Please use a PC Browser to access Register-Tadawul

Is Meta Platforms Poised for Growth After $14.2B CoreWeave Deal?

Meta Platforms META | 644.23 | -1.30% |

Trying to figure out what’s next for Meta Platforms stock? You are not alone. Whether you have been riding the wave since Meta’s dramatic turnaround or you are wondering if now is the right moment to jump in, there is plenty to unpack about this tech giant’s ongoing story. After all, shares are up a striking 426.0% over the last three years and 177.3% in five years. Recent weeks have shown some weariness, with the stock down 2.9% in the past week and slipping 1.1% over the last month.

That minor pullback has come even as Meta grabs headlines for striking multi-billion-dollar infrastructure deals, exploring new chip technologies, and deepening its artificial intelligence investments. However, not all news has been rosy. The company is facing regulatory challenges and internal debates about its AI research direction. These conflicting signals keep the conversation lively about whether Meta is still a growth juggernaut or entering a riskier new phase.

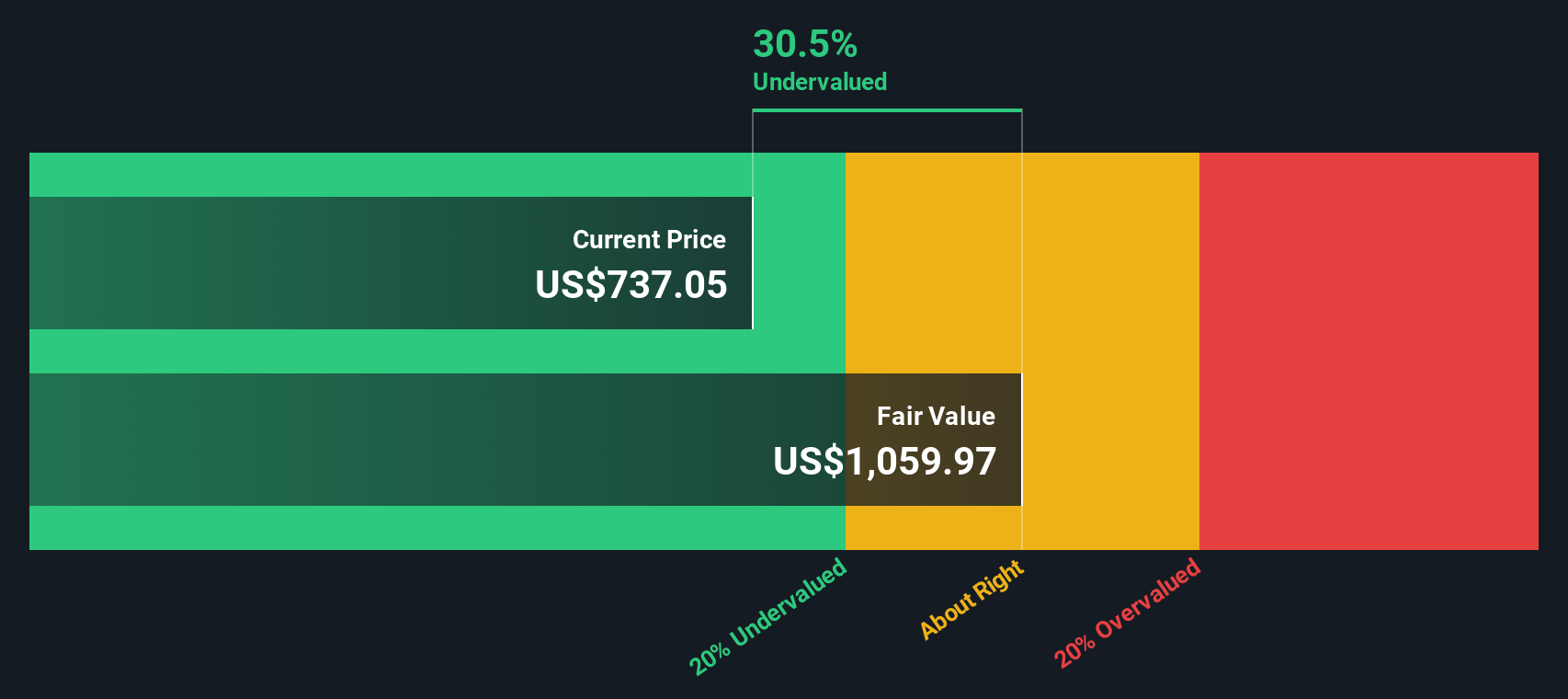

Of course, what matters most for investors is not just the headlines but how the company stacks up relative to its current price. On that note, Meta recently scored a 4 out of 6 on our valuation checklist. This means it looks undervalued in two-thirds of the major methods we track.

So how does Meta’s valuation really hold up according to these different approaches? And is there an even smarter way to cut through the noise when analyzing this stock? Let us break down the numbers and look at what really moves the needle for savvy investors.

Approach 1: Meta Platforms Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a key method for valuing stocks, as it estimates how much a company is worth based on its future cash flows, projected out several years and then discounted back to their value today. This approach helps investors focus on core fundamentals, rather than just short-term market prices.

