Please use a PC Browser to access Register-Tadawul

Is DexCom Set for Growth After Recent Share Price Drop in 2025?

DexCom, Inc. DXCM | 66.96 | -2.87% |

Are you wondering what to make of DexCom’s stock these days? You are definitely not alone. Investors have watched DexCom move through a string of changes, with its shares closing recently at $76.22. After a dip of 5.3% in the past week and 5.8% over the last month, it is natural to question whether this is an opportunity in disguise. Even with a negative return so far this year, DexCom stock is up nearly 10% compared to a year ago, a sign that there is still faith in the company’s growth prospects, despite some bumps along the way.

Much of the recent movement in DexCom’s share price reflects shifting views on the entire diabetes tech sector as new competitors enter the market and advances in medical devices grab investors’ attention. While the stock has seen significant ups and downs over the last few years, including a 15.4% drop over three years and 21.7% over five, its steady climb for the past twelve months suggests improving sentiment. This could indicate a reassessment of risks and opportunities among long-term holders.

If you are looking at valuation as your North Star, DexCom scores a 3 out of 6 on our undervaluation checks. This middle-of-the-road score suggests a balance of both promise and caution for value-focused investors. So, how do those valuation methods actually stack up for DexCom right now? Let’s dive into the details of the main approaches, and stay tuned because we will cover a more insightful way to understand DexCom’s real value by the end.

DexCom delivered 9.7% returns over the last year. See how this stacks up to the rest of the Medical Equipment industry.Approach 1: DexCom Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today's dollars. This method helps investors gauge what a business could be worth based on its expected ability to generate cash in the years ahead.

According to the DCF analysis for DexCom, the company generated $631 million in free cash flow over the last twelve months. Analyst estimates predict robust growth, with projected free cash flow reaching just under $2 billion by 2029. While analysts provide forecasts for the next five years, figures beyond this window are extrapolated to provide a more complete long-term view.

