Please use a PC Browser to access Register-Tadawul

Is It Too Late To Consider Royal Gold (RGLD) After An 86% One Year Surge?

Royal Gold, Inc. RGLD | 285.54 | +5.06% |

- This article examines whether Royal Gold’s recent share price performance suggests the stock is overvalued or still offers value, focusing on what the numbers indicate.

- The share price recently closed at US$259.36, with returns of 17.3% over the past month and 85.9% over the last year, even after a 10.7% decline in the past week.

- Recent news flow around Royal Gold has highlighted investor interest in gold related equities as a way to gain exposure to the precious metals market, as well as ongoing attention on royalty and streaming models as an alternative to traditional miners. These themes help frame why sentiment around the stock may have shifted over different time frames.

- Royal Gold currently scores 1 out of 6 on our valuation checks, as shown by its valuation score. Next we look at how standard valuation approaches align for this stock and then conclude with a framework that can help you interpret what “value” may mean in this context.

Royal Gold scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

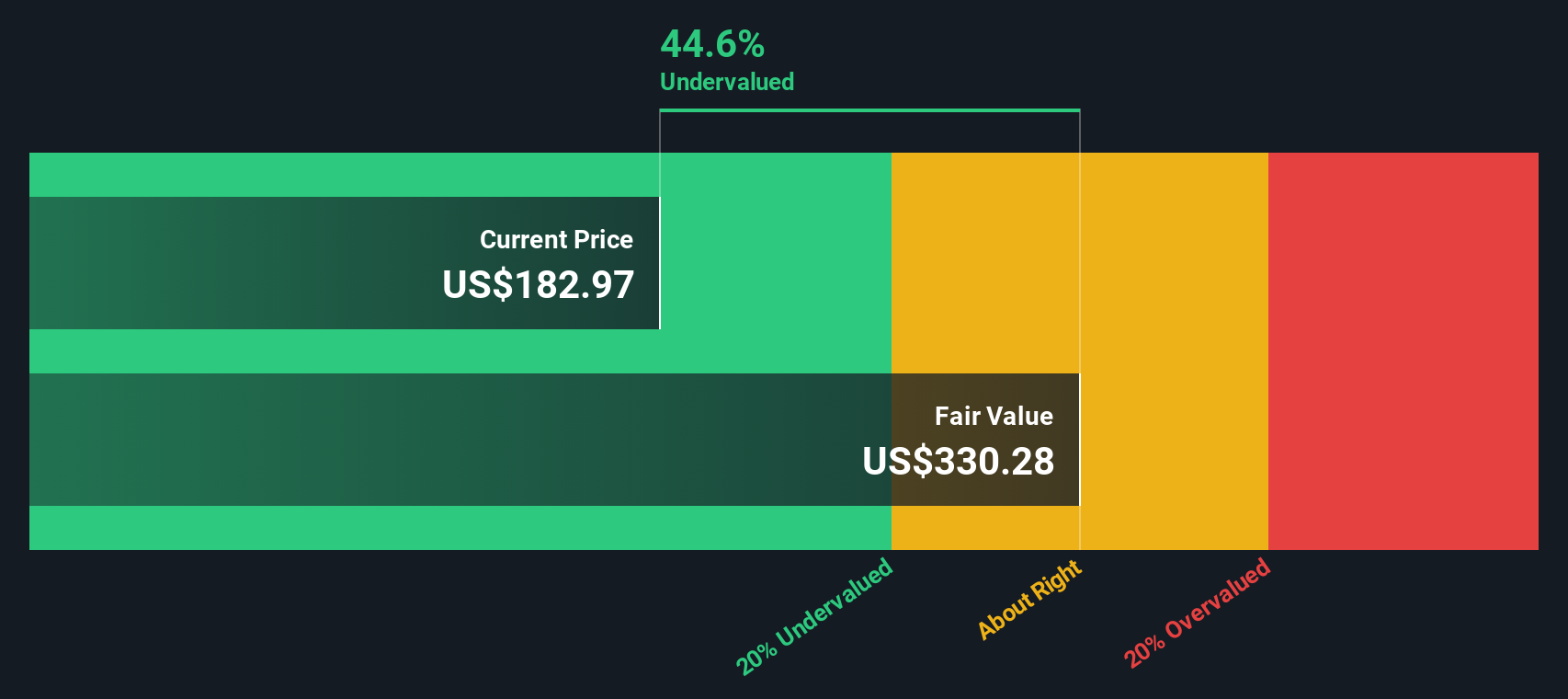

Approach 1: Royal Gold Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of the cash a company could generate in the future and discounts those amounts back to today using a required rate of return, giving an estimated present value for the equity.

For Royal Gold, the model used is a 2 Stage Free Cash Flow to Equity approach. The company’s last twelve months free cash flow is reported at US$13.09 million. Analyst and extrapolated projections, provided in the model, reach US$1,405.36 million in 2035, with intermediate years between 2026 and 2034 also in the hundreds of millions of US dollars. Estimates beyond the initial analyst horizon are extrapolated by Simply Wall St, rather than based on new analyst forecasts.

