Please use a PC Browser to access Register-Tadawul

Is Coty a Bargain After Shares Drop Over 50% in the Past Year?

Coty Inc. Class A COTY | 2.66 | -15.56% |

- Thinking about Coty's stock and wondering if now is the right time to buy, sell, or hold? You are not alone, especially if you are curious about the real value behind the recent price action.

- Shares have struggled this year, dropping by 47.1% year-to-date and sliding 52.2% over the last 12 months. This could signal new risks or a potential opportunity for long-term investors.

- These declines have happened against a backdrop of increased investor skepticism and changing market sentiment, partly driven by shifts in the beauty sector and fluctuating demand for consumer brands. Some headlines have pointed to Coty's evolving product strategy and high-profile marketing campaigns as attempts to stabilize momentum and appeal to new customer segments.

- When we break down the numbers, Coty earns a valuation score of 5 out of 6. This means it is undervalued in most, but not all, fundamental checks. Stick with us as we walk through the most common valuation approaches and reveal a smarter, more comprehensive way to think about Coty's worth by the end of this article.

Approach 1: Coty Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth by projecting its future cash flows and then discounting them back to today's value. This approach aims to answer how much investors should be willing to pay for Coty based strictly on its ability to generate cash over time.

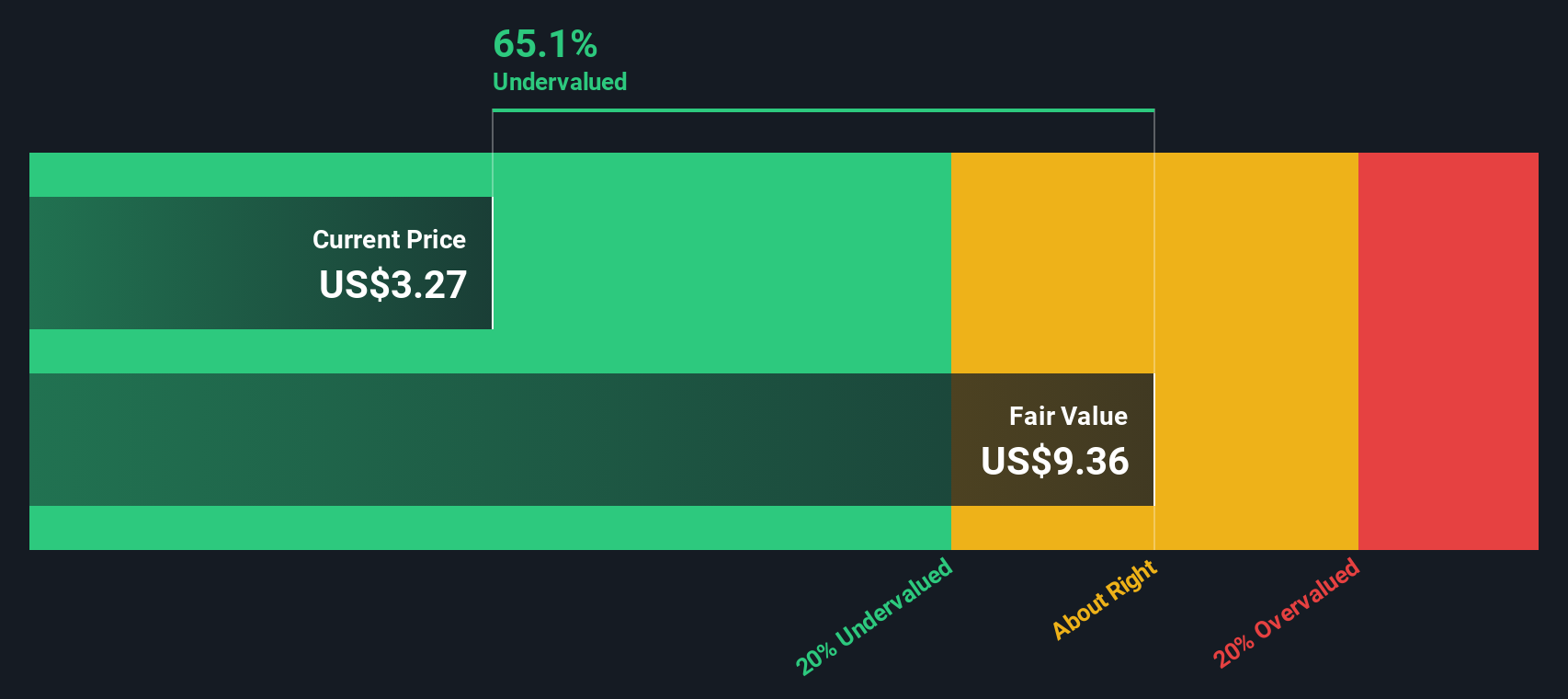

Coty's current trailing twelve month Free Cash Flow stands at approximately $276.5 million. Analyst forecasts show this rising to $572 million by 2028, highlighting an expectation of strong cash flow growth over the next few years. While analyst estimates cover up to five years, further projections are extrapolated based on Coty's historical performance and industry factors. According to these models, annual Free Cash Flow could reach over $1 billion within ten years.

