Please use a PC Browser to access Register-Tadawul

Is It Too Late To Consider Excelerate Energy (EE) After A 42% Year-To-Date Rally?

Excelerate Energy, Inc. Class A EE | 42.15 | +0.52% |

- If you are trying to figure out whether Excelerate Energy is priced attractively right now, it helps to step back and look at both the recent share moves and what they might be saying about expectations.

- The stock last closed at US$40.36, with returns of 12.7% over 7 days, 27.8% over 30 days, 42.4% year to date, and 36.9% over the past year. These moves may have changed how investors think about its potential and its risks.

- Recent news flow around Excelerate Energy has focused on its position in the energy sector, its role in providing LNG infrastructure, and how the business is responding to broader energy market trends. Together, these updates help explain why the share price has been active and why sentiment may have shifted compared with earlier periods.

- Despite this, Excelerate Energy currently has a valuation score of 0 out of 6. Next, we will look at how different valuation approaches line up with that score, then finish with a way of thinking about value that can add extra context to those numbers.

Excelerate Energy scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

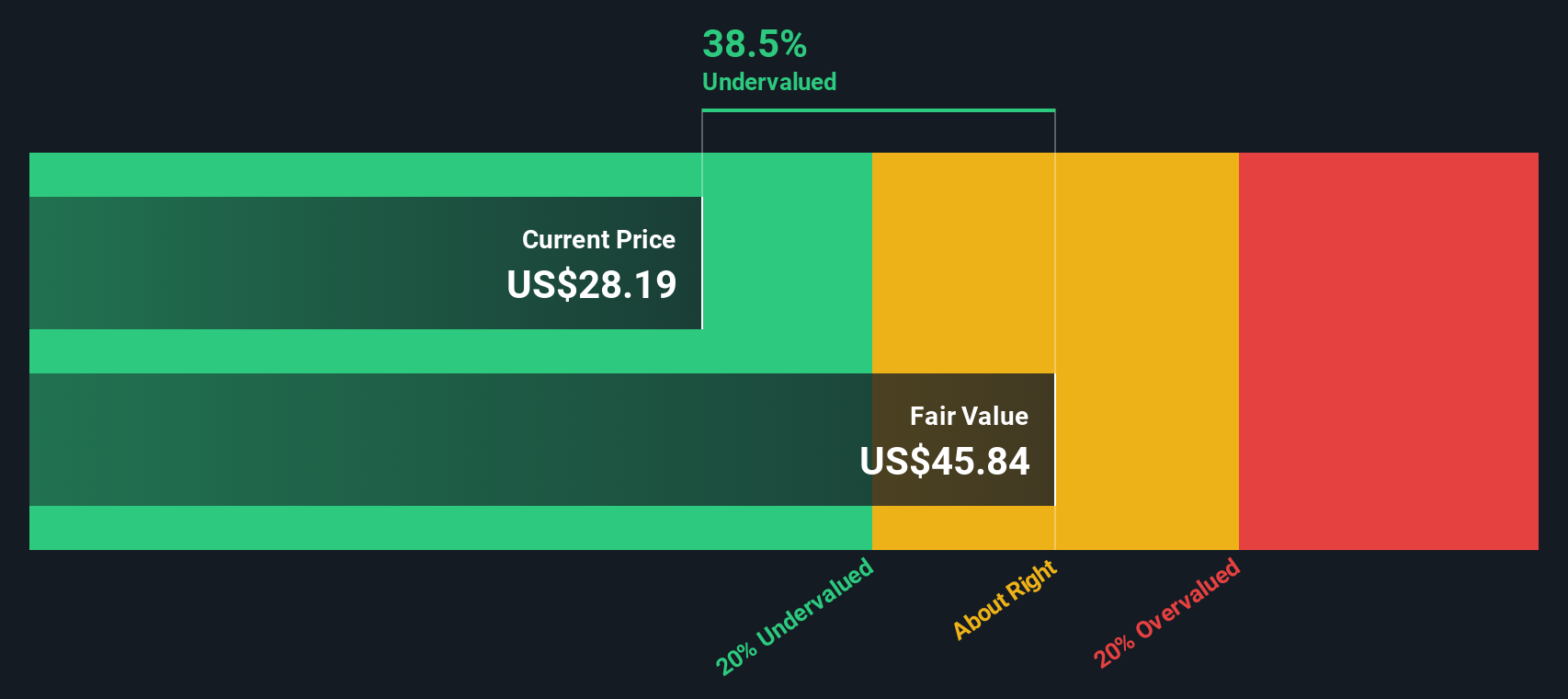

Approach 1: Excelerate Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes forecasts of a company’s future cash flows and discounts them back to today to estimate what the business could be worth in present value terms.

For Excelerate Energy, the model used is a 2 Stage Free Cash Flow to Equity approach, based on projected free cash flows in US$. The latest twelve month free cash flow is US$192.0 million. Analyst and extrapolated estimates then feed into a ten year path of cash flows, including US$28.7 million in 2026, US$249.6 million in 2027, and US$114.0 million in 2028. Later years are based on further extrapolation from these inputs.

Discounting this stream of cash flows back to today results in an estimated intrinsic value of about US$7.39 per share. Compared with the recent share price of US$40.36, the DCF output suggests the stock is very fully priced, with an implied overvaluation of 446.1%.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Excelerate Energy may be overvalued by 446.1%. Discover 55 high quality undervalued stocks or create your own screener to find better value opportunities.

