Please use a PC Browser to access Register-Tadawul

Is International Flavors & Fragrances (IFF) Pricing Reset Justified After Recent Share Price Rebound?

International Flavors & Fragrances Inc. IFF | 81.39 | -0.28% |

- If you are wondering whether International Flavors & Fragrances is offering fair value right now, you are not alone. A closer look at its valuation can help frame your next move.

- The stock last closed at US$76.76, with recent returns of 9.1% over 7 days, 11.1% over 30 days, 12.8% year to date, but a 7.8% decline over 1 year, a 13.2% decline over 3 years and a 35.9% decline over 5 years.

- These mixed returns leave many investors looking to recent company updates and sector news to understand what might be shaping sentiment around International Flavors & Fragrances. That context matters if you are trying to work out whether the recent strength is a reset in expectations or just a short term swing.

- On Simply Wall St's valuation checks, International Flavors & Fragrances scores 3 out of 6 for being undervalued. Next we will look at how different valuation approaches point to that score, before finishing with a simple framework that can help you read valuations more clearly.

Approach 1: International Flavors & Fragrances Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of the cash a company could generate in the future and discounts those cash flows back to today using a required rate of return, to arrive at an estimate of what the business might be worth now.

For International Flavors & Fragrances, the model used is a 2 Stage Free Cash Flow to Equity approach based on cash flow projections. The latest twelve month Free Cash Flow is about $421.4 million. Simply Wall St then uses analyst estimates for the next few years and extends them, with projected Free Cash Flow of around $1.4 billion in 2035, shown as discounted values year by year in the model.

Pulling those projections together, the DCF output suggests an estimated intrinsic value of about $88.39 per share. Against the recent share price of $76.76, that implies the stock is 13.2% undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests International Flavors & Fragrances is undervalued by 13.2%. Track this in your watchlist or portfolio, or discover 51 more high quality undervalued stocks.