Applying the DCF method to these figures results in an estimated intrinsic value of $11.42 per share. With Coty's current share price trading at a 68.2% discount to this calculated value, the stock appears significantly undervalued by this metric.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coty is undervalued by 68.2%. Track this in your watchlist or portfolio, or discover 877 more undervalued stocks based on cash flows.

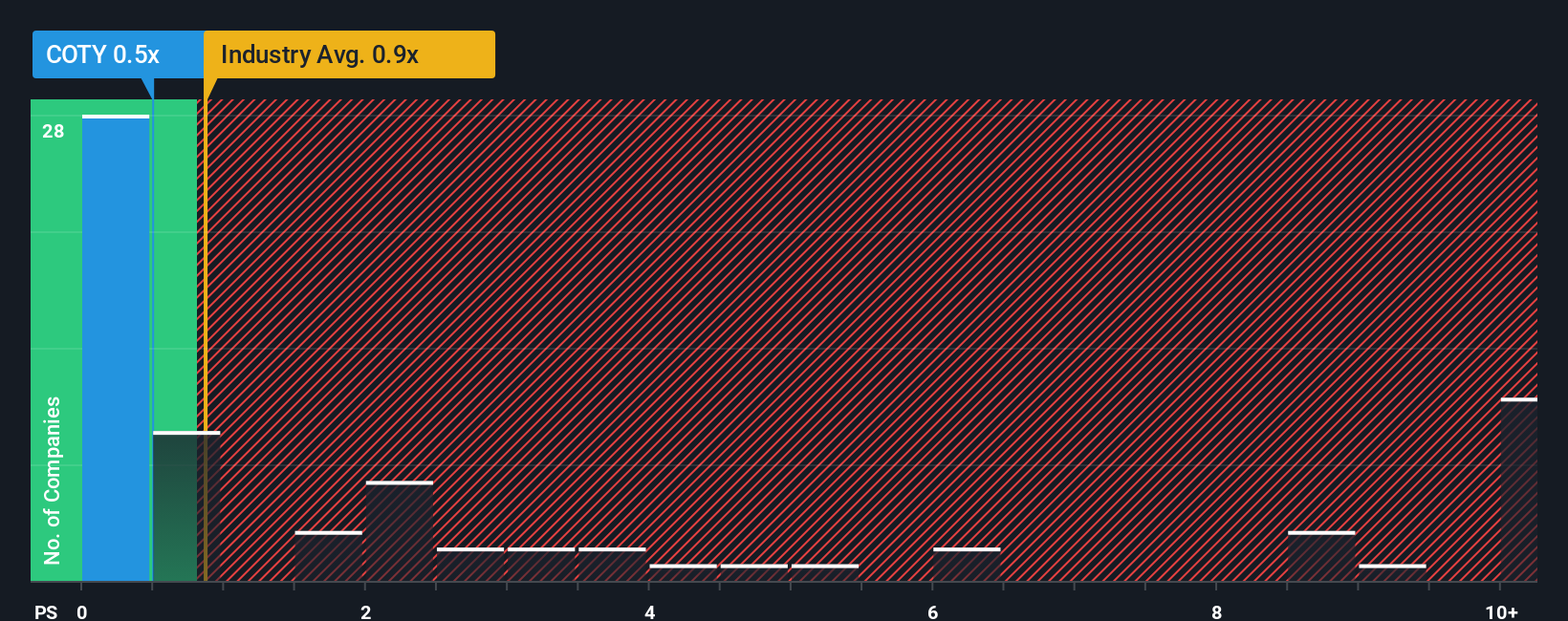

Approach 2: Coty Price vs Sales

Using the price-to-sales (P/S) ratio is a popular way to assess the valuation of companies where profits may be volatile or understated, but where revenue provides a clearer picture of business scale and market opportunity. For companies like Coty, which are still navigating margin pressures and cyclical profitability, the P/S ratio offers a more stable lens for evaluating value compared to earnings-based metrics.

A "normal" or "fair" P/S ratio often reflects growth expectations and business risks. High-growth, lower-risk companies typically command higher ratios, while mature or higher-risk firms tend to trade at lower multiples. This makes industry benchmarks helpful, but they can be limited if company-specific fundamentals differ significantly from the average.

