Please use a PC Browser to access Register-Tadawul

Is It Time to Revisit Disney Stock After Streaming and Valuation Shifts in 2025?

Walt Disney Company DIS | 111.60 | +0.13% |

Thinking about what to do with your Walt Disney stock? You are not alone. With shares closing recently at $113.03, the conversation around Disney has been swirling, especially as the stock has returned 2.9% in the last week and nearly 20% over the past year. After a tough five-year stretch, where shares are still down 5.5%, the tides seem to be shifting just enough to stir up interest again.

Fresh news out of Disney has helped revive confidence, including moves in the streaming business and ongoing chatter about long-term strategic plans. These stories have contributed to the feeling that risk perception is changing, even if long-term gains are still in early innings. Investors have noticed that while the recent 30-day return is a modest 0.7%, the market is now viewing Disney as both a legacy entertainment giant and a more nimble media tech player.

If you are trying to figure out whether the company is undervalued, you will want to look at the numbers. Based on our scorecard, Disney is undervalued according to three of six valuation checks, a score of 3. On paper, that puts it right in the middle of the pack, signaling there could be value depending on which lens you use and how much weight you give to the changes happening under the hood.

So, how does Disney stack up under various valuation approaches, and is there a smarter way to truly gauge its worth? Let us dig into each method next, and stay tuned for a look at a powerful tool that might change the way you think about valuation altogether.

Approach 1: Walt Disney Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating the future cash flows a business will generate and then calculating what those future streams are worth in today’s dollars. For Walt Disney, this method uses projections about the company's ability to create Free Cash Flow (FCF) over the coming years and discounts those numbers to present value.

