Please use a PC Browser to access Register-Tadawul

Is It Too Late To Consider Arista Networks (ANET) After AI Data Center Hype-Driven Rally?

Arista Networks, Inc. ANET | 132.79 | -3.24% |

- If you are wondering whether Arista Networks' share price still reflects good value after a strong run, you are not alone. This article will help you frame that question clearly.

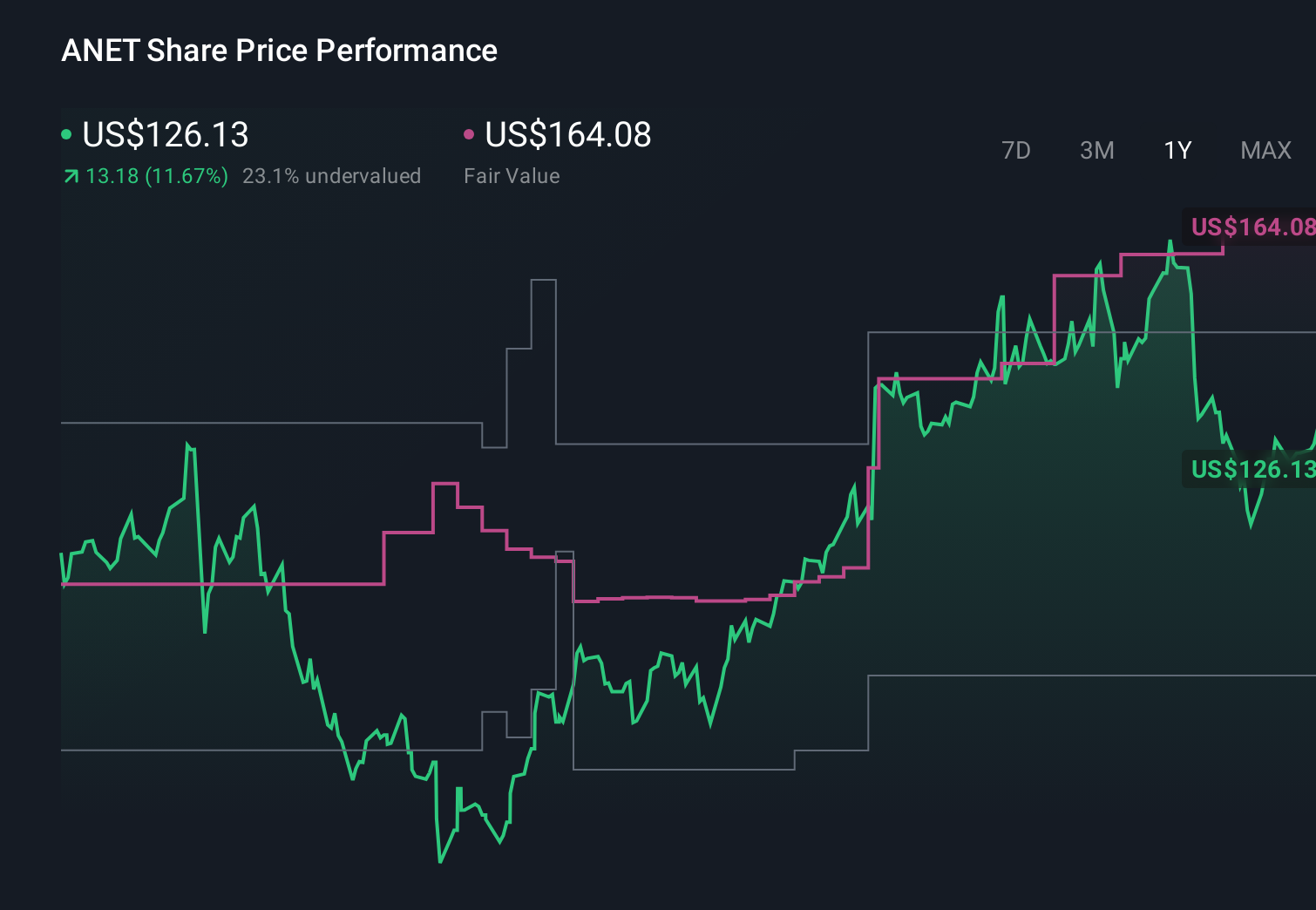

- The stock last closed at US$135.12, with returns of 5.0% over 7 days, 4.0% over 30 days, 1.1% year to date and 23.1% over 1 year, which gives useful context before comparing the price to underlying fundamentals.

