Please use a PC Browser to access Register-Tadawul

Is It Too Late To Consider Centrus Energy (LEU) After The Recent Share Price Pullback?

Centrus Energy Corp. Class A LEU | 203.73 | -2.47% |

- This article examines whether Centrus Energy, at around US$199 per share, is still priced attractively or whether most of the easy gains may already have occurred, by exploring what the current share price might imply about value.

- The stock has been volatile recently, with a 24.4% decline over the past week and a 39.8% pullback over the last 30 days. This comes even though the 1 year return stands at 74.7% and the 3 year return is approximately 4x.

- Recent moves have put fresh attention on Centrus Energy, as investors consider how the current share price compares with longer term return figures, such as the 26.9% year to date decline and the very large 5 year gains of around 7x. This combination of sharp recent declines and strong multi year returns has raised questions about whether expectations or perceived risk around the stock have shifted.

- Centrus Energy currently records a valuation score of 1 out of 6 on our checks. Next, we will look at what different valuation approaches indicate about the stock today and then conclude with a broader way to think about its value that goes beyond any single metric.

Centrus Energy scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Centrus Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth by projecting its future cash flows and then discounting those amounts back to today, using a required rate of return. It is essentially asking what those future dollars are worth in present terms.

For Centrus Energy, the model used is a 2 Stage Free Cash Flow to Equity approach, based on cash flows available to shareholders. The latest twelve month Free Cash Flow is about $41.6 million. Analyst and extrapolated projections show Free Cash Flow moving through a mix of negative and positive years, with a projected $176 million in 2030, all expressed in US$.

Bringing these projected cash flows back to today gives an estimated intrinsic value of about $214.66 per share. Compared with the current share price of around $199, the model implies the stock is about 7.2% undervalued. This is a relatively small gap and suggests the market price is fairly close to this DCF estimate.

Result: ABOUT RIGHT

Centrus Energy is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Centrus Energy Price vs Earnings