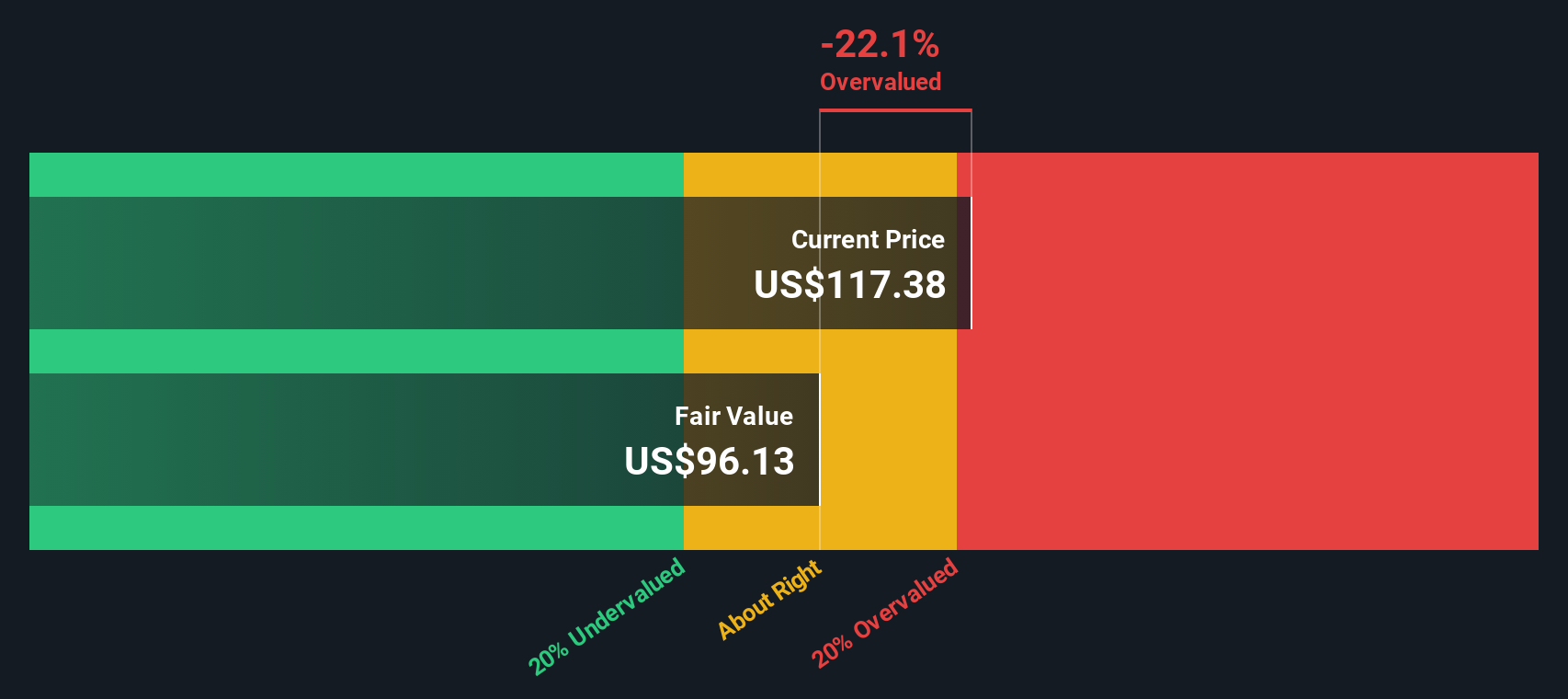

Currently, Disney reports Free Cash Flow of around $13.0 billion. Analyst estimates provide guidance for the next five years; for Disney, projections see annual FCF growing to approximately $13.5 billion by 2030. Intermediate figures include $9.5 billion in 2026 and $11.6 billion in 2028. Beyond these analyst estimates, further years are extrapolated using growth assumptions by financial analysts at Simply Wall St.

After running this forecast through the DCF process, the estimated intrinsic value for Disney stock comes to about $106.31 per share. Given the recent share price near $113.03, this suggests Disney’s stock is trading at around a 6.3% premium to its calculated intrinsic worth. In other words, Disney is just slightly overvalued by this method.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Walt Disney's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Walt Disney Price vs Earnings