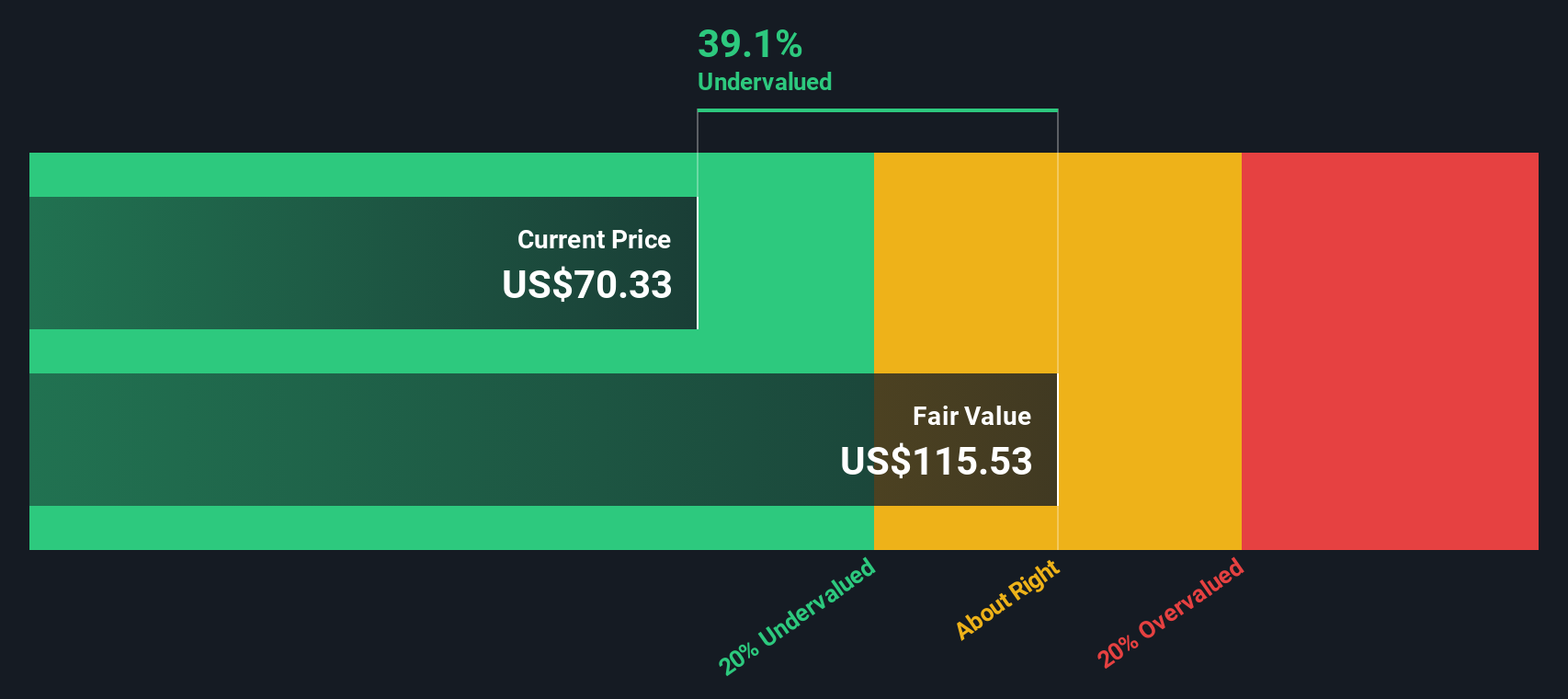

The final result of this model is an estimated intrinsic fair value of $119.26 per share for DexCom. This value is 36.1% above the current market price of $76.22, indicating significant potential upside. If these projections hold and the company's growth trajectory continues as expected, DexCom stock may be considered undervalued based on this analysis.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for DexCom.

Approach 2: DexCom Price vs Earnings

For profitable companies like DexCom, the Price-to-Earnings (PE) ratio is a go-to valuation tool because it directly connects a company's share price to its bottom-line profitability. This makes PE especially useful for established firms with positive earnings.

Growth expectations and risk each play a role in what qualifies as a “normal” or “fair” PE ratio. Investors will typically pay a higher PE for businesses expected to grow earnings faster. On the other hand, perceived risks or uncertainty warrant a lower PE multiple as a cushion for potential downside.

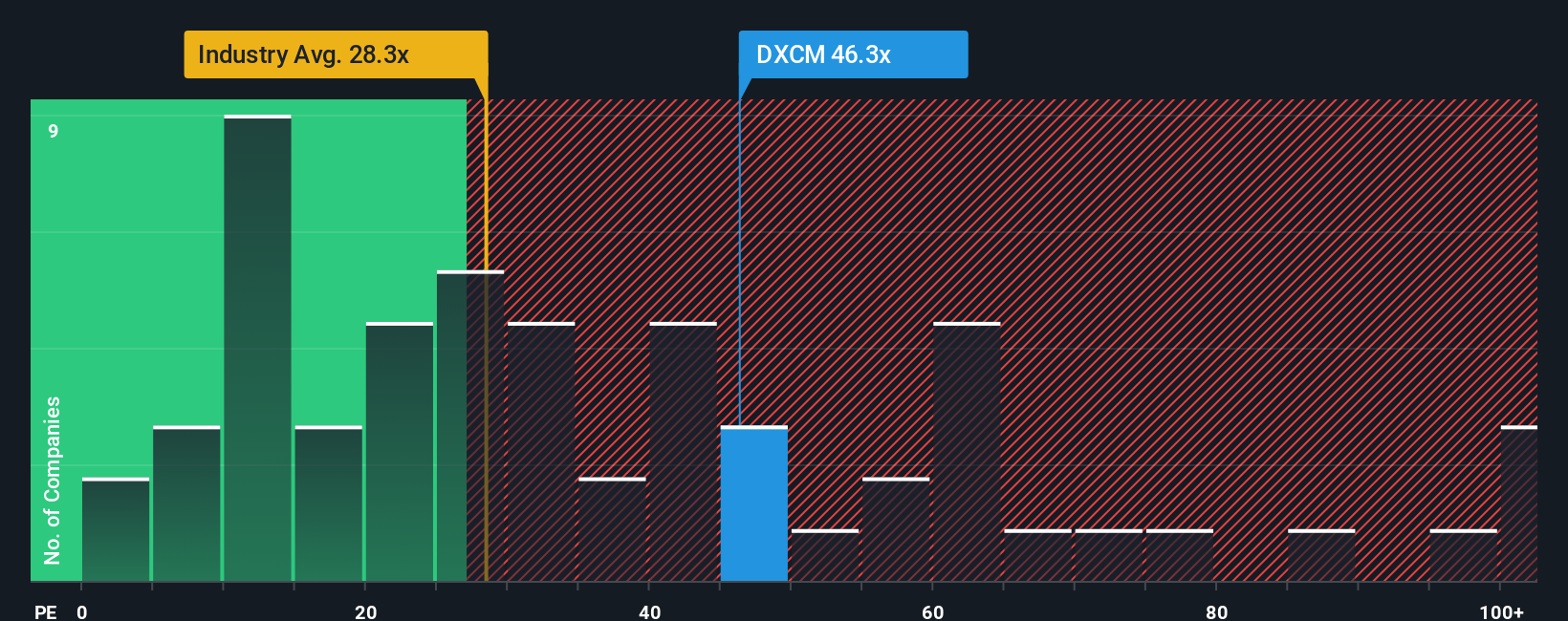

Currently, DexCom trades at a PE ratio of 52.3x. This is well above the Medical Equipment industry average of 29.1x and higher than its peer group average of 45.9x. At first glance, this might make DexCom appear expensive compared to its sector and peers.

