Please use a PC Browser to access Register-Tadawul

Is It Time To Revisit Simply Good Foods (SMPL) After Its Steep Share Price Slide?

Simply Good Foods Co SMPL | 16.91 | +0.83% |

- If you are wondering whether Simply Good Foods is a bargain or a value trap at its recent price, this article walks through what the current market value really reflects.

- The stock has been under pressure, with a 7 day return of a 3.9% decline, a 30 day return of a 23.3% decline, and a 1 year return of a 56.9% decline from a last close of US$16.41.

- Recent coverage has focused on Simply Good Foods as a packaged food business in the weight management and nutrition space, where brands compete for shelf space and consumer loyalty. That backdrop has framed recent price moves as investors reassess how much they are willing to pay for companies in this corner of the food and beverage sector.

- Despite that weak share price performance, Simply Good Foods currently has a valuation score of 5 out of 6, which suggests the market price lines up with several traditional metrics. We will walk through those approaches next before finishing with a more rounded way to think about what the stock might be worth.

Approach 1: Simply Good Foods Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes estimates of a company’s future cash flows and discounts them back to today’s dollars, giving you a single figure for what the business might be worth on this basis.

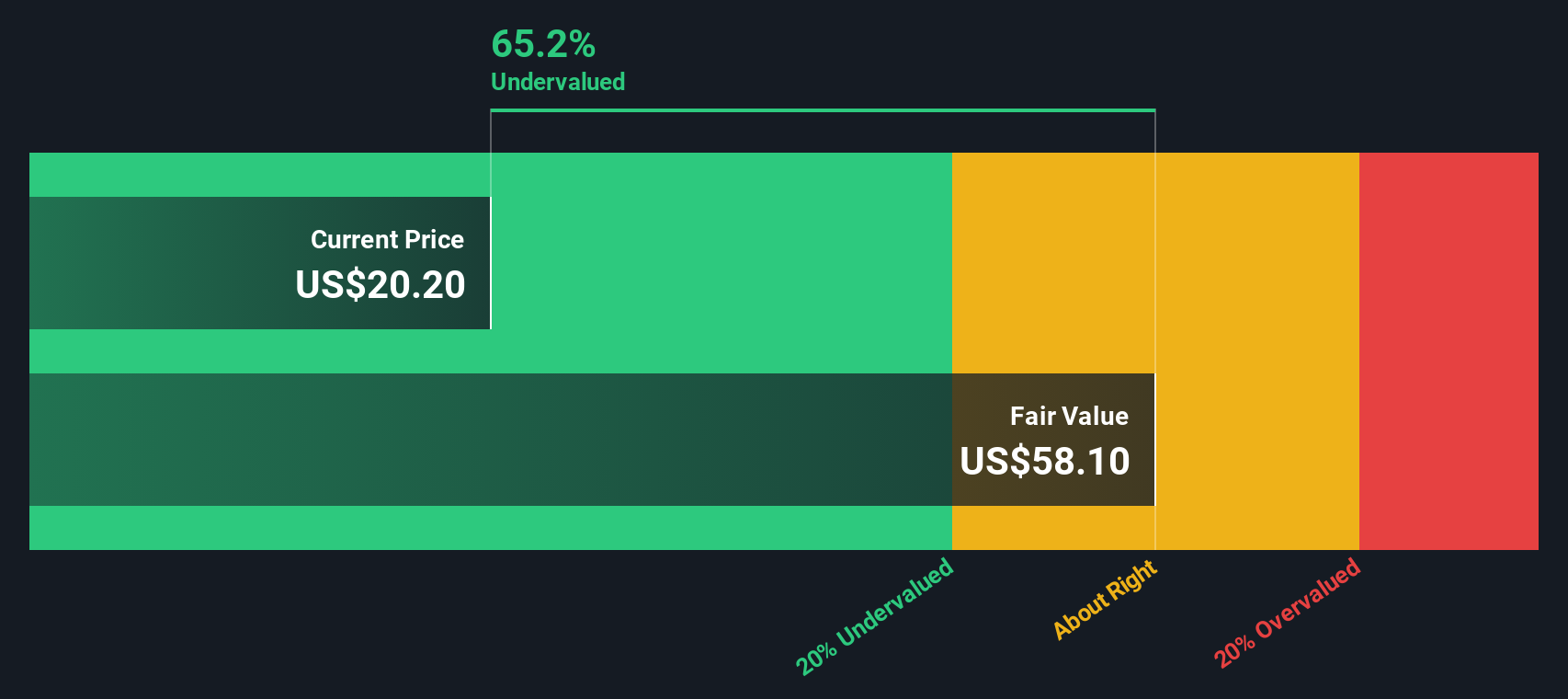

For Simply Good Foods, the model uses a 2 Stage Free Cash Flow to Equity approach, starting from last twelve months free cash flow of about $181.5 million. Analyst estimates and subsequent extrapolations suggest free cash flow projections that reach $238 million in 2030, with further annual figures out to 2035 also incorporated, all in $ and all below $1b.