- Recent news coverage has focused on Arista Networks' role in data center and cloud networking, as investors consider how its products fit into large scale infrastructure spending. This backdrop helps explain why the share price performance has attracted fresh attention from both new and existing shareholders.

- On our valuation checks, Arista Networks currently scores 2 out of 6 for being undervalued. You can see that breakdown in more detail at this valuation scorecard, which we will compare with standard valuation methods before finishing with a different way of thinking about value at the end of the article.

Arista Networks scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

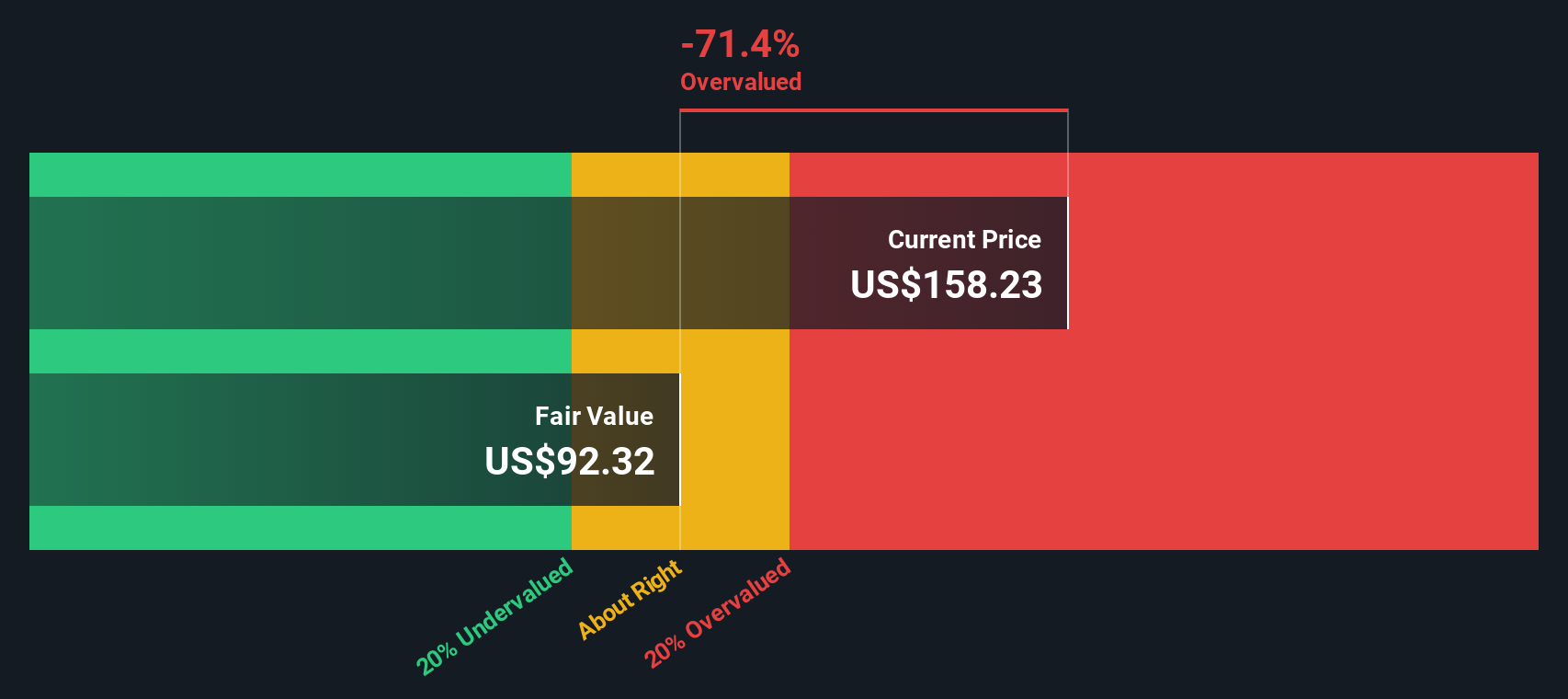

Approach 1: Arista Networks Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of the cash a company could generate in the future and discounts those amounts back to today, to arrive at an estimated intrinsic value per share.

For Arista Networks, the model used is a 2 Stage Free Cash Flow to Equity approach based on cash flow projections. The latest twelve month free cash flow is about $4.08b. Analyst inputs and extrapolated estimates point to projected free cash flow of $9.27b in 2035, with interim years such as 2026 and 2029 at $4.62b and $6.88b respectively. These future cash flows are discounted back using Simply Wall St's assumptions to reflect their value in today's dollars.

On this basis, the DCF model estimates an intrinsic value of about $111.82 per share, compared with the recent share price of $135.12. That gap implies the stock screens as roughly 20.8% overvalued using this cash flow framework.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arista Networks may be overvalued by 20.8%. Discover 55 high quality undervalued stocks or create your own screener to find better value opportunities.