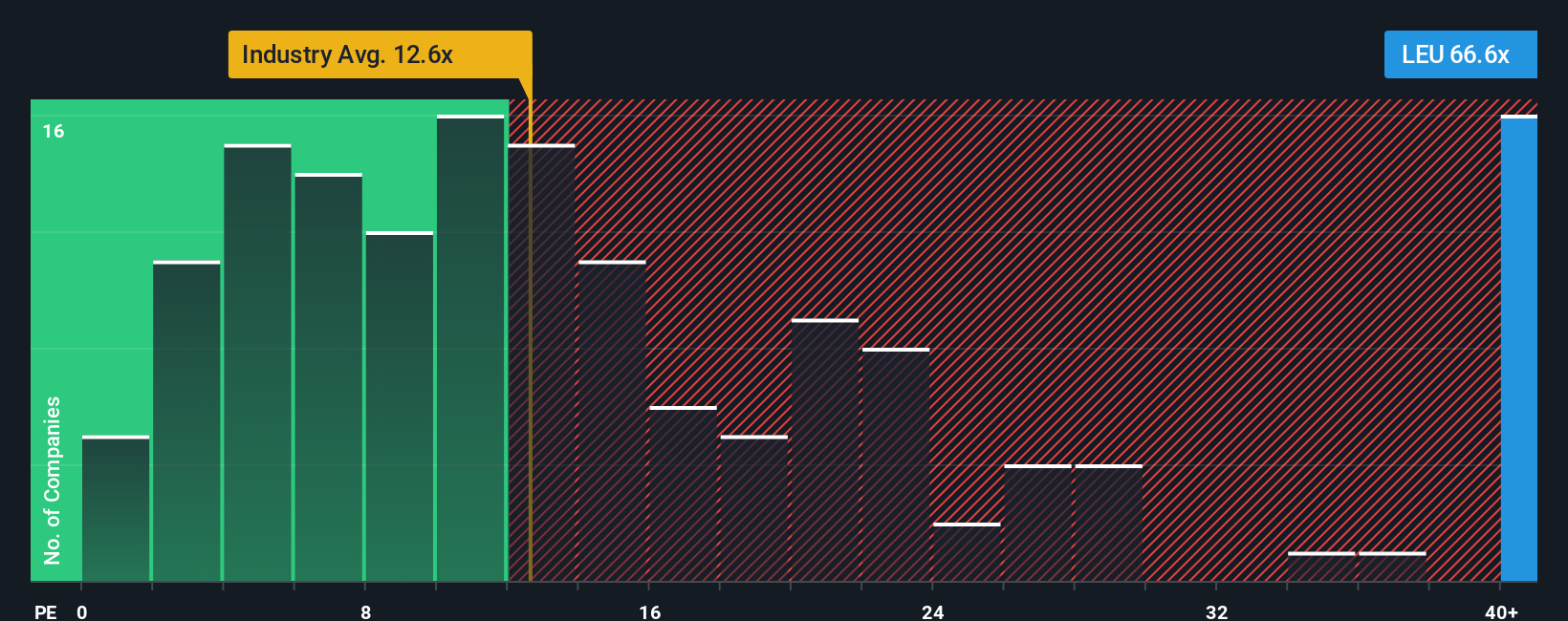

For a profitable company, the P/E ratio is a useful way to think about what you are paying for each dollar of earnings. It ties directly to the bottom line and lets you compare how the market prices those earnings across different businesses.

What counts as a “normal” P/E depends on how the market views growth potential and risk. Higher expected growth or lower perceived risk can support a higher P/E, while slower expected growth or higher risk usually point to a lower, more conservative multiple.