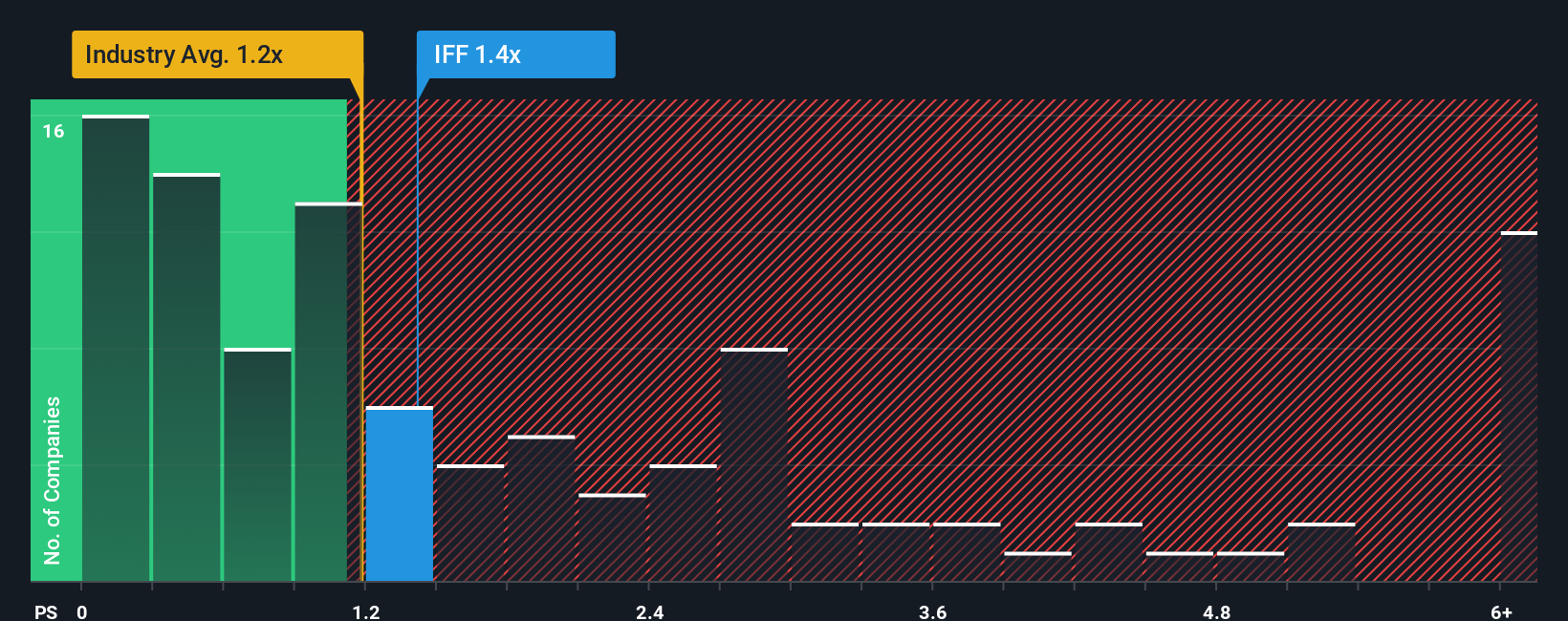

Approach 2: International Flavors & Fragrances Price vs Sales

For a business where profitability is not the main driver right now, the P/S ratio can be a useful way to think about value because it compares what the market is paying to the company’s revenue base rather than its net income.

In simple terms, higher growth expectations or lower perceived risk often justify a higher P/S ratio, while lower growth or higher risk usually point to a lower, more conservative multiple as being normal or fair.

International Flavors & Fragrances currently trades on a P/S of 1.78x. That sits above the broader Chemicals industry average of about 1.17x, but below the peer group average of 2.37x. Simply Wall St also calculates a Fair Ratio of 2.07x for the company, which is the P/S level that might be reasonable given factors such as its earnings profile, industry, profit margins, market cap and risk characteristics.

Because the Fair Ratio rolls all of those company specific drivers together, it can be more informative than a simple comparison with the industry or peers, which do not always share the same growth outlook, size or risk profile.

Comparing the Fair Ratio of 2.07x with the current P/S of 1.78x suggests International Flavors & Fragrances may be trading below that fair level.

Result: UNDERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your International Flavors & Fragrances Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company linked directly to your own assumptions on future revenue, earnings, margins and fair value.

On Simply Wall St’s Community page, Narratives let you set out why you think International Flavors & Fragrances should be worth a certain amount, tie that story to a forecast and fair value, and then compare that fair value with the current share price to help you decide whether the stock looks closer to a buy, hold or sell in your view.

Because Narratives update as new information like news or earnings arrives, you can quickly see how a fresh data point might change your fair value rather than starting from scratch each time.