However, the Simply Wall St Fair Ratio for DexCom is 38.9x. Unlike a basic benchmark, the Fair Ratio is tailored for each company and takes into account earnings growth rates, profit margins, market capitalization, industry dynamics, and risk factors. It is designed to offer a more accurate yardstick of what the company's PE should be, rather than just comparing to sector averages.

Comparing DexCom’s actual PE of 52.3x to its Fair Ratio of 38.9x suggests the stock is trading above what would be justified by its fundamentals and outlook.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your DexCom Narrative

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your investment story. It is how you connect your personal outlook, research, and assumptions about DexCom (including what you expect for revenue, profit margins, and fair value) to a clear picture of what the company’s future could look like.

Rather than relying solely on static ratios, Narratives help you translate a company’s business drivers and news into an evolving financial model. This makes your decision process far more flexible and insightful. Available right on Simply Wall St’s Community page, Narratives are easy to create or follow. They unlock discussion and analysis from millions of investors worldwide.

With Narratives, you can track how your “fair value” for DexCom stacks up against the current share price and see how your reasoning compares with others. Best of all, they automatically update as new earnings data or market developments come in, helping you react confidently to changes.

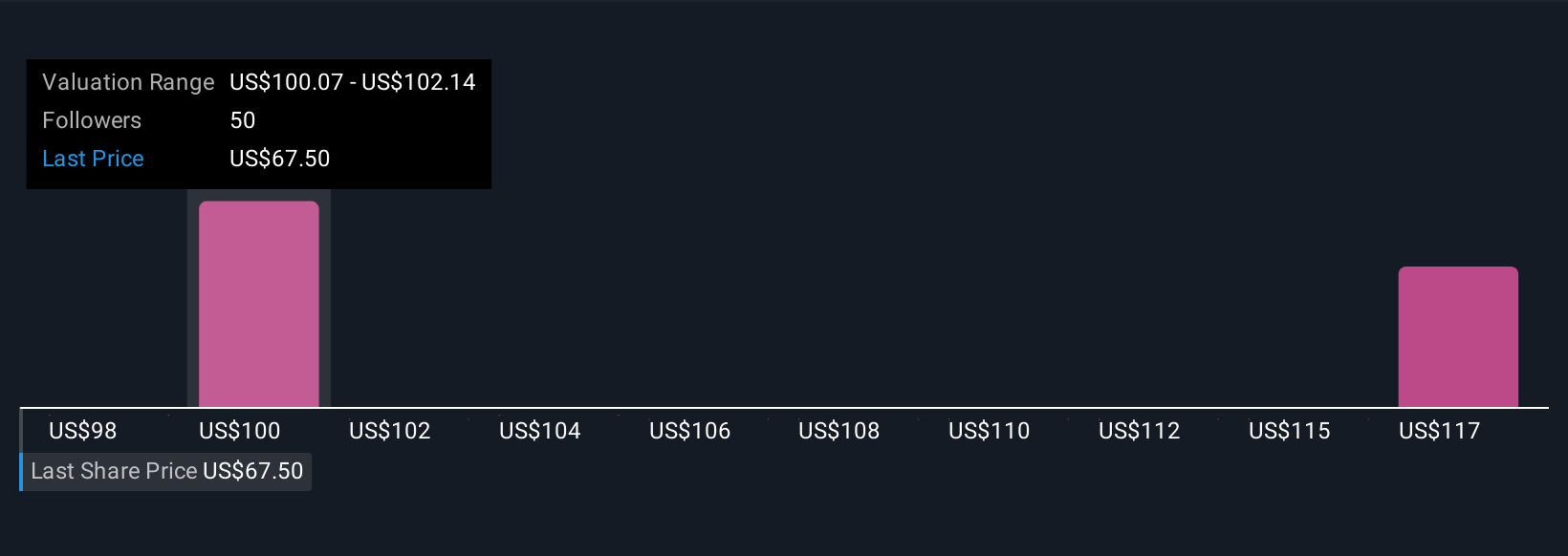

- For DexCom, some investors see global insurance coverage, digital integration, and margin gains unlocking a fair value as high as $115 per share.

- Others worry about competition or execution risks, leading to a more cautious view near $83 per share.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.