Please use a PC Browser to access Register-Tadawul

Is MP Materials’ Soaring Stock Justified After Recent Rare Earth Supply Chain Discussions?

MP Materials Corporation Ordinary Shares - Class A MP | 56.66 57.54 | -5.58% +1.55% Pre |

It’s hard not to pay attention when a company’s stock has soared like MP Materials. If you’re wondering whether now’s the right moment to double down, hold tight, or cash in on those gains, you’re not alone. The past year has seen MP Materials rocket up 457.3%, with an eye-popping 501.9% jump year-to-date. Even in just the last week, the stock is up 33.7%. These numbers make it tempting to jump on board, especially after the impressive 55.3% pop in the last month alone.

What’s fueling all this excitement? Investors have become more bullish in response to renewed global discussions about rare earth supply chains, an industry where MP Materials takes center stage. With its pivotal position in rare earth production, market watchers are recalibrating risk and growth potential, which can heighten demand for shares. Over the last five years, a 615.9% return has turned a lot of heads as expectations continue to shift with new policies and geopolitical developments.

But does the current price reflect MP Materials’ true worth? If you rely on valuation metrics alone, the answer is complicated. Using a straightforward 6-point under/overvaluation scorecard, MP Materials only checks 1 of the 6 boxes as undervalued. That’s not a resounding bargain on paper, but it’s only part of the story. Let’s break down how MP stacks up according to different valuation methods, and make sense of what really matters by the time we reach the end of this analysis.

MP Materials scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

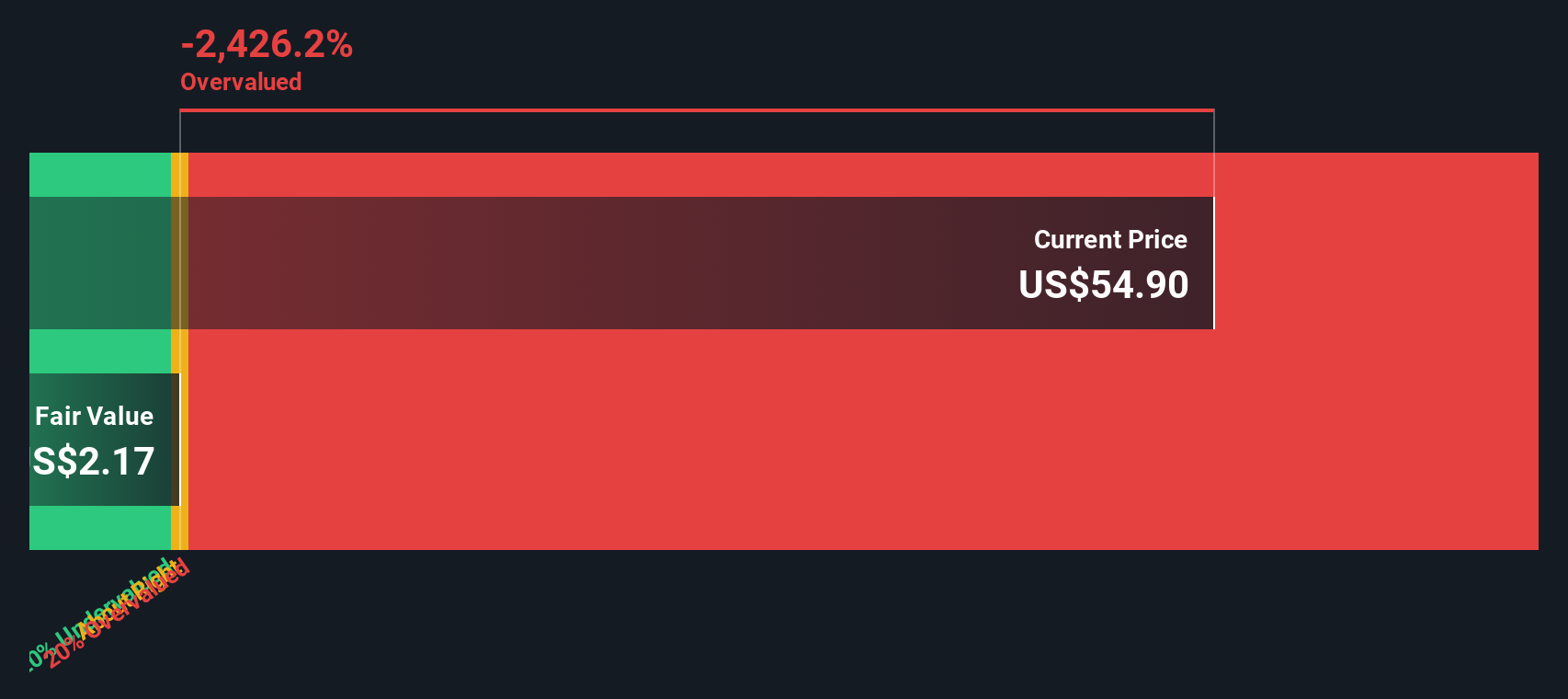

Approach 1: MP Materials Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those back to today’s dollars. This process aims to capture what the business is fundamentally worth, based on the cash it can generate for shareholders over time.