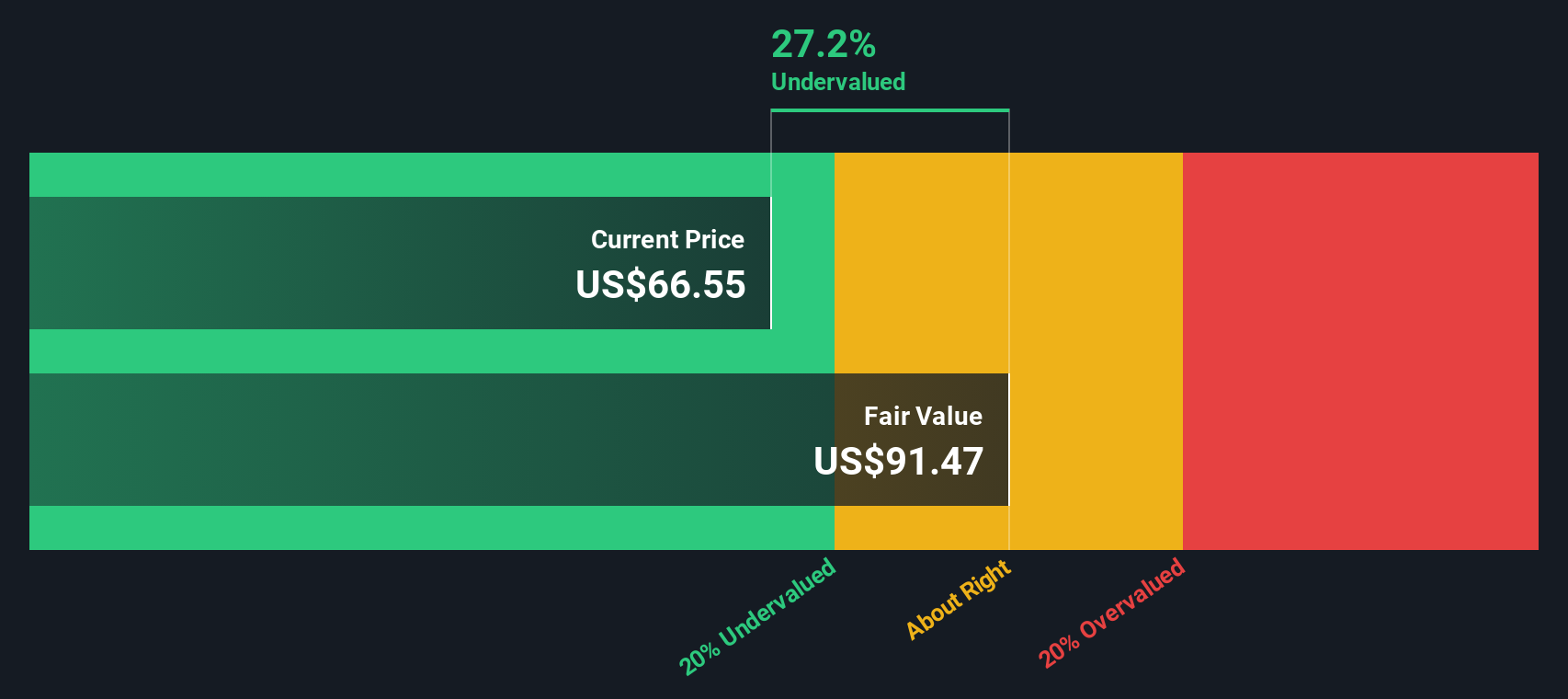

For example, one International Flavors & Fragrances investor might build a more optimistic Narrative that lines up with a higher fair value around US$99.72 or even US$100, while another might build a more cautious Narrative closer to US$66, and seeing those different stories and numbers side by side can help you decide which assumptions feel closer to your own.

For International Flavors & Fragrances however we will make it really easy for you with previews of two leading International Flavors & Fragrances Narratives:

On Simply Wall St these appear side by side, so you can quickly see which storyline feels closer to how you see the company and what that means for your own fair value range and margin of safety.

Fair value in this Narrative: US$82.37 per share

Implied pricing gap: about 6.8% undervalued versus the recent US$76.76 share price

Modeled revenue growth: 61.98%

- Focus shifts toward higher margin, differentiated products and R&D backed offerings, supported by divestitures of more commodity like units.

- Analysts in this camp see profit margins improving and earnings recovering over time, with a P/E multiple of 32.14x used to support their fair value.

- The story leans on demand for health focused products, expansion in emerging markets, and a balance sheet that allows ongoing reinvestment.

Fair value in this Narrative: US$66.00 per share

Implied pricing gap: about 16.3% overvalued versus the recent US$76.76 share price

Modeled revenue growth: 1.16% decline

- This view assumes pressure from regulation, supply chains, competition and integration challenges, with slower revenue trends and more conservative expectations.

- Analysts here still model margin improvement, but pair it with a lower future P/E multiple of 28.58x and a slightly higher discount rate.

- The conclusion is that at US$76.76 the shares sit above what these assumptions support, so the price is closer to or above what they see as fair.

Seeing these Narratives side by side can help you decide which assumptions feel closest to your own, and whether you lean more toward the higher fair value story around US$82 or the more cautious one near US$66 for International Flavors & Fragrances.

Do you think there's more to the story for International Flavors & Fragrances? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.