For Meta Platforms, the most recent reported Free Cash Flow stands at $57.6 billion over the last twelve months. Analysts currently provide forecasts for the next several years, but for a full 10-year view, these expert estimates are extended with further projections. Looking ahead to 2029, Meta’s Free Cash Flow is expected to reach $108.6 billion, with a steady rise each year as the business grows. The cash flows projected from 2026 through 2035 all comfortably exceed $30 billion each year, underlining robust long-term profitability.

Based on these projections and using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share for Meta Platforms is $1,097.92. Compared to the current market price, this implies the stock is trading at a 33.8 percent discount to its fair value. This may indicate undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Meta Platforms is undervalued by 33.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Meta Platforms Price vs Earnings (P/E) Ratio

The Price-to-Earnings (P/E) ratio is a widely used metric for valuing mature, profitable companies like Meta Platforms. It helps investors gauge how much they are paying for each dollar of current earnings, making it a practical benchmark, especially for technology leaders posting strong profits.

A company’s expected growth and inherent risks are key factors that influence what a "normal" or "fair" P/E ratio should be. High-growth companies often command higher P/E ratios, as investors expect greater earnings in the future. On the other hand, higher risk or uncertainty can suppress those multiples.

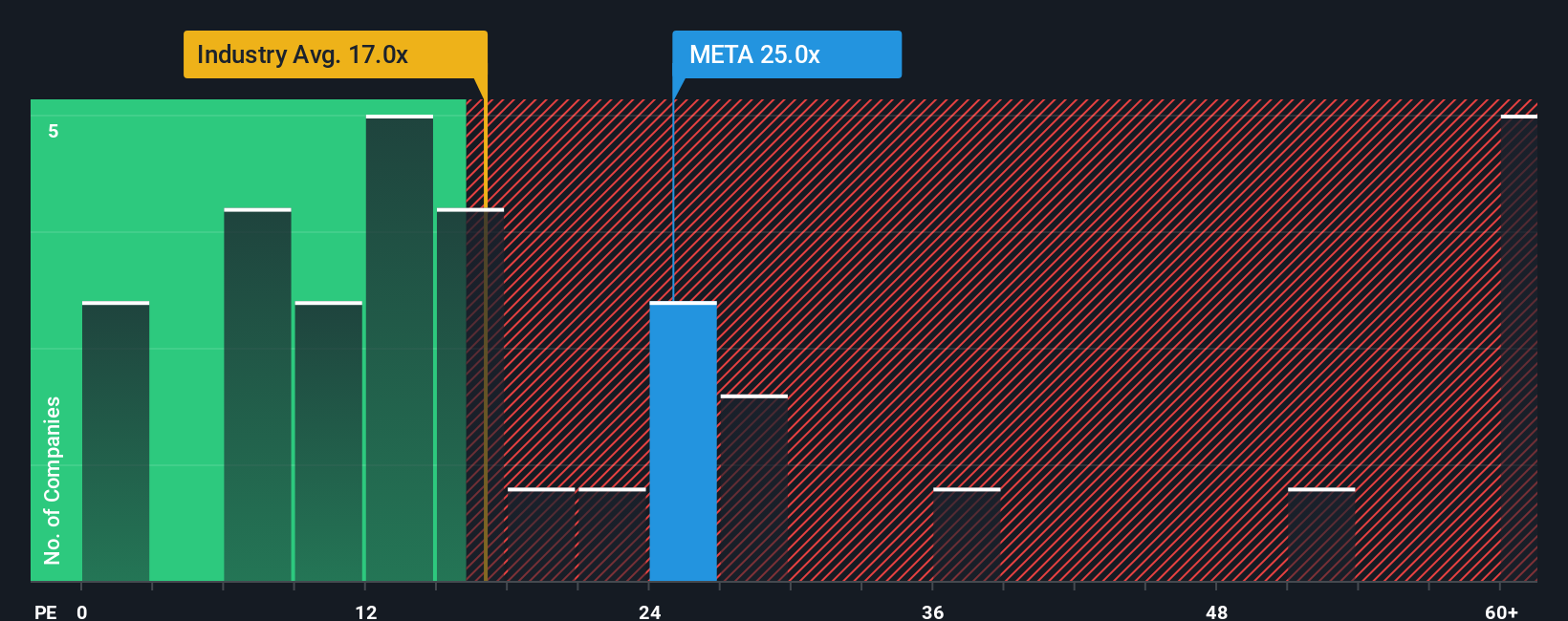

Meta currently trades at a P/E ratio of 25x. This is above the industry average of 17x for Interactive Media and Services but below the peer average of 37x. To get a more nuanced perspective, we turn to Simply Wall St’s proprietary “Fair Ratio,” which adjusts for Meta’s specific growth rate, profit margins, industry dynamics, market cap, and other risk factors. For Meta, this Fair Ratio is estimated at 39x. This figure reflects the company’s scale, growth prospects, and profitability more accurately than broad industry numbers alone.

