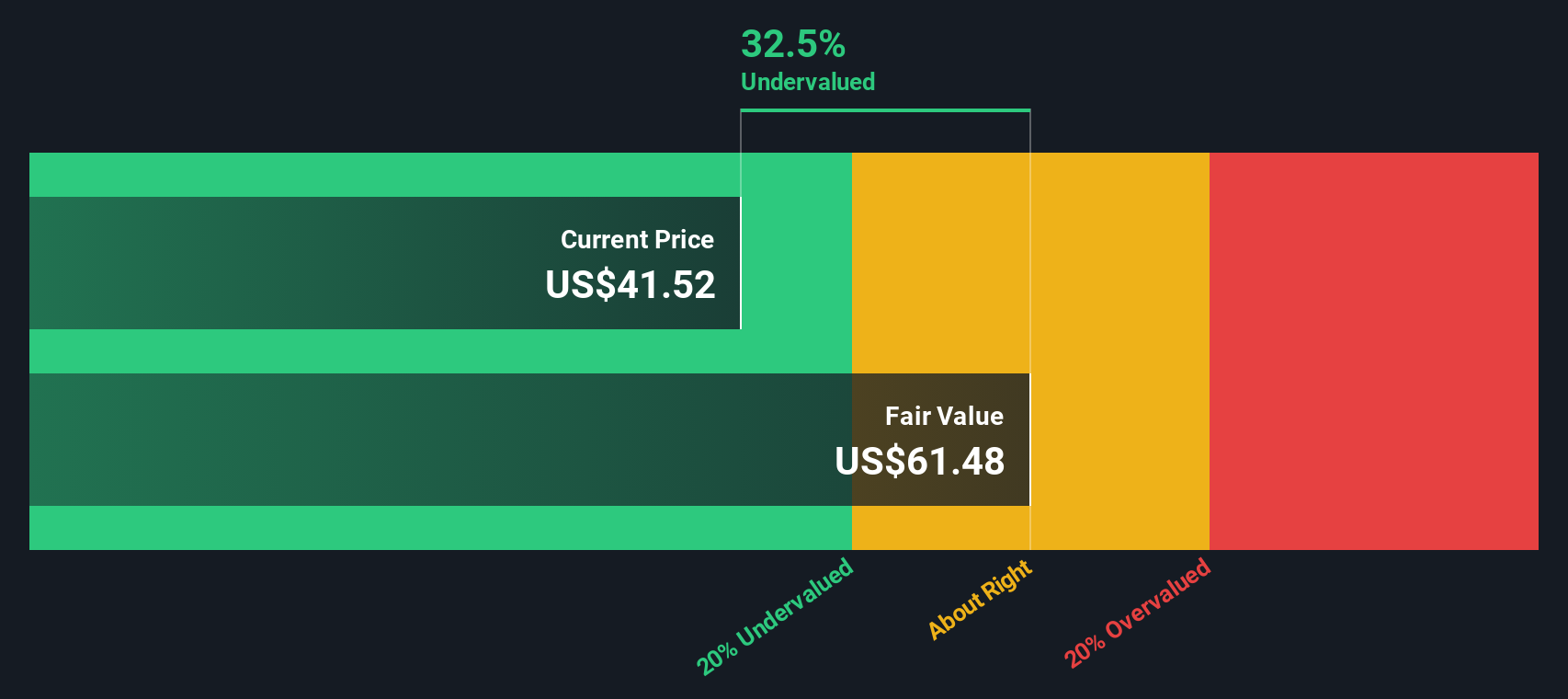

On this basis, the model estimates an intrinsic value of about $71.21 per share, compared with the recent share price of $53.37. That gap implies the stock is 25.1% below the DCF estimate. This indicates a potential valuation cushion if the cash flow path used in the model proves reasonable.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Celsius Holdings is undervalued by 25.1%. Track this in your watchlist or portfolio, or discover 868 more undervalued stocks based on cash flows.

Approach 2: Celsius Holdings Price vs Sales

For profitable consumer brands like Celsius Holdings, the P/S ratio is often a useful way to think about what the market is paying for each dollar of revenue, especially when earnings based metrics can be skewed by investment in growth or one off items.

In general, investors tend to accept a higher P/S multiple when they expect stronger growth and lower perceived risk, and look for a lower multiple when growth expectations are more modest or risks feel higher. The question then becomes whether the current P/S lines up with what you think about those two forces.

Celsius Holdings currently trades on a P/S of 6.47x, compared with the Beverage industry average of 1.92x and a peer average of 1.61x. Simply Wall St’s Fair Ratio for the stock is 3.38x, which is its own estimate of what a reasonable P/S might be given Celsius Holdings earnings growth profile, profit margins, size, industry and risk factors.

The Fair Ratio aims to be more tailored than a straight industry or peer comparison because it adjusts for company specific characteristics rather than assuming all beverage names deserve similar pricing. With the current 6.47x P/S sitting above the 3.38x Fair Ratio, the stock screens as expensive on this metric.

Result: OVERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Celsius Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your own story about a company tied directly to your assumptions for fair value, future revenue, earnings and margins.

Instead of looking at the numbers in isolation, a Narrative connects what you believe about Celsius Holdings as a business to a financial forecast and then to a fair value estimate, so you can clearly see how your view translates into a price.

On Simply Wall St, Narratives sit inside the Community page and are designed to be easy to use, so you can compare your Fair Value to the current share price and decide for yourself whether the gap is large enough to consider buying, holding, or selling.

Because Narratives update when new information comes in, such as earnings releases or major news, your fair value view stays aligned with the latest data rather than a static model you built months ago. On Celsius Holdings you might see one investor pricing in very strong future margins while another assumes much more conservative profitability. This leads to very different fair values even though they are looking at the same company.

Do you think there's more to the story for Celsius Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.