Please use a PC Browser to access Register-Tadawul

Is Marvell Technology Fairly Priced After Recent 6% Slide and AI Expansion Moves?

Marvell Technology, Inc. MRVL | 78.92 | -2.98% |

- Curious if Marvell Technology is a smart buy right now? You are not alone, especially as investor interest in chip stocks keeps making headlines.

- The stock has had its ups and downs lately, dropping 6.2% over the last week but managing a gain of 1.5% in the past month. The longer-term picture shows a 22.9% decline year-to-date and a slight 3.2% loss over the past year.

- Marvell Technology has continued to make strategic moves like investing in next-generation semiconductor solutions and expanding partnerships within the AI and data center space. Investors have been reacting to both the industry buzz surrounding AI infrastructure and the company's own product development updates.

- When we break down the numbers using our valuation checklist, Marvell scores just 2 out of 6 for undervaluation. Let's unpack what those different valuation approaches really mean, and why there is an even better way to spot value in a stock. More on that by the end.

Marvell Technology scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Marvell Technology Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model forecasts a company's future free cash flows and discounts them back to today's value, giving investors an estimate of what the business may be worth today. This method focuses on the actual cash Marvell Technology is expected to generate, adjusted to reflect its value in today's dollars.

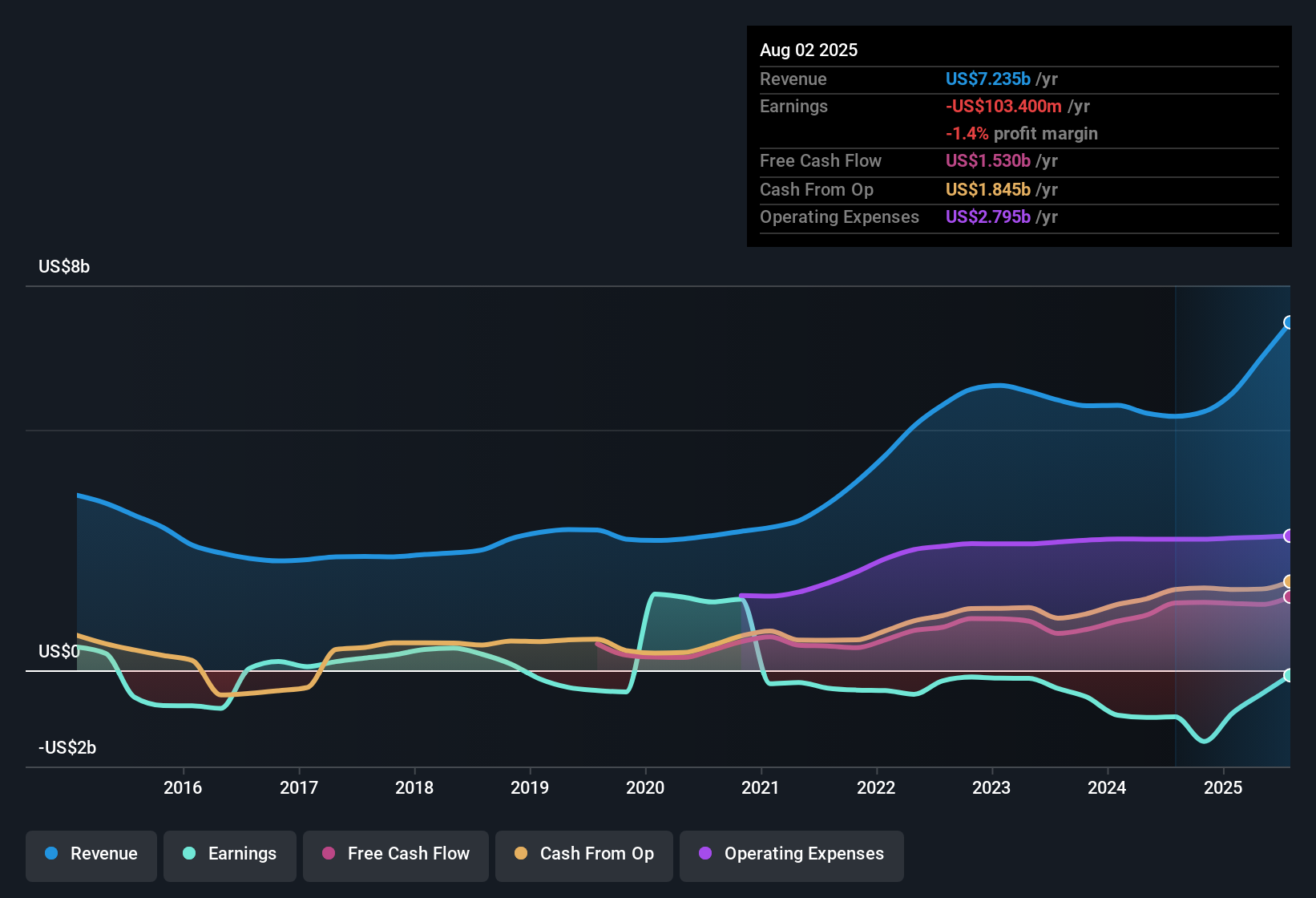

Currently, Marvell's trailing twelve-month Free Cash Flow stands at approximately $1.48 billion. Analyst estimates predict strong growth in the years ahead, with Free Cash Flow projected to rise to around $4.23 billion by 2030. While analyst consensus provides forecasts for the next five years, additional projections are extrapolated to estimate how the business could perform in subsequent years.

