Please use a PC Browser to access Register-Tadawul

Is Now the Moment to Reassess T-Mobile US After Its 5G Expansion Push?

T-Mobile US, Inc. TMUS | 193.43 | -2.07% |

- Wondering whether T-Mobile US at around $208 a share is a bargain or a value trap right now? You are not alone, and we are going to unpack what the current price really implies.

- The stock has slipped about 0.5% over the last week and is off 5.2% year to date, but longer term it is still up 52.1% over three years and 64.1% over five. This tells you sentiment has been far from dull.

- Recent headlines have focused on T-Mobile US continuing to expand its 5G network coverage and enterprise offerings, while also pushing deeper into fixed wireless broadband as an alternative to traditional home internet. Together, these moves help explain why investors are reassessing both its growth runway and its risk profile, even if the share price has cooled lately.

- On our framework, T-Mobile US currently scores 4 out of 6 on undervaluation checks. This suggests there is some value appeal but also a few flags. Next, we will walk through the key valuation approaches investors typically rely on and hint at an even better way to think about what this stock is truly worth by the end of the article.

Approach 1: T-Mobile US Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those back into present dollar terms. For T-Mobile US, the model used is a 2 Stage Free Cash Flow to Equity approach that looks at how cash generation might evolve as growth gradually slows.

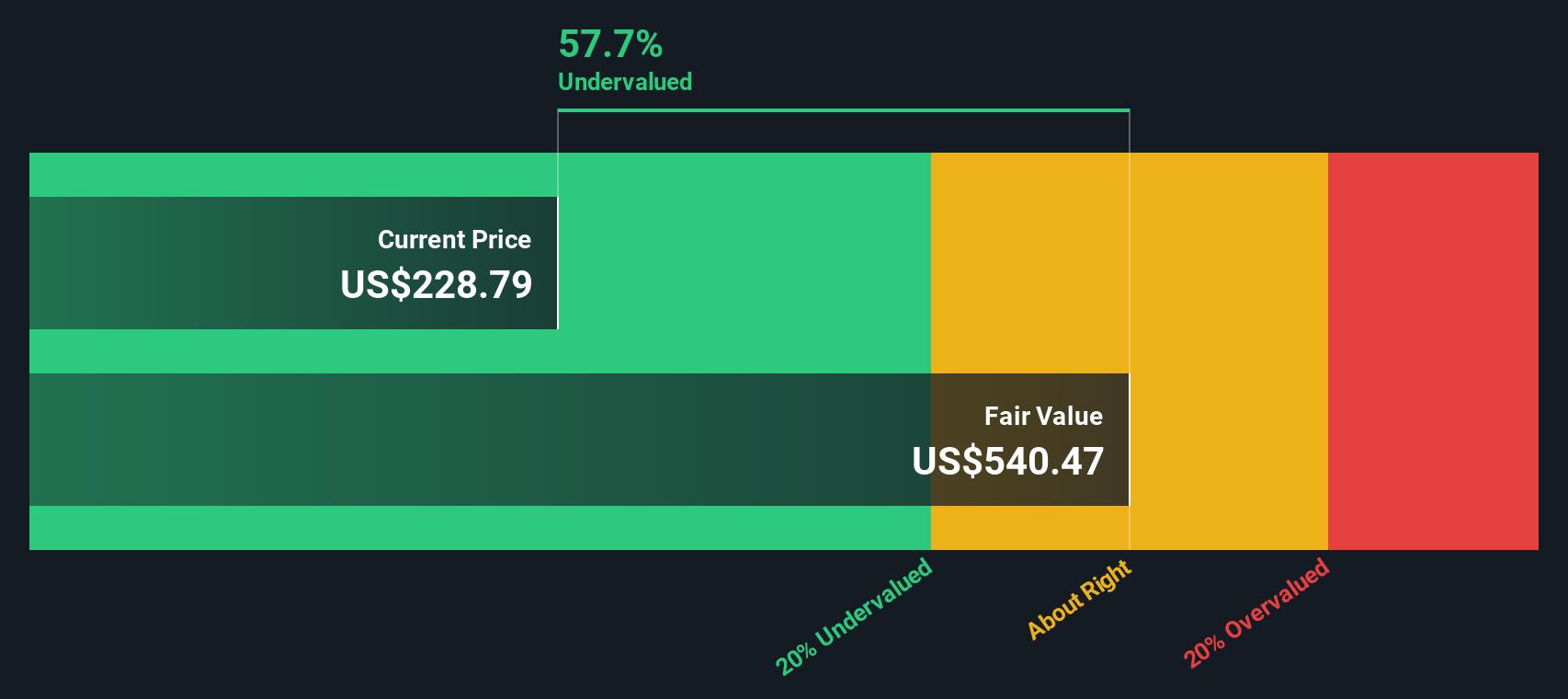

T-Mobile generated around $14.0 billion of free cash flow over the last twelve months. Analysts and extrapolations by Simply Wall St see that rising to roughly $29.5 billion by 2035, with interim projections in the high teens to mid $20 billion range over the coming decade. These growing cash flows, all in $, are then discounted back to today to arrive at an estimated intrinsic value per share of about $529.28.