For MP Materials, the current Free Cash Flow (FCF) stands at a negative $260.5 Million. Analyst projections and estimates suggest that FCF will grow steadily over the next decade, reaching around $23.7 Million by 2035. Up to 2027, analyst forecasts are directly used, while subsequent years are extrapolated with growth rates ranging from slight declines to modest gains. This highlights a cautious but positive outlook for improvement in cash generation.

Despite these upward trends in projected FCF, the DCF model calculates a fair value per share of just $2.36. With the current market price massively outpacing this estimate, the result is a striking intrinsic discount of -4088.4%. That means, according to this model, the stock is priced far above what the long-term cash flow justifies right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MP Materials may be overvalued by 4088.4%. Find undervalued stocks or create your own screener to find better value opportunities.

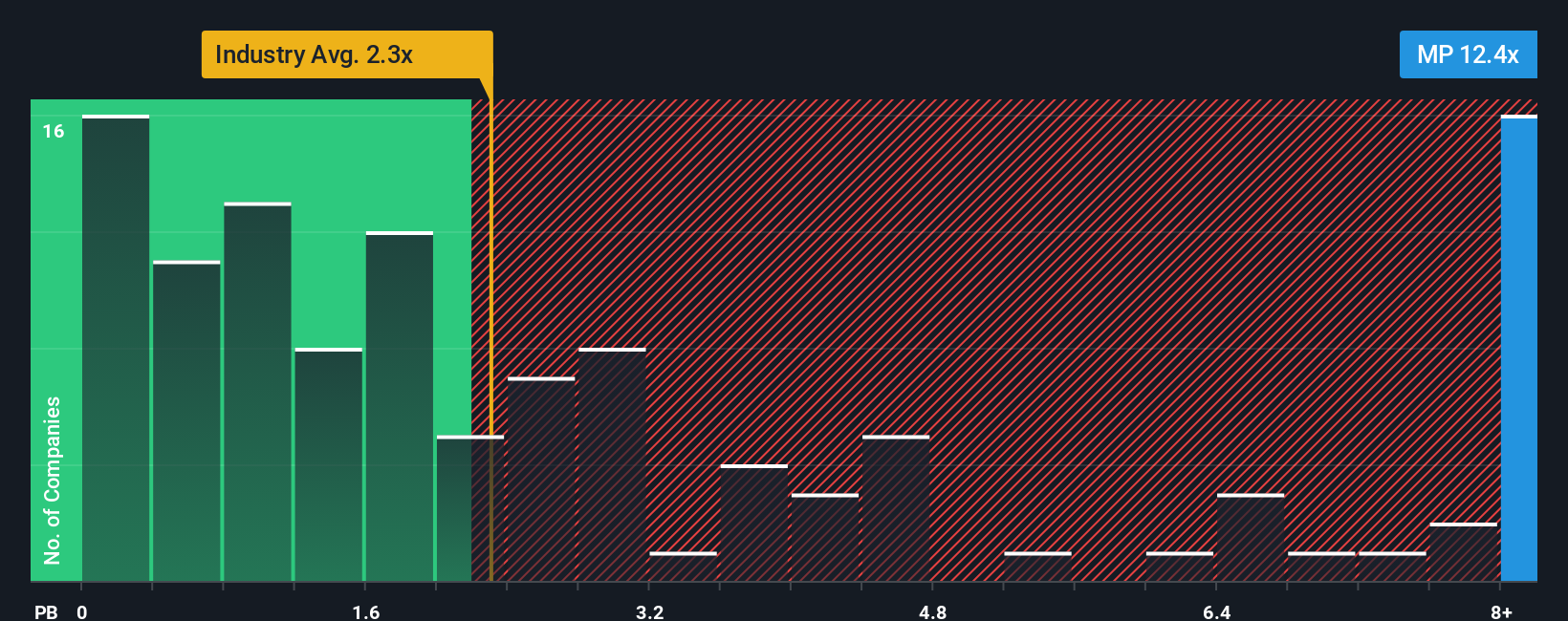

Approach 2: MP Materials Price vs Book (P/B)

The Price-to-Book (P/B) ratio is a useful metric for valuing asset-heavy companies like those in metals and mining, especially when profits are variable or negative. This approach assesses how much investors are paying for each dollar of net assets, making it a suitable choice for analyzing MP Materials right now.