When those projected cash flows are discounted back to today, the model arrives at an estimated intrinsic value of about $63.67 per share. Compared with the recent share price of $16.41, this suggests the stock is about 74.2% below that DCF estimate, which indicates material undervaluation on this specific model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Simply Good Foods is undervalued by 74.2%. Track this in your watchlist or portfolio, or discover 51 more high quality undervalued stocks.

Approach 2: Simply Good Foods Price vs Earnings

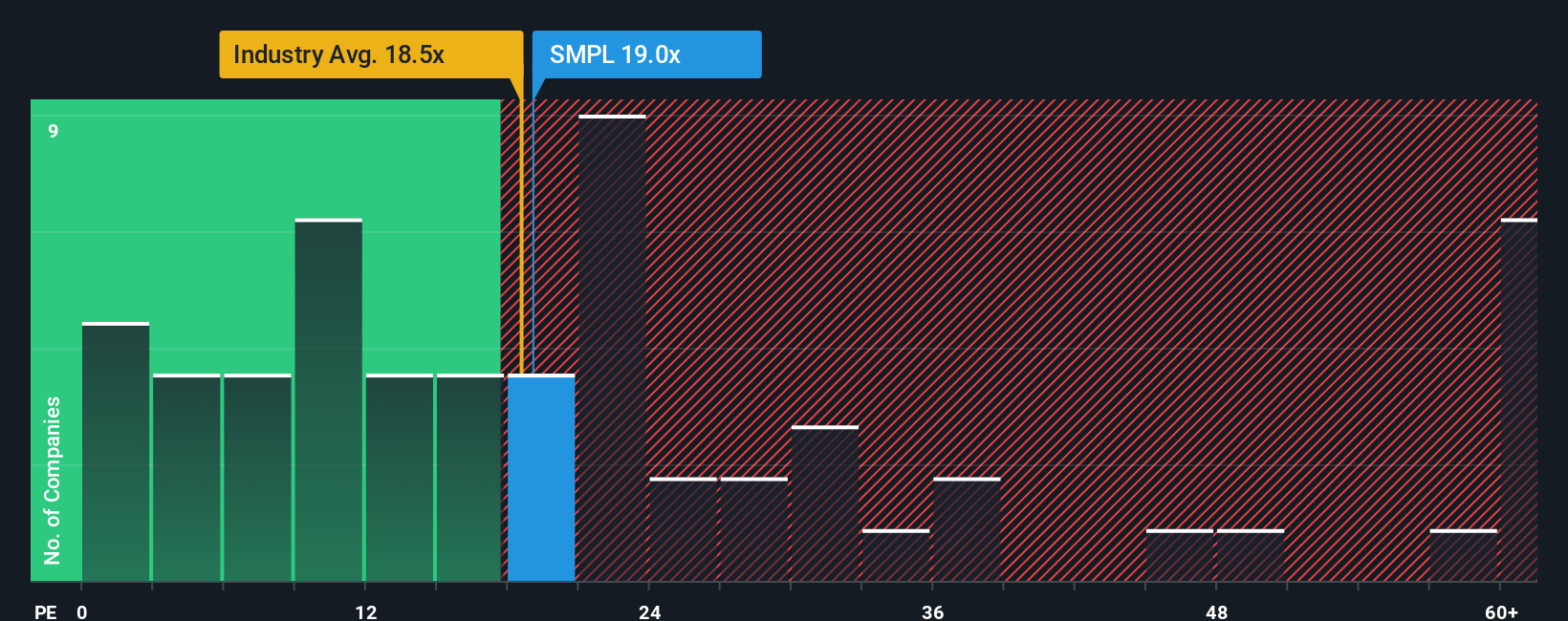

For a profitable company like Simply Good Foods, the P/E ratio is a useful shorthand for how much investors are paying for each dollar of current earnings. It reflects not only what the business is earning today, but also what the market is willing to pay given its perceived growth potential and risk profile.

Higher growth expectations or lower perceived risk usually support a higher, or more generous, P/E, while slower expected growth or higher risk tends to justify a lower multiple. Simply Good Foods currently trades on a P/E of 16.7x. That sits below the Food industry average of about 23.5x and the peer group average of 75.5x, which suggests the market is assigning a more moderate earnings multiple compared with those benchmarks.

Simply Wall St also calculates a Fair Ratio for the stock of 23.9x. This is a proprietary estimate of what a reasonable P/E could be once factors like earnings growth, profit margins, industry, market cap and company specific risks are taken into account. Because it adjusts for these business characteristics, the Fair Ratio can be a more tailored reference point than a simple comparison with the industry or peers.

On that basis, the current P/E of 16.7x sits below the Fair Ratio of 23.9x. This indicates that the shares are trading at a discount on this earnings based view.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Simply Good Foods Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is where you tell the story behind your numbers by linking your view of Simply Good Foods, your own revenue, earnings and margin assumptions, and the fair value they imply. It is all within an easy tool on Simply Wall St’s Community page that updates as new news or earnings arrive and lets you compare your Fair Value to today’s price to judge whether the shares look attractive or stretched. One investor might build a more optimistic Simply Good Foods Narrative that lines up with a Fair Value around US$43.00, while another might prefer a more cautious Narrative closer to US$22.00, each grounded in different expectations for how the Quest, Atkins and OWYN brands perform over time.

Do you think there's more to the story for Simply Good Foods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.