Please use a PC Browser to access Register-Tadawul

Is CubeSmart (CUBE) Pricing Look Interesting After Recent Self Storage REIT Reassessment

CubeSmart CUBE | 40.30 | +4.24% |

- If you are wondering whether CubeSmart is offering good value at around US$37.53 per share, you are not alone. This article is built to unpack what that price might really mean.

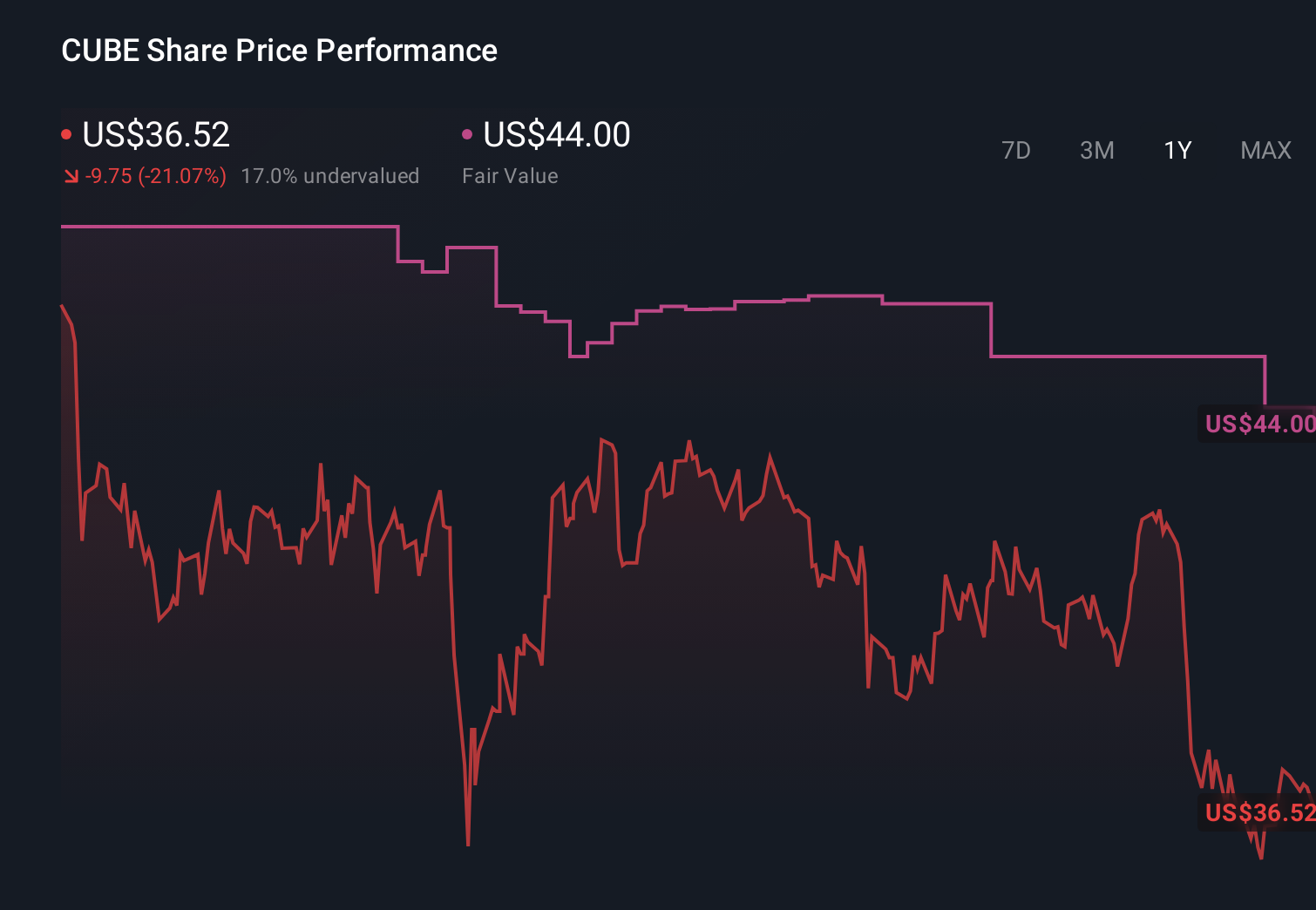

- The stock has had mixed recent returns, with a 1.9% decline over the last 7 days, a 4.1% gain over the last 30 days, a 6.0% gain year to date, and a 5.2% decline over the last year, while sitting on a 31.7% gain across 5 years.

- Recent news coverage has focused on CubeSmart as part of broader self storage and real estate investment trust discussions, highlighting how investors are reassessing income focused sectors as interest rate expectations shift. This context helps explain why shorter term price moves look different to the longer term return profile.

- CubeSmart currently has a valuation score of 5/6. Next we will break down what that score means across different valuation approaches, before finishing with a way to think about value that goes beyond any single model.