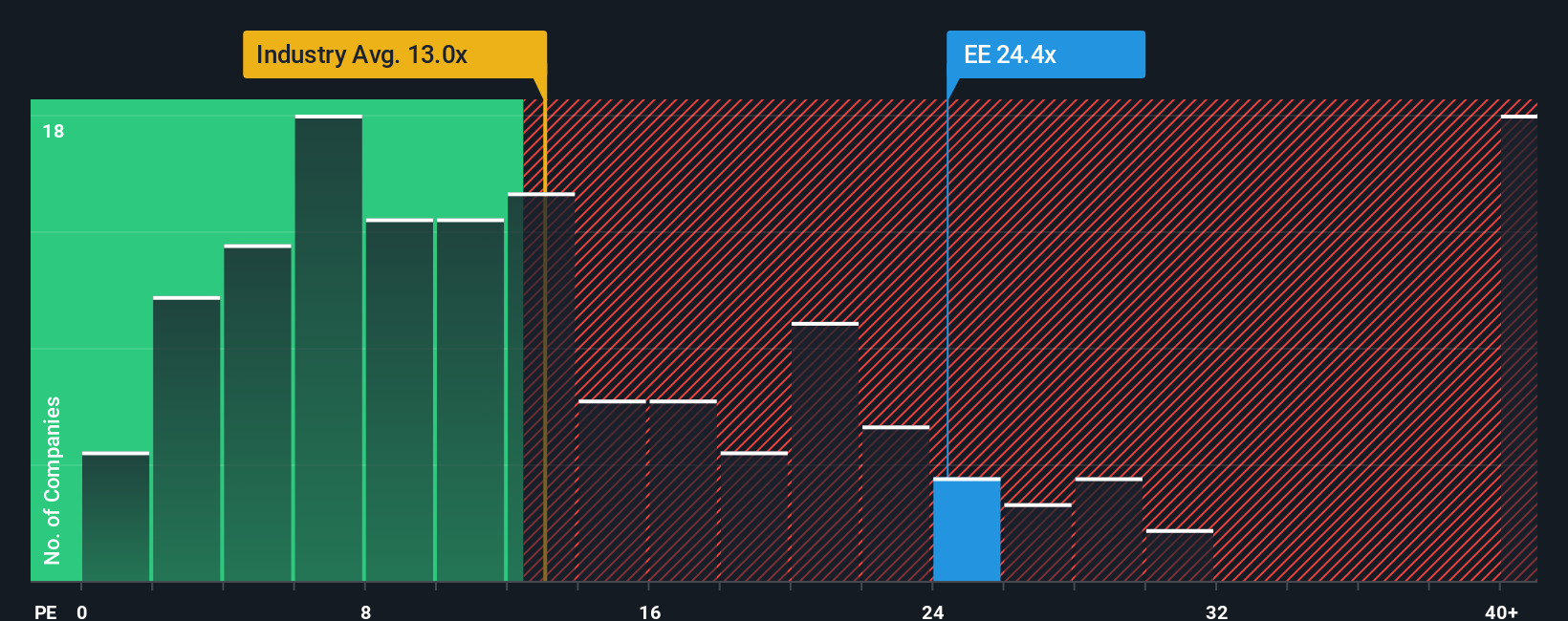

Approach 2: Excelerate Energy Price vs Earnings

For a profitable company, the P/E ratio is a practical way to see how much you are paying for each dollar of earnings, which makes it a natural next check alongside the DCF work you have just seen.

What counts as a “normal” P/E depends on how the market views a company’s growth prospects and risk profile, with higher expected growth or lower perceived risk often lining up with a higher P/E, and the opposite also being true.

Excelerate Energy currently trades on a P/E of 31.51x. That sits above the Oil and Gas industry average of 14.50x and also above its peer group average of 29.35x. Simply Wall St’s Fair Ratio framework goes a step further. It estimates what P/E might make sense for Excelerate Energy given factors such as its earnings growth profile, industry, profit margins, market cap and specific risks, and arrives at a Fair Ratio of 24.73x.

Because the Fair Ratio is tailored to the company’s own characteristics, it can be more informative than a simple comparison with broad industry or peer averages. Set against this 24.73x Fair Ratio, the current 31.51x P/E points to Excelerate Energy trading on a richer multiple than the model suggests.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Excelerate Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, which are simple stories you build around Excelerate Energy that connect your view of its future revenue, earnings and margins to a financial forecast, a Fair Value, and then a clear comparison with today’s price. All of this is available within an easy tool on Simply Wall St’s Community page that updates as new news or earnings arrive and can reflect very different views. For example, you might choose a more cautious Narrative that lines up with a Fair Value around US$26.00, a more optimistic take closer to US$43.20, or something in the middle around US$33.18 or US$29.00. This way, you can see how your assumptions translate into numbers and decide for yourself whether the current share price looks high, low, or roughly in line with what you think the company is worth.