In theory, growth expectations and risk factors play a major role in what a “normal” or “fair” P/B ratio should be. Companies with strong growth prospects may justify higher P/B ratios, while higher risks or weaker asset returns typically demand lower multiples. For context, MP Materials is currently trading at a striking 17.29x P/B. This compares to the industry average of just 2.50x, and the average among similar peers at 28.53x.

Rather than relying solely on these benchmarks, Simply Wall St uses a proprietary metric called the “Fair Ratio.” This evaluates what P/B multiple makes sense after factoring in MP Materials’ growth outlook, profit margins, asset structure, market cap, and sector risks. By looking beyond basic comparisons, the Fair Ratio offers a more tailored and credible sense of value.

Given the available data, the company’s current P/B multiple stands far above what would be regarded as reasonably fair for its profile. This substantial gap suggests the stock is priced at a premium compared to its true underlying value.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

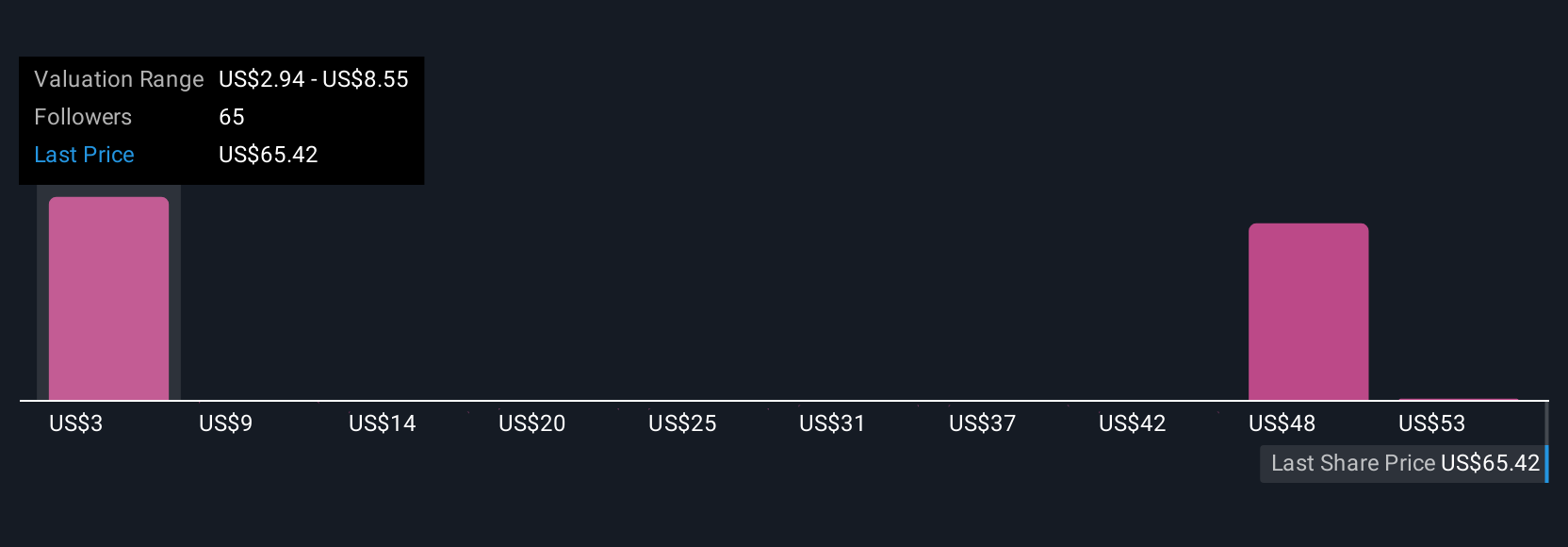

Upgrade Your Decision Making: Choose your MP Materials Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal investment story for a company: it is where you bring together your perspective on MP Materials’ future, such as your expectations for revenue growth, profit margins, and risks, link those beliefs to a financial forecast, and see a fair value that matches your outlook. Instead of just crunching numbers, you can use Narratives (directly within the Community page on Simply Wall St, used by millions of investors) to compare your fair value to current prices, helping you make confident buy or sell decisions backed by your own assumptions. Narratives update automatically as new news or earnings reports come out, keeping your view fresh and relevant. For example, one investor might build a bullish Narrative for MP Materials using the highest analyst expectations, stating that government contracts and high-tech partnerships will drive strong profit growth and a fair value above $85, while another could adopt a more cautious approach, citing operational risks and suggesting a fair value closer to $65. In just a few clicks, you can see and share your own Narrative and learn how your expectations translate into fair value so your investing decisions truly reflect your personal insight and the latest developments.

Do you think there's more to the story for MP Materials? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.