Putting these projected cash flows together, the DCF output suggests an estimated intrinsic value of US$264.92 per share. Against the recent share price of US$259.36, this implies the stock is around 2.1% undervalued. This is a very small gap and falls within a margin where assumptions can easily swing the result.

Result: ABOUT RIGHT

Royal Gold is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

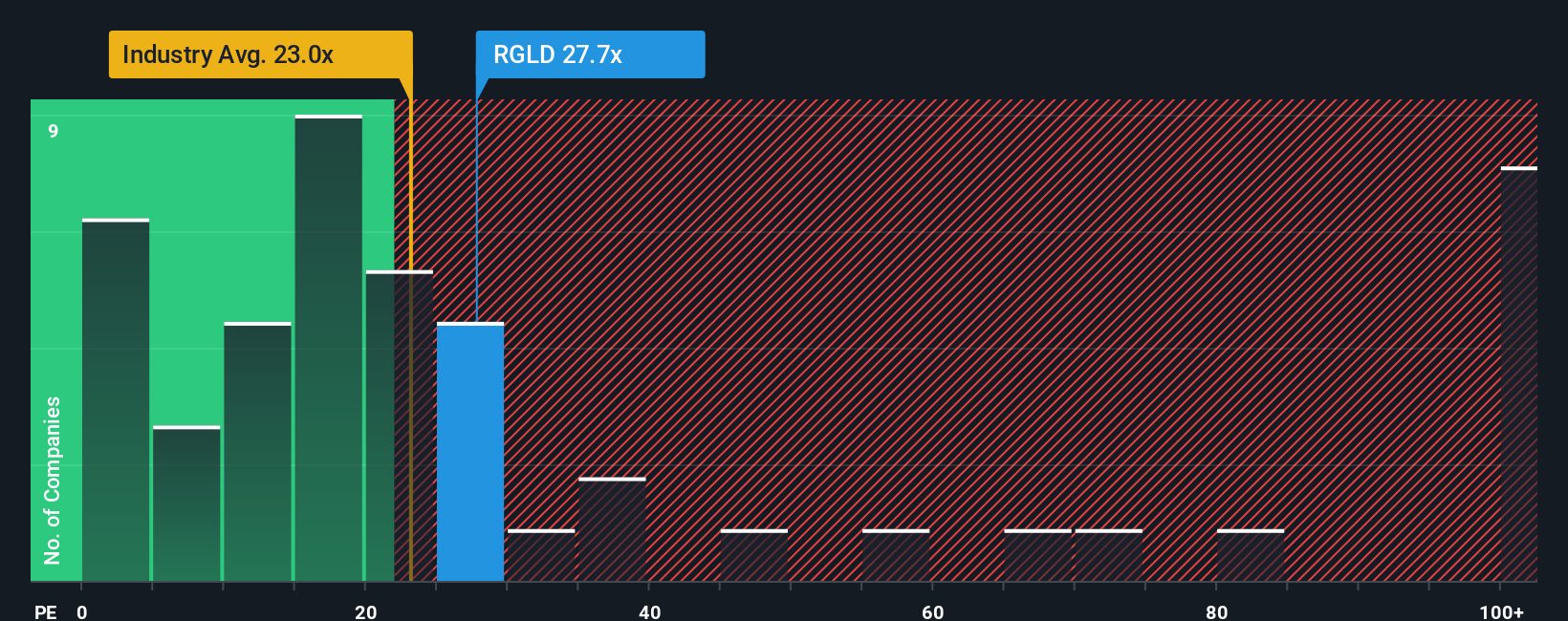

Approach 2: Royal Gold Price vs Earnings

For a profitable company like Royal Gold, the P/E ratio is a useful shorthand for how much investors are currently willing to pay for each dollar of earnings. It ties the share price directly to reported profits, which many investors watch closely.

What counts as a “normal” P/E often reflects how the market views a company’s growth potential and risk. Higher expected growth or lower perceived risk can justify a higher P/E, while slower expected growth or higher risk usually supports a lower multiple.

Royal Gold is trading on a P/E of 45.59x, compared with a Metals and Mining industry average of 27.40x and a peer average of 25.21x. Simply Wall St’s Fair Ratio for Royal Gold is 26.60x. The Fair Ratio is a proprietary estimate of what P/E might make sense for this specific company, given its earnings growth profile, industry, profit margins, market capitalization and risk factors.

Because the Fair Ratio adjusts for those company specific features, it can be more tailored than a simple comparison with peers or the broad industry. On this basis, Royal Gold’s current P/E of 45.59x sits above the Fair Ratio of 26.60x.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1424 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Royal Gold Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, written in numbers and plain language, where you set your view of fair value along with your expectations for future revenue, earnings and margins. On Simply Wall St’s Community page, used by millions of investors, Narratives link that story to a full financial forecast and then to a fair value estimate, so you can quickly see how your view compares with the current market price. This helps you decide if Royal Gold looks attractive to you by checking whether your Fair Value sits above or below today’s share price, and those Narrative values automatically update as new news, earnings or other data come in. For example, one Royal Gold Narrative might assume a relatively cautious fair value and modest earnings outlook, while another might set a higher fair value based on stronger assumptions about the company’s ability to grow.

Do you think there's more to the story for Royal Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.