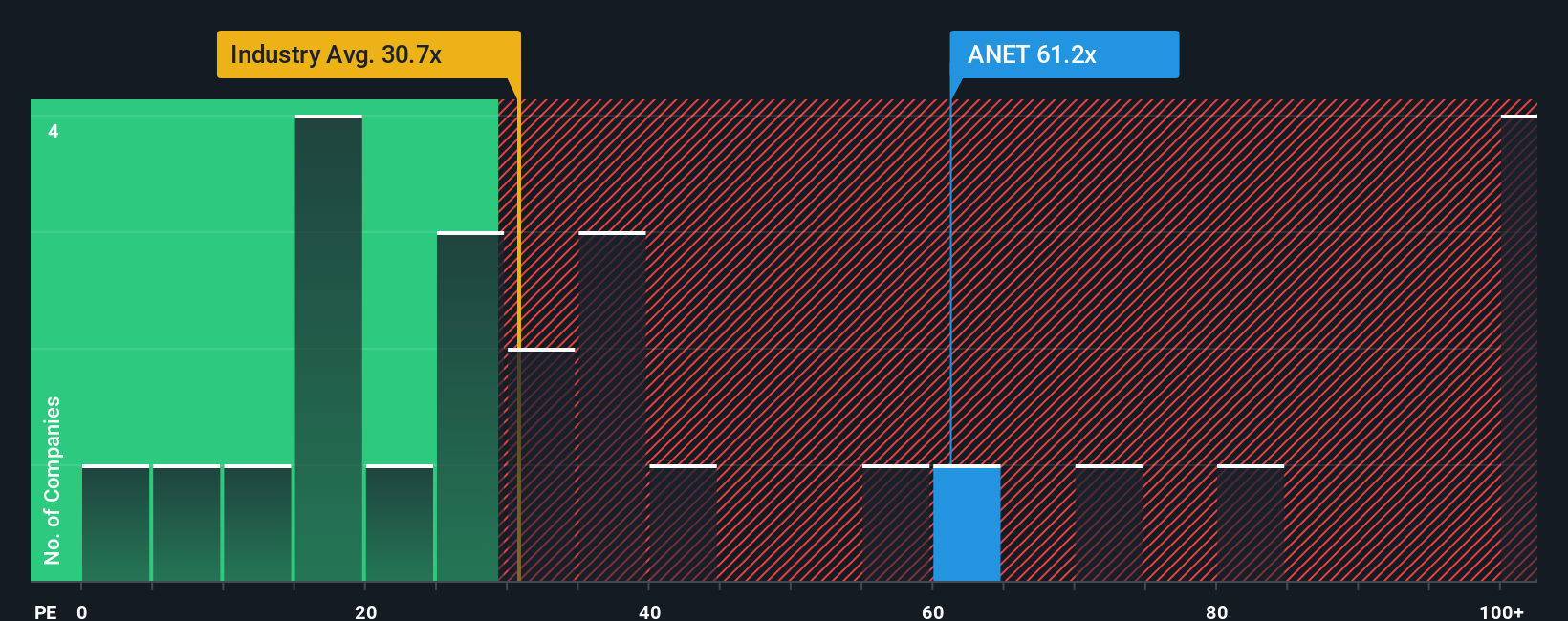

Approach 2: Arista Networks Price vs Earnings

For profitable companies like Arista Networks, the P/E ratio is a useful cross check because it links what you pay for each share with the earnings that support that price. Investors usually accept a higher or lower P/E depending on what they expect for future growth and how risky they think those earnings are.

Arista Networks currently trades on a P/E of 50.69x. That sits above the Communications industry average of 32.93x and below the peer group average of 68.87x, so the stock is priced at a premium to the broader industry but not at the top end of its closer comparables.

Simply Wall St also calculates a Fair Ratio of 39.60x for Arista Networks. This is a proprietary estimate of what the P/E might be given the company’s earnings growth profile, profit margins, market cap, risk factors and its industry. Because it brings these company specific inputs together, the Fair Ratio can be a more tailored yardstick than a simple comparison with peers or sector averages.

Comparing the current P/E of 50.69x with the Fair Ratio of 39.60x suggests the shares trade above this implied fair range.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Arista Networks Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St you can use Narratives, where you write the story you believe about Arista Networks, link that story to explicit assumptions for revenue, earnings, margins and a fair value, and then see in one place how a more cautious view with a fair value around US$76 can sit alongside a much more optimistic view closer to US$194, a bearish analyst view near US$113 and a consensus style view around US$163. All of these update automatically as fresh news or earnings arrive, so you can compare each fair value to the current price and decide whether the stock looks expensive, inexpensive or somewhere in between for you.

For Arista Networks however we will make it really easy for you with previews of two leading Arista Networks narratives:

