Please use a PC Browser to access Register-Tadawul

Is It Time To Reassess Valley National Bancorp (VLY) After Its Strong 1 Year Rally?

Valley National Bancorp VLY | 13.36 | +1.52% |

- If you are wondering whether Valley National Bancorp is genuinely good value at its current share price, or if the market is getting ahead of itself, this article is designed to help you weigh that up clearly.

- With the stock last closing at US$13.71 and returns of 10.0% over 7 days, 13.6% over 30 days, 17.3% year to date and 39.1% over 1 year, many investors are reassessing what they are willing to pay for the shares.

- Recent market attention on regional banks, regulatory scrutiny across the sector and ongoing discussion about interest rate trends have all kept Valley National Bancorp on investors' radars. These themes help frame how investors are thinking about the bank's risk profile, funding costs and long term profitability.

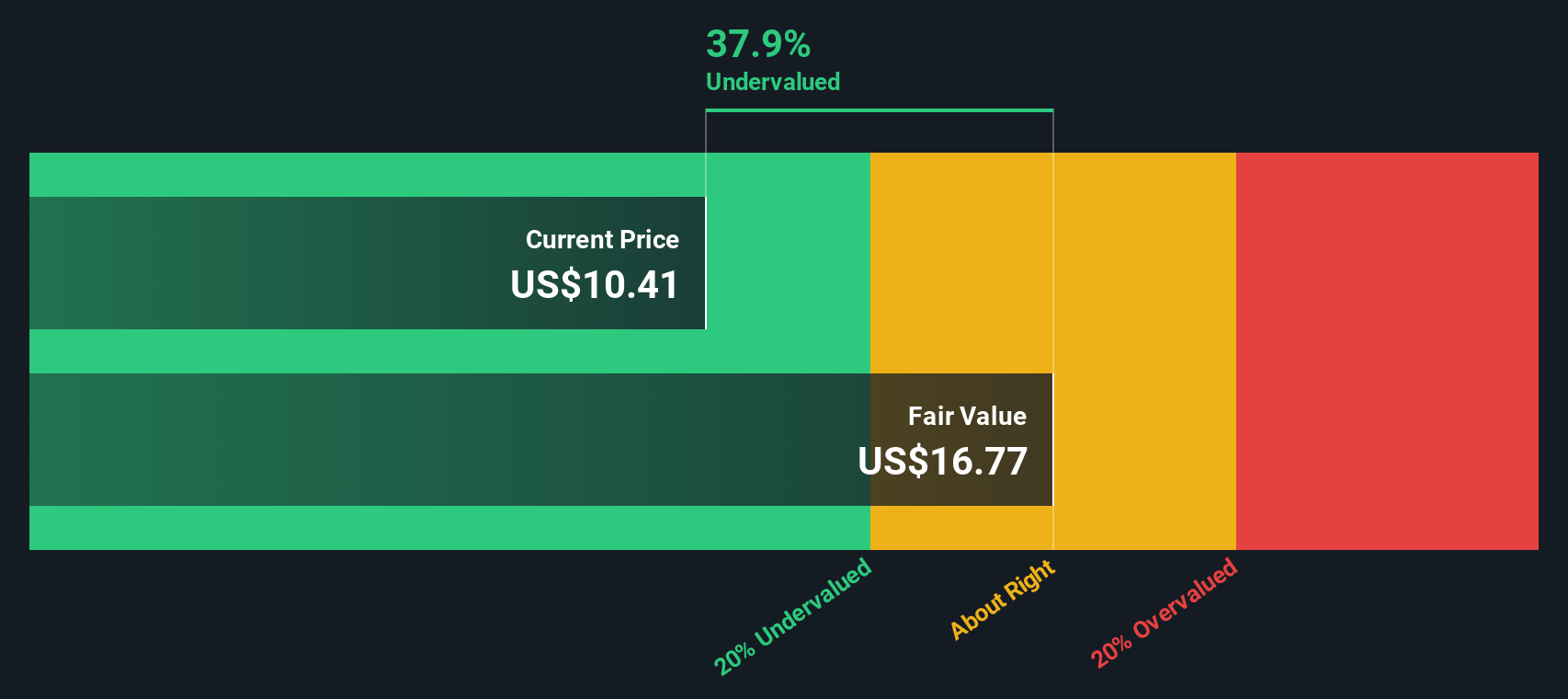

- On our checklist based valuation, Valley National Bancorp scores 4 out of 6 for being undervalued. This sets up a closer look at standard methods like P/E, P/B and cash flow based models, followed by a more complete way to think about valuation at the end of the article.

Approach 1: Valley National Bancorp Excess Returns Analysis

The Excess Returns model looks at how much profit a bank can generate above the return that equity investors are asking for, then capitalises that stream of “excess” profit into an intrinsic value per share.

For Valley National Bancorp, the model starts with a Book Value of $13.39 per share and an Average Return on Equity of 9.87%. Analysts estimate a Stable EPS of $1.47 per share, based on weighted future Return on Equity forecasts from 6 analysts. Against this, the Cost of Equity is put at $1.06 per share, which leaves an Excess Return of $0.42 per share.

Using a Stable Book Value of $14.93 per share, based on estimates from 8 analysts, and applying these excess returns, the model arrives at an intrinsic value of about $26.33 per share. Compared with the recent share price of $13.71, this implies the stock is 47.9% undervalued on this framework.