Comparing Meta’s current P/E of 25x with its Fair Ratio of 39x suggests that the stock may be undervalued on this basis because the market price does not fully reflect the company’s growth and quality factors captured in the Fair Ratio.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Meta Platforms Narrative

Earlier, we hinted at an even better way to analyze a stock like Meta. Let us introduce you to Narratives, a simple and powerful tool that lets you combine the story you believe about Meta with your own financial forecasts, resulting in a fair value tailored to your view.

A Narrative connects your perspective on the company’s strategy, risks, and future potential directly to estimates for revenue, earnings, and margins. This ultimately generates a fair value that reflects your outlook. This approach is far more dynamic than relying only on generic ratios or historic data, as it enables you to bring the company’s real-world story into the numbers.

Accessible to millions of investors on Simply Wall St’s Community page, Narratives are designed to be approachable and can be created or compared at any time. They automatically update when there is breaking news, new earnings, or major announcements, ensuring your view stays current and relevant.

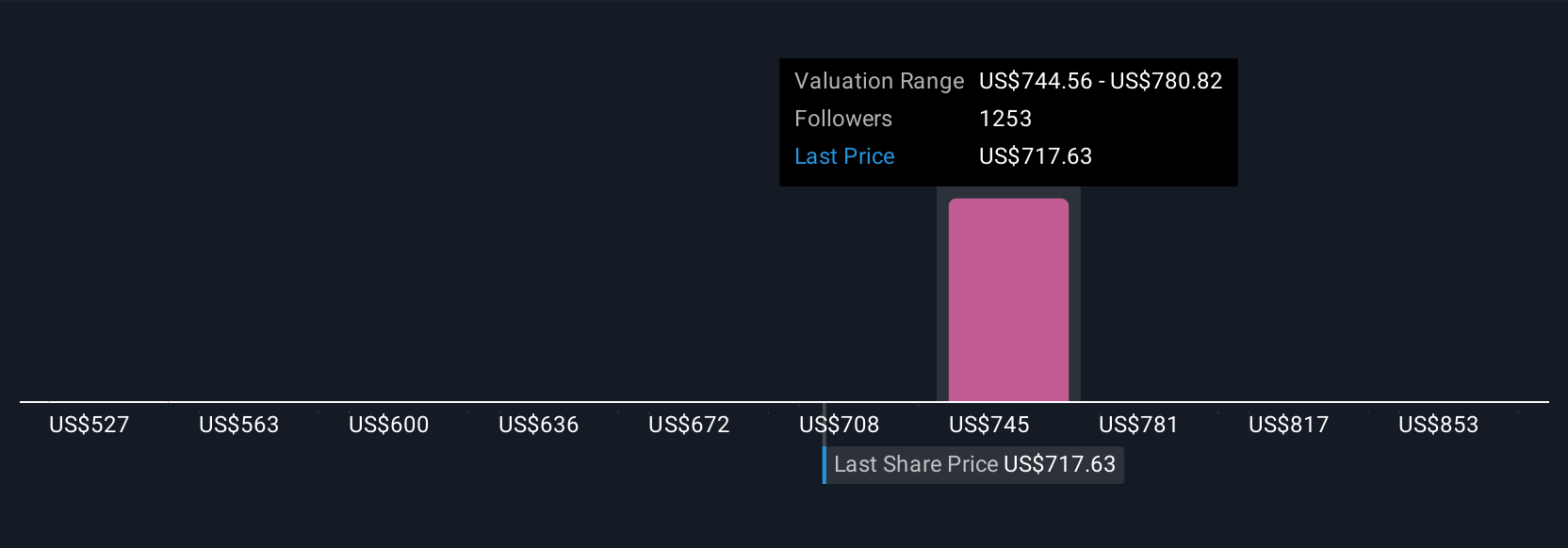

With Narratives, you can see whether your fair value is above or below the share price, which can guide your decision to buy, hold, or sell based on your own logic. For example, recent Narratives for Meta Platforms have set fair values as high as $1,086, highlighting excitement over AI and product growth, or as low as $538, reflecting concerns about regulatory risk and future expenses.

For Meta Platforms, we will make it easy for you with previews of two leading Meta Platforms Narratives:

Fair value: $863.20

Undervalued by 15.8%

Analyst consensus revenue growth rate: 15.6%

- AI-driven personalization and diversified revenue streams position Meta for durable, long-term growth.

- Expansion of digital commerce and monetization efforts in messaging platforms are expected to boost topline and margin expansion.

- Key risks include rising AI and infrastructure investment, regulatory headwinds, and uncertainty around monetizing metaverse and AI initiatives.

Fair value: $538.09

Overvalued by 35.2%

Projected revenue growth rate: 10.5%

- Meta is expected to grow AR/VR and Reality Labs revenues, but profitability timelines remain uncertain and are subject to heavy competition and capital expenditure demands.

- Sustained reliance on digital advertising leaves Meta exposed to regulatory, privacy, and economic headwinds despite efforts to diversify income.

- Significant AI infrastructure investment and organizational cost-cutting present both opportunities and risks, with concerns over execution and return on spending.

Do you think there's more to the story for Meta Platforms? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.