Approach 1: CubeSmart Discounted Cash Flow (DCF) Analysis

A DCF model takes CubeSmart’s expected adjusted funds from operations, treats them as free cash flow to equity, and discounts those future cash flows back to today using a required rate of return. The idea is to estimate what the stream of future cash flows is worth in today’s dollars.

For CubeSmart, the latest twelve month free cash flow is about $600.8 million. Based on analyst inputs for the next few years, and then Simply Wall St extrapolations after that, projected free cash flow for 2030 is $696.1 million. The model uses a two stage approach, combining explicit forecasts up to 2030 with a longer term phase that extends out to 2035.

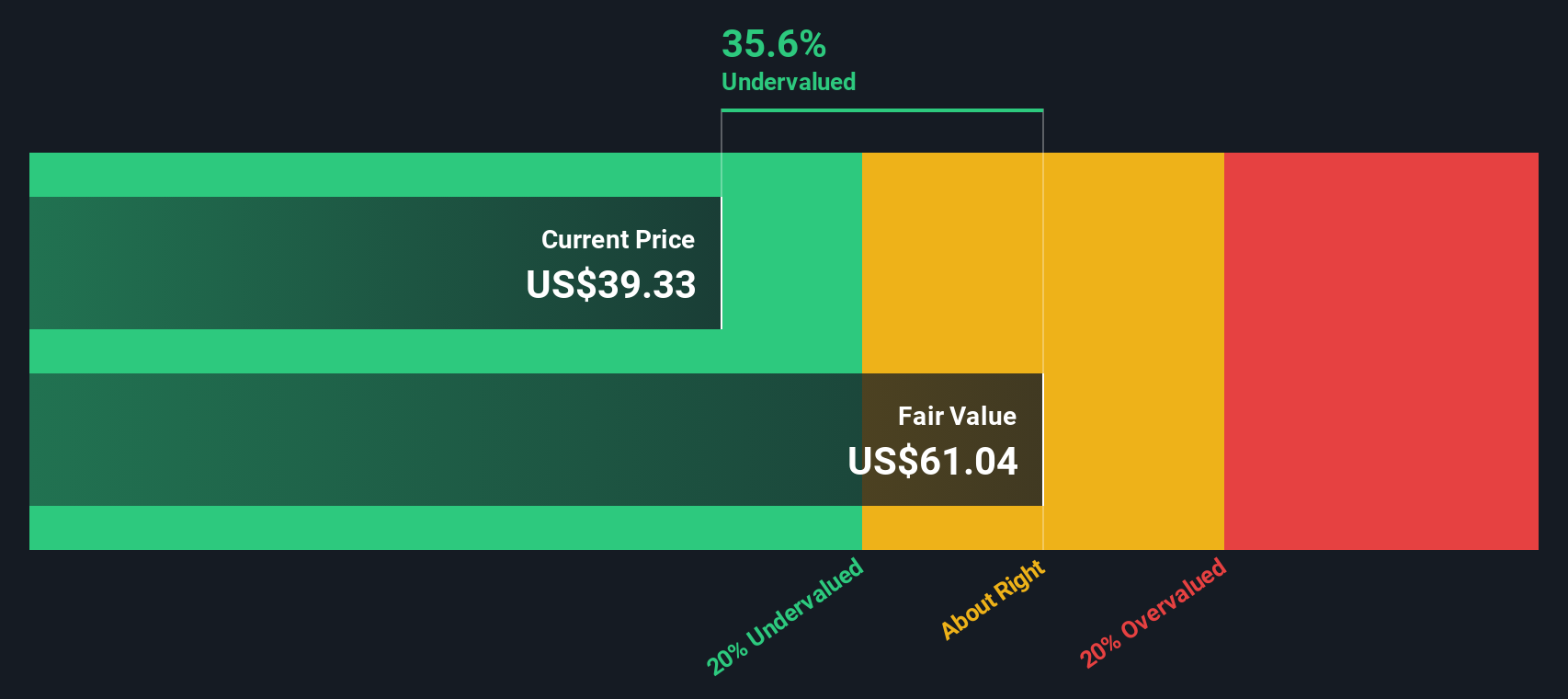

Bringing all those projected cash flows back to today gives an estimated intrinsic value of about $57.47 per share. Compared with the recent share price of roughly $37.53, the DCF output indicates that CubeSmart is trading at a 34.7% discount, suggesting that the shares are currently priced below this model’s estimate of value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CubeSmart is undervalued by 34.7%. Track this in your watchlist or portfolio, or discover 867 more undervalued stocks based on cash flows.

Approach 2: CubeSmart Price vs Earnings

For a profitable company like CubeSmart, the P/E ratio is a useful shorthand for how much investors are paying for each dollar of earnings. A higher or lower P/E often reflects what the market expects for future growth and how much risk investors are willing to tolerate, so a “normal” or “fair” P/E usually sits somewhere between cautious expectations and more optimistic ones.