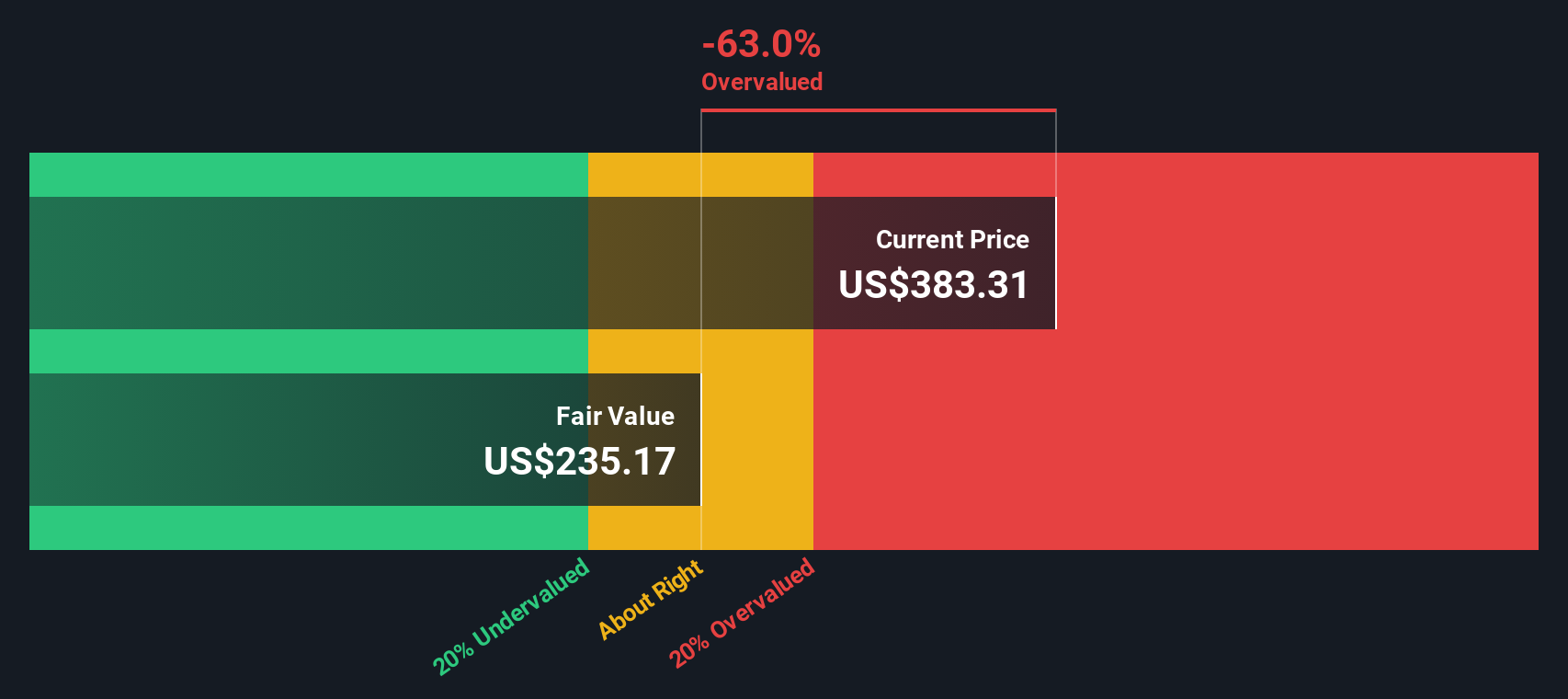

Centrus Energy currently trades on a P/E of about 50.35x. That is above the Oil and Gas industry average of around 14.46x and also higher than the peer group average of roughly 44.06x. Simply Wall St’s “Fair Ratio” for Centrus Energy is 13.10x. This Fair Ratio is a proprietary estimate of the P/E that might be reasonable given factors such as earnings growth characteristics, industry, profit margins, market cap and specific risks.

Compared with simple peer or industry comparisons, the Fair Ratio aims to be more tailored, because it adjusts for those company specific factors instead of assuming all businesses deserve similar multiples. With Centrus Energy’s actual P/E well above its Fair Ratio, the shares screen as expensive on this measure.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Centrus Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St you can use Narratives on the Centrus Energy Community page to link your view of the company’s story to a forecast and a fair value, then compare that fair value to the current price. The system updates your Narrative automatically as new news or earnings arrive. This is why one investor might build a bullish Centrus Narrative around a fair value of US$390.00, while another takes a more cautious view closer to US$171.40. You can then quickly see which version of the story you think makes more sense for you.

For Centrus Energy, however, we'll make it really easy for you with previews of two leading Centrus Energy Narratives:

First up is a bullish view that leans on supportive policy, federal funding and long term nuclear demand, and then a more cautious take that focuses on contract concentration, dilution and funding uncertainty. Seeing both side by side can help you decide which set of assumptions feels closer to your own.

Fair value in this bullish narrative: US$279.73 per share

Implied discount to this fair value at the last close of US$199.19: about 29% undervalued

Revenue growth assumption: 11.05% a year

- Analysts in this camp anchor their view on robust policy support for nuclear, growing enrichment demand and Centrus Energy's position as a key supplier across LEU and HALEU.

- They factor in revenue growing at double digit rates while margins step down from current levels but remain healthy enough to support a higher earnings base by around 2028.

- This narrative leans on access to capital, Department of Energy funding, a US$3.6b backlog and operating leverage from expansion to support the case that the stock can justify a relatively high future P/E multiple.

Fair value in this bearish narrative: US$171.40 per share

Implied premium to this fair value at the last close of US$199.19: about 16% overvalued

Revenue growth assumption: 17.98% annual decline

- This more cautious view leans on contract concentration, slower assumed revenue growth, shrinking margins and the risk that nuclear demand could be pressured by alternative energy and technology shifts.

- Analysts here build in much lower earnings by 2028, continued share count growth of 7.0% a year and a need for a very high future P/E to support even the lower price target of US$108.00.

- Funding and dilution from the US$1b at the market program, uncertainty around the size and timing of future Department of Energy awards and regulatory or ESG constraints are central to this narrative.

These Narratives frame the spread of expectations that is already in the market, from higher growth and sustained policy support through to slower growth and more pressure on returns. Your job as an investor is to decide which earnings path, margin profile and funding outcome feels more realistic for Centrus Energy, and where you would be comfortable owning the stock relative to those assumptions.

If you want to see how other investors are thinking about these same trade offs, and how their fair values compare to the current share price, Curious how numbers become stories that shape markets? Explore Community Narratives can be a useful next step.

Do you think there's more to the story for Centrus Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.