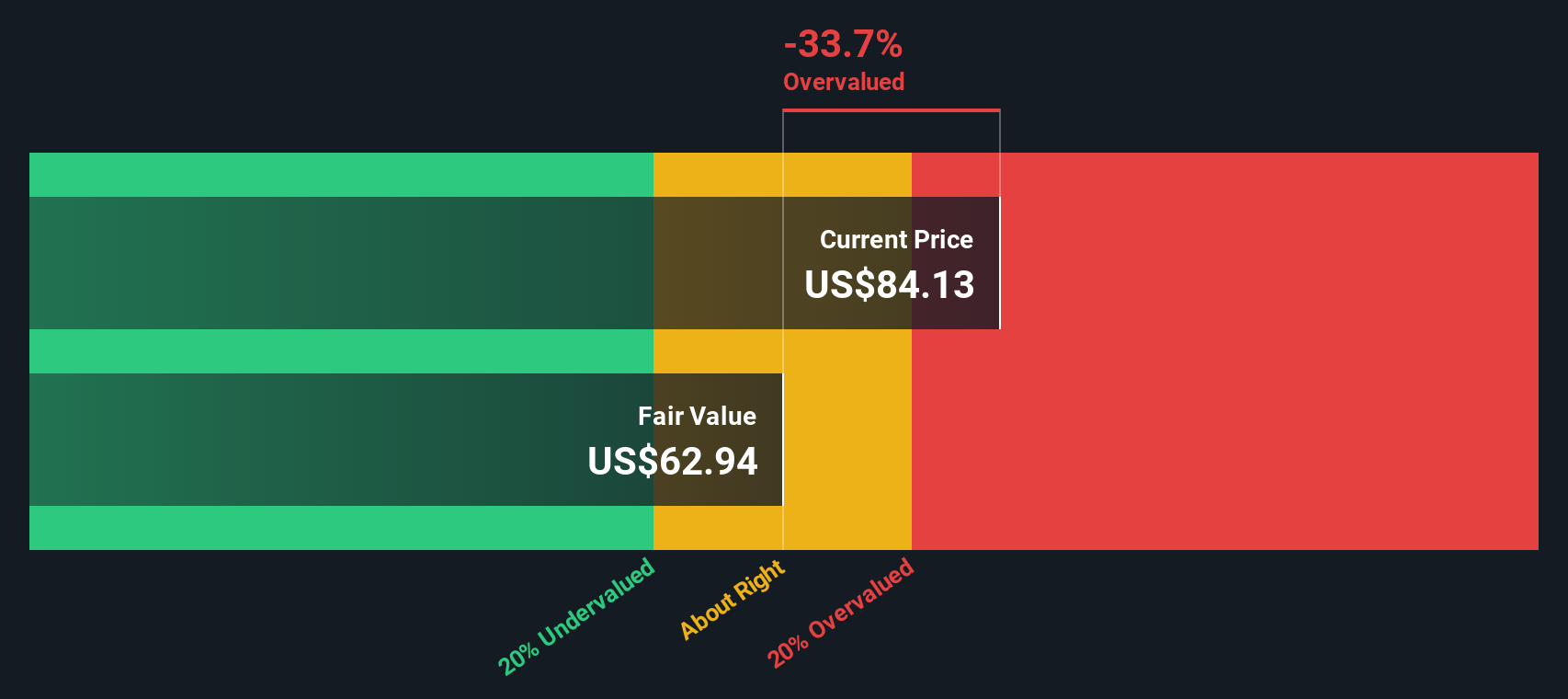

With the DCF approach, Marvell's intrinsic fair value is calculated at $60.19 per share. However, this figure suggests the stock is about 45.4% overvalued compared to its current price. In other words, based solely on cash flow expectations, investors may be paying a significant premium at current levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marvell Technology may be overvalued by 45.4%. Discover 882 undervalued stocks or create your own screener to find better value opportunities.

