Please use a PC Browser to access Register-Tadawul

Is It Too Late to Consider NVIDIA After Shares Jumped 41% in 2025?

NVIDIA Corporation NVDA | 185.61 184.95 | -2.89% -0.36% Post |

- Wondering whether NVIDIA's meteoric rise means it's still a good value, or if the price has already sprinted ahead of its fundamentals? Let’s dig into what’s really driving the story so you can make a smarter call.

- Over the past five years, NVIDIA’s stock has soared an incredible 1355.1%, jumping 41.1% so far this year despite occasional pullbacks such as this week’s 3.8% dip.

- Fueling this momentum, NVIDIA continues to make headlines for its leadership in graphics processing and AI hardware, drawing investor attention as tech giants compete for a slice of the AI boom. Partnerships with industry heavyweights and ongoing product launches have only intensified the spotlight.

- But here’s the twist: our valuation framework gives NVIDIA a score of 2 out of 6 for being undervalued, so the numbers suggest caution. Up next, we’ll break down those valuation checks, plus why the most useful approach to value might not be the usual one, and how you can go deeper at the end of the article.

NVIDIA scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

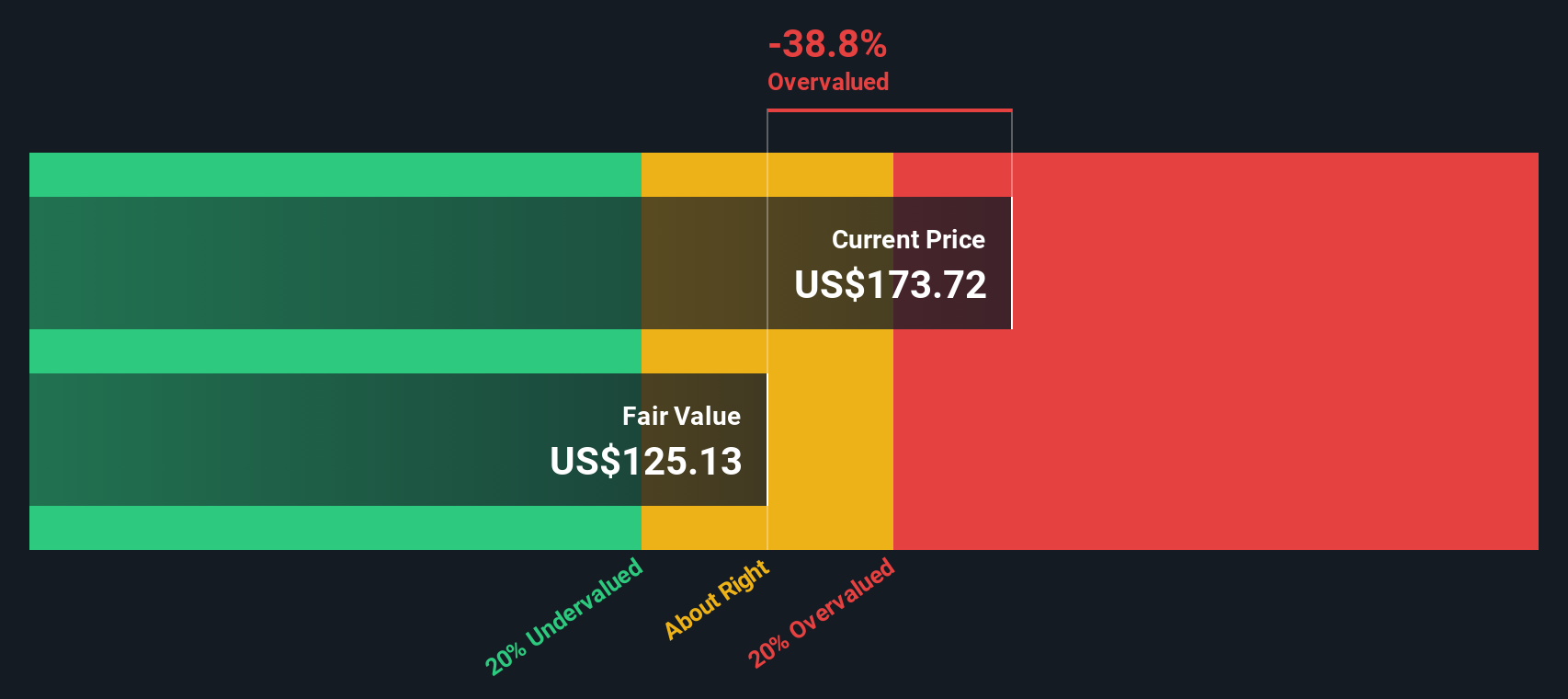

Approach 1: NVIDIA Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its expected future cash flows and then discounting those amounts back to their present value. This approach helps investors gauge what a stock should be worth based on its ability to generate cash over time.

For NVIDIA, the current Free Cash Flow sits at an impressive $72.28 billion. Analysts forecast considerable growth in the coming years, with projections reaching $284.04 billion by 2030. Estimates for the next five years are based on analyst consensus. Longer-term numbers rely on Simply Wall St's extrapolation. The model used here is a two-stage Free Cash Flow to Equity approach, reflecting higher initial growth and gradually tapering off as the business matures.

Using these inputs, the DCF model calculates an intrinsic value for NVIDIA of $165.19 per share. This figure comes in 18.2% below the current share price, suggesting that the stock is more than fairly valued based on its future cash flow potential.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NVIDIA may be overvalued by 18.2%. Discover 849 undervalued stocks or create your own screener to find better value opportunities.