Result: UNDERVALUED

Our Excess Returns analysis suggests Valley National Bancorp is undervalued by 47.9%. Track this in your watchlist or portfolio, or discover 53 more high quality undervalued stocks.

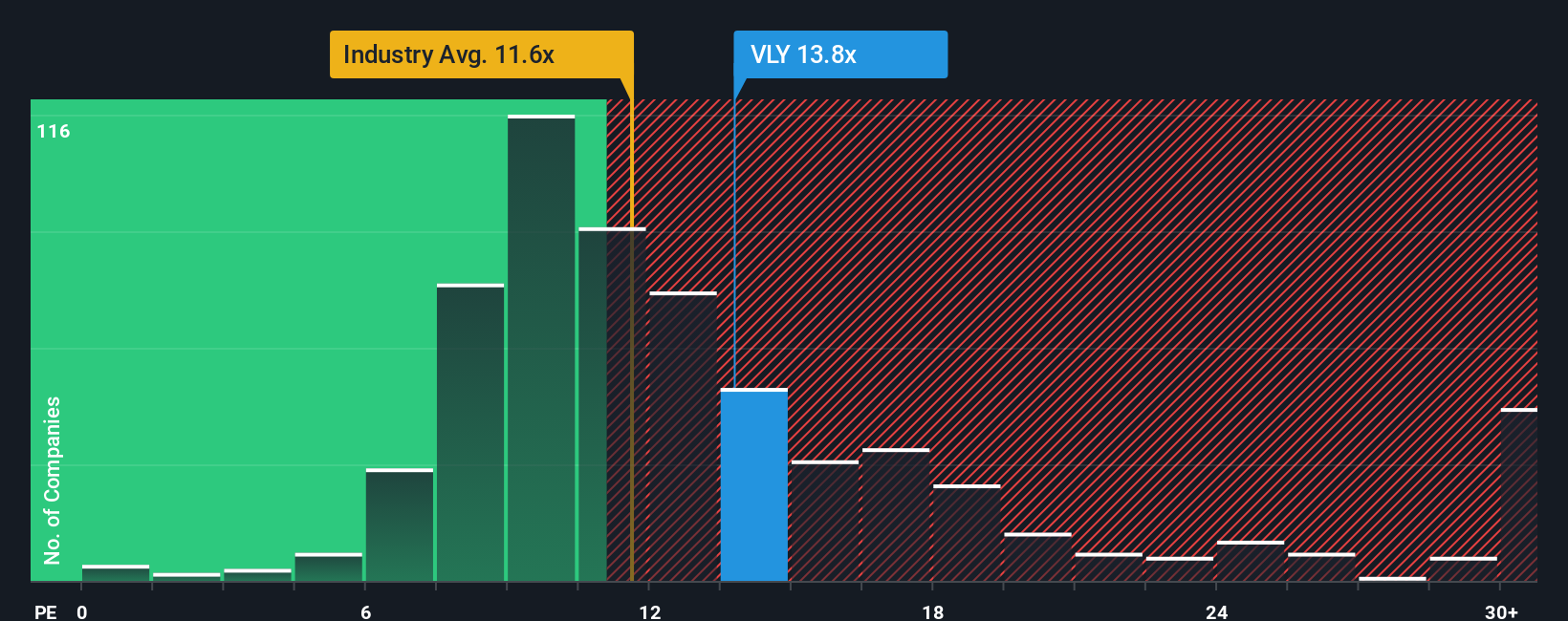

Approach 2: Valley National Bancorp Price vs Earnings

For a profitable bank, the P/E ratio is a straightforward way to connect what you pay per share with what the company earns per share. It gives you a quick sense of how many years of current earnings the market is currently pricing in.

What counts as a “normal” P/E depends on what investors expect for future growth and how risky they think those earnings are. Higher expected growth or lower perceived risk can justify a higher P/E, while lower growth or higher risk usually point to a lower one.

Valley National Bancorp currently trades on a P/E of 13.41x. That is above the Banks industry average of 12.04x, but below the peer group average of 16.59x. Simply Wall St’s Fair Ratio concept goes a step further. It estimates what P/E might make sense for this specific company, given factors like its earnings growth profile, profit margins, risks, industry and market cap. For Valley National Bancorp, that Fair Ratio is 14.84x, which indicates that once those company specific factors are considered, the current 13.41x P/E points to the shares trading at a discount to that fair level.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 22 top founder-led companies.

Upgrade Your Decision Making: Choose your Valley National Bancorp Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Valley National Bancorp’s story with the numbers behind it.

A Narrative is your own explanation of what you think is happening at the bank and why, paired with your assumptions for future revenue, earnings and margins, which then flow through to a fair value estimate.

On Simply Wall St’s Community page, millions of investors use Narratives to link a company’s story to a financial forecast and then to a fair value. You can then compare that fair value with the current share price and decide whether the gap is large enough to consider buying, holding or selling.

Because Narratives update when fresh information arrives, such as earnings releases or key news, your fair value view can adjust in real time. For Valley National Bancorp this means one investor might build a Narrative that assumes more conservative profitability and gets a lower fair value, while another assumes stronger usage of its balance sheet and gets a higher fair value. This gives you a clear sense of where your own view sits on that spectrum.

Do you think there's more to the story for Valley National Bancorp? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.