Please use a PC Browser to access Register-Tadawul

Is It Too Late To Reassess Par Pacific Holdings (PARR) After Its 101% One Year Run?

Par Pacific Holdings Inc PARR | 42.75 | +1.04% |

- If you are wondering whether Par Pacific Holdings is still attractively priced after a strong run, this article walks through the numbers in a clear, practical way.

- The stock trades at US$35.21 after a 4.5% decline over the last week and a 1.7% decline year to date, even though the 1 year return sits at 101.2% and the 5 year return at 165.1%.

- Recent coverage has focused on how Par Pacific fits into the broader US energy sector and how investors are reassessing refinery and logistics operators in light of shifting fuel demand and infrastructure needs. News flow has also highlighted corporate actions and portfolio moves across energy assets, which helps explain why sentiment on refinery linked stocks has been active.

- Simply Wall St currently gives Par Pacific Holdings a valuation score of 6/6. We will look at what different valuation methods say about that score, and then finish with a more holistic way to think about what the stock might be worth.

Approach 1: Par Pacific Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company could be worth today by projecting its future cash flows and then discounting those back to a present value. It is essentially asking what future cash generated for shareholders is worth in today’s dollars.

For Par Pacific Holdings, the model used is a 2 Stage Free Cash Flow to Equity approach, based on cash flow projections in $. The latest twelve month free cash flow is about $224.1 million. Analysts have provided forecasts out to 2027, with free cash flow for 2027 estimated at $204.3 million. Beyond that, Simply Wall St extrapolates free cash flow out to 2035. Projected figures each year between 2026 and 2035 are roughly around the $200 million mark. These are then discounted using its DCF framework.

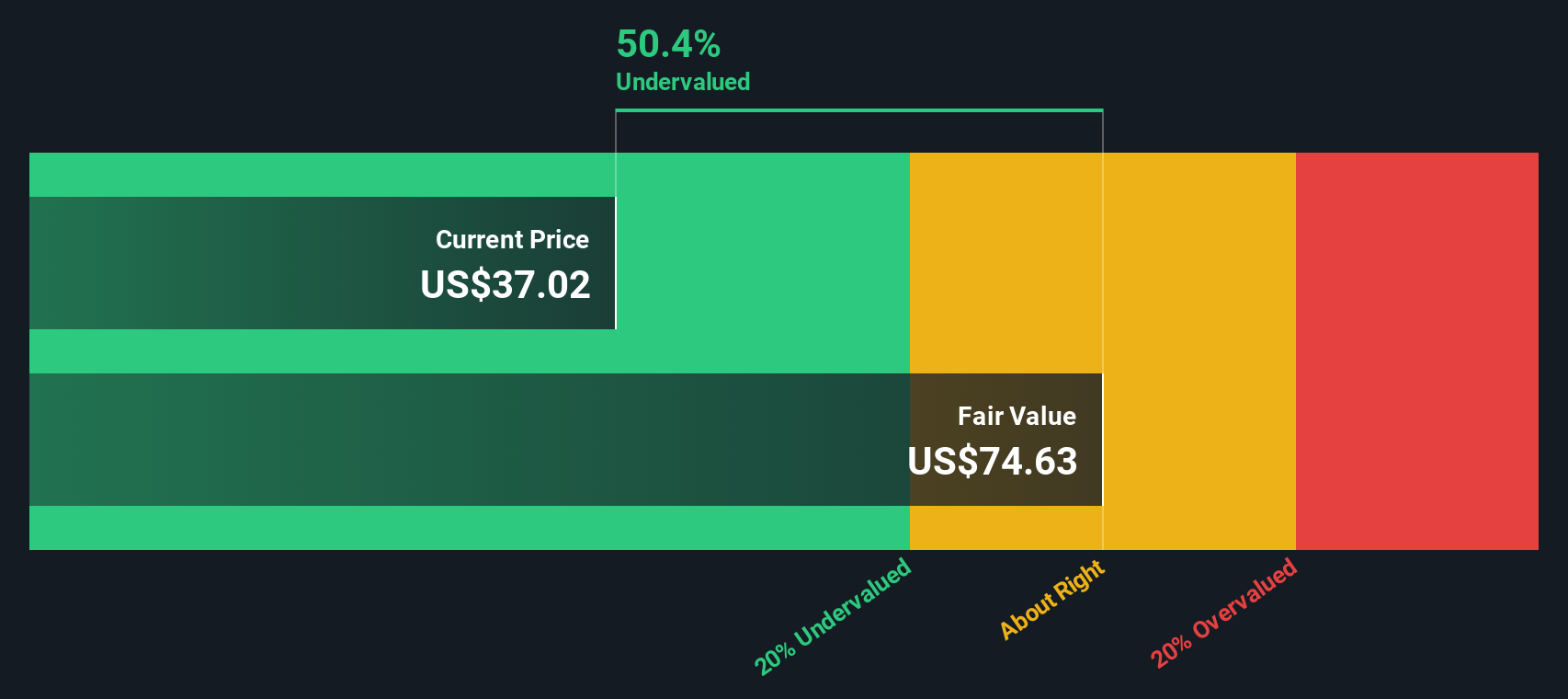

Pulling this together, the model arrives at an estimated intrinsic value of about $80.86 per share, compared with the current share price of $35.21. That implies the stock is assessed as 56.5% undervalued on this DCF view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Par Pacific Holdings is undervalued by 56.5%. Track this in your watchlist or portfolio, or discover 864 more undervalued stocks based on cash flows.