Here is a constructive view that leans on AI networking demand and supports a higher fair value range.

Fair value in this narrative: US$163.37 per share

Implied pricing: around 17.2% below this narrative fair value, based on the recent US$135.12 share price

Revenue growth assumption: 21.20% a year

- Frames Arista as a key AI and cloud networking supplier, with open Ethernet and high bandwidth platforms supporting sustained demand and market share gains.

- Highlights a shift toward software, automation and enterprise customers, which adds more recurring revenue and aims for steadier long term earnings.

- Flags real risks around customer concentration, tough competition, geopolitics and execution, while pointing out that analyst targets cluster close to the recent price, suggesting limited gap to their consensus fair value.

For balance, here is a contrasting narrative that sees the shares as fully priced or stretched against cash flow expectations.

Fair value in this narrative: US$127.06 per share

Implied pricing: around 6.4% above this narrative fair value, based on the recent US$135.12 share price

Revenue growth assumption: 15.0% a year

- Focuses on Arista as a high quality, debt free business with strong return on equity that has already earned a premium rating.

- Points out that free cash flow would need to roughly double between 2024 and 2027 to meet some valuation markers, which the author views as achievable but demanding.

- Concludes that, relative to a fair value of about US$76 and the cash flow path required, the shares look closer to fairly valued or rich, so outcomes depend heavily on how the next few years of growth play out.

If you want to go beyond these snapshots and read the full arguments, including the assumptions behind each fair value, Curious how numbers become stories that shape markets? Explore Community Narratives and see how other investors are framing Arista Networks.

Do you think there's more to the story for Arista Networks? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.