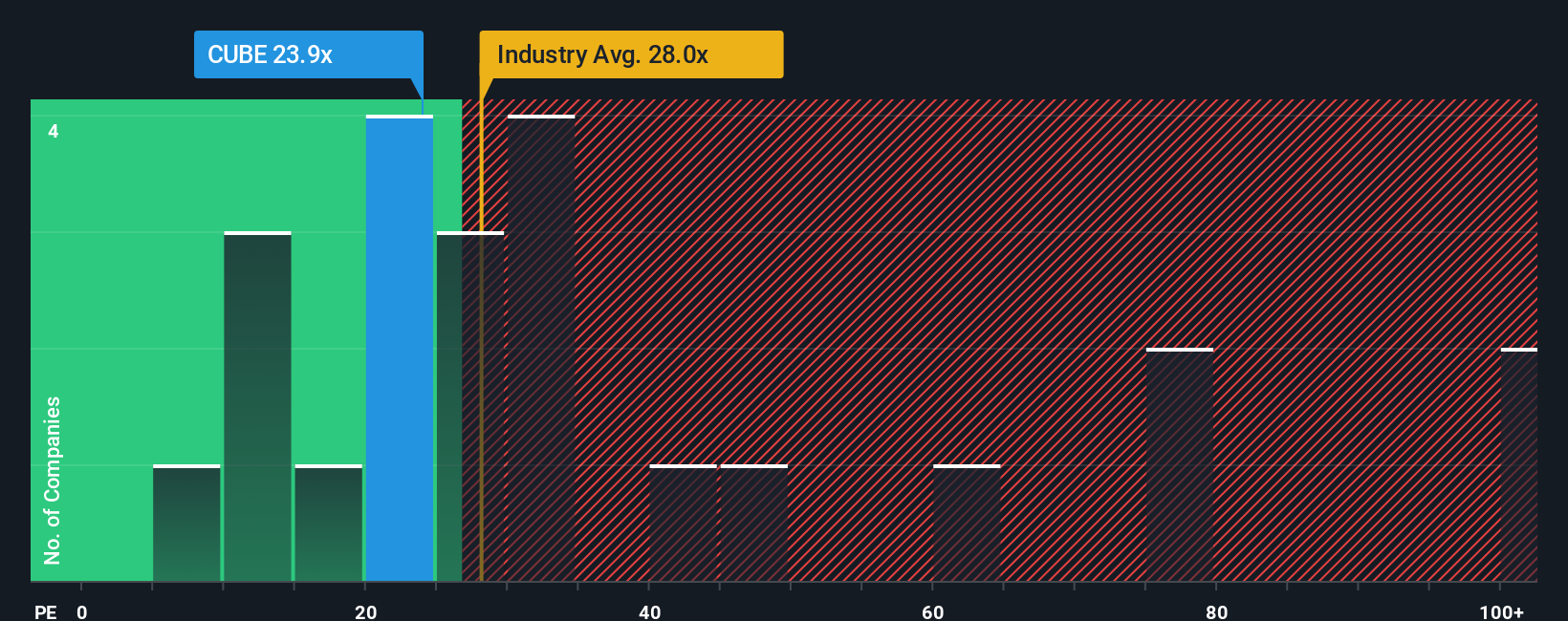

CubeSmart is currently trading on a P/E of 23.97x. That sits above the Specialized REITs industry average of 16.58x, but below the peer group average of 35.37x. On its own, that indicates the stock is priced more optimistically than the broader industry, yet less aggressively than some peers.

Simply Wall St’s Fair Ratio for CubeSmart is 30.21x. This is a proprietary estimate of what the P/E might look like once you factor in the company’s earnings growth profile, profit margins, industry, market cap and key risks, rather than just lining it up against a broad average. Because it is tailored to CubeSmart’s characteristics, it can be more informative than simple peer or industry comparisons. With the current P/E of 23.97x sitting below the Fair Ratio of 30.21x, this approach indicates that the shares may be undervalued on an earnings basis.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1419 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CubeSmart Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which let you tell a clear story about CubeSmart by linking your view on its business to specific forecasts for revenue, earnings and margins, then to a fair value that you can compare against today’s share price.

On Simply Wall St, Narratives live in the Community page and are built to be simple. You choose your assumptions, the platform turns them into a financial forecast, calculates a fair value, and then shows you whether that fair value sits above or below the current market price to help you decide if CubeSmart appears attractive, fairly priced or expensive on your terms.

Narratives update automatically when new data comes in, such as fresh earnings or major news. This way you are not stuck with a stale view and can quickly see how changes in CubeSmart’s outlook might affect your valuation and your decision to hold, add or trim.

For example, one CubeSmart Narrative might assume a relatively low fair value while another assumes a much higher one. This illustrates how two investors can look at the same company and, using the same tool, arrive at very different but clearly explained views.

Do you think there's more to the story for CubeSmart? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.