Approach 2: Par Pacific Holdings Price vs Earnings

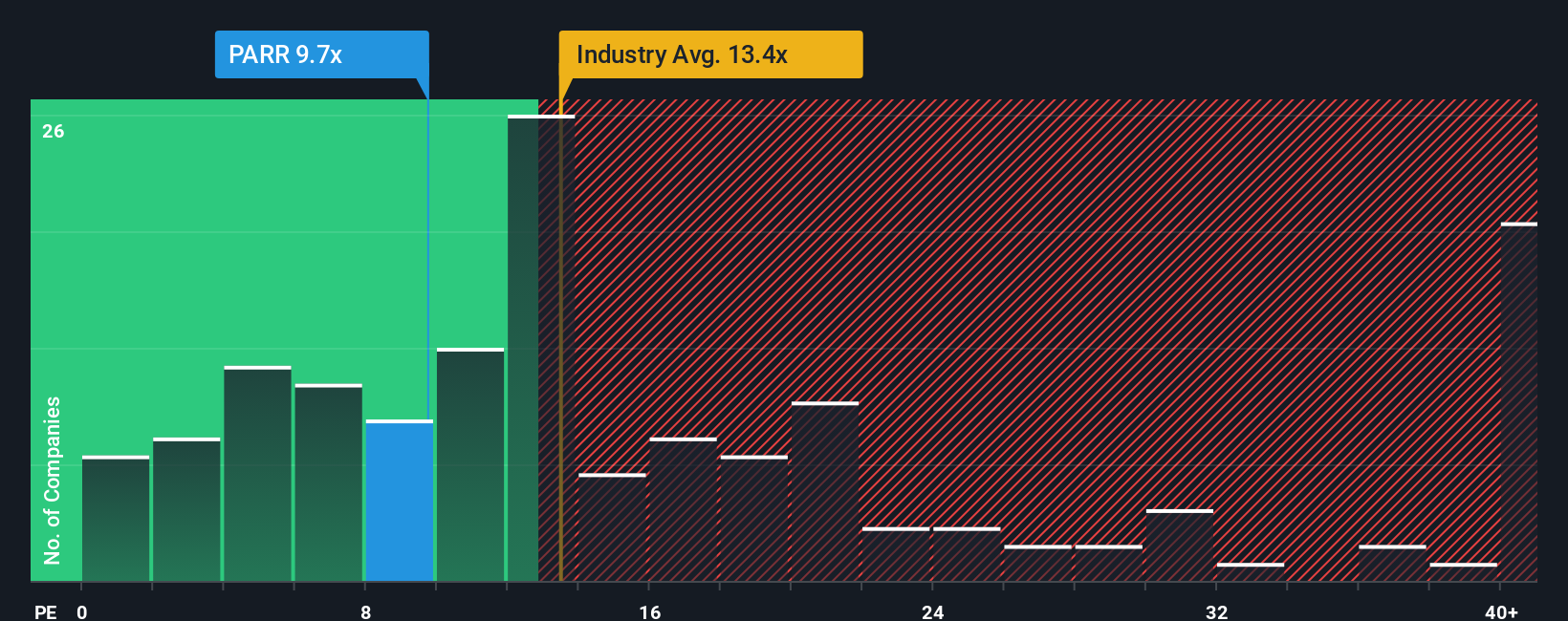

For a profitable company like Par Pacific Holdings, the P/E ratio is a useful way to think about what you are paying for each dollar of current earnings. It is simple, widely used and ties directly to the bottom line that ultimately supports shareholder returns.

What counts as a “normal” or “fair” P/E depends on how the market views a company’s growth prospects and risk. Higher expected growth or more resilient earnings can justify a higher P/E, while higher risk or more volatile profits typically line up with a lower P/E.

Par Pacific Holdings is trading on a P/E of 7.5x. That sits below the Oil and Gas industry average of about 13.6x and also below the peer group average of 43.3x. Simply Wall St’s Fair Ratio for Par Pacific Holdings is 9.5x. This Fair Ratio is a proprietary estimate of what the P/E might be given factors such as the company’s earnings growth profile, profit margins, risk characteristics, industry and market cap. Because it adjusts for these company specific features, it can be more informative than a straight comparison with peers or the broad industry. Comparing 7.5x to the Fair Ratio of 9.5x suggests the shares are priced below that Fair P/E level.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1428 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Par Pacific Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which Simply Wall St hosts on the Community page used by millions of investors.

A Narrative is your story about a company, written in numbers, where you combine your view of its business with your own assumptions for future revenue, earnings and margins, and arrive at a personal fair value estimate.

In practice, a Narrative links three things: the company’s story, a forward looking forecast, and a fair value that you can compare with today’s share price to help you decide whether you are comfortable buying, holding or selling.

Narratives on the platform are easy to set up, update automatically when new information like news or earnings is added, and always show your Fair Value next to the current Price so you can see how your thesis on Par Pacific Holdings is tracking. For example, one investor might see Par Pacific as worth far above the current US$35.21 price, while another might see it as worth well below that level.

Do you think there's more to the story for Par Pacific Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.