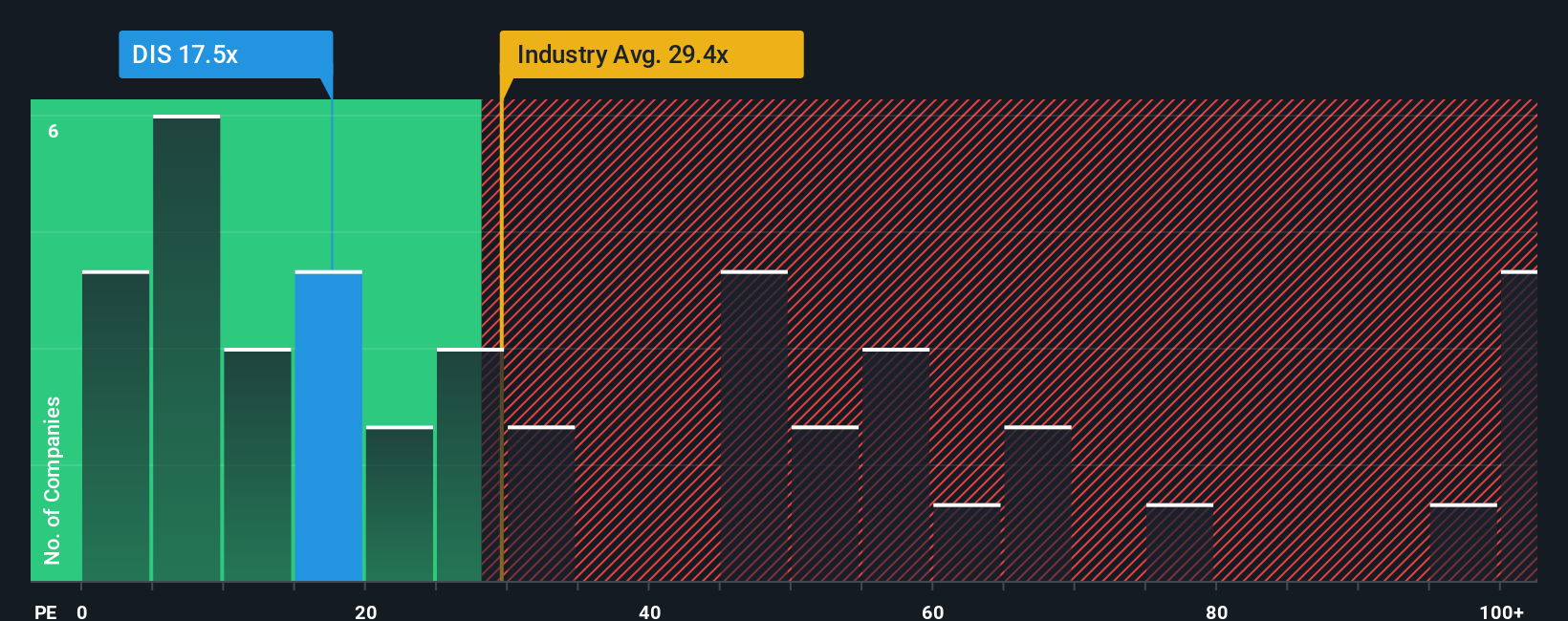

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies like Walt Disney because it connects a company's stock price to its bottom-line earnings, reflecting what investors are willing to pay today for a dollar of current profits. For businesses generating steady profits, the PE ratio offers a clear picture of investor sentiment and future growth expectations.

It is important to remember that the “right” PE ratio for a company does not exist in a vacuum. Growth prospects, profitability, and perceived risks all play a crucial role in determining what multiple seems reasonable. Generally, investors will accept a higher PE if they expect robust earnings growth or a company has lower risk. Conversely, they will shy away from lofty multiples if growth is deemed stale or risks loom large.

Disney is trading at a PE of 17.6x, which is notably below the Entertainment industry average of 26.4x and its peer average of 83.6x. That might catch your eye as a sign of undervaluation, but those raw numbers only tell part of the story. Simply Wall St’s proprietary “Fair Ratio” model goes a step further by weighing key company-specific factors including Disney’s earnings growth outlook, market cap, profit margins, and unique risk profile. According to the Fair Ratio, Walt Disney’s fair value multiple is 25.7x. This approach is more nuanced than a simple average. It provides a tailored benchmark that allows for smarter comparisons by considering the full financial picture rather than just using peer or industry benchmarks in isolation.

Given Disney’s current PE of 17.6x versus the Fair Ratio of 25.7x, the stock appears undervalued when you account for everything from its growth profile to its scale and profitability. The difference is meaningful, suggesting the market may be more cautious than underlying fundamentals warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Walt Disney Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is the story or perspective you bring to a company like Walt Disney, connecting your outlook on its future, such as expected revenue, profit margins, and industry trends, to an actual financial forecast and fair value estimate. Narratives make investing more dynamic and accessible by letting you anchor your investment view in real numbers. They help explain not just what you think will happen, but why you believe it, and what that means for the stock’s value.

Used by millions on Simply Wall St’s Community page, Narratives empower investors to weigh real-time news and earnings updates as they happen, so you are always working with the most current information. They offer a framework for comparing your personal fair value to Disney’s current price, making it easier to decide whether to buy, hold, or sell as your view or the facts change.

For example, one Walt Disney Narrative sees ESPN’s NFL expansion and streaming growth driving fair value up to $131.50, reflecting optimism about sports and digital. Another expects price pressure and intense competition to keep fair value closer to $79. In seconds, you can compare these perspectives, track updates, and construct your own, so your investment decisions are smarter and better grounded than ever before.

Do you think there's more to the story for Walt Disney? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.