Please use a PC Browser to access Register-Tadawul

Is It Time To Reconsider Veeva Systems (VEEV) After AI Agents Rollout?

Veeva Systems Inc Class A VEEV | 180.31 | -1.24% |

- If you are wondering whether Veeva Systems at around US$228.49 still offers good value, you are not alone; many investors are asking the same question.

- The stock shows mixed recent returns, with a 3.9% decline over the last 7 days, a 2.3% gain over 30 days, a 4.1% gain year to date, an 8.4% gain over 1 year, a 39.6% gain over 3 years, and a 17.8% decline over 5 years.

- Recent coverage has focused on Veeva Systems as a healthcare software company and how its share price history compares with broader benchmarks, giving investors more context for these moves. Commentary has also highlighted how current sentiment around the stock fits into longer term return patterns.

- On Simply Wall St's valuation checks, Veeva Systems scores 3/6 for value, as shown by the valuation score. Next, we will look at what different valuation approaches say about the stock and why there may be an even more useful way to think about value by the end of this article.

Approach 1: Veeva Systems Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth today by projecting its future cash flows and then discounting those back to the present.

For Veeva Systems, the model used here is a 2 Stage Free Cash Flow to Equity approach, based on cash flow projections in $. The latest twelve month free cash flow is about $1.35b. Analysts provide explicit free cash flow estimates for the next few years, and Simply Wall St then extends those out to 10 years using its own assumptions, with projected free cash flow reaching about $3.28b by 2035 in nominal terms.

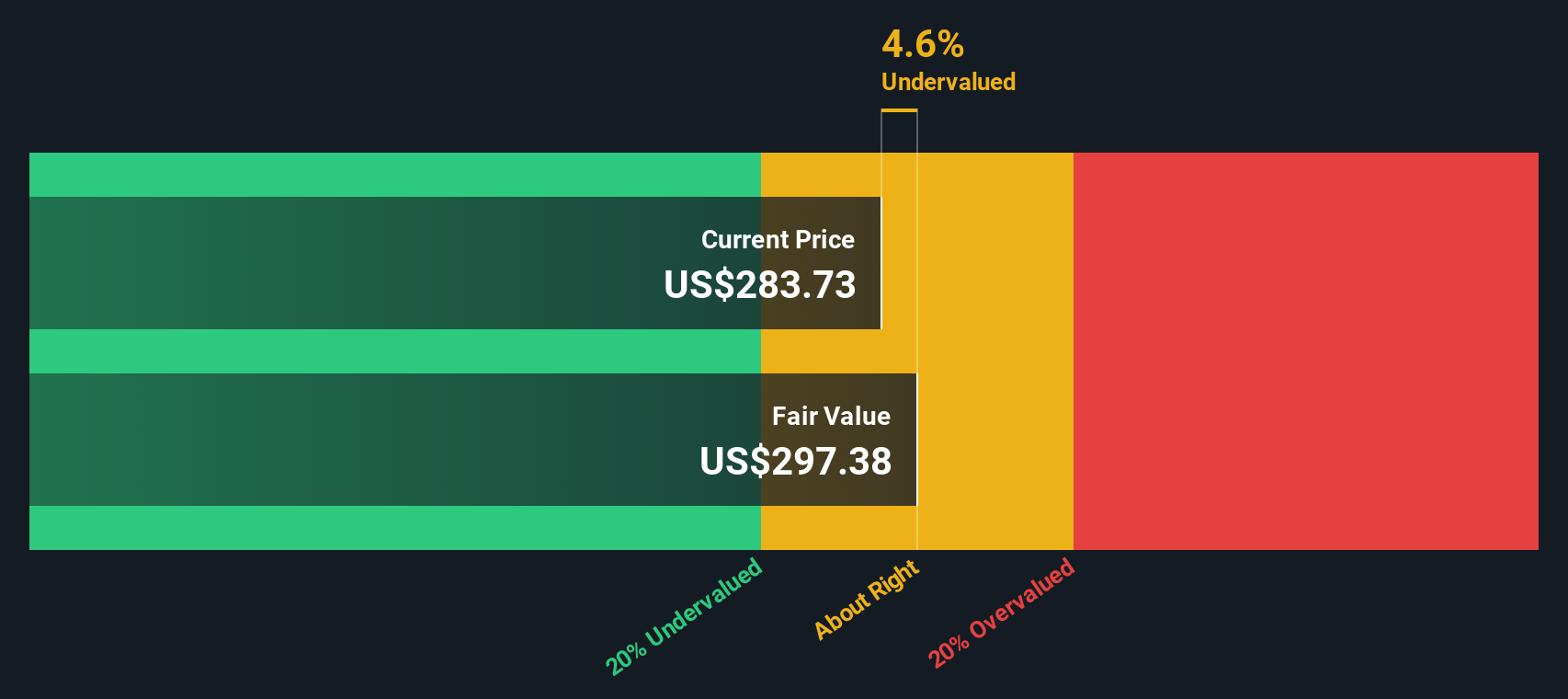

When those projected cash flows are discounted back, the model suggests an estimated intrinsic value of about $276.94 per share, compared with a current share price around $228.49. That implies roughly a 17.5% discount, which points to the shares trading below this DCF estimate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Veeva Systems is undervalued by 17.5%. Track this in your watchlist or portfolio, or discover 884 more undervalued stocks based on cash flows.

