Please use a PC Browser to access Register-Tadawul

Is Noble (NE) Pricing Reflect Its DCF Upside After Recent Share Price Strength

Noble Corporation PLC Class A NE | 45.52 | +0.40% |

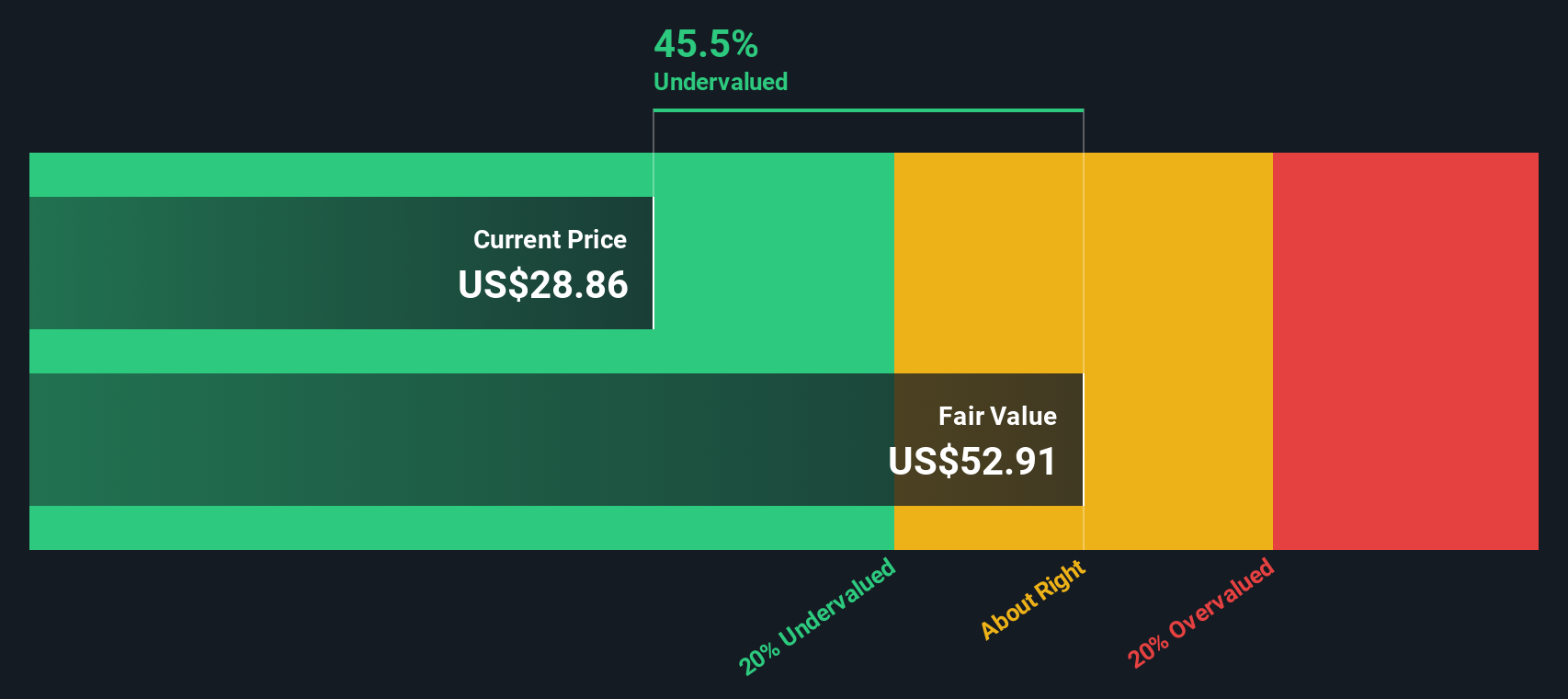

- If you are wondering whether Noble at around US$36.00 is giving you fair value or a potential discount, you are in the right place. This article focuses squarely on what the current price might mean for you.

- Over shorter periods the stock has been active, with a 2.3% return over the last 7 days, 24.1% over the last 30 days, and 23.2% over the past year, which can influence how investors think about both opportunity and risk.

- Recent coverage of Noble has focused on its position in the energy sector and how investors are reacting to that exposure, as well as how the stock is featuring in broader discussions about the offshore drilling space. This kind of attention helps explain why the share price has been moving and sets an important backdrop for thinking about what the current valuation might be telling you.

- Noble currently scores 3 out of 6 on our valuation checks. We will run through the standard valuation approaches shortly, then finish by looking at a more complete way to think about what that score really means for long term investors.

Approach 1: Noble Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth by projecting its future cash flows and then discounting those back to today to account for the time value of money and risk.

For Noble, the model uses a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is about $344.4 million. Analysts provide explicit forecasts for the next few years, and Simply Wall St extends these into a longer path, with projections running out to 2035. By year ten, the model is using an estimated free cash flow of roughly $742.7 million, with interim years stepping up from the 2026 and 2027 analyst inputs.

When all of those projected cash flows are discounted back and combined with a terminal value, the DCF model arrives at an estimated intrinsic value of about $76.61 per share. Compared with the current share price of roughly US$36.00, this indicates an implied 53.0% discount. Under this framework, the shares screen as materially undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Noble is undervalued by 53.0%. Track this in your watchlist or portfolio, or discover 876 more undervalued stocks based on cash flows.

Approach 2: Noble Price vs Earnings

For profitable companies like Noble, the P/E ratio is a useful way to relate what you pay per share to the earnings that each share generates. Investors generally accept a higher P/E when they expect stronger growth or see lower risk, and a lower P/E when they see weaker growth or higher uncertainty.

Noble currently trades on a P/E of about 25.2x. That sits above the Energy Services industry average of roughly 22.8x and below the peer group average of about 27.6x. These simple comparisons can be helpful, but they do not fully reflect Noble’s specific earnings outlook, business risks, margins or size.

Simply Wall St’s Fair Ratio for Noble is 21.9x. This is a proprietary estimate of what Noble’s P/E might be, given factors such as its earnings growth profile, industry, profit margin, market capitalization and risk characteristics. Because it is tailored to the company, the Fair Ratio can give you a more company specific reference point than raw industry or peer averages. Comparing Noble’s current P/E of 25.2x to the Fair Ratio of 21.9x suggests the shares screen as overvalued on this metric.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1424 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Noble Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, where you connect your view on its business to numbers like fair value, expected revenue, earnings and profit margins. On Simply Wall St, within the Community page used by millions of investors, Narratives let you tie that story to a clear financial forecast and then to a fair value per share, so you can compare that fair value to the current price and decide what action, if any, makes sense for you. The key advantage is that Narratives update automatically when fresh information such as news or earnings is added, so your view does not stay stuck in the past. For Noble, one investor might build a Narrative with a higher fair value based on a stronger outlook for offshore drilling while another might use more cautious assumptions and arrive at a much lower fair value, and both views sit side by side for you to compare.

Do you think there's more to the story for Noble? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.