Coty's current P/S ratio stands at 0.55x, meaning investors are paying $0.55 for every dollar of the company’s annual sales. This is considerably lower than the personal products industry average of 0.77x and well below the peer average of 2.43x. To provide a clearer assessment of value, Simply Wall St’s proprietary "Fair Ratio" incorporates factors such as Coty’s growth outlook, profitability, risk profile, and market capitalization. For Coty, the Fair Ratio is calculated to be 1.11x.

The Fair Ratio serves as a more tailored benchmark than simple industry or peer comparisons, as it captures nuances in growth potential, margins, and risk that averages may not reflect. Comparing Coty’s current P/S of 0.55x to its Fair Ratio of 1.11x suggests the stock is currently undervalued based on its underlying fundamentals and outlook.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coty Narrative

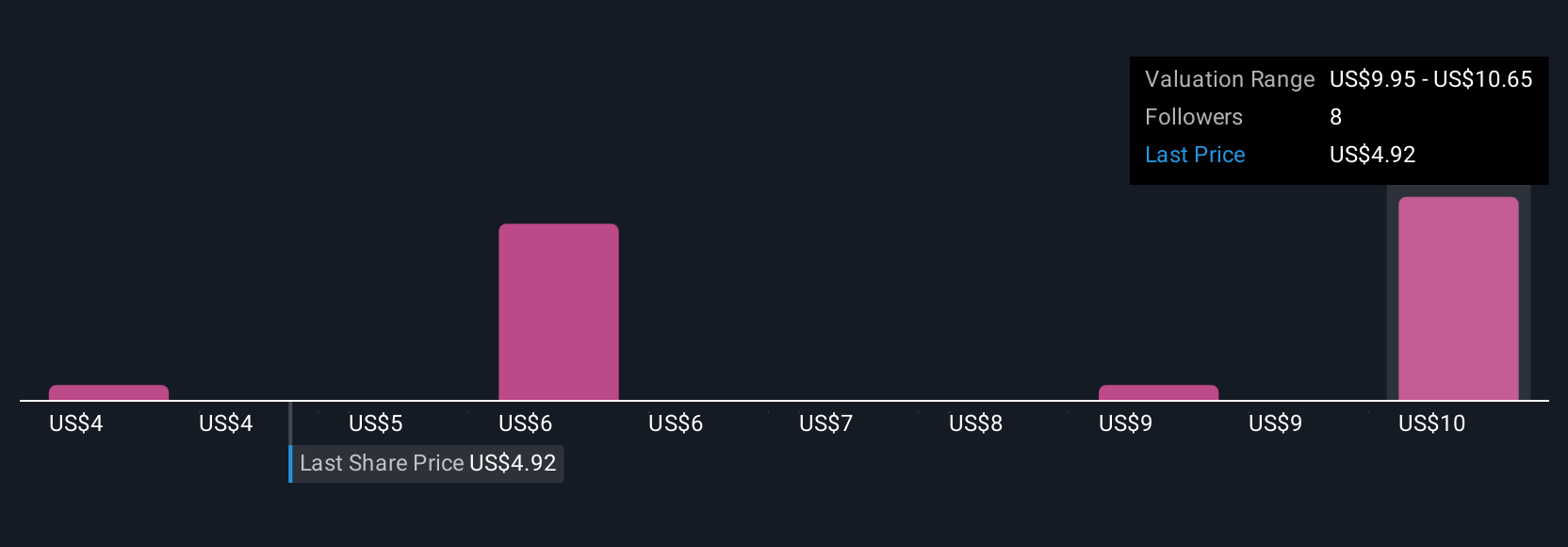

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, tying together what you believe about Coty's business, its strategy, future growth, and risks, with your own assumptions for future revenue, earnings, and margins, all the way through to a fair value estimate. Narratives connect the dots between a company's story, what that means financially, and how much the company is truly worth.

Narratives make investment decisions more intuitive by letting you easily compare your Fair Value estimate to the current share Price, clearly signaling if you see Coty as a buy, sell, or hold. This tool, available on Simply Wall St’s Community page (used by millions of investors), is accessible and updated dynamically. When new information such as news or earnings is released, your Narrative automatically adjusts and keeps you current.

For example, one investor might believe in Coty's brand strength and innovation, leading them to forecast higher margins and target a fair value above $8. Another, more cautious view, expects ongoing challenges, lower earnings, and a fair value closer to $3.5. Narratives empower you to make smarter, more personalized decisions by linking your unique insights straight to actionable valuation results.

Do you think there's more to the story for Coty? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.