Compared with a recent share price near $208, the DCF suggests the stock is trading at roughly a 60.7% discount to its intrinsic value. This indicates the market may be pricing in a weaker cash flow outlook than the one assumed in this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests T-Mobile US is undervalued by 60.7%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: T-Mobile US Price vs Earnings

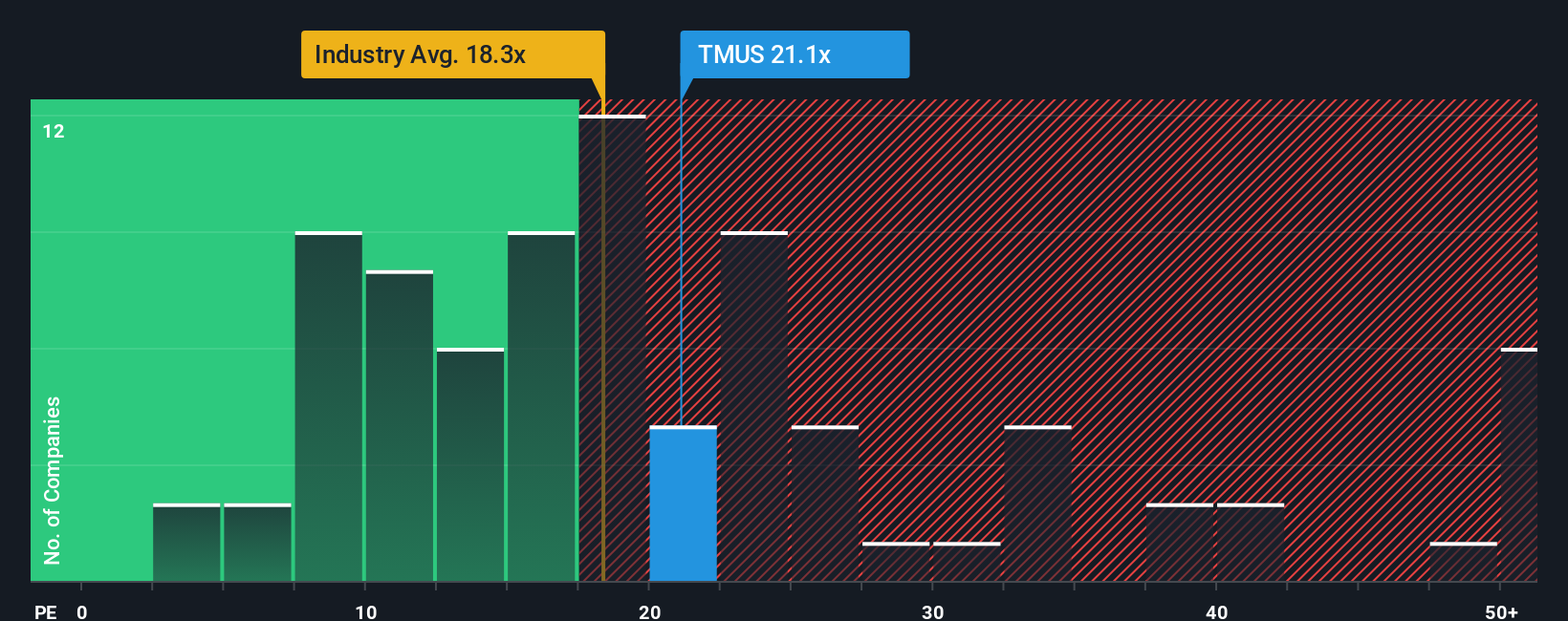

For a profitable business like T-Mobile US, the price to earnings, PE, ratio is a practical way to gauge how much investors are willing to pay for each dollar of current profits. In general, faster growth and lower perceived risk justify a higher PE, while slower, more uncertain growth calls for a lower, more conservative multiple.

T-Mobile currently trades on a PE of about 19.6x. That sits a little above the Wireless Telecom industry average of roughly 17.6x, but comfortably below the broader peer group average near 30.3x. This suggests the market is applying a moderate, not aggressive, premium to its earnings.

Simply Wall St also calculates a Fair Ratio of 16.68x, a proprietary estimate of what T-Mobile’s PE should be when you factor in its earnings growth outlook, margins, size and specific risks, alongside the dynamics of its industry. This tailored yardstick is more informative than a simple peer or industry comparison because it adjusts for the company’s own fundamentals rather than assuming all telecoms deserve the same multiple. With the current 19.6x PE sitting above the 16.68x Fair Ratio, the stock screens as slightly expensive on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your T-Mobile US Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of T-Mobile US’s business to a set of forecasts and a Fair Value estimate. A Narrative is your story behind the numbers, where you spell out how you think revenue, earnings and margins will evolve, and then see what that implies for a reasonable valuation today. On Simply Wall St’s Community page, used by millions of investors, Narratives make this process easy by linking the company’s story to a financial model and then to a clear Fair Value, which you can compare directly with the current share price to work out whether TMUS looks like a buy, hold or sell to you. These Narratives are dynamic, automatically updating when new news, earnings or guidance comes in so your Fair Value does not go stale. For example, one T-Mobile Narrative might lean bullish, assuming continued 5G leadership and satellite expansion support a Fair Value closer to $309, while a more cautious Narrative that focuses on pricing pressure and competitive risks might anchor closer to $200. The difference between them reflects how each investor connects the same facts to very different financial outcomes.

Do you think there's more to the story for T-Mobile US? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.