Approach 2: Veeva Systems Price vs Earnings

For a profitable company like Veeva Systems, the P/E ratio is a useful way to think about what you are paying for each dollar of current earnings. It links directly to the bottom line and is one of the most familiar yardsticks investors use.

What counts as a “normal” P/E depends on how fast earnings are expected to grow and how risky those earnings appear. Higher growth or lower perceived risk can support a higher multiple, while slower growth or higher uncertainty usually points to a lower one.

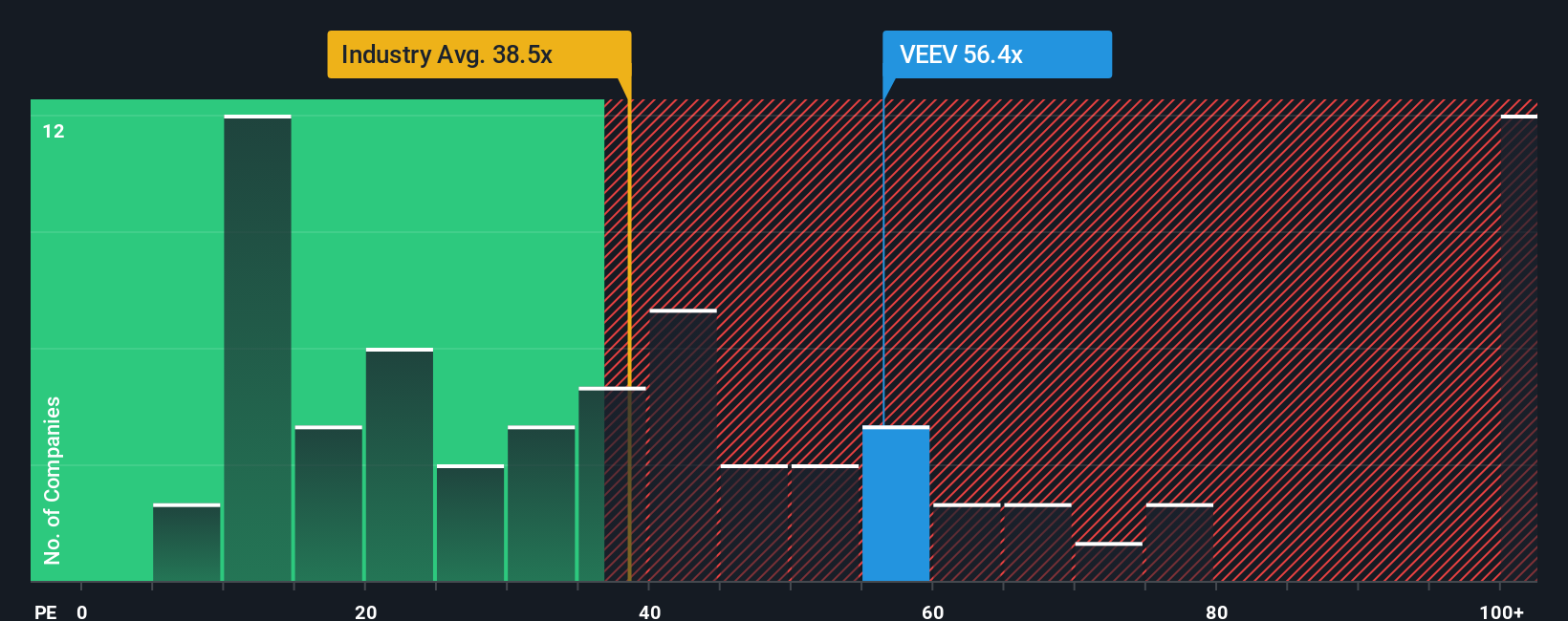

Veeva Systems is currently trading on a P/E of 43.66x, compared with the Healthcare Services industry average of about 31.59x and a peer average of 61.99x. Simply Wall St also provides a proprietary “Fair Ratio” of 32.34x, which estimates the P/E you might expect given factors such as earnings growth, profit margins, industry, market cap and company specific risks.

This Fair Ratio can be more informative than a simple comparison with peers or the industry because it adjusts for those company specific drivers rather than assuming all firms deserve similar multiples. Since Veeva Systems’ current P/E of 43.66x is above the Fair Ratio of 32.34x, the shares screen as trading richer than this metric suggests.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Veeva Systems Narrative

Earlier we mentioned that there is an even better way to think about valuation, and on Simply Wall St that shows up as Narratives, where you set out your own story for Veeva Systems, link that story to concrete forecasts for revenue, earnings and margins, and see what fair value falls out of your assumptions. Narratives on the Community page are designed to be simple to use, connecting your view of the business to a financial model and a fair value, then comparing that fair value with the current share price to help you decide whether you see Veeva as closer to a buy, a hold or a sell. They also update automatically when new information, such as earnings, guidance or news like Roche’s Vault CRM expansion and Veeva’s AI Agents rollout, is added to the platform. For example, one Veeva Systems Narrative currently anchors around a fair value of about US$362.00 using more optimistic assumptions, while another sits closer to US$222.00 with more cautious views. This shows how the same company can look very different once you plug your own expectations into the numbers.

Do you think there's more to the story for Veeva Systems? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.