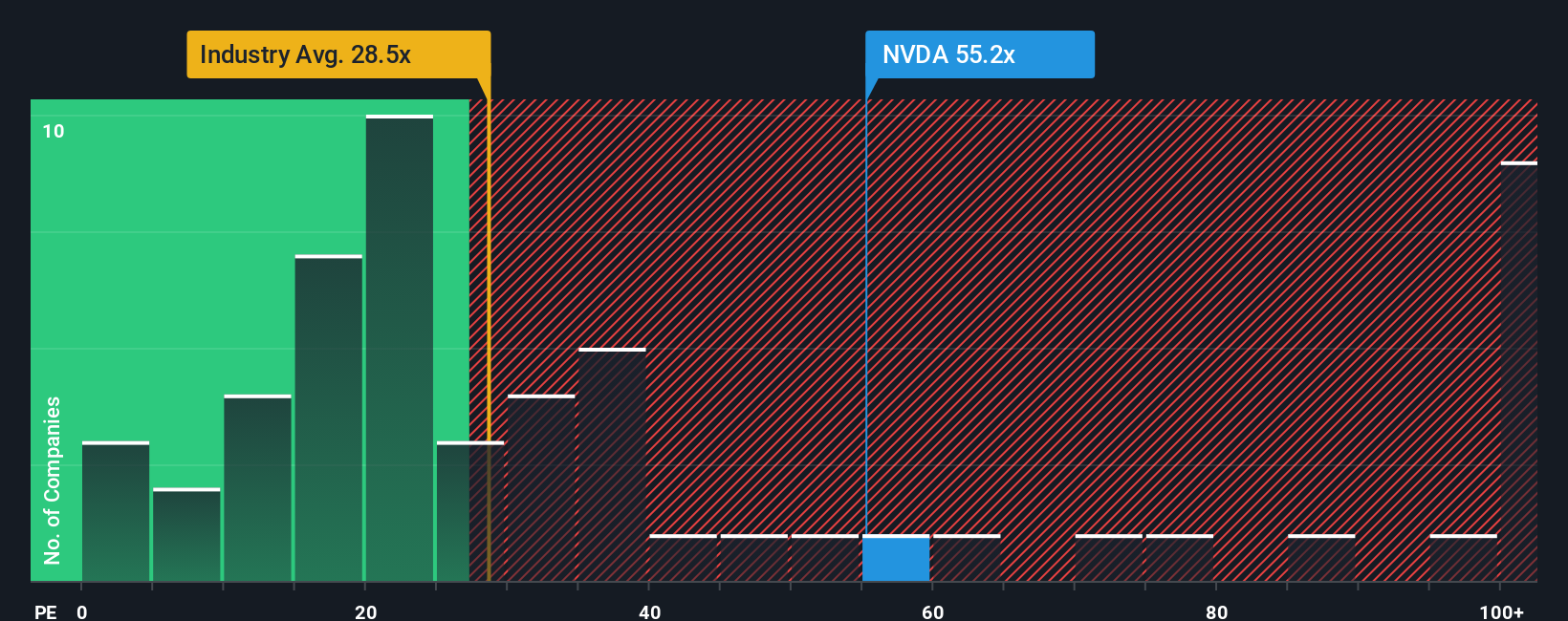

Approach 2: NVIDIA Price vs Earnings

For profitable companies like NVIDIA, the Price-to-Earnings (PE) ratio is often considered the go-to valuation metric. The PE ratio tells investors how much they are paying today for each dollar of earnings, making it a useful gauge for growth-oriented businesses with consistent profits.

While a high PE might be justified by expectations of rapid growth or lower risk, it is important to compare it to several benchmarks. NVIDIA currently trades at a PE ratio of 54.8x, which is above the Semiconductor industry average of 36.9x, but below the peer group average of 67.7x. Such comparisons can provide helpful context, showing how the market views NVIDIA relative to its competitors and the broader industry.

However, raw comparisons can be misleading without considering all the relevant company-specific factors. This is where the Simply Wall St “Fair Ratio” comes in, a proprietary benchmark that tailors the expected multiple to NVIDIA's unique situation by factoring in its earnings growth, profit margin, market capitalization, risk profile, and industry context. This comprehensive approach gives a more nuanced perspective than simply matching to other companies’ valuations.

NVIDIA’s Fair Ratio stands at 65.7x, which is not far off its actual PE ratio of 54.8x. This suggests that, when accounting for NVIDIA's strengths and risk profile, the current price is about right and neither noticeably overvalued nor undervalued.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NVIDIA Narrative