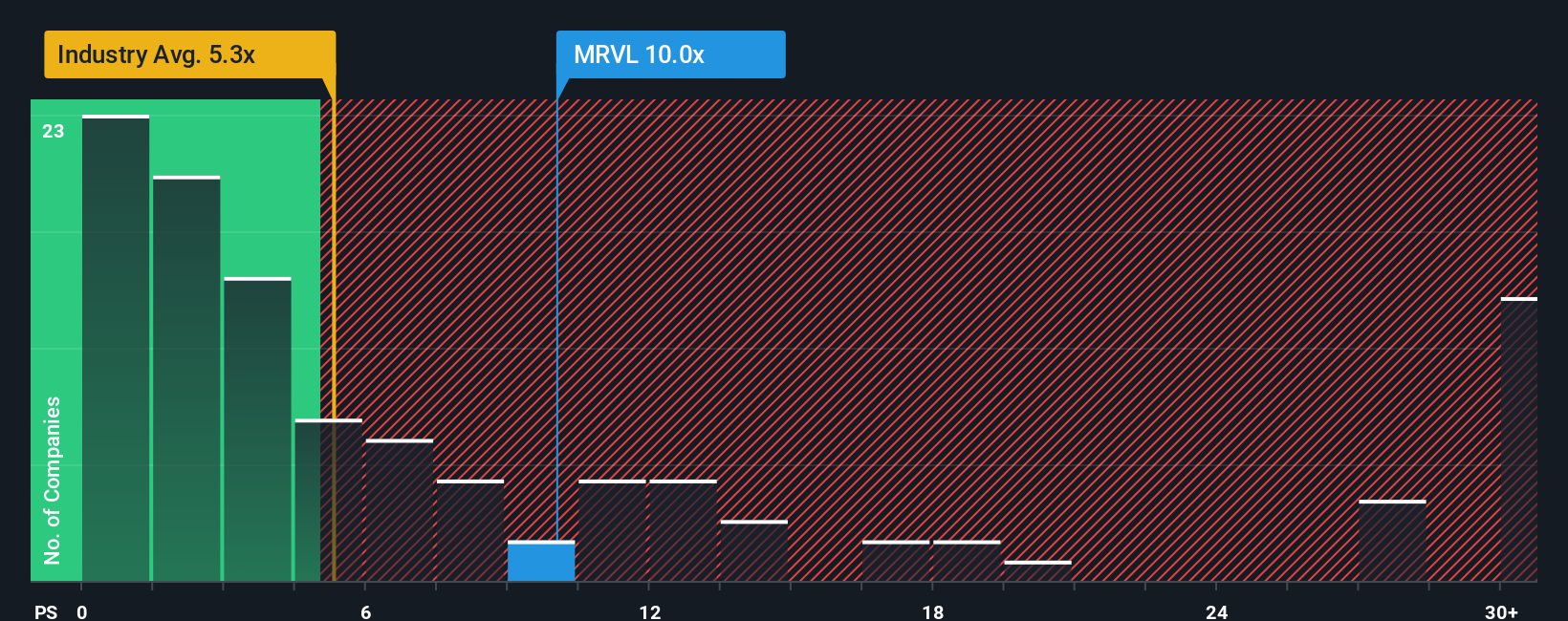

Approach 2: Marvell Technology Price vs Sales

For growth-focused tech companies like Marvell Technology, the Price-to-Sales (PS) ratio is often the preferred valuation tool. Since profits can fluctuate with investment cycles and industry changes, the PS ratio provides a more stable benchmark for companies aggressively reinvesting for future growth.

Growth expectations and company-specific risks play a big role in what investors consider a “normal” or “fair” PS ratio. When high revenue growth is expected or a company carries less risk, higher PS multiples can be justified. On the other hand, if a company faces strong industry headwinds or growth is slowing, a lower ratio may be more appropriate.

Marvell Technology’s current PS ratio sits at 10.43x, which is more than twice the average for the semiconductor industry at 4.81x, and still below the peer group average of 16.46x. However, instead of just comparing to the industry and peers, Simply Wall St’s proprietary “Fair Ratio” takes the analysis further by blending in Marvell’s growth, profit margins, risk profile, industry positioning, and market cap. For Marvell, the Fair Ratio is 11.53x. This metric is designed to provide a more comprehensive view than simple averages, reflecting the unique dynamics influencing the stock.

Comparing these figures side by side, Marvell’s current PS ratio is just below its calculated Fair Ratio, suggesting the stock appears to be roughly fairly valued based on this approach.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marvell Technology Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives offer investors a more dynamic and intuitive approach by tying a company's story, your own perspective on its future, directly to key financial forecasts and fair value estimates, rather than relying on one-size-fits-all multiples or static analysis. On Simply Wall St’s Community page, millions of investors leverage Narratives as an accessible tool that lets them outline their assumptions about Marvell Technology’s growth, margins, and risks, and see how these projections play out in real time as new information arrives.

With a Narrative, you bridge the company’s business outlook to a financial forecast and then to a fair value, helping you decide whether to buy or sell by comparing your fair value to the current price. Narratives are continuously updated when new news, results, or significant data is released, keeping your investment thesis relevant and actionable.

For example, some investors see Marvell’s expanding role in AI infrastructure and project a bullish fair value as high as $122 per share, while more cautious perspectives, wary of data center concentration and competitive pressures, peg it closer to $58. This reflects how Narratives turn valuations into living, investor-driven stories, not just numbers.

Do you think there's more to the story for Marvell Technology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.