For Excelerate Energy however we'll make it really easy for you with previews of two leading Excelerate Energy Narratives:

Together they frame a reasonable range of outcomes based on the same core business but very different assumptions about growth, margins, and how the market might price the stock in future.

Fair value: US$43.20 per share

Gap to this fair value versus the latest close of US$40.36: around 6.6% below that fair value level

Revenue growth assumption: 30.27% a year

- Focuses on Excelerate Energy using long term LNG contracts, regional expansion and small scale LNG distribution to build recurring earnings and higher returns from assets such as the Jamaica platform.

- Assumes strong revenue growth and higher future earnings supported by LNG infrastructure scarcity, pricing power and a broadening project pipeline across regions.

- Flags meaningful risks from decarbonization, renewables and tighter financing conditions, which could hurt LNG demand and require careful scrutiny of the bullish price target and growth assumptions.

Fair value: US$29.00 per share

Gap to this fair value versus the latest close of US$40.36: around 39.2% above that fair value level

Revenue growth assumption: 12.65% a year

- Emphasizes that expansion into emerging LNG markets, including the Jamaica hub model, comes with political, regulatory and energy transition risks that could limit long term revenue and asset utilization.

- Highlights that heavy investment in fleet and new LNG projects could meet weaker than expected LNG demand, leading to overcapacity, lower utilization and pressure on margins and returns.

- Points to exposure to decarbonization policies, potential carbon costs, access to capital and counterparty risk in emerging markets as key reasons why Excelerate Energy could trade above its assessed fair value.

Do you think there's more to the story for Excelerate Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.