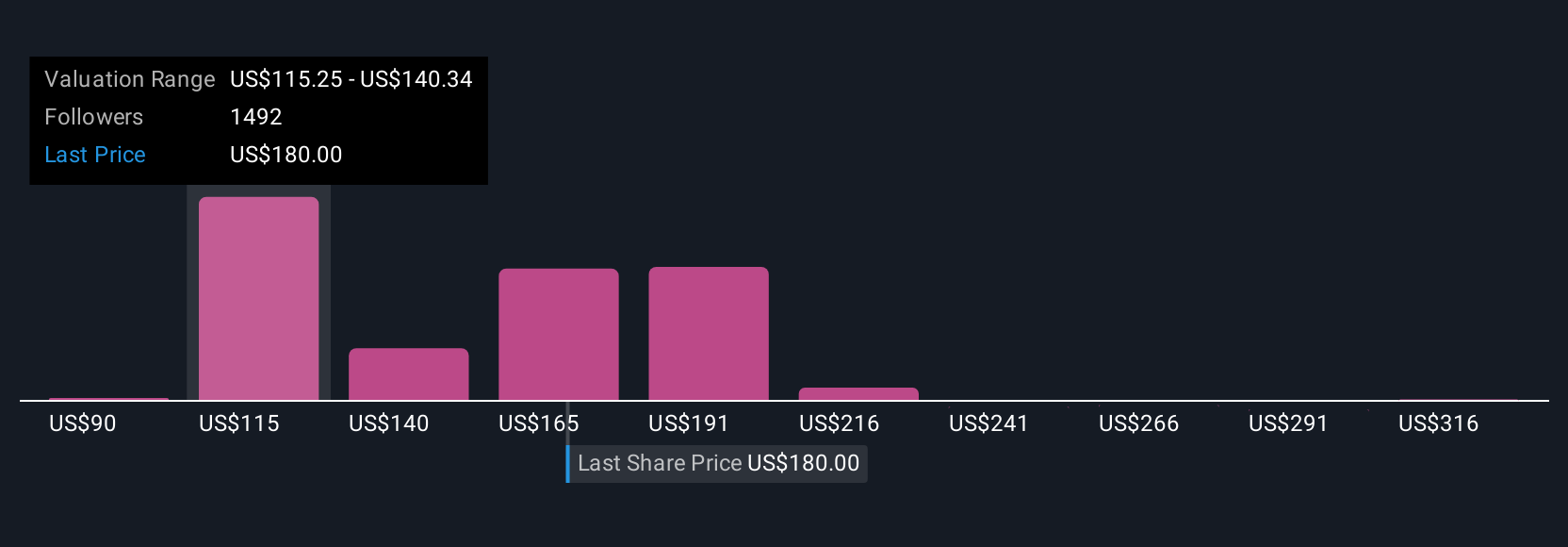

Earlier we mentioned that there’s an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, yet powerful, way for investors to document the story they believe about a company. Instead of explaining just what the numbers are, Narratives clarify why those numbers make sense for the future. With Narratives, you link your personal viewpoint (such as drivers of growth or risks) directly to the financial forecasts and fair value you think is justified for NVIDIA.

Narratives go beyond just comparing ratios or reading analyst targets. They help you connect the company’s underlying story, your expectations for future earnings or revenue, and the valuation that results from those beliefs. On Simply Wall St’s Community page, millions of investors are already using Narratives to organize their research and track evolving viewpoints over time.

The real power of Narratives is that, as new information such as fresh earnings or major news comes in, they automatically update the fair value. This way, you always see how your perspective lines up against the current price. You can compare your Narrative with others, check consensus or outlier scenarios, and quickly see whether your view aligns with a buy opportunity, a hold, or a potential sell.

For instance, some investors believe NVIDIA’s fair value is as high as $235 per share, backing continued AI dominance and margin expansion, while others see the fair value closer to $68, reflecting expectations of competitive threats and normalization of growth. This range makes it easy to spot the full spectrum of conviction around the stock.

For NVIDIA, we'll make it really easy for you with previews of two leading NVIDIA Narratives:

Fair Value: $225.50

Current discount to fair value: -13.4%

Projected revenue growth rate: 29.1%

- Surging global AI adoption and infrastructure digitization are driving multi-year, compounding revenue growth, supported by NVIDIA’s continuous innovation and expanding platform offerings.

- The company deepens customer lock-in and raises margins through full-stack AI solutions, recurring software revenues, and premium pricing power. This enables robust profitability as customers expand across sectors.

- Key risks include U.S.–China tensions, customer vertical integration, supply chain fragility, and rising infrastructure constraints. Analyst consensus expects significantly higher earnings and a price target 17.5% above current levels.

Fair Value: $67.95

Current premium to fair value: 187.3%

Projected revenue growth rate: 14.4%

- Oversupply of compute power, rising competition from AMD, Intel, and customer-designed chips, as well as pricing pressures, threaten NVIDIA’s historically high margins and future earnings power.

- Customer vertical integration by hyperscalers and slowing cloud infrastructure growth could curb demand. The rapid expansion in hardware may also cause a cyclical decline in revenues as capacity is filled.

- While NVIDIA may maintain technical leadership in AI hardware, the narrative assumes slowing margin expansion, more moderate revenue growth, and a sharp valuation correction as growth normalizes.

Do you think there's more to the story for NVIDIA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.